Cheap Lexus Auto Insurance in 2025 (Earn Savings With These 10 Companies!)

Discover why Erie, AAA, and NJM are the top picks for cheap Lexus auto insurance, with rates starting as low as $70 monthly. These providers excel not only in affordability but also in offering comprehensive coverage options, making them premier choices for Lexus auto insurance seekers looking for reliability.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Min. Coverage for Lexus

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Lexus

A.M. Best Rating

Complaint Level

The top picks for cheap Lexus auto insurance are Erie, AAA, and NJM, known for their competitive pricing and comprehensive coverage.

These companies stand out in the luxury auto insurance market by offering tailored policies that balance cost and value. Learn more in our “Understanding How Auto Insurance Works.”

Our Top 10 Company Picks: Cheap Lexus Auto Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $70 A+ Competitive Rates Erie

#2 $75 A Member Discounts AAA

#3 $77 A+ Customer Satisfaction NJM

#4 $80 A+ Discount Programs Progressive

#5 $83 A Affordable Coverage Mercury

#6 $85 A++ Policy Flexibility Travelers

#7 $87 B Reliable Service State Farm

#8 $90 A+ Multiple Discounts Nationwide

#9 $92 A Customizable Policies Farmers

#10 $95 A Flexible Options Liberty Mutual

Their reputation for customer satisfaction and financial stability makes them reliable choices for Lexus owners. As you shop for insurance, consider these providers to secure robust protection for your vehicle at an affordable price.

If you’re looking to lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool above to compare your rates against the top insurers.

- Erie is the top pick for affordable Lexus auto insurance

- Tailored policies meet the specific needs of Lexus owners

- Focus on balancing cost and value in luxury car insurance

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – Erie: Top Overall Pick

Pros

- Affordable Premiums: Erie offers competitive rates, starting as low as $70 per month. See more details on our “Erie Auto Insurance Review: Can you get affordable quotes?“

- High Financial Rating: With an A+ rating from A.M. Best, Erie is recognized for its financial stability.

- Extensive Policy Options: Erie provides a variety of insurance policies that can be tailored to different needs.

Cons

- Geographic Limitations: Erie’s services might not be available in all states.

- No Online Claims for All Policies: Some policy claims cannot be processed online, requiring direct interaction.

#2 – AAA: Best for Member Discounts

Pros

- Exclusive Member Benefits: AAA provides special discounts and benefits for its members.

- Strong Financial Health: Rated ‘A’ by A.M. Best, indicating solid financial backing. Check out insurance savings in our complete “AAA Auto Insurance Review: Can you get affordable quotes?“

- Diverse Coverage Options: Offers a range of coverage that suits different customer needs.

Cons

- Membership Required: You must be a member to take advantage of insurance offerings.

- Higher Rates for Non-Members: Non-members may face significantly higher rates.

#3 – NJM: Best for Customer Satisfaction

Pros

- Exceptional Customer Service: NJM is known for its high level of customer satisfaction. Learn more in our complete “NJM Insurance Group Auto Insurance Review: Can you get affordable quotes?“

- Competitive Pricing: Offers rates starting at $77, which are competitive within the industry.

- Comprehensive Coverage: Provides thorough coverage options that meet a variety of needs.

Cons

- Limited Availability: NJM’s services are limited to certain geographic areas.

- Less Flexibility in Policy Modifications: Fewer options for adjusting policy terms on the fly.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#4 – Progressive: Best for Discount Programs

Pros

- Variety of Discounts: Offers numerous discounts, including multi-policy and safe driver incentives.

- Innovative Tools: Provides tools like the Name Your Price tool for personalized rate options.

- Broad Acceptance: Welcomes drivers with diverse driving histories. Discover insights in our Progressive auto insurance review.

Cons

- Inconsistent Customer Service: Customer service quality may vary by region.

- Higher Rates for Riskier Drivers: Riskier drivers might face higher premiums.

#5 – Mercury: Best for Affordable Coverage

Pros

- Competitively Priced: Offers one of the more affordable monthly rates at $83. See more details in our guide titled “Cheap Mercury Auto Insurance.”

- Tailored Insurance Solutions: Mercury excels in providing coverage that meets specific budget needs.

- Efficient Claim Process: Known for a straightforward and efficient claims process.

Cons

- Limited National Reach: Availability can be restricted to certain states.

- Basic Plan Limitations: Basic plans may lack some features that are standard with other insurers.

#6 – Travelers: Best for Policy Flexibility

Pros

- Flexible Policy Options: Offers flexible policy options to suit various needs and scenarios.

