Cheap Jaguar Auto Insurance in 2025 (Secure Low Rates With These 10 Companies)

Progressive, State Farm, and Allstate are the top choices for cheap Jaguar auto insurance starting rates as $118 per month, these providers deliver great value. Known for their extensive coverage, excellent customer service and competitive pricing that is ideal for Jaguar drivers seeking reliable insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage for Jaguar

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 11,638 reviews

11,638 reviewsCompany Facts

Min. Coverage for Jaguar

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsProgressive, Geico, and State Farm leads the way as the top choice for cheap Jaguar auto insurance as low as $118 per month.

cheap Jaguar auto insurance quotes are more affordable than average, even when compared to other luxury brands like Audi, BMW, and Lexus. You’ll also want to choose your policy coverage carefully to ensure your Jaguar is properly covered for all types of events.

Read more: Affordable Audi Auto Insurance Quotes

Our Top 10 Company Picks: Cheap Jaguar Auto Insurance| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $118 | A+ | Qualifying Coverage | Progressive | |

| #2 | $127 | B | Customer Service | State Farm | |

| #3 | $133 | A+ | Infrequent Drivers | Allstate | |

| #4 | $141 | A | Policy Options | Farmers | |

| #5 | $146 | A | Policy Options | Liberty Mutual |

| #6 | $152 | A+ | Vanishing Deductible | Nationwide |

| #7 | $157 | A | Costco Members | American Family | |

| #8 | $161 | A++ | Bundling Policies | Travelers | |

| #9 | $167 | A+ | Tailored Policies | The Hartford |

| #10 | $171 | A+ | Dividend Payments | Amica |

Keep reading our Jaguar car insurance review to learn more about the answer to how much insurance coverage do I need and which models have the lowest auto insurance rates.

To find cheap Jaguar auto insurance rates right now, enter your ZIP code above.

- Jaguar insurance costs $118 per month

- The expensive Jaguar to insure is the sporty two-seater F-TYPE convertible

- You’ll get the lowest Jaguar auto insurance quotes when you compare rates

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – Progressive: Top Overall Pick

Pros

- Affordable Starting Rates: Offers one of the lowest starting rates at $118 per month, making it a great option for those seeking cheap Jaguar auto insurance.

- Extensive Coverage Options: Wide range of coverage options, including specialized plans for luxury vehicles, ensuring your Jaguar is well-protected.

- Snapshot Program: Rewards safe driving habits with discounts, potentially lowering premiums further and contributing to cheap Jaguar auto insurance. Find out more through our “Progressive Insurance Review.”

Cons

- Rate Increases: Premiums may increase significantly after filing a claim, which could affect the overall affordability of cheap Jaguar auto insurance.

- Limited Local Agents: Primarily operates online, which might be less convenient for those preferring in-person service, especially when dealing with a luxury brand like Jaguar.

#2 – State Farm: Best for Customer Service

Pros

- Excellent Customer Service: Known for high customer satisfaction and personalized service, which is crucial for maintaining cheap Jaguar auto insurance. Learn more through our “State Farm Auto Insurance Review.”

- Multiple Policy Discounts: Save more by bundling auto insurance with other policies like home or life insurance, contributing to overall cheaper Jaguar auto insurance.

- Strong Financial Stability: Rated highly by A.M. Best for financial strength, ensuring reliability and value in your cheap Jaguar auto insurance.

Cons

- Higher Base Rates: Generally higher base rates compared to competitors, which might make cheap Jaguar auto insurance harder to achieve.

- Limited Online Tools: Fewer digital tools and resources compared to other major insurers, which might limit your ability to manage cheap Jaguar auto insurance online.

#3 – Allstate: Best for Infrequent Drivers

Pros:

- Accident Forgiveness: Protects from rate increases after the first accident, which helps maintain cheap Jaguar auto insurance. Read more through our “Allstate Insurance Review.”

- New Car Replacement: Replaces a totaled car with a new one if the car is less than two years old, offering peace of mind with cheap Jaguar auto insurance.

