Cheap Rhode Island Auto Insurance in 2025 (Find Savings With These 10 Companies)

USAA, State Farm, and Travelers provide affordable and cheap Rhode Island auto insurance, starting at only $28 per month. Known for their cost-effectiveness, extensive coverage options, and excellent customer service, these companies are excellent choices for Rhode Island auto insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

UPDATED: Oct 28, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 28, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage in Rhode Island

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 1,733 reviews

1,733 reviewsCompany Facts

Min. Coverage in Rhode Island

A.M. Best Rating

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviewsFinding cheap Rhode Island auto insurance is easy and straightforward with top providers USAA, State Farm, and Travelers.

If you need details on Rhode Island insurance policies, you’ve come to the right spot. Understanding auto insurance in Rhode Island doesn’t have to be hard.

We’ve gathered everything you need to know to buy cheap Rhode Island auto insurance with confidence.

Our Top 10 Company Picks: Cheap Rhode Island Auto Insurance

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $28 | A++ | Military Focused | USAA | |

| #2 | $32 | B | Customer Service | State Farm | |

| #3 | $44 | A++ | Balanced Coverage | Travelers | |

| #4 | $49 | A+ | Unique Discounts | Progressive | |

| #5 | $50 | A+ | Tailored Policies | The Hartford |

| #6 | $53 | A++ | Low Rates | Geico | |

| #7 | $64 | A | Competitive Rates | American Family | |

| #8 | $80 | A+ | Comprehensive Coverage | Allstate | |

| #9 | $81 | A+ | Vanishing Deductible | Nationwide |

| #10 | $100 | A | Customizable Policies | Liberty Mutual |

Get affordable Rhode Island auto insurance today. Just enter your ZIP code above for free Rhode Island car insurance quotes.

- The monthly cost of car insurance in Rhode Island is $28

- Tailored Rhode Island insurance policies are made to meet the unique needs

- The state of Rhode Island follows the tort insurance system

#1 – USAA: Top Overall Pick

Pros

- Excellent Satisfaction: USAA consistently ranks high in customer satisfaction surveys, known for smooth and efficient claims processes. Lear more about on Allstate vs. USAA.

- Discounts For Military Families.: USAA offers special discounts and low rates tailored specifically for active duty, veterans, and their families.

- Comprehensive Coverage Options: Their policies cover a wide range of needs, ensuring that members have ample protection in various scenarios.

Cons

- For Military Only: Membership is restricted, making it unavailable to the general public.

- Phone Services: Most interactions and services are handled remotely, which may not suit those who prefer in-person assistance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#2 – State Farm: Best for Customer Service

Pros

- Personalized Service: State Farm offers a vast network of agents, allowing customers to receive tailored advice and support.

- Extensive Discounts: They offer various discounts that can significantly reduce premiums, particularly when bundling multiple policies. Learn more in our “State Farm Auto Insurance Review.”

- Robust Coverage Options: State Farm provides specialized insurance, like coverage for rideshare drivers, catering to diverse needs.

Cons

- Higher Premiums: State Farm’s rates can be on the higher side, especially for certain demographics or coverage levels.

- Discounts Uncompetitive: While they offer many discounts, the savings may vary and not always be the best in certain areas.

#3 – Travelers: Best for Balanced Coverage

Pros

- Varied Coverage Options: Travelers offers a broad spectrum of policy enhancements to protect against various risks. Access comprehensive insights into our “Travelers Auto Insurance Review.”

- Strong Reputation Claims: They are known for quick and fair claim resolutions, minimizing hassle for customers.

- Multi-Policy Discounts: Travelers provides attractive discounts when bundling auto and home insurance policies.

Cons

- Not Affordable Option: Travelers may have higher rates, particularly for younger, less experienced drivers.

- Limited Availability: They have fewer local agents, which may limit face-to-face service options.

#4 – Progressive: Best for Unique Discounts

Pros

- Variety Of Discounts: They offer numerous discounts that can help lower premiums, such as for bundling different types of insurance.

- Strong Online Tools: Progressive’s website and mobile app are highly functional, making it easy to get quotes and manage policies.

- Optional Coverage: They offer specialized coverage for customizations and additional vehicle equipment. Read up on the Progressive auto insurance review for more information.

Cons

- Rates Driving History: Premiums may fluctuate significantly based on the individual’s driving record, potentially leading to higher costs.

- Mixed Reviews: Some customers report inconsistent experiences with Progressive’s customer service.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#5 – The Hartford: Best for Tailored Policies

Pros

- Tailored Policies: The Hartford specializes in crafting policies suited for mature drivers, offering unique benefits like RecoverCare.

