Cheap Auto Insurance for Teenagers in 2025 (Get Low-Cost Coverage With These 10 Providers)

Geico, State Farm, and Allstate are top choices for affordable cheap auto insurance for teenagers, with rates starting at $107 per month. These providers offer comprehensive coverage and flexible policies, making them ideal, budget-friendly options with reliable protection at a lower cost.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

UPDATED: Oct 28, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 28, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage for Teenagers

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 11,638 reviews

11,638 reviewsCompany Facts

Min. Coverage for Teenagers

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsGeico, State Farm, and Allstate are the leading cheap auto insurance for teenagers that has a lowest rate starting at $ per month.

The day that you, as a parent, have been dreading is finally here. Your little one has outgrown of his or her bicycle and is ready to get behind the wheel. This is an exciting time for your teenager, yet a very stressful time for you, as a parent.

Our Top 10 Company Picks: Cheap Auto Insurance for Teenagers| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $107 | A++ | Cheap Rates | Geico | |

| #2 | $125 | B | Customer Service | State Farm | |

| #3 | $167 | A+ | Infrequent Drivers | Allstate | |

| #4 | $170 | A+ | Financial Strength | Amica | |

| #5 | $178 | A+ | Vanishing Deductible | Nationwide |

| #6 | $223 | A | Loyalty Rewards | American Family | |

| #7 | $271 | A | Safe-Driving Discounts | Farmers | |

| #8 | $279 | A | Add-on Coverages | Liberty Mutual |

| #9 | $281 | A+ | Competitive Rates | Progressive | |

| #10 | $310 | A++ | Coverage Options | Travelers |

Not only does your child now need to face the challenges of the road, but they also need to face the challenge of finding an affordable auto insurance policy. Luckily, while insurance prices for teenagers are usually outrageously expensive, there are still a few ways for you to save some money when it comes to insuring your teen. Continue reading below to find out:

- What is auto insurance for teenagers?

- When should you buy auto insurance for your teen driver?

- The types of auto insurance that are usually required for teenage drivers.

- Ways teenage drivers can still save money on their otherwise expensive insurance policy

- Outlines the cheap auto insurance providers for teenagers

- It includes advice on comparing quotes and securing discounts

- It highlights factors impacting teenage car insurance rates and ways to save

#1 – Geico: Top Overall Pick

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Pros

- Low Rates: Offers some of the lowest rates for teenage drivers, starting at around $107 per month. This makes Geico a great choice for cheap auto insurance for teenagers. Read more on Geico auto insurance review for more details.

- Multiple Discounts: Provides multiple discounts for teens, including good student and driver’s education discounts. These discounts help further lower the cost of cheap auto insurance for teenagers.

- User-Friendly Mobile App: Comprehensive mobile app features for policy management, claims submission, and more, ideal for tech-savvy teens. The app simplifies managing cheap auto insurance for teenagers from any location.

Cons

- Limited Local Agents: Fewer local agents available, which may not suit those who prefer in-person service. This can be a drawback for families seeking cheap auto insurance for teenagers with local agent support.

- High Post-Claim Rates: Rates can increase significantly after a claim, which may concern new drivers. Such increases can negate the benefits of cheap auto insurance for teenagers.

#2 – State Farm: Best for Customer Service

Pros

- Exceptional Customer Service: Known for excellent customer service with a wide network of local agents, ideal for families wanting personal guidance. This can be advantageous for finding cheap auto insurance for teenagers with personal support.

- Steer Clear Program: Offers additional discounts through the Steer Clear program, which promotes safe driving. This program specifically helps make auto insurance cheaper for teenage drivers. Read more on State Farm auto insurance review for further information.

- Strong Financial Stability: High A.M. Best financial strength rating, ensuring reliable claim payouts. This ensures peace of mind while securing cheap auto insurance for teenagers.

Cons

- Higher Premiums: Tends to have higher premiums compared to other providers, especially without discounts. This can affect its competitiveness for cheap auto insurance for teenagers.

- Slow Online Quote Process: The online quote process can be slower and less user-friendly. A lengthy quote process may frustrate those seeking quick and cheap auto insurance for teenagers.