- Multiple Payment Options: Flexible payment plans and options to fit different budgets, allowing you to better manage your cheap Jaguar auto insurance costs.

Cons:

- High Premiums: Base premiums are higher, particularly for high-performance models like the Jaguar F-TYPE, making cheap Jaguar auto insurance harder to find.

- Strict Eligibility for Discounts: Some discounts may have stringent eligibility criteria, potentially impacting your ability to secure cheap Jaguar auto insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#4 – Farmers: Best for Policy Options

Pros

- Customizable Policies: Extensive customization options to tailor coverage to individual needs, which can help secure cheap Jaguar auto insurance. Read more through our “Farmers Auto Insurance Review.”

- New Car Pledge: If a new car is totaled within the first two years, they will replace it with a new one, ensuring your investment is protected with cheap Jaguar auto insurance.

- Glass Repair Service: No deductible for glass repairs, beneficial for luxury vehicles like Jaguars, contributing to cheaper Jaguar auto insurance overall.

Cons

- Above-Average Premiums: Often more expensive than other providers, especially for high-value vehicles, which can make finding cheap Jaguar auto insurance challenging.

- Limited Discounts: Fewer discount options compared to competitors like State Farm or Progressive, which may limit opportunities for cheap Jaguar auto insurance.

#5 – Liberty Mutual: Best for Policy Options

Pros

- Better Car Replacement: Replaces totaled cars with one that is a year newer and with fewer miles, offering better value with cheap Jaguar auto insurance.

- Lifetime Repair Guarantee: Guarantees repairs for as long as you own the car, when done at an approved shop, ensuring long-term savings on your cheap Jaguar auto insurance.

- Accident Forgiveness: Prevents rate increases after the first accident, maintaining your cheap Jaguar auto insurance rates. Read more through our “Liberty Mutual Auto Insurance Review.”

Cons

- Higher-than-Average Rates: Premiums tend to be on the higher side, particularly for luxury vehicles, making it difficult to secure cheap Jaguar auto insurance.

- Limited Availability: Some coverage options are not available in all states, which could affect access to cheap Jaguar auto insurance depending on your location.

#6 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Deductible decreases over time with safe driving, potentially down to zero, helping you achieve cheap Jaguar auto insurance.

- Strong Customer Support: Offers 24/7 customer service and claims support, ensuring your cheap Jaguar auto insurance experience is smooth and hassle-free.

- Multi-Policy Discounts: Significant savings when bundling with other insurance products, contributing to overall cheaper Jaguar auto insurance. Find out more through our “Nationwide Insurance Review.”

Cons

- Average Base Premiums: Standard premiums are not as low as some competitors, which might impact your ability to find cheap Jaguar auto insurance.

- Limited Online Features: Fewer online resources and tools compared to other major insurers, which might limit your ability to manage cheap Jaguar auto insurance effectively.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#7 – American Family: Best for Costco Members

Pros

- Generous Bundling Discounts: Significant savings when combining auto with home or life insurance, contributing to affordable and cheap Jaguar auto insurance.

- Teen Safe Driver Program: Helps parents monitor and reduce insurance costs for teenage drivers, making it easier to find cheap Jaguar auto insurance for families.

- Strong Claims Support: High customer satisfaction with claims handling, ensuring that your cheap Jaguar auto insurance remains a positive experience. Delve more through our “American Family Auto Insurance Review.”

Cons

- Regional Availability: Coverage may not be available in all areas, which could limit access to cheap Jaguar auto insurance depending on your location.

- Limited Online Tools: Fewer digital tools for managing policies and claims online, potentially impacting the convenience of maintaining cheap Jaguar auto insurance.

#8 – Travelers: Best for Bundling Policies

Pros

- Responsible Driver Discount: Rewards drivers with clean records, significantly lowering premiums and making Jaguar auto insurance more affordable.

- New Car Replacement: Provides new car replacement coverage for totaled vehicles within the first five years, protecting your investment while keeping Jaguar auto insurance cheap.

