Best Auto Insurance for Disabled Veterans in 2025 (Find the 10 Companies Here!)

Explore the best auto insurance for disabled veterans, offering as low as $50 per month from Progressive, State Farm, and Geico. These companies excel in affordability and customer service, providing tailored coverage options that cater specifically to veterans' needs.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

UPDATED: Jan 25, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 25, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Disabled Veterans

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Disabled Veterans

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews

Our Top 10 Company Picks: Best Auto Insurance for Disabled Veterans

Company Rank Military Discount A.M. Best Best For Jump to Pros/Cons

#1 10% A+ Multi-Policies Discount Progressive

#2 12% B Customer Service State Farm

#3 10% A++ Employee Discount Geico

#4 15% A++ Military Savings USAA

#5 11% A+ Local Agents Allstate

#6 10% A+ Vanishing Deductible Nationwide

#7 12% A Online Tools Liberty Mutual

#8 9% A Satisfaction Guarantee Farmers

#9 8% A++ Competitive Rates Travelers

#10 9% A+ Lifetime Renewability The Hartford

Get fast and cheap auto insurance coverage today with our quote comparison tool below.

- Progressive excels with user-friendly comparison tools

- Veterans have specialized insurance programs

- Government assists with car modification costs for disabled veterans

#1 – Progressive: Top Overall Pick

Pros

- Access to Multiple Insurers: Allows customers to get quotes from a wide range of insurers.

- Comprehensive Coverage Options: Offers a variety of coverage options to suit different needs.

- Convenient Online Tools: Provides user-friendly tools for managing policies online.

Cons

- Higher Rates for Some Drivers: Premiums can be higher for certain demographics or regions.

- Varied Customer Service: Quality of customer service may vary based on location.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#2 – State Farm: Best for Customer Service

Pros

- Excellent Customer Service Reputation: Known for outstanding customer service and personalized support.

- Wide Network of Local Agents: Provides accessibility and personalized service through local agents.

- Variety of Discounts: Offers a range of discounts to help lower premiums. Learn more in our State Farm auto insurance review.

Cons

- Higher Premiums: Rates may be higher compared to some competitors.

- Limited Digital Tools: Digital tools and online services may not be as advanced as other insurers.

#3 – Geico: Best for Employee Discount

Pros

- Discounts for Federal Employees and Military Members: Offers discounts to federal employees and military personnel.

- Strong Online and Mobile App Services: User-friendly digital platforms for managing policies.

- Competitive Pricing: As mentioned in our Geico auto insurance review, the company is known for competitive rates in the auto insurance market.

Cons

- Mixed Customer Service: Customer service experiences can vary.

- Claims Satisfaction Variability: Satisfaction with claims process can vary among customers.

#4 – USAA: Best for Military Savings

Pros

- Lowest Rates for Military Members: Offers the lowest rates for military members, veterans, and their families.

- Exceptional Customer Service: Highly rated for customer service and claims satisfaction.

- Highly Rated Claims Satisfaction: Known for excellent claims handling and customer satisfaction. See more details on what information I need to provide when filing an auto insurance claim with USAA.

Cons

- Limited Availability: Only available to military members, veterans, and their families.

- Limited Branch Locations: Physical branch locations are limited compared to other insurers.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#5 – Allstate: Best for Local Agents

Pros

- Wide Network of Local Agents: Offers accessibility and personalized service through local agents.

- Numerous Discounts Available: Provides a variety of discounts to help reduce premiums.

- User-Friendly Digital Tools: Offers easy-to-use digital tools for managing policies. See more details in our Allstate Auto Insurance Review.

Cons

- Higher Premiums: Premium rates may be higher compared to some competitors.

- Mixed Customer Service Reviews: Customer service experiences can vary.

#6 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible Program: Offers a program that reduces deductibles over time for safe driving.

- Excellent Mobile App: As mentioned in our Nationwide auto insurance review, the company provides a robust mobile app for policy management.

