Cheap West Virginia Auto Insurance in 2025 (Cash Savings With These 10 Companies)

The top three companies for cheap West Virginia auto insurance are USAA, State Farm, and Geico. These insurers provide some of the lowest rates starting at $25 per month. This article explores the advantages and disadvantages of each provider, helping you make an informed decision for drivers of West Virginia.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage in WV

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage in WV

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews

USAA, State Farm, and Geico are standout providers for cheap West Virginia auto insurance, offering competitive rates and comprehensive coverage.

Our Top 10 Company Picks: Cheap West Virginia Auto Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $25 A++ Military Families USAA

#2 $29 B Low Rates State Farm

#3 $31 A++ Competitive Rates Geico

#4 $38 A++ Flexible Options Travelers

#5 $39 A+ Good Discounts Nationwide

#6 $41 A+ Snapshot Program Progressive

#7 $42 A+ Low Rates Erie

#8 $51 A Comprehensive Coverage Farmers

#9 $60 A+ Great Discounts Allstate

#10 $72 A Customizable Coverage Liberty Mutual

Let’s take a look at West Virginia auto insurance, including the minimum auto insurance coverage in West Virginia and cheap auto insurance. Enter your ZIP code now for free West Virginia auto insurance quotes.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – USAA: Top Overall Pick

Pros

- Low Rates for Military Families: Offers the most competitive monthly rate at $25, making it a top choice for affordable West Virginia auto insurance for military families. This affordability is ideal for those seeking budget-friendly coverage.

- Comprehensive Coverage Options: Provides extensive coverage options including liability, collision, and comprehensive, ensuring high-quality coverage at a low cost, which is crucial for affordable insurance in West Virginia.

- Excellent Customer Service: Consistently high ratings for customer satisfaction and support, making it a top choice for personalized service in West Virginia, where good service is essential for maintaining affordable coverage. Find our more through our Allstate vs. USAA insurance review.

Cons

- Eligibility Restrictions: Only available to military personnel, veterans, and their families, limiting access for the general public in West Virginia who might be seeking affordable options.

- Limited Availability: Not available in all states, which can restrict options for West Virginia residents looking for comprehensive yet inexpensive auto insurance.

#2 – State Farm: Best for Low Rates

Pros

- Wide Range of Discounts: Offers various discounts including multi-policy, safe driver, and good student discounts, with monthly rates starting at $29, making it a viable option for cheap auto insurance in West Virginia.

- Strong Local Agent Network: Extensive network of local agents for personalized service and advice, which is beneficial for West Virginia residents looking for affordable coverage with a personal touch.

- Flexible Coverage Options: Provides a variety of coverage options to suit different needs, supporting cost-effective insurance solutions in West Virginia. Delve more through our State Farm insurance review.

Cons

- Higher Rates for Some Drivers: Rates may be higher for high-risk drivers or those with poor credit, potentially impacting affordability for those seeking cheap West Virginia auto insurance.

- Mixed Customer Service Reviews: Some customers report variable experiences with customer service, which can be a drawback for those needing reliable and affordable insurance solutions in West Virginia.

#3 – Geico: Best for Competitive Rates

Pros

- Competitive Pricing: Known for offering competitive rates with monthly premiums starting at $31, making it a strong candidate for cheap West Virginia auto insurance. This pricing is beneficial for budget-conscious drivers.

- Easy Online Access: Provides a user-friendly website and mobile app for managing policies and filing claims, making it easier to manage affordable insurance in West Virginia. Read more through our Geico insurance review.

- Strong Financial Stability: High financial strength ratings from A.M. Best (A++), ensuring reliability and security in coverage, which supports finding affordable and dependable auto insurance in West Virginia.

Cons

- Limited Personal Interaction: Primarily online and phone-based service can feel impersonal, which might not suit all customers in West Virginia who prefer face-to-face interactions for cheap insurance solutions.

- Variable Customer Service: Customer service experiences can be inconsistent based on location and specific service needs, potentially affecting satisfaction for those seeking affordable auto insurance in West Virginia.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#4 – Travelers: Best for Flexible Options

Pros

- Customizable Coverage Options: Offers a wide range of customizable coverage options to tailor policies to individual needs, starting at $38 per month, which helps in finding affordable and flexible insurance solutions in West Virginia.