- Accident Forgiveness: Available to prevent premium increases after the first accident, helping to maintain cheap Jaguar auto insurance over time. Look for more details through our “Travelers Auto Insurance Review.”

Cons

- Average Customer Service: Not as highly rated for customer service as competitors like State Farm, which might impact your overall satisfaction with cheap Jaguar auto insurance.

- Above-Average Premiums: May not be the cheapest option for luxury vehicles like Jaguars, which could affect your ability to secure truly cheap Jaguar auto insurance.

#9 – The Hartford: Best for Tailored Policies

Pros

- Tailored Coverage: Specializes in offering customized policies to meet specific needs, helping you find the right balance of coverage and cheap Jaguar auto insurance.

- Lifetime Renewability: Guarantees policy renewal for as long as you can drive, offering peace of mind and consistent cheap Jaguar auto insurance.

- Disappearing Deductible: Deductible decreases for every year of safe driving, helping maintain cheap Jaguar auto insurance over time. Read more through our “Auto Insurance Policy With The Hartford.”

Cons

- Higher Rates for Young Drivers: Premiums can be significantly higher for younger, less experienced drivers, making it more challenging to secure cheap Jaguar auto insurance.

- Limited Online Features: Not as many online tools for managing policies and claims compared to other insurers, potentially affecting the ease of managing cheap Jaguar auto insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#10 – Amica: Best for Dividend Payments

Pros

- Dividend Policies: Offers dividend-paying policies, where policyholders can receive a portion of their premium back, contributing to overall cheap Jaguar auto insurance.

- Flexible Payment Plans: Offers a variety of payment options to suit different financial situations, helping you manage and maintain cheap Jaguar auto insurance.

- Generous Bundling Discounts: Significant savings when bundling multiple insurance products, making it easier to secure cheap Jaguar auto insurance especially for full coverage auto insurance.

Cons

- High Initial Costs: Initial premiums can be higher, though offset by dividends in the long term, which might affect the upfront affordability of cheap Jaguar auto insurance.

- Limited Availability: Not available in all states or regions, which may limit access to cheap Jaguar auto insurance depending on your location.

