10 Best Auto Insurance Companies That Do Not Monitor Your Driving in 2025

Progressive, USAA, and State Farm are the best auto insurance companies that do not monitor your driving. USAA is the cheapest with rates costing $90/mo but coverage is only available to military members. Insurance companies don't track you unless you sign up for usage-based insurance and give them permission.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

UPDATED: May 2, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: May 2, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

13,283 reviews

13,283 reviewsCompany Facts

Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsProgressive, USAA, and State Farm are the best auto insurance companies that do not monitor your driving.

The good news is that you have to give your insurance company permission to monitor your daily driving activity. The best auto insurance companies listed below won’t follow how you drive unless you’re enrolled in a usage-based insurance program (UBI).

Our Top 10 Picks: Best Auto Insurance Companies That Do Not Monitor Your Driving

Company Rank Low-Mileage Discount A.M. Best Best For Jump to Pros/Cons

#1 30% A++ Flexible Policies State Farm

#2 30% A+ Comprehensive Coverage Progressive

#3 30% A+ Coverage Options Allstate

#4 30% A Technology Integration Liberty Mutual

#5 20% A+ Policy Discounts Nationwide

#6 15% A Loyalty Rewards American Family

#7 15% A Customized Plans MetLife

#8 10% A++ Exceptional Service USAA

#9 10% A Personalized Service Farmers

#10 10% A++ Financial Stability Travelers

However, monitoring your driving habits has its perks, including lower rates for high-risk car insurance.

Most insurers allow tracking for usage-based auto insurance programs, but since you’re looking for auto insurance companies that don’t monitor your driving, enter your ZIP code into our free quote tool to see what you could pay for a policy today.

- Progressive is the best company that won’t monitor driving habits

- USAA is the cheapest company that doesn’t track drivers

- Auto insurance companies won’t monitor your driving unless you agree

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – Progressive: Top Pick Overall

Pros

- Affordable Rates: Progressive auto insurance is cheaper than the national average at $100/mo.

- National Availability: Auto insurance in all 50 states. Compare quotes by state in our Progressive review.

- Policy Perks: Full coverage policies automatically include minor accident forgiveness (up to $500) and pet insurance (up to $1,000).

- Unique Policy Add-Ons: Including rideshare insurance for Uber and Lyft drivers and a Deductible Savings Account for diminishing deductibles.

Cons

- Poor Claims Service: Ranks below average in annual J.D. Power satisfaction surveys.

- High Number of Complaints: Receives more customer complaints than other national insurers

#2 – USAA: Best Customer Service

Pros

- Cheap Rates: Cheapest average auto insurance rates in the country at $90/mo. Get free quotes in our USAA auto insurance review.

- Exceptional Customer Service: Excellent customer and claims satisfaction ratings.

- Financial Services: Members have access to banking services, investments, and loans.

- National Availability: Auto insurance in all 50 states.

Cons

- Limited Policies: Coverage only available to active and retired military and their immediate families.

- No Gap Coverage: Gap insurance not available for new or leased vehicles.

#3 – State Farm: Best for Flexible Policies

Pros

- Driver Favorite: Most popular auto insurance company in the country with cheap rates averaging $110/mo and exceptional customer service.

- Flexible Policy Options: Add-ons for rideshare drivers, roadside assistance, and travel expense coverage.

- Affordable High-Risk Insurance: Drivers with accidents or DUIs get lower rates than with other companies.

- National Availability: Auto insurance in all 50 states. Use our State Farm insurance review to compare quotes in your state.

Cons

- No Gap Coverage: Gap insurance not available for new or leased vehicles.

- Model Restrictions: Some Kia and Hyundai models not eligible for State Farm coverage.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#4 – Allstate: Best Coverage Options

Pros

- Allstate Rewards: Claim-free drivers earn discounts and gift cards. Explore more discounts in our Allstate auto insurance review.

- National Availability: Auto insurance in all 50 states.

- Big Bundling Discounts: Save 25% when you bundle home and auto together with Allstate.

