Cheap Tennessee Auto Insurance for 2024

Tennessee auto insurance quotes average $73 per month for full coverage, which is below the national average rate. To save even more on Tennessee auto insurance coverage, drivers should shop around for Tennessee auto insurance quotes from multiple Tennessee auto insurance companies to find the best rates.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jul 27, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jul 27, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Tennessee auto insurance can be affordable as long as drivers take the time to understand what Tennessee insurance coverage they need and how they can save.

Luckily, understanding auto insurance in Tennessee is not hard when it’s broken down. It’s important to do a lot of research before buying auto insurance in Tennessee, but we have done that hard work for you.

Before you buy Tennessee auto insurance, make sure you have compared rates. Enter your ZIP code now for the best Tennessee auto insurance quotes.

Tennessee Auto Insurance Requirements

In Tennessee, the state liability coverage minimums are:

- Tennessee Auto Insurance

- Bodily Injury Liability Coverage – $25,000 per person

- Bodily Injury Liability Coverage – $50,000 per accident

- Property Damage Liability Coverage – $15,000 per accident

Take a look at how Tennessee’s minimum rates compare with surrounding states.

Optional coverage options in TN include:

- Comprehensive Coverage

- Collision Coverage

- Medical Payments Coverage

- Rental Car Reimbursement Coverage

- Roadside Assistance / Towing and Labor Coverage

- Uninsured Motorists Coverage

First of all, many states require you to have a minimum amount of different types of auto insurance coverage to be financially responsible for an accident. These areas include bodily injury liability and property damage. All insurance providers have to comply with the state’s set minimums on the amount of coverage required for these three categories.

Bodily injury pays for injuries to the other driver, passengers, and pedestrians when you are at fault in an accident. For the state of Tennessee, the minimum for bodily injury per person is $25,000 and $50,000 per accident.

The other category of coverage is property damage. This category covers all the expenses needed to repair or replace the other driver’s car or other property after an accident where you are at fault. The minimum set for this is $15,000.

Though these are the minimum set requirements, it’s not always recommended that you only get the minimum. The amount of coverage you should get varies depending on your needs, as well as the assets you have to protect if you are sued following an accident. The cost of a serious accident can be very high, so purchase as much coverage as you can afford.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Tennessee Auto Insurance Rates