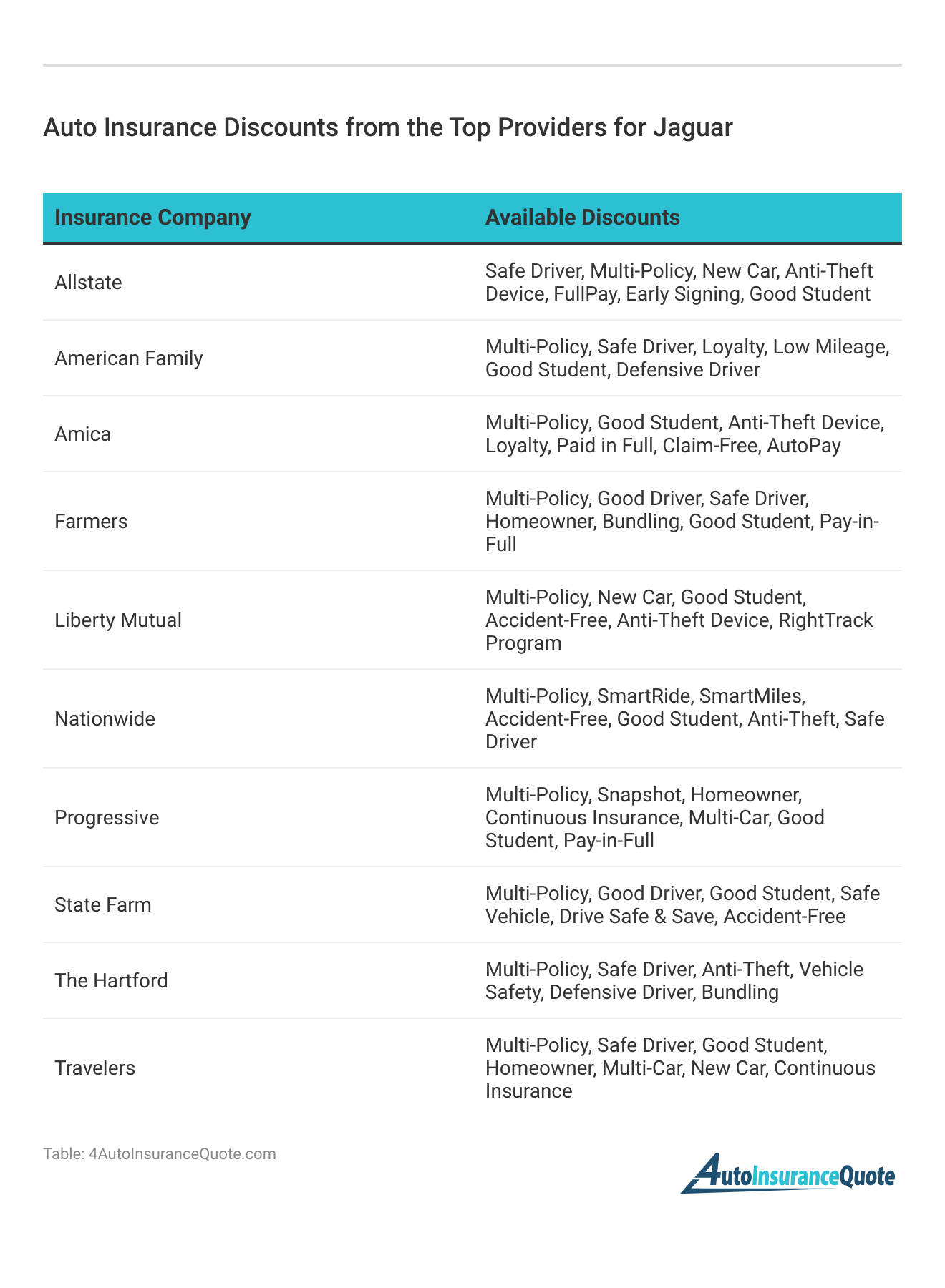

Comparing Jaguar Auto Insurance Quotes

How much is Jaguar insurance? You can find out by comparing auto insurance quotes across different models and companies.

Jaguar Auto Insurance Monthly Rates by Coverage Level & Provider| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $133 | $235 |

| American Family | $157 | $268 |

| Amica | $171 | $289 |

| Farmers | $141 | $247 |

| Liberty Mutual | $146 | $258 |

| Nationwide | $152 | $262 |

| Progressive | $118 | $212 |

| State Farm | $127 | $223 |

| The Hartford | $167 | $281 |

| Travelers | $161 | $273 |

Monthly insurance on a Jaguar F-PACE costs $199 on average, which is the second most expensive after the F-TYPE convertible. Keep reading for a detailed overview of Jaguar insurance rates and tips on how to get cheap auto insurance for sports car drivers.

The Cost of Auto Insurance for a Jaguar F-TYPE

Jaguar F-TYPE auto insurance quotes are the most expensive, averaging $214 per month for full coverage. You’ll likely pay even higher rates for a brand-new F-TYPE since the newest models come with supercharged V8 engines and accelerate to 60 mph in under four seconds.

Jaguar announced that it is retiring the F-TYPE in 2024, which could affect your insurance costs if replacement parts become unavailable or hard to obtain. Shop around regularly for Jaguar quotes to ensure you aren’t overpaying for coverage.

The Cost of Auto Insurance for a Jaguar F-PACE

On average, you can expect to pay closer to $200 monthly for full coverage auto insurance on your Jaguar F-PACE. However, your age and driving record will significantly impact how much you pay.

Older drivers with clean records pay around $199 monthly for F-PACE insurance, but young drivers in their teens and 20s will pay between $420-$450 per month. Auto insurance for teenagers is usually the most expensive.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Features That Impact Jaguar Insurance Costs

The high price of replacement parts and repairs causes Jaguar insurance rates to be more expensive than other sports and luxury vehicles. And as the manufacturer continues to retire many of its models, replacement parts may become harder to find.