Cons

- Expensive High-Risk Auto Insurance: Raises rates more than other companies after an accident or DUI.

- High Number of Complaints: Receives nearly three times more customer complaints than other national insurers.

#5 – Nationwide: Best Policy Discounts

Pros

- Multi-Vehicle Discounts: Save 20% for insuring multiple vehicles

- Low-Mileage Discounts: Save 25% if you drive less than 7,500 miles per year

- Great Customer Service: Good claims handling and receives half the number of complaints than other companies its size. Read more customer reviews in our Nationwide auto insurance review.

Cons

- Limited Availability: Coverage only in 46 states and policy options are limited in some states.

- Expensive High-Risk Insurance: Raises rates higher than other companies after a DUI.

#6 – Farmers: Best for Personalized Service

Pros

- Personalized Coverage: More auto policies than any other company, including new car replacement and windshield coverage. Compare coverage options in our Farmers insurance review.

- National Availability: Auto insurance in all 50 states.

- Long List of Discounts: More auto insurance discounts than any other company.

Cons

- Expensive: Higher rates than other companies at $115/mo.

- Pulling Coverage: Farmers is no longer writing new auto policies in Florida.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#7 – Liberty Mutual: Best for Technology Integration

Pros

- Great Mobile App: Customers rate the insurance app 4.6/5 on Google Play and 4.8/5 on the App Store.

- Discounts for Young Drivers: Teens save 10% with defensive driving and 15% with student discounts.

- Policy Add-Ons: New Car and Better Car Replacement get drivers back on the road in a new car after their vehicle is totaled in a covered event or collision.

Cons

- Expensive High-Risk Insurance: Raises rates more than other companies after a speeding ticket or accident.

- Poor Customer Service: Consistently ranks below average for customer and claims satisfaction in annual J.D. Power surveys.

#8 – American Family: Best Loyalty Rewards

Pros

- Exceptional Claims Service: Top ten in claims satisfaction according to J.D. Power. Get full rankings in our AmFam auto insurance review.

- Driver Rewards: DreamKeep Rewards program encourages driver safety by awarding gift cards and more for certain actions, like checking tire pressure, organizing a neighborhood watch, and installing smoke alarms.

- Unique Policies: Rideshare insurance, gap coverage, accidental death and dismemberment, and OEM coverage available.

Cons

- Limited Availability: Coverage only in 21 states.

- Limited Rewards: DreamKeep Rewards only available in Illinois, but AmFam plans to expand the program.

#9 – Travelers: Best for Financial Stability

Pros

- Financial Strength: One of the largest and most financially stable insurance providers in the U.S. See company rankings in our Travelers Insurance review.

- Cheap Commercial and High-Risk Insurance: Affordable rates for business policies and drivers with accidents.

- Easy Claim Filing: Drivers can file auto insurance claims directly from the Travelers mobile app

Cons

- Limited Availability: Coverage only in 42 states.

- Fewer Discounts: Other companies have more auto insurance discounts.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#10 – MetLife: Best for Customized Plans

Pros

- Suite of Products: Wide array of insurance coverage, including auto, life, dental, vision, etc.

- Variety of Auto Policies: Including RV, boat, and personal excess liability protection.

- Single Deductible: Drivers in some states are eligible for one deductible if they purchase auto and home policies with MetLife. Learn what happens when an auto insurance deductible is waived.

Cons

- Limited Availability: Auto coverage is only available as part of group insurance programs offered by participating employers.

- Not Underwritten by MetLife: Farmers underwrites auto insurance policies offered through MetLife auto and home group insurance programs.

Auto Insurance Rates With Companies That Don’t Monitor Driving

If you’re considering auto insurance companies that don’t monitor your driving, remember that an insurer can’t track you without your express permission. The insurance company won’t know how far or fast you drive unless you download a mobile app or install an insurance device in your car.

Progressive is the best car insurance company that doesn’t monitor your driving. It has a variety of policy perks, like accident forgiveness and pet coverage, but these perks come with a price.