- Competitive Rates: Known for competitive pricing in the auto insurance market.

Cons

- Inconsistent Customer Service: Customer service quality may vary.

- Limited Availability: Not available in all states.

#7 – Liberty Mutual: Best for Online Tools

Pros

- Advanced Online Tools: Offers advanced online tools and resources for policy management.

- Customizable Coverage Options: Provides flexibility in choosing coverage options. Check out insurance savings in our complete Liberty Mutual auto insurance review.

- 24/7 Claims Service: Offers round-the-clock claims service for convenience.

Cons

- Higher Premiums: Premium rates may be higher compared to some competitors.

- Limited Discounts: Discounts offered may not be as generous as other insurers.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#8 – Farmers: Best for Satisfaction Guarantee

Pros

- Satisfaction Guarantee on Claims: Offers a satisfaction guarantee on the claims process.

- Variety of Coverage Options: As outlined in our Farmers auto insurance review, Farmers provides a wide range of coverage options to meet different needs.

- Good Customer Service Reputation: Known for good customer service and support.

Cons

- Higher Rates: Premium rates may be higher compared to some competitors.

- Limited Discounts: Limited number of discounts available.

#9 – Travelers: Best for Competitive Rates

Pros

- Competitive Pricing: Known for offering competitive rates in the auto insurance market.

- Strong Financial Stability: Has a strong financial standing and stability. Access comprehensive insights into our Travelers auto insurance review.

- Multiple Discounts Available: Offers a variety of discounts to help lower premiums.

Cons

- Limited Availability: Availability may be limited in some regions.

- Mixed Customer Service Reviews: Customer service experiences can vary.

#10 – The Hartford: Best for Lifetime Renewability

Pros

- Lifetime Renewability Option: Offers a lifetime renewability option for policies.

- AARP Partnership: Partners with AARP to offer additional discounts and benefits. Check out our page titled What membership discounts are available for auto insurance? to learn more about the discounts.

- Good Customer Service Ratings: Known for good customer service and satisfaction.

Cons

- Higher Rates: Premium rates may be higher compared to some competitors.

- Limited Availability: Availability may be limited in some states.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

The Best Auto Insurance for Disabled Veterans

Not every company offers a military discount, but the options available can help disabled veterans pay up to 50% less for car insurance.

The average driver can expect to pay around $100 per month for car insurance, but for anyone in the military or who has previously served, USAA will likely offer the best rates for auto insurance policies.

Disabled Veteran Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $60 $140

Farmers $60 $140

Geico $55 $130

Liberty Mutual $60 $140

Nationwide $55 $130

Progressive $50 $120

State Farm $80 $140

The Hartford $65 $150

Travelers $60 $140

USAA $65 $150

If you don’t want to sign with USAA, Geico offers a favorable discount to veterans. However, Esurance and Safe Auto will offer the best savings for veterans.