Fortunately, the high-tech safety features in many of Jaguar’s latest models will help lower your Jaguar auto insurance rates. Most safety features and anti-theft recovery systems will save you an average of 5%-10% on car insurance with discounts.

You should compare multiple companies to see which offers the biggest discount and overall best price you may Enter your ZIP code to get your quote now.

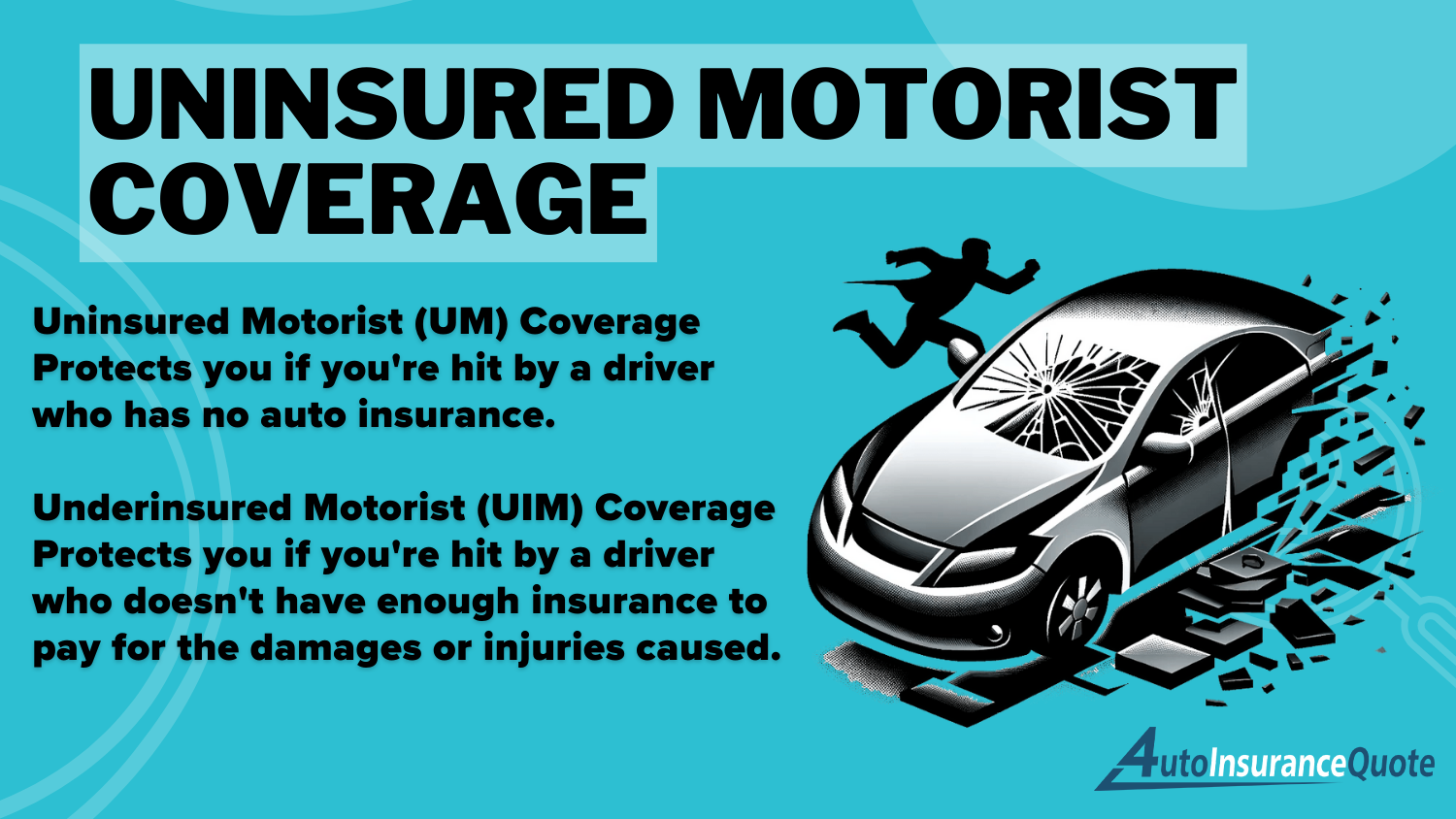

Understanding the Different Types of Jaguar Auto Insurance

It’s worth noting that auto insurance rates are higher on a leased car because lenders typically require full coverage insurance on top of the state’s minimum requirements.

