Cheap Nebraska Auto Insurance for 2025 (Find Savings With These 10 Companies)

AAA, State Farm, and Auto-Owners are top options for cheap Nebraska auto insurance. These companies offer some of the most competitive rates, beginning at $16 per month. This article explores the advantages and disadvantages of each insurer to help Idaho drivers make a well-informed decision.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Oct 28, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 28, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage in Nebraska

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 563 reviews

563 reviewsCompany Facts

Min. Coverage in Nebraska

A.M. Best Rating

Complaint Level

563 reviews

563 reviewsAAA, State Farm, and Auto-Owners are the best options for cheap Nebraska auto insurance, offering competitive prices and comprehensive coverage.

Understanding auto insurance and how it works can help you to buy Nebraska auto insurance with confidence, and we have everything you need to know.

Read on for laws, Nebraska car insurance rates, and more.

Our Top 10 Company Picks: Cheap Nebraska Auto Insurance

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $16 | A | Roadside Assistance | AAA |

| #2 | $18 | B | Customer Service | State Farm | |

| #3 | $21 | A++ | Reliability Focused | Auto-Owners | |

| #4 | $25 | A+ | Qualifying Coverage | Progressive | |

| #5 | $26 | A++ | Cheap Rates | Geico | |

| #6 | $27 | A++ | Bundling Policies | Travelers | |

| #7 | $30 | A | Costco Members | American Family | |

| #8 | $35 | A | Policy Options | Farmers | |

| #9 | $33 | A+ | Infrequent Drivers | Allstate | |

| #10 | $48 | A | 24/7 Support | Liberty Mutual |

If you want to find cheap Nebraska auto insurance right now, just enter your ZIP code to compare quotes from top companies.

- Nebraska car insurance requirements are 25/50/25

- The starting rate of car insurance in Nebraska are $16/mo

- Nebraska operates under the tort insurance system

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – AAA: Top Overall Pick

Pros

- Low Rates: AAA offers some of the most affordable rates for cheap Nebraska auto insurance, starting at just $16 per month for minimum coverage. This makes it a top choice for budget-conscious drivers.

- Member Benefits: AAA members receive additional perks, including roadside assistance and travel discounts, which can add significant value beyond basic auto insurance.

- Strong Reputation: Known for its high-quality customer service and reliable claims handling, AAA provides peace of mind and trusted support. Learn more through our AAA auto insurance review.

Cons

- Membership Requirement: To access some benefits and discounts, you need to be a AAA member, which may not be ideal for those who prefer not to join organizations.

- Limited Availability: AAA’s insurance offerings may not be available in all areas, which could restrict options for drivers in certain regions of Nebraska.

#2 – State Farm: Best for Customer Service

Pros

- Excellent Customer Service: State Farm is renowned for its high customer service ratings, making it a reliable choice for those seeking support with their cheap Nebraska auto insurance.

- Discounts and Savings: State Farm provides a variety of discounts, including those for safe driving and bundling, which can help lower your overall insurance costs. Discover more in our State Farm auto insurance review.

- User-Friendly Digital Tools: The company’s online tools and mobile app streamline the process of managing your policy, filing claims, and accessing account information.

Cons

- Higher Rates for Some Drivers: Drivers with higher risk profiles may find State Farm’s rates less competitive compared to other providers.

- Potential for Rate Increases: State Farm may raise rates after accidents or moving violations, which could impact the affordability of your cheap Nebraska auto insurance.

#3 – Auto-Owners: Best for Reliability Focused

Pros

- Reliable Coverage: Auto-Owners is known for its dependable coverage and efficient claims service, providing reliable protection for your cheap Nebraska auto insurance needs.

- Affordable Rates: Offers competitive pricing and various discounts, making it an attractive option for budget-conscious drivers.

- Strong Financial Ratings: With high ratings from A.M. Best, Auto-Owners ensures financial stability and reliability in handling claims. Read more on Auto-Owners auto insurance review.

Cons

- Limited Digital Options: Auto-Owners’ online tools and mobile app are less advanced compared to some competitors, which may affect convenience.

- Availability Issues: Coverage options may be limited in certain areas, potentially reducing accessibility for some Nebraska drivers.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#4 – Progressive: Best for Qualifying Coverage

Pros

- Competitive Rates: Progressive often provides some of the lowest rates for cheap Nebraska auto insurance, making it an attractive choice for cost savings. Find more details about this provider in our guide: Progressive Auto Insurance Review

- Flexible Coverage Options: Offers a range of coverage options and innovative features like the Name Your Price® tool, which helps tailor policies to your budget.