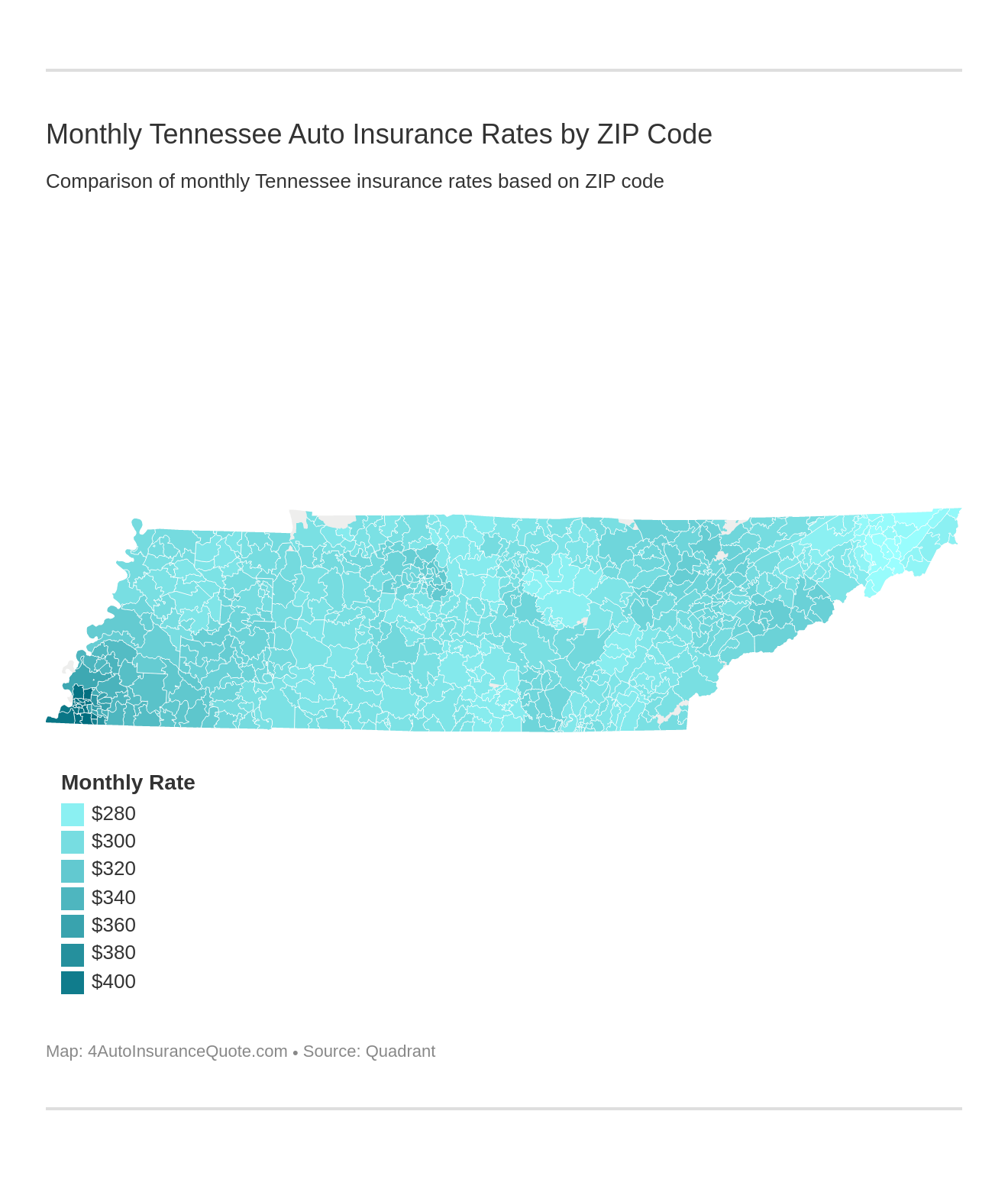

The price for insurance varies greatly in Tennessee, however. Depending on where you’re located, the price can vary from $900 to $1,600.

On average, the price for auto insurance in Tennessee is about $1000. It’s shocking how the price fluctuates between rural Tennessee and major cities; major metropolitan areas like Memphis will have average insurance premiums of about $1,600, while other cities such as Nashville will offer the same insurance at about $1,200.

There are a lot of factors that auto insurance companies take into consideration when determining your rates. Take a look at our overview here.

While many of these factors are simply based on your own driving record, two things that affect even the safest of drivers are age and gender. As with most states, males typically pay higher auto insurance rates than females.

Tennessee Auto Insurance Rates by Company

Though the state boasts fairly low auto insurance rates overall, let’s take a look at how rates vary between some of the largest companies.

But which companies are the largest, holding the most market share percentage in the region?

Tennessee Driving Statistics

It’s important to remember that driving is oftentimes very dangerous and that you have to take great precautions on the road. From 2003 to 2007, a total of 675,545 people have been involved in some kind of auto accident. In that same course of time, 48,000 people suffered from injuries, and more than 5,000 people were killed.

Even though you should be covered by some insurance policy, it’s very important to remember to be your safest on the road because of the high rates of incidents and keep anti-theft recovery systems on your vehicle. The amount of auto theft in Tennessee is quite high as well. In 2009 alone, there were 14,973 stolen vehicles reported, making the rate 237.8 thefts per 100,000 vehicles. Fortunately, the rate has been decreasing since 2001, but it is still a great number of vehicles.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Tennessee Auto Insurance Agents

Tennessee Auto Insurance Agents

- Get Affordable Knoxville, TN Auto Insurance Quotes (2024)

- Get Affordable Murfreesboro, TN Auto Insurance Quotes (2024)

- Get Affordable Norris, TN Auto Insurance Quotes (2024)

- Get Affordable Red Boiling Springs, TN Auto Insurance Quotes (2024)

- Get Affordable Three Way, TN Auto Insurance Quotes (2024)

Additional Tennessee Auto Insurance Resources

- Motor Vehicle Commission – From the TN Department of Commerce and Insurance.

- Financial Responsibility Laws – If you need an SR22 in the state of Tn., you should read this.

- TN State Highway Laws – Key laws in the state of Tennessee from the GHSA.

Tennessee Auto Insurance Quotes

Looking for a place to get an insurance quote can oftentimes be difficult, so here at 4AutoInsuranceQuote.com we try to make things as simple as possible for you.

We can easily help you find the best auto insurance rates in Tennessee. If you’re interested in getting a quote for cheap Texas insurance policies in your area, just enter your ZIP code to begin.

Frequently Asked Questions

What are the minimum auto insurance requirements in Tennessee?

In Tennessee, the state’s minimum liability coverage requirements are 25/50/15. This means you must have at least $25,000 in bodily injury liability coverage per person, $50,000 in bodily injury liability coverage per accident, and $15,000 in property damage liability coverage.

Why is it important to compare quotes from multiple insurance companies?

Comparing quotes from multiple insurance companies allows you to find the best rates for your Tennessee auto insurance coverage. Rates can vary significantly between companies, and by shopping around, you increase your chances of finding affordable insurance that meets your needs.

Should I only get the minimum required coverage?

While the state sets minimum coverage requirements, it’s not always recommended to only get the minimum. The cost of a serious accident can be high, so it’s advisable to purchase as much coverage as you can afford to adequately protect your assets and potential liabilities.

What factors affect auto insurance rates in Tennessee?

Several factors can affect your auto insurance rates in Tennessee, including your driving record, age, gender, location, type of vehicle, credit history, and the coverage options you choose. Insurance companies consider these factors when calculating your premium.

How do auto insurance rates vary in Tennessee?

Auto insurance rates in Tennessee can vary significantly depending on your location. On average, the price for auto insurance in Tennessee is about $1,000 per year. However, rates can range from $900 to $1,600 depending on where you live, with major metropolitan areas generally having higher premiums.

Does Tennessee have high auto insurance rates?

The average rate for auto insurance in Tennessee is $83/mo, which is on the lower side.

Is it illegal to not have auto insurance in Tennessee?

Yes, all drivers must have Tennessee auto insurance coverage.

Is Tennessee a no-fault state?

No, Tennessee is an at-fault state.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.