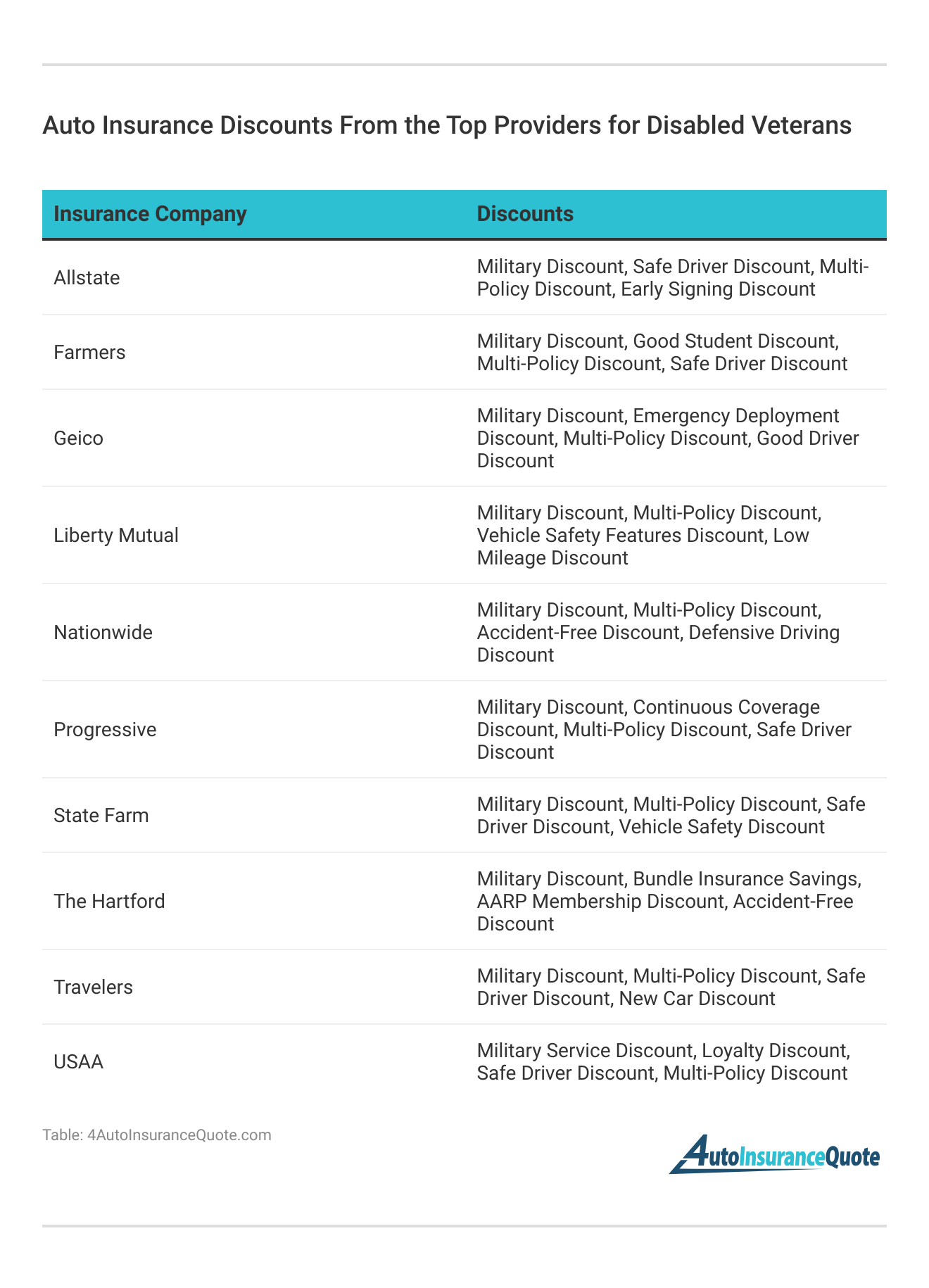

Auto Insurance Discounts for Disabled Veterans

Several nationally recognized providers offer discounts to military personnel. Some offer a significant chunk off for your service, while some offer a nominal percent.

What auto insurance companies offer military members car insurance discounts? Check out the table below for disabled veteran’s auto insurance company discount options:

Military Auto Insurance Discounts by Provider

| Insurance Company | Potential Savings |

|---|---|

| Allstate | 10% |

| American Family | 12% |

| Amica Mutual | 10% |

| Auto-Owners | 10% |

| Erie Insurance | 12% |

| Farmers | 12% |

| Geico | 15% |

| Hanover Insurance | 7% |

| Liberty Mutual | 4% |

| MAPFRE Insurance | 6% |

| Mercury Insurance | 8% |

| National General | 9% |

| Nationwide | 10% |

| Progressive | 15% |

| Safe Auto | 25% |

| Safeco | 8% |

| State Farm | 10% |

| The General | 20% |

| Travelers | 5% |

| USAA | 12% |

Members of AARP know that the benefits are endless when you sign up. But if you’re a disabled veteran, AARP savings are next level:

- AARP veteran members can receive discounts between 10-25% at car part retailers like Jiffy Lube, O’Reilly Auto Parts, and Advanced Auto Parts.