- Easy Comparison: Progressive’s tools allow you to compare coverage and rates within their offerings, simplifying the process of finding affordable insurance.

Cons

- Customer Service Variability: Customer service experiences can be inconsistent, leading to mixed reviews regarding support and claims handling.

- Higher Premiums for Some Drivers: Drivers with poor credit or a history of claims might face higher rates, affecting overall affordability.

#5 – Geico: Best for Cheap Rates

Pros

- Lowest Rates: Geico is well-known for offering some of the cheapest rates for auto insurance, including cheap Nebraska auto insurance, which makes it a top choice for savings.

- Extensive Discounts: Provides numerous discounts, such as those for military members and federal employees, which can further reduce your insurance costs. Discover more on Geico auto insurance review.

- Good Financial Stability: Strong financial ratings ensure reliability and stability in handling your claims.

Cons

- Limited Local Agents: Geico’s reliance on online and phone service means fewer opportunities for in-person interactions with local agents.

- Potential Rate Hikes: Rates may increase after claims or other factors, which could impact the long-term affordability of your cheap Nebraska auto insurance.

#6 – Travelers: Best for Bundling Policies

Pros

- Customizable Coverage: Provides a wide range of coverage options and endorsements, allowing you to customize your policy to fit your specific needs.

- Good Claims Service: Generally positive reviews for claims handling and customer service contribute to a reliable insurance experience.

- Innovative Discounts: Offers discounts for advanced safety features in vehicles, which can help lower your premium. Read our full review of Travelers insurance for more information.

Cons

- Higher Premiums for Some: Rates may be higher for certain drivers, potentially making it less cost-effective compared to other options.

- Complex Policy Options: The variety of coverage options can be overwhelming and may require careful review to ensure you’re getting the best value.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#7 – American Family: Best for Costco Members

Pros

- Exclusive Discounts for Members: American Family offers special discounts for Costco members, which can make their policies more affordable.

- Comprehensive Coverage Options: Provides a broad selection of coverage options and add-ons, allowing for a tailored insurance experience. Learn how to file an auto insurance claim with American Family in our comprehensive guide.

- Flexibility in Coverage: Offers customizable policies to meet your specific insurance needs and preferences.

Cons

- Higher Rates for Some Drivers: May have higher rates compared to some competitors, particularly for those with higher risk profiles.

- Limited Availability: Coverage options and discounts may vary by location, potentially affecting access for some Nebraska drivers.

#8 – Farmers: Best for Policy Options

Pros

- Wide Range of Policies: Farmers offers a diverse selection of policy options, ensuring you can find coverage that suits your needs.

- Customizable Plans: Allows for significant customization of your coverage, providing flexibility to tailor your policy.

- Discounts for Bundling: Provides substantial savings for bundling auto insurance with other types of coverage, such as home insurance. Take a look at our Farmers auto insurance review to learn more.

Cons

- Potentially Higher Premiums: Rates may be higher compared to some competitors, especially for younger or higher-risk drivers.

- Inconsistent Customer Service: Service quality can vary by location and agent, leading to mixed experiences.

#9 – Allstate: Best for Infrequent Drivers

Pros

- Good for Infrequent Drivers: Allstate offers competitive rates for drivers who use their vehicles less frequently, which can lower your cheap Nebraska auto insurance costs. Take a more in-depth in our Allstate vs. USAA.

- Strong Claims Handling: Generally positive reviews for claims processing and customer support contribute to a reliable insurance experience.

- Discounts for Safety Features: Offers discounts for vehicles equipped with advanced safety features, helping to reduce your premium.

Cons

- Higher Rates for Some: Can be more expensive for high-risk drivers or those with poor credit.

- Complex Policies: The broad range of options can be confusing, requiring careful review to ensure you get the best coverage for your needs.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for 24/7 Support

Pros

- 24/7 Support: Liberty Mutual provides round-the-clock customer support, ensuring you can get assistance whenever needed. Our auto insurance experts share more in our Liberty Mutual auto insurance.

- Competitive Rates: Offers competitive rates and various discounts, making it a good option for finding cheap Nebraska auto insurance.

- Good for Multi-Policy Discounts: Significant savings available for bundling multiple insurance policies.

Cons

- Mixed Customer Reviews: Customer service and claims handling can be inconsistent, leading to varied experiences.

- Potential for Rate Increases: Premiums may rise after claims or due to other factors, which can impact long-term affordability.

Nebraska Auto Insurance Laws and Minimums

Nebraska operates its auto insurance laws under the tort system, which the majority of states follow in some form or another. The main feature of this system is that when an accident occurs, one of the drivers or parties involved will be labeled the at-fault party.