Progressive auto insurance rates are affordable but not the cheapest on our list:

Auto Insurance Monthly Rates by Coverage Level & Providers That Don’t Monitor Driving

Insurance Company Minimum Coverage Full Coverage

$90 $170

$75 $155

$85 $165

$95 $175

$100 $180

$75 $155

$70 $150

$80 $160

$85 $165

$60 $130

USAA is the cheapest company that won’t track driving habits. It also offers a 15% discount for safe drivers who remain claim and accident-free without using a monitoring device.

Along with low rates, USAA policyholders enjoy an array of financial and banking services. USAA provides auto loans and bank accounts to its members, which you can sign up for online.

Unfortunately, only members of the military and their immediate families can buy USAA car insurance. If you aren’t active military or a veteran, consider comparing quotes from Progressive, American Family, and Nationwide, the next cheapest auto insurance companies that do not monitor your driving.

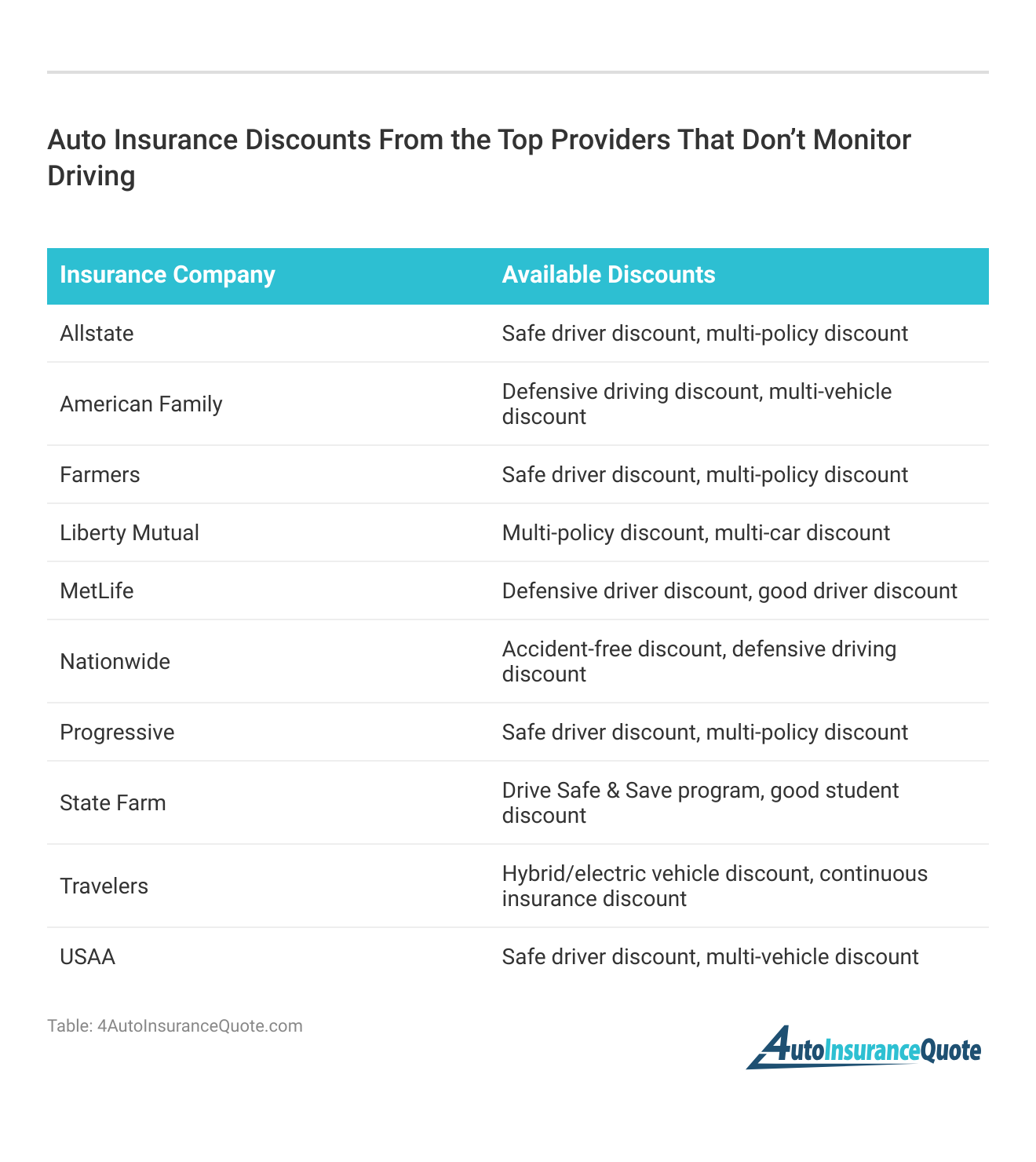

More Ways to Save on Auto Insurance

You don’t need an auto insurance tracking device to save money on car insurance. All of the companies on this list offer a long variety of car insurance discounts, with Nationwide and Farmers having the best discounts for drivers who don’t want to be tracked.

This table lists the biggest discounts with each company:

Scroll through our list of auto insurance discounts for more details. For example, Liberty Mutual offers huge discounts of up to 25% for multiple policies and vehicles, but teens and college students away at school also enjoy big discounts between 15%-20% for good grades and safe driving.

Risks of Using Auto Insurance Tracking Devices

What is an auto insurance monitoring device? Many companies that offer insurance driving monitoring devices either give you a device to hook up to your car, a mobile app, or both. The car insurance device connects to your vehicle’s computer, or the company monitors you through a mobile app.

UBI is based on telemetrics which measure your driving habits, including speed, and show the insurance company how far you drive. Other data providers collect can include:

- Smartphone use

- Hard braking

- Time of day

The insurer will use your tracking data to set rates, but how it will impact your costs varies between companies. You should also be wary of giving an insurer your data and how it will use that information in legal processes if you’re involved in a claim.

Read More: How to File an Auto Insurance Claim

