Best Auto Insurance for Non-US Citizens in 2025 (Our Top 10 Picks)

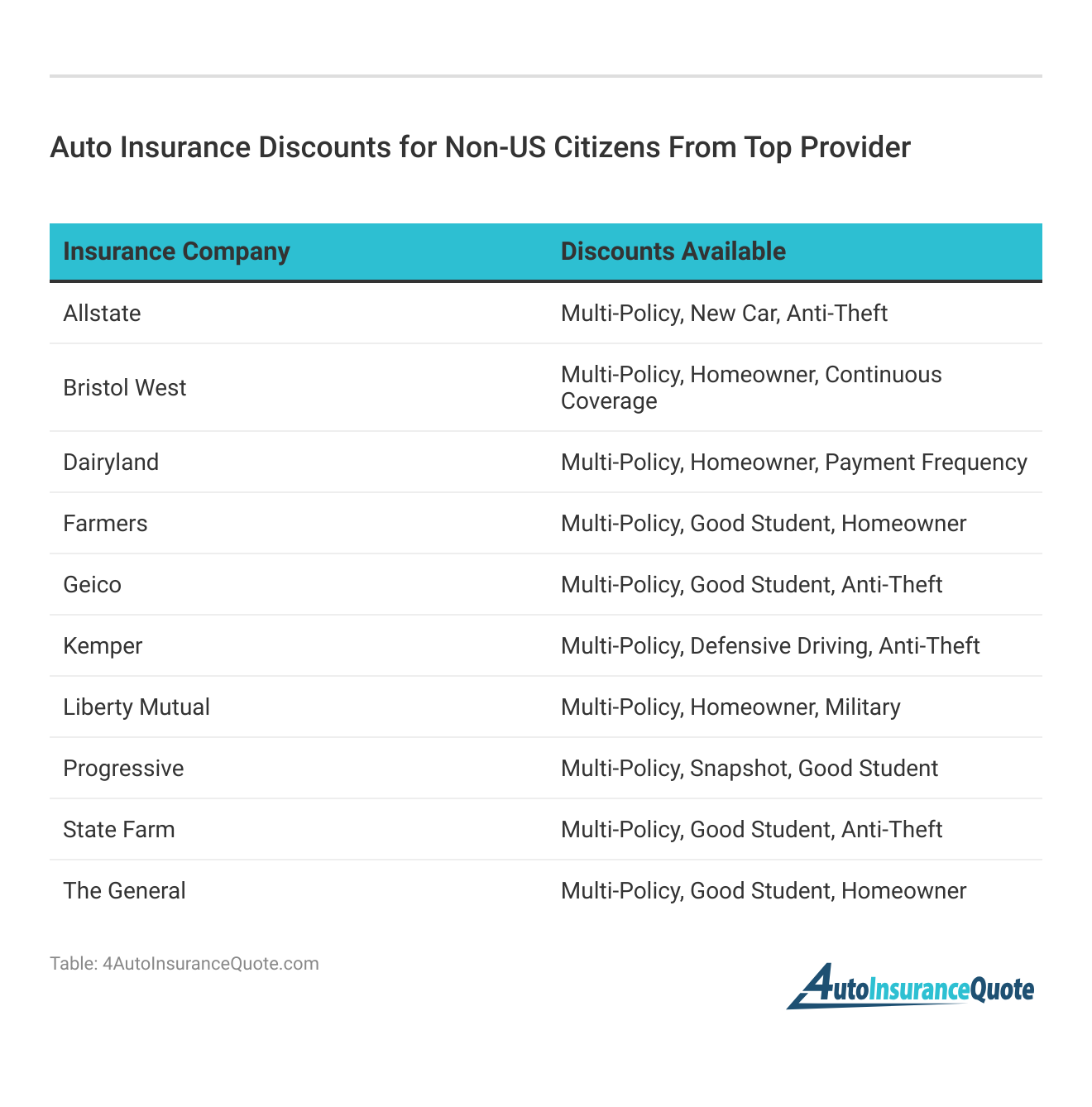

Progressive, Geico, and State Farm provide the best auto insurance for non-US citizens, with premiums starting at just $78 per month. Our goal is to help you compare quotes from these reliable insurers to find the perfect coverage and take advantage of personalized discounts for your vehicle.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Nov 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Non-US Citizens

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Non-US Citizens

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – Progressive: Top Overall Pick

Pros

- Competitive Rates: Offers some of the lowest rates in the industry.

- Variety of Discounts: Numerous discounts available for safe drivers, multiple policies, and more.

- Snapshot Program: Usage-based insurance program that can lower rates based on driving habits.

Cons

- Customer Service: Mixed reviews on customer service quality.

- Complex Policies: In our Progressive auto insurance review, some customers find policy options and terms confusing.

#2 – Geico: Best for Low Rates

Pros

- Low Rates: Consistently offers some of the most affordable rates. Read more in our Geico auto insurance review.

- Online Tools: Excellent online tools and mobile app for policy management.

- Wide Coverage Options: Comprehensive coverage options available, including mechanical breakdown insurance.

Cons

- Claims Process: Some customers report difficulties with the claims process.

- Limited Local Agents: Fewer local agents compared to some competitors, which may be a drawback for those who prefer in-person service.

#3 – State Farm: Best for Extensive Network

Pros

- Extensive Network: Largest network of agents for personalized service.

- Strong Financial Ratings: Excellent financial stability and claims-paying ability.

- Good Driver Discounts: Substantial discounts for safe and young drivers.