- Discounts for Safety Features: Provides discounts for advanced safety features in vehicles, which can lead to additional savings and support budget-friendly insurance in West Virginia.

- Good Claims Handling: Generally positive reviews for claims processing and handling, ensuring efficient resolution of issues, which is crucial for maintaining affordable insurance coverage in West Virginia. Look for more details through our Travelers insurance review.

Cons

- Potentially Higher Rates: Can be more expensive compared to some budget providers, impacting overall affordability for those looking for cheap auto insurance in West Virginia.

- Mixed Customer Satisfaction: Some customers report issues with customer service and claims support, which can be a concern for those seeking reliable and affordable insurance solutions in West Virginia.

#5 – Nationwide: Best for Good Discounts

Pros

- Good Discount Programs: Offers multiple discount opportunities, including for bundling policies, with monthly rates starting at $39, making it a competitive option for cheap auto insurance in West Virginia.

- Comprehensive Coverage Choices: Provides a wide range of coverage options to meet diverse needs, supported by an A+ rating from A.M. Best, ensuring affordable and comprehensive insurance in West Virginia.

- Strong Customer Satisfaction: Generally positive feedback on customer service and claims processing, contributing to a good experience for those seeking budget-friendly coverage in West Virginia. Find out more through our Nationwide insurance review.

Cons

- Higher Premiums for Certain Drivers: Rates can be higher for drivers with poor records or credit, affecting affordability for those seeking cheap auto insurance in West Virginia.

- Limited Local Presence: Fewer local agents compared to some competitors, which might limit personalized service options for West Virginia residents looking for affordable coverage.

#6 – Progressive: Best for Snapshot Program

Pros

- Snapshot Program: Offers a unique Snapshot program where safe driving can lead to additional savings, with monthly rates starting at $41, making it a good option for cheap auto insurance in West Virginia for careful drivers. Find out more through our Progressive insurance review.

- Extensive Online Tools: Strong online tools for managing policies and claims, enhancing user experience and accessibility for those looking for budget-friendly auto insurance in West Virginia.

- Wide Range of Coverage Options: Provides a variety of add-on options and customizable policies, helping to tailor insurance to meet diverse needs while keeping costs down in West Virginia.

Cons

- Higher Rates for Some Drivers: Rates can be higher for drivers with less favorable risk profiles, impacting overall cost and affordability for those seeking cheap auto insurance in West Virginia.

- Mixed Reviews on Claims: Customer reviews on claims processing can be inconsistent, which might affect satisfaction for those needing reliable and inexpensive insurance in West Virginia.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#7 – Erie: Best for Low Rates

Pros

- Affordable Rates: Known for offering some of the most affordable rates in the industry, with monthly premiums starting at $42, making it a strong option for cheap West Virginia auto insurance.

- Good Customer Service: Positive customer service ratings and support contribute to a satisfactory experience for those seeking affordable coverage in West Virginia.

- Various Discounts Available: Provides discounts for multiple policies and safety features, enhancing cost savings and supporting budget-friendly insurance solutions in West Virginia. Learn more through our Erie auto insurance review.

Cons

- Limited National Presence: Not available in all states, which can restrict options for West Virginia residents seeking cheap and comprehensive auto insurance.

- Fewer Online Tools: Less advanced online tools compared to some competitors, which may affect convenience for those managing affordable insurance in West Virginia.

#8 – Farmers: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage Options: Offers a wide range of coverage choices, including extensive add-ons, with monthly rates starting at $51, making it a robust option for affordable and comprehensive insurance in West Virginia.

- Discounts for Bundling: Provides significant discounts for bundling multiple policies, which can lead to savings and support cost-effective insurance solutions in West Virginia.

- Strong Local Agent Network: Good availability of local agents for personalized service, ensuring tailored support for affordable insurance in West Virginia. Read more through our Farmers auto insurance review.

Cons

- Higher Rates for Some Drivers: Rates can be higher for drivers with poor credit or driving records, potentially impacting overall affordability for those seeking cheap insurance in West Virginia.

- Complex Policy Options: Extensive coverage options can be overwhelming, requiring careful consideration to ensure affordable insurance in West Virginia.