- Highest Financial Rating: Holds an A++ rating from A.M. Best, indicating top-tier financial health.

- Customizable Packages: Allows extensive customization of insurance packages. More information is available about this provider in our “Travelers Auto Insurance Review: Can you get affordable quotes?“

Cons

- Potentially High Premiums: Premiums can be high depending on the customization and options chosen.

- Complexity in Policy Selection: A wide range of options might overwhelm some customers.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#7 – State Farm: Best for Reliable Service

Pros

- Consistent Reliable Service: Known for reliable and consistent customer service.

- Comprehensive Coverage Options: Provides a wide array of insurance options. If you want to learn more about the company, head to our “State Farm Auto Insurance Review: Can you get affordable quotes?“

- Discounts for Safe Drivers: Offers discounts for drivers with a safe driving record.

Cons

- Higher Cost for Certain Policies: Certain policies may have higher than average costs.

- Limited High-Risk Options: Not as competitive for high-risk drivers compared to other insurers.

#8 – Nationwide: Best for Multiple Discounts

Pros

- Wide Range of Discounts: Provides various discounts including for bundling, loyalty, and safety features.

- Extensive Coverage Selection: Offers an extensive selection of coverage types.

- Robust Online Resources: Excellent online tools and resources for customers. Discover more about offerings in our Nationwide auto insurance review.

Cons

- Varying Service Levels: Customer service quality can vary significantly between regions.

- Premium Fluctuations: Premiums may fluctuate more than some competitors.

#9 – Farmers: Best for Customizable Policies

Pros

- Highly Customizable Policies: Allows for extensive customization to meet specific needs.

- Strong Financial Rating: Holds an ‘A’ rating from A.M. Best, ensuring financial stability.

- Dedicated Agents: Provides dedicated agents to assist with policy management. Delve into our evaluation of Farmers auto insurance review.

Cons

- Higher Premiums: Generally, premiums are higher, especially for customized policies.

- Complex Policy Management: Managing highly customized policies can be complex and time-consuming.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for Flexible Options

Pros

- Broad Flexibility: Offers a wide range of flexible options to cater to various insurance needs.

- Strong Financial Standing: Rated ‘A’ by A.M. Best, indicating a strong financial base. Access comprehensive insights into our Liberty Mutual auto insurance review.

- Custom Coverage Offerings: Known for offering coverage that can be tailored very specifically.

Cons

- Higher Rates for Customized Plans: Customized plans can be significantly more expensive.

- Inconsistent Claims Process: Some customers report variability in the claims process experience.

Lexus Auto Insurance: Rate Comparison by Coverage

Choosing the right auto insurance involves understanding the difference in monthly rates between the minimum and full coverage options. Our comprehensive table below details how these rates vary across several top providers, offering insight into the potential cost of insuring your Lexus.

Lexus Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $75 $145

Erie $70 $140

Farmers $92 $160

Liberty Mutual $95 $170

Mercury $83 $150

Nationwide $90 $165

NJM $77 $145

Progressive $80 $150

State Farm $87 $160

Travelers $85 $155

The table “Lexus Auto Insurance Monthly Rates by Coverage Level & Provider” provides a clear comparison of monthly premiums for both minimum and full coverage across various insurance companies.

For instance, AAA offers minimum coverage at $75 and full coverage at $145, while Erie presents the most competitive rates with $70 for minimum and $140 for full coverage. On the higher end, Liberty Mutual charges $95 for minimum and $170 for full coverage.

This data allows Lexus owners to gauge which insurance provider offers the best rates according to their coverage needs, facilitating a more informed decision when choosing their insurer. Learn more in our “Affordable Full Coverage Auto Insurance.”

The History of Lexus

The headquarters of Lexus, the high-end division of Toyota Motor Corporation, is located in Nagoya, Japan. Additionally, it has production plants in Torrance, California, and Brussels, Belgium. Delve into our evaluation of “Cheap Toyota Auto Insurance.”

Despite being formally founded in 1989, Lexus got its start in 1983 as part of Toyota’s “Flagship One” concept. The goal of this project was to increase Toyota’s fleet size by designing the greatest car possible. One of the original Lexus models was produced as a result.

The LS 400 and ES 250 sedans were the first two Lexus cars to be sold in the United States in 1989. After a successful launch, Lexus quickly surpassed BMW and Mercedes-Benz in sales and rose to the top spot among imported luxury brands in the nation.