Your car insurance tracking device will use all the data you acquire to understand how you perform while out on the road. If you are a more risky driver, your insurance company may want to reevaluate your rates. This can be seen as a risk to someone who doesn’t want their every movement tracked.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Understanding Usage-Based Auto Insurance

Usage-based auto insurance (UBI) uses telemetrics to monitor how far you drive and if you operate the vehicle safely.

What is a usage-based insurance program? UBI is car insurance with a tracker — the insurance company will give you a car insurance driving monitor to insert into your vehicle or you’ll download an insurance app that tracks your driving. It also measures your miles and the amount of care you take while on the road.

The best telematics insurance companies include some providers on this list. Check out our car insurance tracking device reviews to learn more:

- Geico DriveEasy Review

- Liberty Mutual RightTrack Review

- State Farm Drive Safe & Save Review

- Travelers IntelliDrive Review

These are just a few options, as telematics insurance comparisons have become more prevalent in recent years.

Pay-Per-Mile Auto Insurance Programs

Some people have found less use for their vehicles than in the past. Since drivers have been commuting less in recent years, more insurance companies see the value in offering mile-based auto insurance programs. Compare the average miles driven per year by state.

More insurance companies now offer auto insurance based on how often you use your car, known as pay-per-mile or pay-per-use auto insurance. Your monthly rates will be based on a flat rate multiplied by how many miles you drive each month. For example, if you only drive 15 miles per week, the insurance company will base your rates on those miles.Dani Best Licensed Insurance Producer

UBI and pay-per-mile programs can give affordable rates for drivers who don’t use their cars that much. So, if you’re not driving your vehicle often, telemetry-based auto insurance can help you save. Understanding auto insurance and how usage-based policies work can save you money in the long run.

If you prefer to buy car insurance without a tracker, you may still be eligible for low-mileage auto insurance discounts.

Auto Insurance Discounts for GPS Tracking

The benefit of using car insurance monitoring devices is that you will likely save on your auto insurance rates each month. Car insurance companies track your vehicle to offer different discounts associated with your driving habits.