#3 – Allstate: Best for Infrequent Drivers

Pros

- Pay-Per-Mile Option: Offers a pay-per-mile plan, ideal for teens who drive less frequently. This plan can offer cheap auto insurance for teenagers who drive only occasionally. Explore our “Allstate Auto Insurance Review” for additional insights.

- Comprehensive Add-Ons: Wide range of add-ons, including accident forgiveness, preventing rate increases after the first accident. These add-ons provide more value while maintaining cheap auto insurance for teenagers.

- Drivewise Program: Drivewise tool offers discounts for safe driving through the mobile app. Safe driving can be rewarded with lower premiums, achieving cheap auto insurance for teenagers.

Cons

- Not Cost-Effective for Frequent Drivers: Pay-per-mile plans may not be economical for teens who drive often. This can limit its appeal as a cheap auto insurance option for frequent teenage drivers.

- Higher Rates in Some States: Rates can be higher in certain states, even with available discounts. This variability can impact finding cheap auto insurance for teenagers in different regions.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#4 – Amica: Best for Financial Strength

Pros

- High Customer Satisfaction: Consistently rated for high customer satisfaction and strong financial strength. These ratings support confidence in finding cheap auto insurance for teenagers.

- Loyalty Discounts: Offers loyalty discounts that reward long-term customers with reduced premiums. Such discounts can contribute to cheap auto insurance for teenagers over time. Read more on Amica auto insurance review for additional information.

- Flexible Payment Plans: Provides flexible payment plans, making it easier for families to manage premiums. Flexible payment options support affordable, cheap auto insurance for teenagers.

Cons

- Limited Local Presence: Fewer local agents compared to larger competitors, which may limit personal service options. This could affect access to cheap auto insurance for teenagers through local support.

- Fewer Teen Discounts: Does not offer as many teen-specific discounts, leading to potentially higher premiums. Limited discounts could challenge finding cheap auto insurance for teenagers.

#5 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible Program: Unique Vanishing Deductible reduces the deductible for every year of safe driving. This program helps maintain cheap auto insurance for teenagers who drive safely.

- Range of Discounts: Offers various discounts like family plan and accident-free discounts. Discounts can lower premiums, ensuring cheap auto insurance for teenagers. Read more on Nationwide auto insurance review for more details.

- Strong Stability Ratings: High financial stability and customer service ratings ensure trustworthy coverage. Trustworthy coverage is essential for securing cheap auto insurance for teenagers.

Cons

- Higher Premiums: Premiums can be relatively higher compared to some competitors, especially for new drivers. Higher premiums may deter those seeking cheap auto insurance for teenagers.

- Limited Online Tools: Online tools for managing policies are not as advanced or user-friendly. This can complicate efforts to find and manage cheap auto insurance for teenagers online.

#6 – American Family: Best for Loyalty Rewards

Pros

- Loyalty Rewards Program: Provides loyalty rewards that benefit long-term customers with significant savings. These savings contribute to securing cheap auto insurance for teenagers. Learn more on American Family auto insurance review for additional insights.

- Student Discounts: Good student discount and distant student discount help reduce premiums. Discounts make it easier to find cheap auto insurance for teenagers.

- Personalized Coverage Options: Tailors coverage options to the specific needs of teenage drivers. Customizable coverage helps maintain cheap auto insurance for teenagers.

Cons

- Limited Availability: Not available in all states, which limits its accessibility. Limited availability may affect finding cheap auto insurance for teenagers in some areas.

- Basic Online Resources: Online tools and resources are less comprehensive compared to larger providers. Fewer online resources can complicate finding cheap auto insurance for teenagers.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#7 – Farmers: Best for Safe-Driving Discounts

Pros

- Extensive Safe-Driving Discounts: Offers numerous discounts for safe driving, including telematics-based discounts. These discounts can help provide cheap auto insurance for teenagers.

- Diverse Coverage Options: Wide variety of coverage options, such as gap insurance and accident forgiveness. Diverse options offer value while supporting cheap auto insurance for teenagers. Read more on Farmers auto insurance review for further details.

- Strong Local Agent Network: A broad network of local agents provides personalized service and support. Local agents can assist in finding cheap auto insurance for teenagers.