Since its founding, Lexus has advanced significantly, and the company today has more than 225 dealerships in the country. Its inventory of vehicles includes a range of sedan sizes, including the full-size LS, the midrange ES, and small IS and HS models.

Along with the full-size LX, crossover RX, and NX models, Lexus also produces sports cars. Look to the F brand if you’re seeking a model with great performance. The following are a few of the manufacturer’s best-selling models:

- ES

- GX

- IS

- LS

- RX

Lexus has worked to develop ecologically friendly vehicles since 2006. As a result, several of its best-selling automobiles now come in hybrid form. The “Lexus Musts,” or nearly 500 specific standards, are applied to the design of Lexus vehicles. Leather seat stitching and keyless entry are two of these amenities.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Insurance Rates by Lexus Models

The least expensive Lexus to insure is the compact SUV Lexus NX. A full-coverage policy typically costs $245.50 each month, or $2,946 per year. The Lexus RX, on the other hand, has the highest annual insurance cost of any Lexus, at an average of around $599.83 each month or $7,198 total annually.

Insurance Rates for Lexus Models by Company

The least expensive auto insurance for Lexus drivers is provided by the car insurance company State Farm. A 2021 model’s complete coverage is around $202.17 per month which factors out to be $2,426 annually. Unlock details in our guide titled “Insurance by Vehicle.”

Erie stands out as the definitive choice for Lexus insurance, thanks to its unmatched value and customer service.Brad Larson Licensed Insurance Agent

This is 73% less than the most expensive insurance which comes from Allstate. Allstate Insurance for Lexus Models will cost around $751.92 each month, or $9,023 annually. State Farm is also going to be 47% less than the average premium we saw across the board, which was around $387.50 per month, or $4,650 annually.

Additional Auto Insurance Coverage for Lexus Models

It’s crucial to frequently evaluate your alternatives for auto insurance coverage, especially when buying a new vehicle, whether you intend to continue with your current insurer or find a new one.

Some extra coverage options may also be useful if you’re looking to purchase a new Lexus. To determine which coverage alternatives would be beneficial to have, you might want to take into account your situation. These extra coverage varieties consist of:

- Gap Insurance: If your new car is totaled in a covered accident, gap insurance will pay the difference between what the car is worth and what you still owe on it. You can be required to get gap insurance from some lessors.

- Roadside Support: If you break down on the side of the road, roadside assistance coverage attached to your auto insurance assists with towing, changing a flat tire, and fuel delivery. However, it does not include the price of fuel or tire repair.

- New Car Replacement: If your car is totaled, new car replacement coverage will pay for the cost of a replacement vehicle.

- Insurance With Rental Car Service: This coverage pays for a replacement vehicle while yours is being repaired as a result of a claim that is covered.

If your car is financed or leased, you might need comprehensive and collision coverage in addition to the coverage kinds that your state mandates. Even if the Lexus is paid for, you might want to take into account these coverage options to help cover the expenses of repairs for your car in the event of a covered claim.

How Much Will Lexus Insurance Rates Vary on Average

The typical yearly cost of auto insurance for a Lexus is about $2162, according to CarEdge.com. This figure is based on a 40-year-old motorist with solid credit, full coverage, and a clean driving record. For more information, read our guide titled “Clean Driving Record for Auto Insurance: Simply Explained.”

Additionally, this driver logs roughly 13,000 miles yearly. The range is a single-car policy, so there are no multi-vehicle savings available.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Does Credit Play a Role in Lexus Auto Insurance Rates

Credit significantly affects the cost of premiums in most areas. For drivers under 25, it is often advantageous to be added to their family’s multi-vehicle policy, as they typically lack well-established credit. This approach allows them to access cheap Lexus insurance rates. Once they are older and have maintained a clean driving record, they can then obtain their coverage.

Additionally, people might improve their credit throughout this time. While paying for vehicle insurance on its own doesn’t help your credit, utilizing a credit card to make your regular payments does. Just be careful to pay off your account completely each billing cycle.

Learn more: Your Credit Score and Auto Insurance Quotes

Is It Expensive to Insure a Lexus Model

A Lexus typically costs a good amount to insure. The average insurance cost for all currently offered models was $387.50 per month. That is an increase in insurance for a Mercedes-Benz of around 10%. Toyota owns Lexus, but on average, a Lexus costs $177.67 more per month to insure than a Toyota-branded car.