It is this person’s auto insurance that will pay out associated injury and property damage claims, and this driver will be the one subject to any subsequent legal action.

Nebraska Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $16 | $56 |

| Allstate | $33 | $125 |

| American Family | $30 | $112 |

| Farmers | $35 | $130 |

| Geico | $26 | $92 |

| Liberty Mutual | $48 | $179 |

| Auto-Owners | $21 | $77 |

| Progressive | $25 | $95 |

| State Farm | $18 | $69 |

| Travelers | $27 | $102 |

Drivers in the state are required to purchase a minimum amount of coverage in two different auto insurance policies.

Bodily injury liability insurance covers the medical treatment, rehabilitation, lost wages, and other injury-related costs for the other drivers, passengers, and pedestrians in an accident where the policyholder is the at-fault party.

Property damage liability insurance works much the same, except as the name implies, this coverage is targeted at property damage that results from an accident that you are at fault for causing. Again, this insurance does not cover the policyholder or any of their property.

Average Auto Insurance Rates in Nebraska

Thanks to its lower population and distance from coastal shipping areas which are used to transport stolen automobiles out of the country, drivers in Nebraska enjoy auto insurance prices that are considerably lower than the $120 per month

As of August 2011, drivers in Nebraska are looking at a statewide of just $96 monthly of auto insurance and very reasonable.

Those who live in Nebraska’s major cities will pay slightly higher rates; drivers in Lincoln are looking at $99 per month, and those in Omaha will pay an $95.

Let’s take a closer look at the ZIP codes within the state to see how rates changed based on different areas.

There are a lot of factors that auto insurance companies take into consideration when determining your average cost of auto insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Nebraska Driving Statistics

Unfortunately, Nebraska was one of the only states that saw an increase in vehicle crashes for the most recent years in which data are available. Thankfully, the increase was minuscule and can be considered almost flat when looking at trends.

In 2009, the state saw a total of 34,665 crashes, with 17,775 people injured and 223 fatalities resulting from these accidents. These numbers compare to 2008’s totals of 34,604 crashes, 17,799 injuries, and 208 fatalities.

Nebraska’s Department of Roads is committed to reducing these numbers, and with time it’s likely that the totals will fall further.

News is a bit better when considering auto theft statistics across the state. In 2009, just 3,481 vehicles were reported stolen; this represents a rate of 193.8 vehicles per 100,000 citizens and helped Nebraska rank 31st in the country for instances of auto theft.

These numbers are a major improvement over 2008, when the state saw 4,223 vehicles stolen, a rate of 237 vehicles per 100,000 citizens, and a national ranking of 28th highest. For comparison, the state of Nebraska is the 38th largest state in the country by population.

This is most likely the short-term goal of lawmakers and law enforcement as they work to bring down the state’s auto theft numbers. As this number comes down, affordable instant auto insurance premiums will also fall as the risk of auto theft that insurers have to make up for declines.

Getting an Insurance Quote in Nebraska

4AutoInsuranceQuote.com wants to make finding the best prices for Nebraska auto insurance simple, and we’ve built an excellent tool right into this web page that can help.

Schimri Yoyo Licensed Agent & Financial Advisor

Compare Nebraska auto insurance quotes today. Just enter your ZIP code below to get started.

Frequently Asked Questions

What are the minimum requirements for auto insurance in Nebraska?

In Nebraska, the minimum auto insurance requirements are 25/50/25 for bodily injury and property damage coverage and 25/50 for uninsured motorist coverage.

What is the average cost of auto insurance in Nebraska?

The average auto insurance rates in Nebraska are $96.50 per month or $1,158 per year. Enter your ZIP code for more details.

How can I find the best car insurance companies in Nebraska?

To find the best auto insurance companies in Nebraska, it is recommended to compare rates from multiple companies before making a purchase.

Learn more about how auto insurance companies value cars in our article.

Can I lower my cheap Nebraska auto insurance rates with a good driving record?

Yes, maintaining a clean driving record can help you qualify for lower rates and discounts. Many insurers offer reduced premiums for drivers with a history of safe driving.

What additional coverage options can I add to my Nebraska auto insurance policy?

In Nebraska, you have the option to add additional coverage such as comprehensive coverage, collision coverage, and personal injury protection (PIP) to your auto insurance policy.

Enter your ZIP code to discover different rates.

How can I get an insurance quote for auto insurance in Nebraska?

You can get auto insurance quotes in Nebraska by using a price comparison tool that allows you to compare rates from multiple insurance companies.

Read more: Your Credit Score and Auto Insurance Quotes

How can I find cheap Nebraska auto insurance?