Cons

- Higher Rates: Often has higher premiums compared to competitors. Find out more in our State Farm auto insurance review.

- Limited Online Features: Online tools and app are less advanced compared to others like Geico.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#4 – Allstate: Best for Customer Service

Pros

- Strong Customer Service: High marks for customer service and satisfaction.

- Numerous Discounts: Extensive range of discounts, including for safe driving and new cars.

- Comprehensive Coverage: Wide array of coverage options and add-ons.

Cons

- Expensive Premiums: Higher than average rates for some customers. Use our Allstate auto insurance review as your guide.

- Mixed Claims Satisfaction: Some customers report dissatisfaction with the claims process.

#5 – Farmers: Best for Foreign Licenses

Pros

- Good for Foreign Licenses: Farmers, as mentioned in our Farmers auto insurance review, offers coverage for drivers with foreign licenses.

- Personalized Policies: Customizable coverage options to fit individual needs.

- Strong Agent Network: Large network of local agents for personalized assistance.

Cons

- High Rates: Generally more expensive than other insurers.

- Limited Online Resources: Online tools and mobile app are not as robust as competitors.

#6 – Liberty Mutual: Best for Comprehensive Plans

Pros

- Comprehensive Plans: Wide range of coverage options, including unique add-ons.

- Discounts: Numerous discount opportunities, such as bundling and safe driver discounts.

- Solid Customer Service: Positive ratings for customer service.

Cons

- Premium Costs: Rates can be higher than average. Read more through our Liberty Mutual auto insurance review.

- Complex Discount Requirements: Some discounts have complex eligibility requirements.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#7 – The General: Best for High-Risk Drivers

Pros

- High-Risk Drivers: Specializes in coverage for high-risk drivers.

- Affordable Rates: Competitive rates for those who might struggle to find affordable insurance elsewhere.

- Quick Quotes: Fast and easy quote process.

Cons

- Customer Service: Mixed reviews regarding customer service. Read more through our The General auto insurance review.

- Limited Coverage Options: Fewer coverage options and add-ons compared to major insurers.

#8 – Kemper: Best for Non-Standard

Pros

- Non-Standard Policies: Good for non-standard drivers and unique situations.

- Flexible Payment Options: Offers various payment plans and flexible options.

- Broad Coverage: Provides a range of coverage options. Find out more through our Kemper auto insurance review.

Cons

- Higher Rates for Some: Can be more expensive, particularly for standard drivers.

- Customer Complaints: Some negative reviews regarding claims handling and customer service.

#9 – Bristol West: Best for Flexible Payments

Pros

- Flexible Payments: Offers flexible payment options and plans. For guidance, look for our Bristol West auto insurance review.

- Specializes in High-Risk Drivers: Good option for high-risk drivers needing coverage.

- Responsive Service: Generally responsive customer service.

Cons

- High Premiums: Higher premiums, especially for non-high-risk drivers.

- Limited Discounts: Fewer discount opportunities compared to other insurers.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#10 – Dairyland: Best for High-Risk Drivers

Pros

- High-Risk Coverage: Specializes in providing coverage for high-risk drivers.

- SR-22 Filing: Assists with SR-22 filings for drivers who need it. Look for our Dairyland auto insurance review.

- Flexible Policies: Offers flexible payment plans and coverage options.

Cons

- Higher Costs: Typically more expensive than mainstream insurers.

- Customer Service Issues: Some complaints regarding customer service and claims handling.

Requirements for Car Insurance for Foreigners in the USA

Kind of Coverage for Car Insurance for Foreigners in the USA

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Purchasing Car Insurance for Foreigners in the USA

International Driver’s License for Driving in the USA

Understanding Car Insurance for Foreigners in the USA

When planning your visit to the U.S., consider these points:

- Unless you’re entering from Canada or Mexico, you might need an international driver’s license, obtainable from your home country.

- You don’t need a local social security number (SSN) to apply for auto insurance in the U.S.

- Short-term tourist auto insurance in the USA can be costly; long-term insurance may be more economical.

- Non-U.S. citizens usually face higher auto insurance rates due to perceived higher risk.

- Regardless, some form of insurance coverage is necessary for driving in the U.S., so compare quotes for the best options.

Frequently Asked Questions

Do non-U.S. citizens need car insurance in the USA while visiting?

Yes, auto insurance is required for non-U.S. residents driving in the U.S.

What are the minimum insurance requirements for non-residents?

The minimum requirements vary by state but generally include liability coverage for property damage and bodily injury. Enter your ZIP code to begin.

Do I need an international driver’s license (IDP) to drive in the USA?

Should I get short-term or long-term insurance?

For a short visit, temporary coverage through a rental agency may be suitable. Longer stays may benefit from traditional coverage.

What should I do before driving in the USA?

Consult an American insurance agent for guidance and make sure to have proper insurance coverage to drive legally. Enter your ZIP code now to begin.

Which auto insurance company is considered the top overall pick for non-US citizens?

What starting monthly premium does Progressive offer for comprehensive coverage?

Progressive offers comprehensive coverage starting at $78 per month.

Do Canadian and Mexican drivers need an International Driver’s Permit (IDP) to drive in the USA?

No, Canadian and Mexican drivers do not typically need an International Driver’s Permit (IDP) to drive in the USA. Enter your ZIP code now to start.

What type of insurance might be suitable for a short visit to the USA?

Which auto insurance company is noted for being the best for customer service?

Allstate is noted for being the best for customer service.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.