- Good Customer Service: The company’s focus on older customers often translates into better service and understanding of their specific needs.

- Strong Reputation: The Hartford is known for efficient and fair claims processing, an essential factor for customer satisfaction. Read more through our “Auto Insurance Policy With The Hartford.”

Cons

- Uncompetitive For Drivers: The company’s focus on mature drivers means younger drivers might not find the best rates here.

- Limited For Some Members: Some of the best deals and policy features are restricted to AARP members, limiting access for others.

#6 – Geico: Best for Low Rates

Pros

- Known For Low Rates: Geico is famous for its competitive pricing, often making it a top choice for budget-conscious customers.

- User-Friendly Online: The company’s website and mobile app are intuitive, making policy management and claims processing straightforward.

- Financial Stability: Geico’s solid financial ratings assure customers of its reliability in handling claims. See more details on our “Geico Auto Insurance Review.”

Cons

- Limited Agent Availability: Geico primarily operates online, which may not suit those who prefer in-person interactions with agents.

- Less Personalized Service: The focus on digital interactions may lead to a less personal customer service experience.

#7 – American Family: Best for Competitive Rates

Pros

- Competitive Rates: American Family offers affordable premiums, particularly for safe drivers and those bundling multiple policies. Delve into our evaluation of American Family Insurance auto insurance review.

- Good Discounts: The company provides substantial savings for drivers with clean records and other qualifying factors.

- Satisfaction Ratings: Customers frequently report positive experiences with American Family’s service and claims processes.

Cons

- Limited Availability: American Family’s services are not nationwide, limiting availability depending on your location.

- Non-Family Rates May Higher: Single drivers or those not bundling may find less competitive rates compared to other companies.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#8 – Allstate: Best for Comprehensive Coverage

Pros

- Network of Agents: The company’s extensive network ensures easy access to local, personalized assistance.

- Good Financial Strength: Allstate’s strong financial position provides reliability and trustworthiness in claims payment.

- Variety Discounts Available: The company offers discounts for everything from safe driving to anti-theft devices, helping customers save. More information is available about this provider in our “Allstate vs. USAA: Which Offers More Affordable Auto Insurance Quotes.”

Cons

- More than Premiums: Allstate’s extensive coverage and services can lead to higher costs, making it less appealing for price-sensitive customers.

- Mixed Customer Reviews: While some regions report excellent service, others experience less satisfactory support.

#9 – Nationwide: Best for Vanishing Deductible

Pros

- Unique Features: Nationwide offers innovative options such as vanishing deductibles, rewarding safe drivers by reducing their deductible over time.

- Good Financial Strength: Nationwide is financially stable, ensuring that claims are paid promptly and efficiently. Learn more on how do I file an auto insurance claim with Nationwide.

- Offers Bundling Discounts: Customers can save significantly by combining auto insurance with other policies like home or life insurance.

Cons

- Rates Might Higher: While competitive in some areas, Nationwide’s rates for certain coverages might be above average.

- Customer Service Ratings: Depending on location, customer service experiences can be inconsistent, with some areas providing better support than others.

#10 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Policies: Liberty Mutual allows for extensive customization, enabling customers to tailor their coverage to their specific needs.

- Strong Online Tools: Liberty Mutual’s digital offerings make it easy for customers to manage policies, file claims, and get support.

- Good Financial Stability: The company is financially robust, providing reassurance that claims will be paid. Check out insurance savings in our complete “Liberty Mutual Auto Insurance Review.”

Cons

- Rates May Higher: Liberty Mutual’s extensive coverage options and services can come at a higher price point.

- Customer Experiences: While some customers report positive interactions, others have experienced less satisfactory service.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Average Rhode Island Auto Insurance Rates

Although small in size, Rhode Island is actually quite urban. The Providence metropolitan area is home to over 1.6 million people, making it the 37th most populated area in the United States. In fact, this city is also the 10th most densely populated metropolitan area in the US.

Rhode Island Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $80 | $189 |

| American Family | $64 | $151 |

| Geico | $53 | $125 |

| Liberty Mutual | $100 | $235 |

| Nationwide | $81 | $190 |

| Progressive | $49 | $116 |

| State Farm | $32 | $76 |

| The Hartford | $50 | $75 |

| Travelers | $44 | $103 |

| USAA | $28 | $65 |

Because of this, and other factors, auto insurance rates are high. Rhode Island consistently ranks in the top 10 most expensive states for auto insurance.

In 2008, Rhode Island had an average auto insurance expenditure of $986, making it the 7th most expensive state to buy insurance. With prices this high, shopping around for insurance is a must.

This $986 that Rhode Islanders spend on average to insure their vehicles includes $646 of liability auto insurance coverage, $372 of collision coverage, and $121 of comprehensive auto insurance coverage.