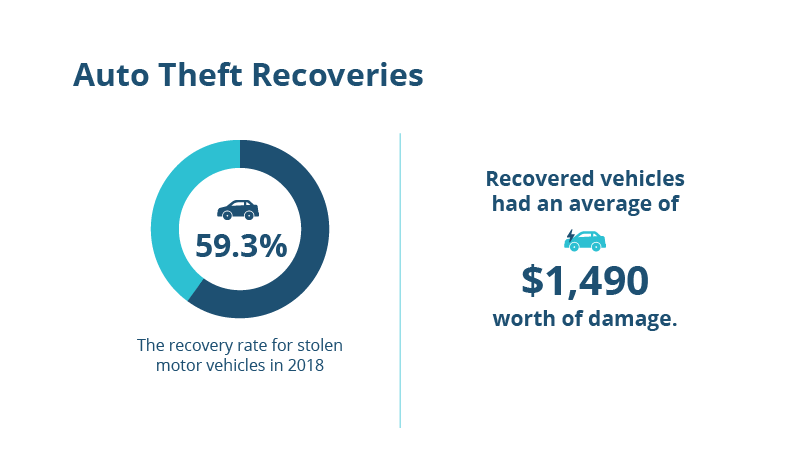

Insurance premiums for luxury vehicles are typically higher than for less expensive vehicles. Replacement parts for a $4,666.67/month Lexus GX are more expensive than parts for a common Kia. Luxury vehicles can also be prime targets for theft. Additionally, more powerful engines are frequently found in more expensive cars, which typically means higher insurance costs.

However, safety features that haven’t made it to less expensive versions, such as sensors that detect turns in the road or oncoming traffic, can occasionally offset high insurance rates for automobiles like Lexus vehicles.

Explore Auto Insurance Rates for Your Lexus Model

Discover the most competitive insurance rates for Lexus vehicles with our detailed comparison table. Our comprehensive overview allows you to easily assess insurance options and secure the ideal coverage for your needs.

Lexus Auto Insurance Cost by ModelConclude your search for the best Lexus auto insurance rates by comparing your options and choosing the ideal coverage that matches your lifestyle and budget.

Read more: Affordable Instant Auto Insurance Quotes

Auto Insurance by Driving Record

Nobody is flawless. We all make mistakes, but when they appear on our driving record, they significantly affect how insurance determines your deductibles and premiums. However, there is one part of your insurance costs that you may significantly influence. The insurance industry favors careful drivers.

They anticipate fewer claims when they know a driver with a spotless driving record since incidents linked to reckless driving are less likely to occur. Less expensive premiums result from this. Similarly, your insurance rate will increase the more fines you have, particularly those that result in demerit points on your license.

Choosing Erie for your Lexus means choosing top-tier protection at an affordable price.Scott W. Johnson Licensed Insurance Agent

Minor infractions can result in significant rate increases. For instance, a mere speeding ticket could potentially cause a 23% increase in your annual rate. What does a serious offense, such as being found guilty of DUI, do? Your annual insurance expenses could increase by as much as 70%.

Discover insights in our guide titled “What is an auto insurance deductible and how does it work?“

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Additional Factors Influencing Lexus Auto Insurance

The cost of Lexus insurance cost varies according to the age of the driver. Younger drivers are more expensive to insure because they lack driving expertise and are more prone to accidents. By the time they age 25, both the probability and the premiums substantially reduce. Up until the age of 60, insurance rates continue to decrease based on age.

Lexus car insurance cost is also influenced by your residence. Rates are higher in Michigan because the state requires higher levels of coverage. Companies do not alter rates in Hawaii, California, or Massachusetts depending on credit. Access comprehensive insights into our guide titled “How Age Affects Your Auto Insurance Rates.”

How to Lower Lexus Auto Insurance

The fact that you own a Lexus does not negate the value of affordable auto insurance. To lower your insurance expenses, take the following actions:

- Don’t drive too far each year

- Overnight parking should be done safely

- Don’t file too many claims

In addition to these processes, you can be eligible for further reductions if your Lexus includes particular features:

- Systems that provide passive restraint, such as airbags and mechanized seatbelts

- Brakes with antilock

- Anti-theft tools

It’s not necessary to spend a fortune on insurance just because you drive a premium car. Find the greatest insurance rates by doing some research, and concentrate on raising your credit score. You can get some of the best Lexus auto insurance rates by following these steps.

Find the Most Affordable Lexus Auto Insurance Today

For the same coverage, Lexus insurance costs will differ greatly amongst carriers. It is important to compare Lexus quotes with as many companies as you can to get the best deal. Also, get new quotes if you’ve been with your current insurance company for more than a few years to be sure you’re not overpaying. See more details in our guide titled “How To Compare Auto Insurance Quotes.”