Some companies may not carry the coverage you need, so shop around with multiple insurers to find the right policy. Start with our guide to the best auto insurance companies that don’t force you to use refurbished parts.

Read more: Affordable Convertible Vehicle Auto Insurance Quotes

Getting Affordable Jaguar Auto Insurance Quotes

If you’re looking for cheap Jaguar auto insurance, be prepared to pay more than most drivers. Jaguar insurance rates are generally higher because repairs and replacement parts are often more expensive compared to other luxury vehicles like BMW and Audi.

Schimri Yoyo Licensed Agent & Financial Advisor

Although finding cheap Jaguar auto insurance can be challenging, we recommend carrying full coverage to ensure your vehicle is protected from theft, accidents, and other unexpected events.

Enter your ZIP code and vehicle information to get started. You may also check out affordable BMW auto insurance quotes for a broader comparison, ensuring you secure a good deal on your Jaguar insurance.

Frequently Asked Questions

Are Jaguars expensive to insure?

Yes, Jaguars are luxury sports vehicles with high MSRPs, fast acceleration, and a variety of high-tech and anti-theft features that raise insurance rates. The most expensive Jaguar to insure is the F-TYPE two-seater convertible because of the high-risk associated with sports cars.

Why is sports car insurance so expensive?

Sports cars have more torque and power than a standard vehicle with a four-cylinder engine, which insurance companies consider risky. Drivers with sports cars are more likely to speed, get into accidents, and file claims, which raises auto insurance rates. Enter you ZIP code now.

How can I find affordable Jaguar auto insurance?

To find affordable Jaguar auto insurance, shop around and compare quotes from multiple providers, maintain a clean driving record, opt for higher deductibles, take advantage of discounts like bundling or safety features, and work on improving your credit score.

This allows you to compare coverage options and rates to make an informed decision about affordable auto insurance.

How much is auto insurance on a 2017 Jaguar?

Car insurance rates for a 2017 Jaguar will vary based on the model you have. For example, a 2017 Jaguar XJ insurance costs less than a 2017 F-TYPE, as sedans are cheaper to insure than sports cars. Shop around and compare multiple companies to find the lowest 2017 Jaguar auto insurance quotes.

How much does Jaguar F-PACE insurance cost?

While most SUVs have lower insurance rates, the Jaguar F-PACE is considered a luxury vehicle and will cost insurance companies more to repair. Monthly Jaguar F-PACE auto insurance is closer to $200 to cover potentially expensive repairs and replacement parts. To get started, Enter your ZIP code here.

What affects the cost of Jaguar auto insurance?

Factors like the model, year, driving history, and location impact insurance costs. Jaguars are luxury cars, so premiums are higher, but combining insurance policies, along with discounts and safe driving, can help you find cheap Jaguar auto insurance.

Can I insure a new Jaguar affordably?

Yes, by shopping around and looking for discounts from insurers like Progressive or State Farm, you can secure cheap Jaguar auto insurance for a new car.

How can I lower my Jaguar insurance premiums?

Raise your deductible, bundle policies, and maintain a clean driving record. Programs like Progressive’s Snapshot can also help reduce your premiums. By entering their ZIP code, users can access personalized quotes and make informed decisions.

Which insurers offer cheap Jaguar auto insurance?

Companies like Progressive, State Farm, and Farmers are known for offering competitive rates and discounts on Jaguar auto insurance. Additionally, understanding the differences between comprehensive vs. collision coverage in car insurance is crucial.

What coverage should I get for my Jaguar?

Consider comprehensive and collision coverage to protect your Jaguar. While these options may raise costs, discounts can help keep your insurance cheap.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.