Cons

- High Premiums: Premium rates tend to be higher, especially without discounts. High rates may make it challenging to find cheap auto insurance for teenagers.

- Limited Mobile App Functionality: The mobile app is less functional than those of other top providers. Limited app features may hinder managing cheap auto insurance for teenagers.

#8 – Liberty Mutual: Best for Add-on Coverages

Pros

- Wide Range of Add-Ons: Provides a variety of add-on coverages, like new car replacement and better car replacement. Additional coverages enhance value while maintaining cheap auto insurance for teenagers.

- Multiple Teen Discounts: Offers several discounts for teens, such as good grades and safe driving discounts. Discounts help keep premiums low, supporting cheap auto insurance for teenagers. Explore more on Liberty Mutual auto insurance review for additional information.

- User-Friendly Digital Tools: Strong online presence with a user-friendly website and mobile app. Easy online tools aid in managing cheap auto insurance for teenagers.

Cons

- Higher Rates: Average rates for teenage drivers can be higher, even with discounts. Higher rates can be a barrier to obtaining cheap auto insurance for teenagers.

- Mixed Customer Service Reviews: Customer service ratings vary, with some reports of delays in claims processing. Inconsistent service can impact the overall value of cheap auto insurance for teenagers.

#9 – Progressive: Best for Competitive Rates

Pros

- Competitive Pricing: Offers competitive rates for teen drivers, along with multiple discounts. Competitive rates are ideal for finding cheap auto insurance for teenagers. Discover more information on Progressive auto insurance review.

- Snapshot Program: Snapshot program provides savings for safe driving habits. This program supports achieving cheap auto insurance for teenagers who drive responsibly.

- Robust Online Tools: High financial strength and easy-to-use online quote tools for rate comparison. Convenient tools assist in comparing cheap auto insurance for teenagers.

Cons

- Monitoring Requirements: Programs like Snapshot may require additional monitoring, which some families might find intrusive. Monitoring may be seen as a downside when seeking cheap auto insurance for teenagers.

- Inconsistent Customer Service: Customer service quality can vary depending on location or local offices. Variable service can affect satisfaction with cheap auto insurance for teenagers.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#10 – Travelers: Best for Coverage Options

Pros

- Extensive Coverage Options: Offers a variety of coverage options, including new car replacement, accident forgiveness, and gap insurance. Such options make it easier to customize cheap auto insurance for teenagers.

- Student Discounts: Provides discounts such as good student and driver training discounts to lower costs. Discounts are crucial for securing cheap auto insurance for teenagers.

- Strong Financial Stability: High ratings for financial stability and reliable claims service. Financial stability ensures reliable and cheap auto insurance for teenagers. Read more on Travelers auto insurance review for further information.

Cons

- Fewer Local Agents: Limited number of local agents may impact those preferring in-person service. Limited agent availability can affect access to cheap auto insurance for teenagers.

- Basic Online Tools: Online tools are not as advanced, limiting policy management capabilities. Limited online tools can complicate managing cheap auto insurance for teenagers.

Car Insurance For Teenagers Explained

There are a lot of misconceptions about auto insurance for teenagers. Let’s attempt to clear some of the confusion up. As you may or may not be aware, auto insurance for teens is:

- Required by state law – In all states, you cannot buy a car or even get into the driver’s seat of a car without proper insurance coverage.

- Expensive – It is expensive to insure teenagers because they are in a very high risk group and statistically get into more accidents than any other age group (especially males under 18).

- Important – Often times teens don’t understand the importance of insurance. A lot of teens think they are invisible behind the wheel and will never get into a car accident. They view insurance as another obstacle (or expense) between them and the road. Educate them on why having insurance is important whenever they in the driver’s seat.

Read more:

- Affordable Auto Insurance Quotes for 18-Year-Olds

- Affordable Auto Insurance Quotes for 19-Year-Olds

- Affordable Auto Insurance Quotes for 20-Year-Olds

When Is The Right Time To Get Car Insurance For A Teenager?

The question of when to get auto insurance for your new teen driver is an important one. Far too many people put off getting affordable auto insurance quotes for international students until the last minute. Luckily, in most states, teenagers are covered under their parents’ policy for as long as they are on their learner’s permit. As soon as they graduate from learner’s permit to driver’s license, however, they need to be insured immediately.