To find out if you can get cheaper auto insurance rates, enter your ZIP code into our free quote tool below to instantly compare prices from various companies near you.

Frequently Asked Questions

How much are the average auto insurance rates for the Lexus GS model?

The typical price for insurance on a Lexus GS, specifically the 2020 model year, averages $3,743. Following its final release in 2020, the GS model was discontinued, but it may still be available at select dealerships.

For additional details, explore our comprehensive resource titled “Finding Auto Insurance Quotes Online.”

How much are the average auto insurance rates for the Lexus RX model?

The most costly Lexus model to insure is the luxury SUV Lexus RX, which has a full coverage average yearly cost of $7,198. That is more than $2,000 more expensive than its nearest model, the NX, and is 55% more expensive than the average cost of all Lexus cars.

How much are the average auto insurance rates for the Lexus NX model?

The Lexus NX SUV has the lowest annual insurance cost of any Lexus car, coming in at just $2,946. That is $2,225 less than the Lexus UX and 37% less than the average rate we discovered for the entire brand. Even though both vehicles are compact SUVs with MSRPs under $40,000, The NX’s greater size might contribute to the explanation for why its costs are so much cheaper.

Enter your ZIP code into our free quote tool below to find the best auto insurance providers for your needs and budget.

Is it possible to find affordable auto insurance for a Lexus vehicle?

Yes, it is possible to find affordable auto insurance for a Lexus vehicle. The cost of insurance depends on various factors, including the model of the Lexus, your driving history, location, and the coverage options you choose.

By comparing quotes from different insurance providers and considering discounts and factors that can lower premiums, you can find an affordable insurance policy for your Lexus.

Are there any specific Lexus models that have lower insurance rates?

Insurance rates can vary based on the specific model of your Lexus vehicle. Generally, luxury vehicles like Lexus tend to have higher insurance rates due to their higher value and repair costs.

However, some factors may help lower insurance rates for specific models. These factors can include the vehicle’s safety features, crash test ratings, and theft rates. It’s recommended to consult with insurance providers or use online insurance comparison tools to get accurate quotes for specific Lexus models.

Access comprehensive insights into our guide titled “Auto Insurance Discounts for Affordable Coverage.”

What are considered affordable Lexus cars?

Models like the Lexus UX and NX are among the more affordable Lexus cars, offering luxury at a lower price point.

Are Lexus cars expensive to insure?

Yes, Lexus cars can be expensive to insure due to their luxury status and repair costs.

What is the average insurance cost for Lexus RX350?

The average insurance cost for a Lexus RX350 typically ranges between $150 and $183 monthly.

What is the best car insurance for Lexus?

Erie Insurance is often considered the best car insurance for Lexus, offering competitive rates and comprehensive coverage.

To find out more, explore our guide titled “Can I buy auto insurance online?“

What is the cheapest car insurance for Lexus?

State Farm and Geico often offer the cheapest car insurance rates for Lexus vehicles.

Which is the cheapest Lexus to insure?

The Lexus NX is generally the cheapest Lexus model to insure.

Which is the cheapest luxury SUV to insure?

Where can I find Colorado Lexus dealerships?

Colorado Lexus dealerships can be found in major cities like Denver, Colorado Springs, and Aurora.

Access comprehensive insights into our guide titled “Do you need auto insurance before you buy a car?“

How much does it cost to insure a Lexus?

The monthly cost of a Lexus insurance quote typically ranges from $125 to $250, varying based on the specific model and geographic location.

What is the least expensive Lexus model?

The Lexus UX is the least expensive model, offering entry-level luxury.

Where can I find Lexus car insurance reviews?

Lexus car insurance reviews can be found on insurance comparison websites and consumer forums online.

What should I know about Lexus crash repairs?

Lexus crash repairs often involve significant expenses, as they necessitate specialized parts and services from certified dealerships, which can impact your Lexus insurance claim.

Learn more by reading our guide titled “How to File an Auto Insurance Claim.”

How much does Lexus gap insurance cost?

The price of Lexus gap insurance usually ranges from a few ten dollars monthly, depending on the value of the vehicle and the loan amount.

What year was Lexus founded?

Lexus was founded in 1989.

Where was Lexus founded?

Lexus was founded in Nagoya, Japan.

Start saving on your auto insurance by entering your ZIP code below and comparing quotes.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.