Compare quotes from multiple providers, look for discounts, and consider options like telematics programs to find the most affordable rates.

What factors affect my auto insurance rates in Nebraska?

Factors include your driving history, vehicle type, location, and credit score. Higher risk factors generally lead to higher premiums. Enter your ZIP code.

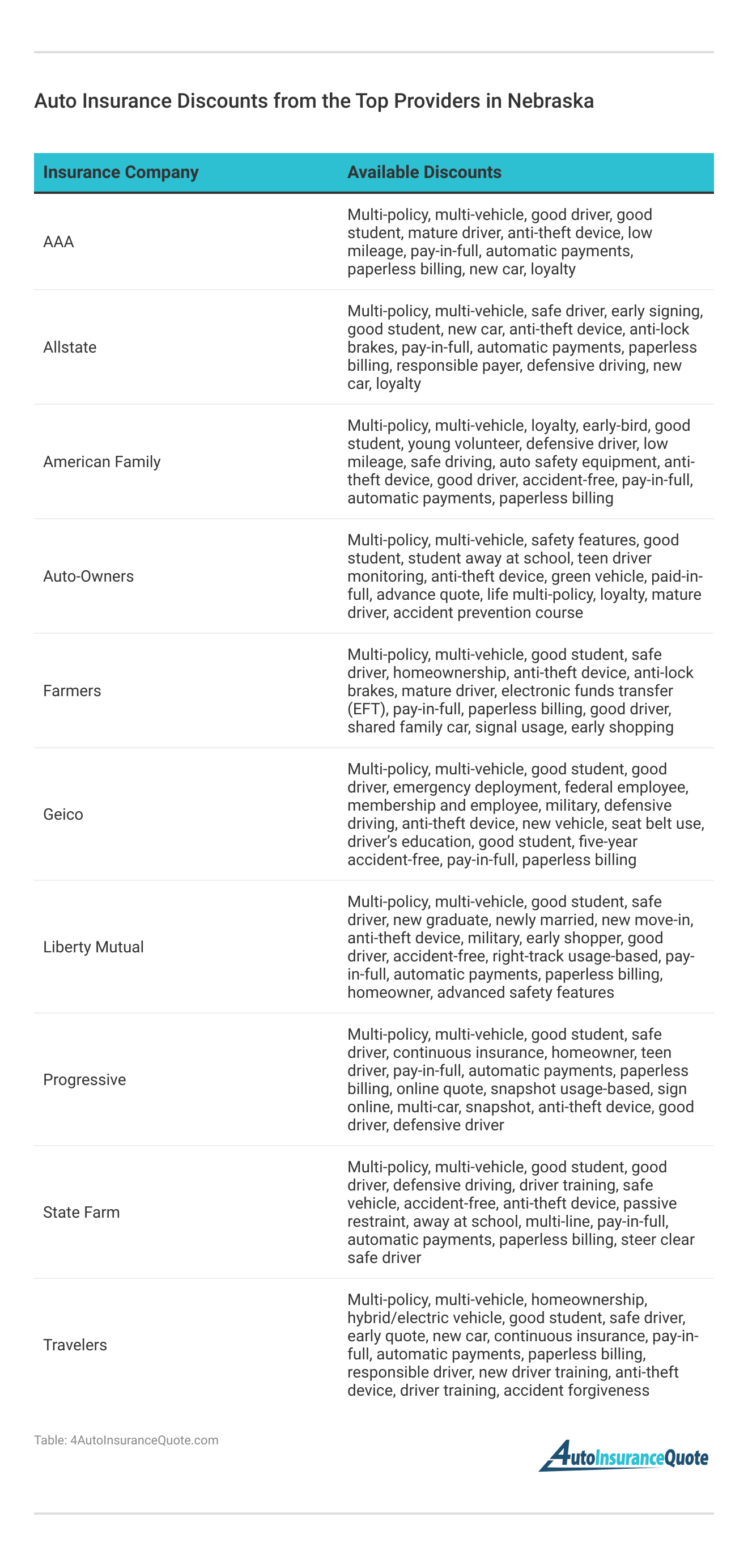

Are there discounts available for Nebraska auto insurance?

Yes, many insurers offer discounts for safe driving, bundling policies, and having safety features in your vehicle.

Learn how to find your car’s make and model in our comprehensive guide.

How does my location in Nebraska impact my auto insurance rates?

Your location affects your rates based on local factors such as population density, crime rates, and accident statistics. For example, rates may be higher in larger cities like Omaha compared to rural areas due to increased risk of accidents and theft.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.