Teenagers Auto Insurance Monthly Rates by Provider & Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $167 | $387 | |

| $223 | $519 | |

| $170 | $397 | |

| $271 | $629 | |

| $107 | $254 | |

| $279 | $626 |

| $178 | $414 |

| $281 | $662 | |

| $125 | $284 | |

| $310 | $740 |

In most situations, adding your teen to your current policy is the most economical way to get him or her insured. It will increase your monthly premium payments by a huge amount, but it is still far cheaper than forcing your teen to go out and buy an individual policy on his own.

It’s important to keep in mind that in many states, anyone who is of driving age and living under your roof (even those who don’t drive) needs to be listed on your car insurance policy. If you have a teenager who has their driver’s license, they will need to obtain affordable auto insurance quotes for high school students.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Types Of Auto Insurance For Teens

Now that you are resigned to the fact that your teenager needs auto insurance coverage, let’s take a look at the types of insurance available for teens. An insurance policy for your teen might include one or more of the following types of coverage:

- Liability Coverage – Liability coverage covers the expenses resulting from damages you are responsible for. This includes property damage costs and personal injury costs to others. In these days of multi-million dollar insurance lawsuits and settlements, not having liability coverage can easily ruin a family’s life. This is why liability coverage is a mandatory requirement for all car insurance policies in the United States. Not only should you equip your teen with your state’s minimum required liability coverage, but you should also increase his or her coverage amount to the point you feel comfortable at.

- Collision Coverage – Collision coverage covers the cost of repairing damages to your own vehicle. This is a very common type of auto insurance coverage and is included in most policies. If you are deemed to be at-fault in an accident, if you get into an accident with an uninsured driver, or if the liable party’s insurance refuses to pay you (for whatever reason), collision coverage will still pay to repair your car.

- Comprehensive Coverage – Comprehensive coverage covers the expenses resulting from things other than collisions. Common examples of things covered by comprehensive coverage include theft, fire damage, water damage, damage from animals, and natural disasters.

- Medical Payments Coverage – Medical payments coverage pays for your medical expenses if you are injured in a car accident, whether you are at-fault or not. While nobody likes to think of their teen being injured in a car accident, having this type of coverage is essential in “huge medical bill” America.

- Uninsured or Underinsured Motorist Coverage – Having uninsured motorist coverage will protect you in case you are involved in an accident with a driver who has no insurance or has insufficient insurance coverage and is unable to pay for the damages made to your vehicle. Slug estimates put over 11% of all drivers on American roads as “uninsured”, so buying this type of coverage for your teen is not only crucial, it is sometimes required by law.

Now that you are educated in the basic insurance coverage types for teens, you are probably asking yourself – how much will all this cost? Well, unfortunately, there is no simple answer to that question.

Insurance premiums depend on many things including the type of car, how often your teen will drive, where your teen will drive, and what discounts you take advantage of. Often times, teenagers can pay as little as $400 a year for insurance and other times, they can pay over $4000 a year for insurance.

It all depends. Fortunately, there are a bunch of things you can do to help your teen find the best possible auto insurance rates. Let’s take a look at them.