#9 – Allstate: Best for Great Discounts

Pros

- Great Discounts Available: Offers a variety of discounts, including for safe driving and bundling, with rates starting at $60, making it a viable choice for cheap auto insurance in West Virginia.

- Strong Customer Service: Generally positive reviews for customer service and support contribute to a good experience for those seeking affordable coverage in West Virginia.

- Comprehensive Coverage Choices: Wide range of coverage options and add-ons to meet diverse needs, supporting budget-friendly insurance solutions in West Virginia. Read more through our Allstate insurance review.

Cons

- Higher Premiums: Premiums can be higher compared to some low-cost providers, impacting overall affordability for those seeking cheap auto insurance in West Virginia.

- Inconsistent Claims Experience: Some customers report variable experiences with claims processing, which might affect satisfaction for those needing affordable and reliable insurance in West Virginia.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for Customizable Coverage

Pros

- Customizable Coverage Options: Provides a variety of customizable coverage and add-on options, with monthly rates starting at $72, making it a flexible option for cheap auto insurance in West Virginia.

- Good Discount Programs: Offers discounts for various factors, including safe driving and bundling, which can support finding cost-effective coverage in West Virginia.

- Strong Financial Ratings: High ratings for financial stability from A.M. Best ensure reliability in coverage, supporting affordable and dependable insurance solutions in West Virginia. Read more through our Liberty Mutual auto insurance review.

Cons

- Higher Premiums: Can be more expensive compared to some budget-focused providers, which might impact overall cost for those seeking cheap auto insurance in West Virginia.

- Mixed Customer Service Feedback: Some customers report inconsistent experiences with customer service, potentially affecting satisfaction for those needing reliable and affordable insurance in West Virginia.

West Virginia Auto Insurance Minimum Requirements

Drivers in West Virginia must be protected by a valid West Virginia auto insurance policy. The state of West Virginia requires that all drivers have 20/40/10 coverage. A driver who has 20/40/10 coverage is protected by the following types of liability insurance: $20,000 in liability coverage is available per person in an accident.

This covers the other driver, passengers in the other car, or pedestrians when you are at fault. This $20,000 in liability coverage does not cover the driver of the insured vehicle.

$40,000 in liability coverage is the maximum amount that the insurance company will pay out for all people injured in one accident. This limit can be raised, however, this is the state minimum.

West Virginia Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $60 $162

Erie $42 $155

Farmers $51 $139

Geico $31 $83

Liberty Mutual $72 $196

Nationwide $39 $104

Progressive $41 $110

State Farm $29 $79

Travelers $38 $102

USAA $25 $67

$10,000 in property damage liability is the minimum amount of coverage to pay for damage to the other car or other personal property when you are at fault. Drivers who exceed these limits may be subject to civil suits in court.

West Virginia is a tort state. This means that drivers are able to bring legal cases in front of a judge for damages from an automobile accident. Drivers who are involved in an accident may sue for medical damages and other costs that arise from an accident.

Drivers who are involved in a legal case should consult a lawyer for more information. A driver in West Virginia should attempt to purchase as much auto insurance as possible. The higher the amount of coverage, the less likely a driver will be dragged into court in order to repay damages.

West Virginia requires that drivers have proof of insurance in their vehicles at all times. A driver who is unable to produce proof of insurance will have their license and registration suspended for 30 days. Repeat offenders may have their license and registration suspended 90 days.

West Virginia does not require drivers to have collision coverage. Collision coverage can protect a driver if they are involved in a collision with another vehicle.

Drivers who purchased a vehicle using a loan or are driving a car that is on lease from a dealer may have to pay for collision coverage. Drivers who own their vehicle outright may decide that collision coverage is too expensive and elect to cancel that portion of their policy.

West Virginia does not require drivers to have comprehensive coverage. Comprehensive coverage protects a vehicle if the vehicle is involved in a theft, vandalized, or has windows broken. Acts of God may also be covered by a comprehensive policy.

Drivers who are using a vehicle purchased on a loan or financed through a lease may have to purchase comprehensive coverage. Drivers can choose the deductible as well as the level of coverage to ensure that the coverage meets their needs.