If you don't drive much, usage-based and pay-per-use programs are a great way to save on monthly rates. For example, since the cost is based on how many miles you go, you can expect that you'd pay much less if you only drive a dozen miles per week or less than 8,000 per year.Michael Leotta Insurance Operations Specialist

If the insurance company can tell that you’re a high-risk driver, usage-based programs can save you 10% to 15% annually. Explore more ways to find affordable high-risk auto insurance.

Comparing the Best Auto Insurance Companies That Do Not Monitor Your Driving

Progressive and State Farm are the best car insurance companies that don’t track driving habits, but USAA is the best insurance company for military drivers. USAA and Progressive are also the cheapest companies on the list.

Despite higher rates, Allstate and American Family offer loyalty rewards to safe drivers who renew their policies. Nationwide and Farmers also offer a variety of auto insurance discounts to lower rates.

If you’re looking for auto insurance companies that don’t monitor your driving, you should know that you must give the company permission to track you. But, with usage-based auto insurance, telematics is a great way to lower your auto insurance rates.

.@nytimes reports that automakers are sharing driving behavior with insurance companies. Prof. @omribenshahar said that “stealth enrollment” was troubling even though “[t]he impact on safety is enormous” with opt-in usage-based insurance. https://t.co/0VBK9k5LZo

— UChicago Law School (@UChicagoLaw) March 11, 2024

Now that you’ve compared the best auto insurance companies that don’t monitor your driving, enter your ZIP code into our free quote tool to see what you could pay for auto insurance near you.

Frequently Asked Questions

What is insurance monitoring?

Auto insurance monitoring is a way for drivers to earn car insurance discounts for safe driving habits.

Can car insurance companies track your vehicle?

Some insurance policies allow you to get usage-based or pay-per-mile programs where you only pay for how far you drive the vehicle. The company monitors how well you drive and how far through a car insurance tracker you willfully attach to your car. If you don’t sign up for this program, your insurance company can’t monitor you’re driving.

Does Root insurance monitor your driving?

Yes, Root is a telemetric insurance company that monitors drivers to set rates. The company tracks driving habits, driving times, mileage, and route consistency through a mobile app to help safe drivers save money. Read our Root auto insurance review to learn more.

Do all auto insurance companies monitor your driving?

No, insurance companies don’t track your driving unless you give them permission. They typically offer usage-based programs for monitoring.

How do insurance companies track your driving?

Auto insurance companies cannot monitor your driving without your permission. You agree by signing up for your company’s usage-based app or by installing a car insurance tracker device into your vehicle.

How does Geico monitor driving?

Geico monitors driving when you sign up for DriveEasy, its usage-based program. Read our Geico DriveEasy review to learn how it works.

What is usage-based auto insurance?

Usage-based auto insurance is a policy that calculates your rates based on how often you drive. It can help you save if you don’t drive much.

Can insurance companies track your car without your permission?

Insurance companies can only track your car if you willingly attach a monitoring device or use a mobile app provided by the insurer.

What are the risks of using car insurance tracking devices?

Insurance companies use tracking data to assess your driving behavior. If you’re considered a risky driver, you’ll pay more for high-risk auto insurance. Also, be cautious about how your data may be used in legal processes.

What are the benefits of an auto insurance monitoring app?

With usage-based auto insurance, you can potentially save on your monthly rates if you drive fewer miles. It offers more personalized pricing based on your driving habits than low-mileage discounts.

How do insurance apps know who is driving?

The gyroscope in your smartphone is able to differentiate where you are seated in the vehicle. However, this sensor isn’t fool-proof, and many drivers complain about apps not being able to always tell who’s driving.

What is the best insurance for high risk drivers?

High-risk drivers with multiple traffic citations, accidents, or claims can benefit from usage-based auto insurance. If you practice safe driving habits now, UBI can help you save money by basing rates on current driving habits and not your driving record. Enter your ZIP code below to find affordable coverage today.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.