- Active duty, National Reserves, and veterans can get an additional 15% discount on Geico insurance through AARP.

- Current and former service members receive $500 off a lease or purchase of a vehicle.

Read More: Disabled Driver Auto Insurance Discount

Some of the best discounts and auto insurance policies geared toward veterans are from USAA.

Specialized Auto Insurance for Military Members

There are a couple of companies that cater exclusively to current and former members of the military. These companies operate like standard auto insurance providers. However, they cater to the specialty needs of service members.

Progressive offers the most competitive rates for both minimum and full coverage, making it a top choice for disabled veterans.Kristen Gryglik LICENSED INSURANCE AGENT

USAA has been serving current and former military members and their families for nearly 100 years. The company offers auto and home insurance in addition to other financial services.

Armed Forces Insurance has been around for a little longer. Since 1887, the company has sought to protect the property and safety of those in the armed forces.

USAA Auto Insurance

According to the company, the average member pays $450 less on auto insurance than a driver with another provider. When compared to national providers, USAA’s rates are 34% lower on average.

USAA disabled veterans discount benefits can be found in the table below:

USAA Auto Insurance Discounts by Savings Amount

| Discount Name | Potential Savings |

|---|---|

| Anti-lock brakes | 5% |

| Anti-theft | 10% |

| Claim free | 12% |

| Daytime running lights | 3% |

| Defensive driver | 3% |

| Distant student | 7% |

| Driver's ed | 3% |

| Driving device/app | 5% |

| Early signing | 12% |

| Family legacy | 10% |

| Garaging/storing | 90% |

| Good student | 3% |

| Low mileage | 5% |

| Loyalty | 10% |

| Married | 5% |

| Military | 10% |

| Military garaging | 15% |

| Multiple policies | 10% |

| Multiple vehicles | 15% |

| Newer vehicle | 12% |

| Occasional operator | 5% |

| Paperless/auto billing | 3% |

| Passive restraint | 7% |

| Safe driver | 12% |

| Senior driver | 5% |

| Vehicle recovery | 5% |

| VIN etching | 3% |

| Young driver | 75% |

The company also offers discounts to auto insurance policyholders. These savings include safe driving, family, and Student auto insurance discount.

Armed Forces Insurance

Armed Forces Insurance is highly rated among customers. However, its public information on rates is limited. AFI is available in every state and has accolades from customers for best serving disabled veterans or retired military members.

Unlike USAA, AFI does not offer any additional discounts to its members. The company site claims to offer competitive rates based on driving record, enrolling in bundle policies, and more.

If neither of these military-focused companies suits you, there are other discounts and programs available. Disabled veterans are eligible to save hundreds on auto insurance with many different providers.

How to Save on Auto Insurance for Disabled Veterans

In addition to military-specific discounts, disabled veterans can also take advantage of cost-effective programs. Many companies have lists of deals that policyholders can take advantage of, and the best way to learn about your options is to ask a provider.

There are also tailored auto insurance programs that use telematics to measure your driving and produce discounted rates. If you’re a disabled veteran that doesn’t drive that much or is a very cautious driver, these usage-based programs may be a good fit.

Here are some auto insurance discounts tailored for disabled veterans from leading providers:

Other ways veterans can save money on car insurance can be as simple as re-evaluating their needs. Maybe you’re using one car more than the other, or you can downgrade to a smaller, safer vehicle. These tweaks could lower your annual policy rates and help you save money on car insurance for disabled veterans.

When it comes to auto insurance for disabled drivers, companies are limited in what they can charge simply based on a disability.