The statewide average for auto insurance is just under $1,100 per year, which is less than $100 a month. Compared to the national average, this rate is more than $300 less. What’s even better is that the rate doesn’t change much when going from an average rural area to a big city.

While many of these factors are simply based on your own driving record, two things that affect even the safest of drivers are age and gender. As with most states, males typically pay higher auto insurance rates than females.

Understanding Rates by Company of West Virginia Auto Insurance

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

West Virginia Driving Laws

West Virginia has a three-tier GDL program. This Graduated Drivers License program is one of the most stringent in the country. Teenagers are required to first use an instruction permit. This permit requires drivers to complete 50 hours of driving behind the wheel with a parent. Teens are also required to pass a road skills test and a written test.

Schimri Yoyo

Licensed Agent & Financial Advisor

West Virginia adult drivers are able to use a cell phone while driving. Drivers should exercise extreme caution when they are using a cell phone while driving. Any driver in West Virginia who is under the age of 18 is not allowed to use a cell phone while driving.

Drivers may be subject to a $25 fine which can increase for multiple violations. Drivers can also be cited if they are using a cell phone and cause a traffic accident.

West Virginia drivers are subject to stringent DUI laws. A 0.08 is the legal limit for adult drivers. Drivers who are over this limit may be subject to jail time, probation, fines, court fees, and license suspension. Teen drivers who are over 0.02 BAC can face the same penalties. Teen drivers may be convicted based on the sole presence of 0.02 BAC in their bodies.

West Virginia Auto Insurance Resources

West Virginia is one of the safest states to drive through, but drivers should not take auto insurance lightly. The state enforces stringent auto insurance requirements, and non-compliance can lead to swift legal consequences.