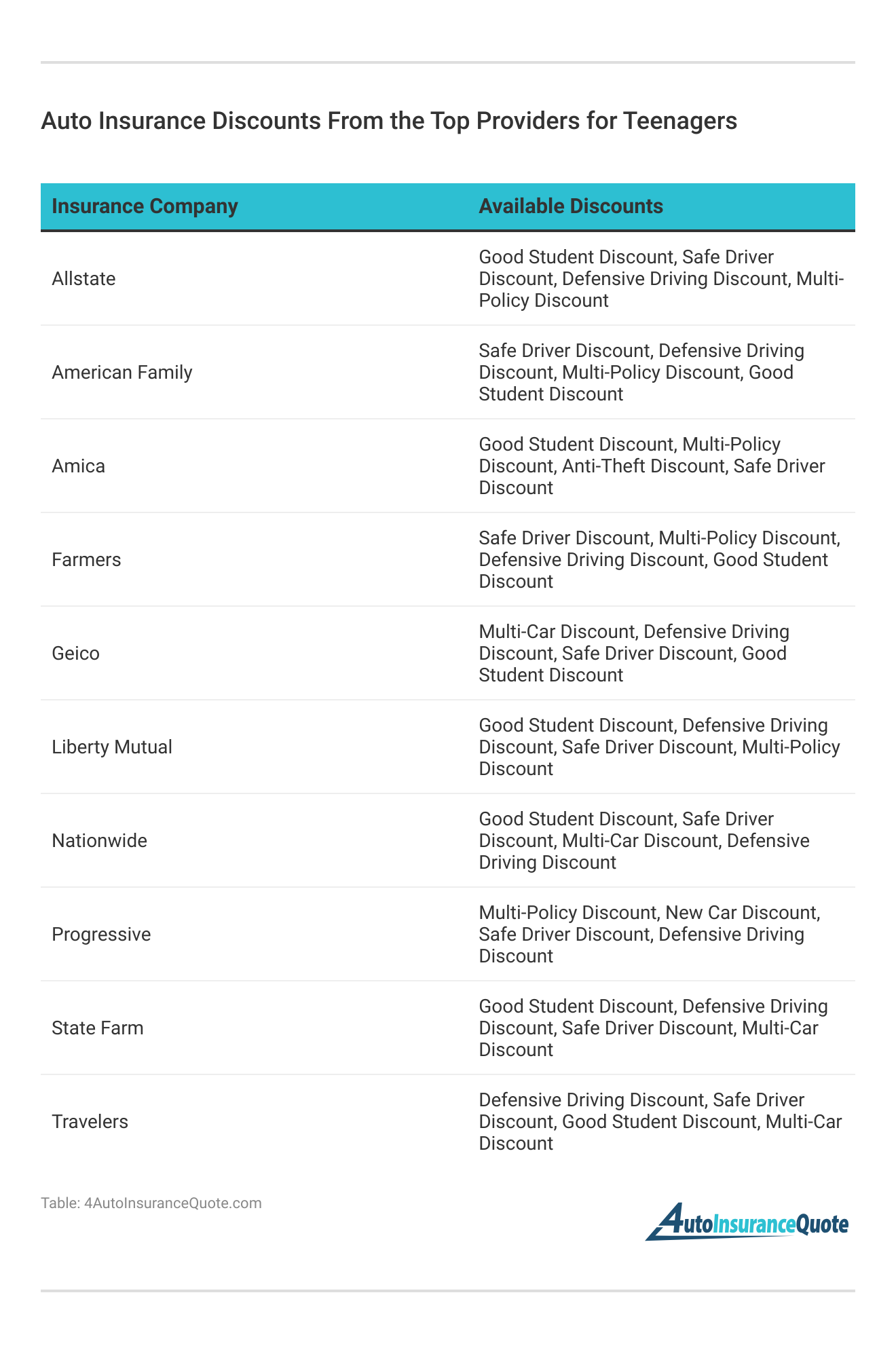

Getting Discounts On Teenage Driver Insurance

Auto insurance rates are based on the amount of risk a company has to take on in insuring the car and driver in question. Most insurance companies will be pretty uneasy about offering low rates or discounts to new teen drivers, but be assured that good deals are still out there. As always, educating yourself and then shopping around for better rates will typically provide you with satisfying results.

If you read our article about auto insurance discounts, you will see many similarities with the tips below. A majority of the discounts available to adults are also available to teens in one way or another. The tips below are simple ways to reduce risk and build trust with your insurance company, and in turn, reducing your premiums.

When it comes to teen drivers, there are seven things that teenagers and parents can do to save money on their car insurance:

- Get under your parents’ policy – As stated above, it is cheaper to put a teen on their family’s policy than it is to insure them separately. This is an easy and cost-effective way to get the large amounts of coverage you believe your teen needs. Not only will adding them to your current policy reduce paperwork and time, but it will also allow them to get a much higher level of coverage than they would be able to get on their own. Recent reports estimate that adding a 16-year-old teenager to your policy will increase your insurance premium by 152%. While this is quite high, realize that if your teen chooses to buy a policy on his own, away from your policy, it will cost them double or triple what it would cost them to stay on your policy.