Under the Americans with Disabilities Act, insurance companies can’t target people for their disabilities. However, there are some pieces to the driving puzzle that aren’t included in the ADA.

An insurance company may charge drivers additional fees for insuring special driving equipment. Common equipment used to modify vehicles for disabled veterans and passengers include:

- Amputee rings

- Automatic doors

- Hand controls

- Keyless entry/ignition

- Pedal extensions

Your disability may impact your auto insurance rates when your medical condition poses a safety risk on the road. Your doctor will report any risk that your disability poses, and the DMV will display this information on your ID.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Key Points on Auto Insurance for Disabled Veterans

If you served in the military, you should have no problem finding affordable auto insurance. Disabled veterans auto insurance is readily available to anyone who wants it.

Before you buy auto insurance for disabled veterans, keep in mind that as a disabled veteran, you have federal protections and benefits at your fingertips. You should contact your benefits representative for more information on these programs.

In the private sector, USAA or AFI may be your best option, or you may find another local retailer that is right for you. Enter your ZIP code now to see what auto insurance rates for disabled veterans are available in your area.

Frequently Asked Questions

How can I lower my auto insurance rates as a disabled veteran?

Besides discounts and programs, there are several other ways to potentially lower your auto insurance rates. These include maintaining a clean driving record, opting for higher deductibles, reducing coverage on older vehicles, and inquiring about any available loyalty or safe driver discounts.

Read More: How To Budget for Auto Insurance

Can I bundle my auto insurance with other insurance policies for additional savings?

Yes, many insurance companies offer bundling options, allowing you to combine your auto insurance with other policies such as home insurance or renters insurance. Bundling policies can often result in additional savings.

Enter your ZIP code into our free quote tool below to find the best auto insurance providers for your needs and budget.

Can I add a caregiver or family member to my auto insurance policy?

Yes, you can typically add a caregiver or family member to your auto insurance policy as an additional driver. This can be beneficial if they assist you with driving or use your vehicle on occasion.

What documents do I need to provide when applying for auto insurance as a disabled veteran?

When applying for auto insurance, you may be asked to provide documents such as your driver’s license, vehicle registration, proof of military service, and any relevant medical documentation related to your disability.

Can I transfer my auto insurance coverage if I switch companies as a disabled veteran?

Yes, it is generally possible to transfer your auto insurance coverage when you switch companies. However, it’s important to check with your current insurer and the new insurer to understand the process and any potential requirements. For more information, read our article titled “Can I transfer auto insurance to a new owner?“.

What is the best auto insurance for disabled veterans?

Disabled veterans can find the best auto insurance rates through USAA, which offers significantly lower rates compared to other nationwide providers. Geico, Esurance, and Safe Auto also provide favorable discounts for veterans.

Do auto insurance companies offer specific discounts for disabled veterans?

Yes, some auto insurance companies offer discounts specifically for disabled veterans. These discounts are often part of a broader effort to support veterans and their families. It’s advisable for disabled veterans to inquire directly with insurance companies about available discounts and eligibility criteria.

Which auto insurance companies provide the best coverage options for disabled veterans?

Several auto insurance companies are known for offering comprehensive coverage options tailored to the needs of disabled veterans. Companies like USAA, which specializes in serving military members and veterans, often provide competitive rates and tailored coverage options for disabled veterans.

Are there specific benefits or advantages for disabled veterans when choosing auto insurance policies?

Yes, disabled veterans may be eligible for certain benefits or advantages when selecting auto insurance policies. These can include special discounts like disabled driver auto insurance discount, flexible payment options, and enhanced customer service geared toward veterans’ unique needs.

How can disabled veterans save money on auto insurance premiums?

Disabled veterans can save money on auto insurance premiums in several ways. Besides discounts offered by insurers, veterans should consider bundling policies, maintaining a clean driving record, and opting for vehicles with safety features that may lower insurance premiums.

Get the best auto insurance rates possible by entering your ZIP code below into our free comparison tool today.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.