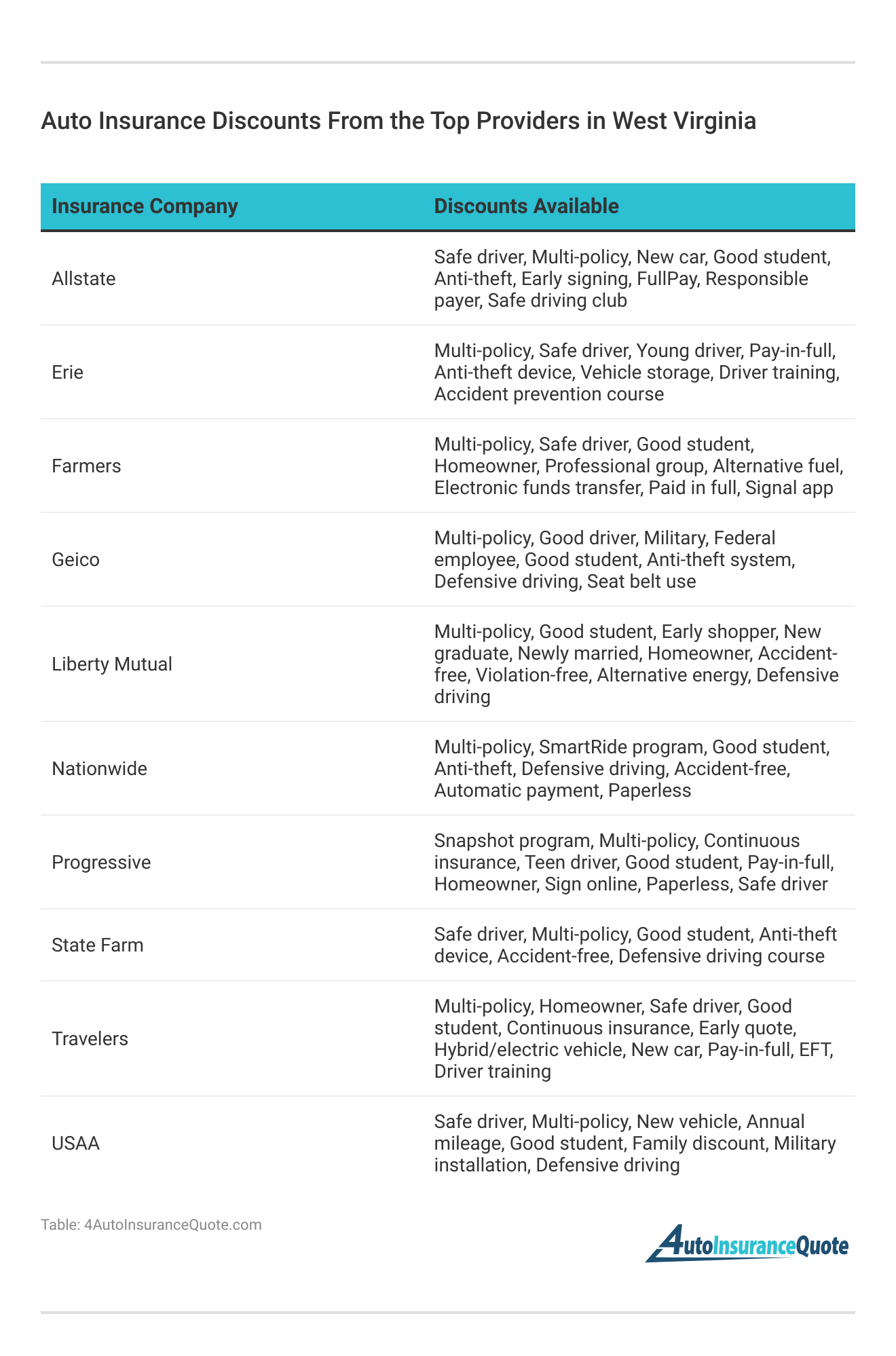

To mitigate costs, drivers in West Virginia should explore available auto insurance discounts to ensure they meet legal standards while potentially reducing their premiums.

If you are a West Virginia driver and are in need of insurance, enter your ZIP code now for quotes from top West Virginia auto insurance companies.

Frequently Asked Questions

What are the minimum auto insurance requirements in West Virginia?

West Virginia requires drivers to have minimum liability coverage of 25/50/25 for bodily injury and property damage.

How can I save on West Virginia auto insurance?

To save on auto insurance in West Virginia, it’s recommended to shop around and obtain quotes from multiple insurance companies. Enter your ZIP code now to begin comparing.

What happens if I don’t have proof of insurance in West Virginia?

Driving without proof of insurance in West Virginia can result in a 30-day suspension of your license and registration. To avoid such penalties, it’s crucial to understand the types of auto insurance coverage available and ensure you have the required coverage.

These types include liability, collision, and comprehensive insurance, each serving different purposes and helping protect you from various risks while driving.

Do I need collision and comprehensive coverage in West Virginia?

West Virginia does not require drivers to have collision or comprehensive coverage, but it may be necessary if you have a financed or leased vehicle.

What is the average cost of auto insurance in West Virginia?

The average cost of auto insurance in West Virginia is approximately $85 per month, which is lower than the national average. Enter your ZIP code now to begin comparing.

What are the monthly rates for the top 10 auto insurance providers in West Virginia?

The monthly rates for the top 10 auto insurance providers range from $25 to $72. USAA offers the lowest rate at $25, while Liberty Mutual has the highest at $72.

When considering options like Tort Auto Insurance, it’s important to compare these rates and coverages to ensure you’re getting the best value for your specific needs.

Which auto insurance provider offers the lowest rates for military families?

USAA offers the lowest rates for military families, with a starting rate of $25 per month. This makes it a top choice for affordable auto insurance tailored to military personnel.

How does Geico’s pricing compare to other providers for cheap auto insurance in West Virginia?

Geico’s pricing is competitive, with rates starting at $31 per month, making it one of the more affordable options among top providers.

It offers a balance of cost and coverage, positioned between USAA and other insurers. Enter your ZIP code now to begin comparing.

What discounts does Progressive offer to help reduce auto insurance costs in West Virginia?

Progressive offers discounts through its Snapshot Program, which provides savings based on driving habits.

This can help reduce overall insurance costs for drivers who maintain safe driving records, making it easier to manage affordability liability auto insurance coverage.

By monitoring driving behavior, the Snapshot Program helps tailor your insurance premium, ensuring you get the best rates while adhering to necessary coverage standards.

Which insurance company provides the most customizable coverage options for West Virginia drivers?

Liberty Mutual offers the most customizable coverage options, allowing drivers to tailor their policies to specific needs. This flexibility helps in finding affordable and suitable coverage for various driving situations.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.