- Get good grades – Most insurance companies offer “good student discounts”. Most insurers require that the student maintains a B- or a 3.0 grade point average to be qualified. This discount can result in rate deductions of up to 25%. This may be difficult for some, but the savings alone make the effort worth it. Talk to your teen about this. It may encourage them to improve their grades, especially if they are paying for a portion of their coverage.

(Click to learn more about insurance for college students and insurance for international students.) - Get experienced – If teenagers take a safe driving course, they are often eligible for a discount of 10% or more. Call your insurance company to ask for more details. Many states and counties require driver improvement classes, to begin with. If you can get your teen enrolled in a driver improvement class, you will not only take stress off of the insurance company and your pocketbook, you will also take stress off of your shoulders. The peace of mind knowing that your teen knows how to drive safely is priceless.

- Don’t get tickets! – Every ticket and traffic citation teenagers receive will have a huge effect on their insurance premiums. After a certain number of citations, some insurance companies can decide to drop their coverage and cancel their policy altogether. Make sure to instill safe driving habits in your teen so they do not get hit with these expensive traffic violations.

- Drive a vehicle that is cheap to insure – Most teens would prefer to drive a flashy sports car, but the fact is, the boring, safer cars are the cheapest to insure. Grandma’s old station wagon might not be such a bad option if you are looking for a cheap car to insure.

- Make sure you have safety features – Discounts may be available for cars that have automatic seat belts, air bags, anti-lock brakes, anti-theft systems, daytime running lights, and electronic stability control. Be sure to read our guide on safety features that lower your insurance rates to get more ideas on which safety features you should look for in a car for your teen.

- Shop around – Teenage insurance rates can be extremely expensive; unaffordable, even. To mitigate this, make sure you shop around to find the best rates possible. Many online rate comparison tools offer free insurance quotes from multiple companies.

Tim Bain Licensed Insurance Agent

Additional Resources For Teen Car Insurance

- Edmunds – Car Insurance for Teenage Drivers

- Rocky Mountain Insurance Information Association – Saving Money on Teen Auto Insurance Policies

Frequently Asked Questions

When should I get car insurance for my teenager?

As soon as your teenager graduates from a learner’s permit to a driver’s license, they need to be insured immediately. In most cases, adding them to your current policy is the most economical option.

What types of auto insurance are available for teens?

Auto insurance policies for teens can include liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, and medical payments coverage. Enter your ZIP code to know more.

How much does auto insurance for teenagers cost?

The cost of auto insurance for teens varies depending on factors like the type of car, driving frequency, location, and discounts applied. Premiums can range from around $400 to over $4,000 per year.

Discover more knowledge on our “Preferred Auto Insurance.”

What discounts are commonly available for teen drivers to help lower their insurance costs?

Common discounts for teen drivers include good student discounts, driver education discounts, and safe driving discounts.

Can I get discounts on teenage driver insurance?

Yes, there are several ways to save money on car insurance for teen drivers. Some common discounts include good student discounts, driver education discounts, safe driving discounts, and multi-policy discounts. By entering your ZIP code below, you can get instant car insurance quotes from top providers.

Where can I find additional resources for teen car insurance?

You can compare quotes from multiple auto insurance companies to find the best rates for teen car insurance. Websites like 4AutoInsuranceQuote.com provide free comparisons from a network of trusted providers. To find out more, explore our guide titled “is it cheaper to insure a new car or an old car”

How can parents find the best rates for insuring their teen drivers?

Parents can find the best rates by comparing quotes from multiple providers and exploring available discounts.

What types of coverage should be included in a teenager’s auto insurance policy?

Essential coverage for teens includes liability, collision, and comprehensive coverage. Find affordable auto insurance rates from top providers by entering your ZIP code.

How does the type of car a teenager drives affect their insurance premiums?

The type of car affects premiums; safer and less expensive cars usually have lower rates. Read more on auto insurance discounts.

What factors should be considered when comparing auto insurance quotes for teenagers?

Key factors include the provider’s reputation, coverage options, available discounts, and overall cost.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.