Although liability coverage is the only one that is required by law, comprehensive and collision coverage are also extremely important to have. Liability insurance covers you for damage you do to other cars (if you are ruled to be at fault in an accident).

Collision coverage covers damage done to your own vehicle. Comprehensive coverage protects you from non-collision accidents such as storms, theft, fire, etc.

Minimum Auto Insurance Coverage in Rhode Island

Like in the rest of the United States, auto insurance is required by law in Rhode Island. The minimum coverages required by state law are $25,000/$50,000 for bodily injury liability and $25,000 for property damage.

Uninsured/Underinsured motorist coverage (UM/UIM) is also required in the state of Rhode Island.

The limits for UM/UIM in the state are equal to the limits of your liability coverage. In addition, Rhode Island law requires that you carry proof of insurance with you at all times.

If you get caught driving without insurance, your license will be suspended until proof of insurance is presented.

Lawmakers in Rhode Island have decided that the state follows the tort system. This means that in an accident, somebody has to be ruled at fault, and this person is responsible for paying the victim’s medical expenses and compensating for additional damages.

Because of this system, most insurance companies recommend that Rhode Islanders carry more than the state’s minimums. For more information regarding Rhode Island’s insurance requirements, please visit their Division of Insurance Regulation website.

Although insurance rates constantly rank higher in Rhode Island compared with the rest of the country, that does not mean you cannot get affordable auto insurance rates even if you are a Rhode Islander.

Our insurance quote finder tool will allow you to find the best prices from a variety of companies. Like they say in all the commercials – when companies compete for your business, you win.

We can also take a closer look at the ZIP codes within the state to see how rates changed based on different areas.

Rhode Island Auto Insurance Rates by Company

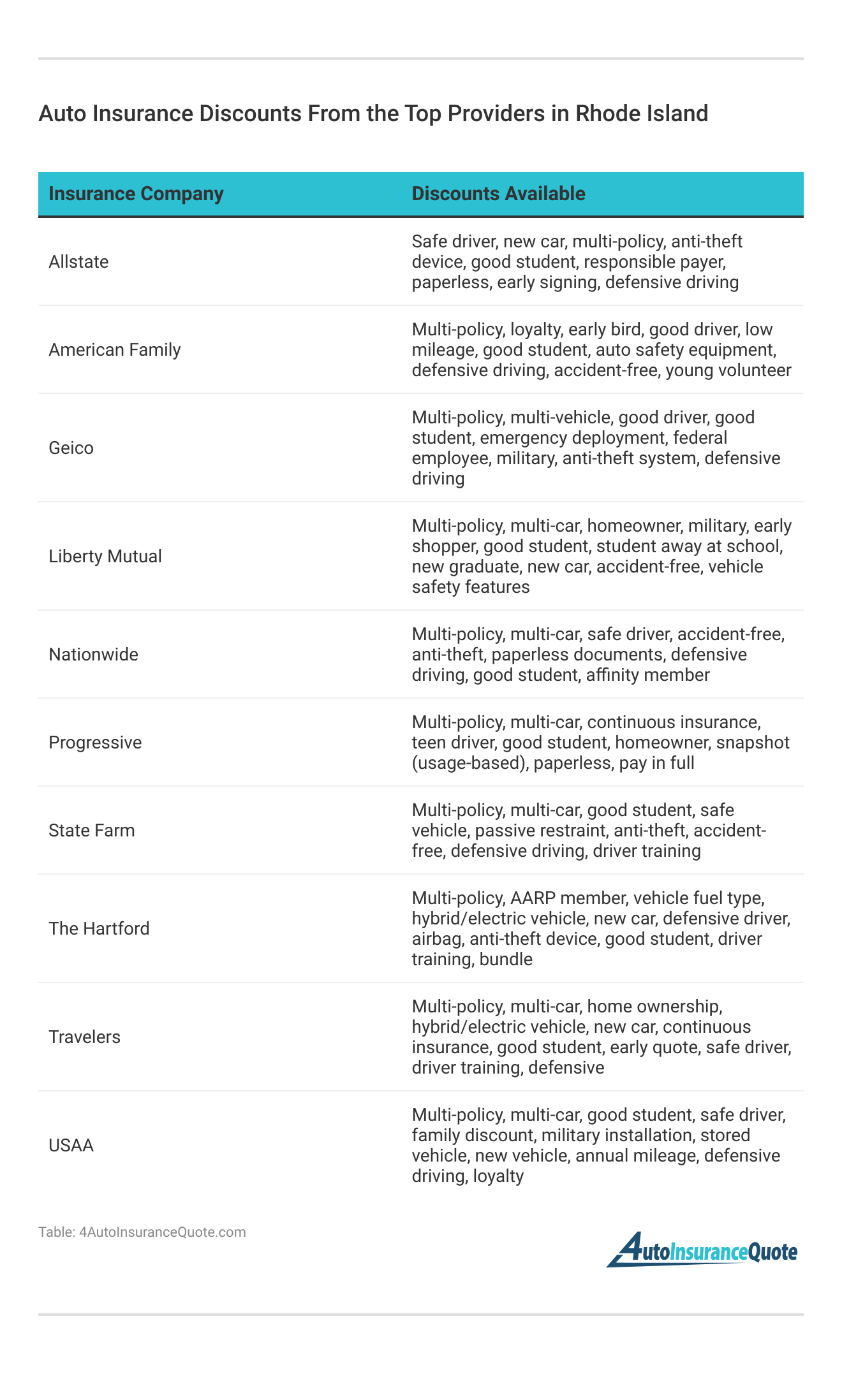

Though the state boasts very cheap auto insurance rates overall, let’s examine how rates, including auto insurance discounts, vary among some of the largest companies.

The largest companies holding the most market share in the region are.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Rhode Island Driving Information

Rhode Island is one of the states located along the famous I-95 highway. Situated between Boston and New York, millions of travelers drive through the state each year. Because of this and other reasons mentioned above, Rhode Island has a high rate of automobile accidents.

Read more: Affordable Land Rover Auto Insurance Quotes

Since 2005, there has been an average of over 40,000 car accidents in Rhode Island per year. Although this number is decreasing due to measures put into place and new roads being constructed, auto accidents are still a real issue in Rhode Island.

Schimri Yoyo Licensed Agent & Financial Advisor

Compare Rhode Island auto insurance rates from top companies to save. Enter your ZIP code now for quotes from top Rhode Island auto insurance companies.

Frequently Asked Questions

How much is car insurance per month in RI?

The average Rhode Island auto insurance rates are $28 per month. These rates are based on the 25/50/25 Rhode Island auto insurance requirements for bodily injury and property damage coverage.

What is the minimum auto insurance coverage in Rhode Island?

In Rhode Island, the state liability coverage minimums are $25,000/$50,000 for bodily injury liability and $25,000 for property damage liability. Uninsured/Underinsured motorist coverage (UM/UIM) is also required in Rhode Island.

Enter your ZIP code below to find the most affordable quotes in your area.

Why is car insurance so expensive in Rhode Island?

Auto insurance rates in Rhode Island are high due to factors such as the state’s population density, traffic congestion, and poor road conditions. Rhode Island consistently ranks among the top 10 most expensive states for auto insurance.

Access comprehensive insights into our guide titled “Auto Insurance Discounts for Affordable Coverage.”

How can I save on Rhode Island auto insurance?

To save on Rhode Island auto insurance, it is recommended to shop around and compare quotes from different auto insurance companies in your area. By comparing quotes, you increase your chances of finding affordable coverage.

What factors can affect auto insurance in Rhode Island?

Auto insurance companies in Rhode Island consider various factors when determining rates, including your driving record, age, gender, ZIP code, and other personal information. Factors such as age and gender can affect rates, with males typically paying higher premiums than females.

Enter your ZIP code now to know more.

What factors influence auto insurance rates in Rhode Island, and how can drivers lower their premiums?

Rates are affected by traffic density, driving history, and credit scores. Drivers can lower premiums by maintaining a clean record, improving credit, and using discounts.

For additional details, explore our comprehensive resource titled “Finding Auto Insurance Quotes Online.”

Which auto insurance companies offer the most affordable rates in Rhode Island for different types of drivers, such as young drivers or those with a clean driving record?

USAA offers low rates for military families, while State Farm and Geico are competitive for clean drivers. Progressive provides savings through its Snapshot program.

What steps should Rhode Island residents take to compare auto insurance quotes effectively and ensure they are getting the best deal?

Gather quotes from multiple insurers and use online comparison tools. Review coverage options, discounts, and customer service ratings.

Enter your ZIP code below to find the most affordable quotes in your area.

How can Rhode Island drivers maximize their savings on auto insurance through discounts and bundling options?

Bundle policies for discounts and seek savings for safe driving and good credit. Consider paying annually or setting up automatic payments.

Access comprehensive insights into our guide titled “Average Cost of Auto Insurance: Find Affordable Quotes.”

Which auto insurance companies offer the most competitive rates for Rhode Island drivers, and what makes them affordable?

Geico, Progressive, and State Farm offer competitive rates due to efficient operations and broad discount options. USAA also provides low rates for military families.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.