Best Auto Insurance Discounts for Nurses in 2025 (Check Out These 10 Companies)

Progressive, Geico, and AAA offer the best auto insurance discounts for nurses, with rates at $70. These top providers excel due to their tailored discounts for medical professionals, extensive coverage options, and superior customer service, making them ideal choices for nurses seeking affordable insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Jun 25, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jun 25, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

3,027 reviews

3,027 reviewsCompany Facts

Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviews 3,792 reviews

3,792 reviewsCompany Facts

Full Coverage

A.M. Best Rating

Complaint Level

3,792 reviews

3,792 reviewsThe best auto insurance discounts for nurses are offered by Progressive, Geico, and AAA. With rates starting at $70 per month. These top providers excel due to their tailored discounts for medical professionals, extensive coverage options, and superior customer service.

Nurses can save significantly by choosing these companies, benefiting from their specialized insurance plans.

Our Top 10 Company Picks: Best Auto Insurance Discounts for Nurses| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 15% | A++ | Many Discounts | State Farm | |

| #2 | 12% | A | Local Agents | AAA |

| #3 | 12% | A | Customizable Polices | Liberty Mutual |

| #4 | 10% | A++ | Accident Forgiveness | Travelers | |

| #5 | 10% | A+ | Online Convenience | Progressive | |

| #6 | 10% | A+ | Add-on Coverages | Allstate | |

| #7 | 10% | A+ | Usage Discount | Nationwide | |

| #8 | 10% | A | Local Agents | Farmers | |

| #9 | 8% | A++ | Cheap Rates | Geico | |

| #10 | 5% | A++ | Military Savings | USAA |

This article explores best auto insurance companies such as the main factors that make these providers the best choices for affordable, comprehensive auto insurance for nurses.

To find the best and most affordable nurse’s auto insurance, enter your ZIP into our free tool above to compare nurse’s auto insurance quotes now.

- Progressive is the best auto insurance discounts for nurses

- The best auto insurance discounts for nurses include tailored offers

- Nurses can save with rates starting at $70

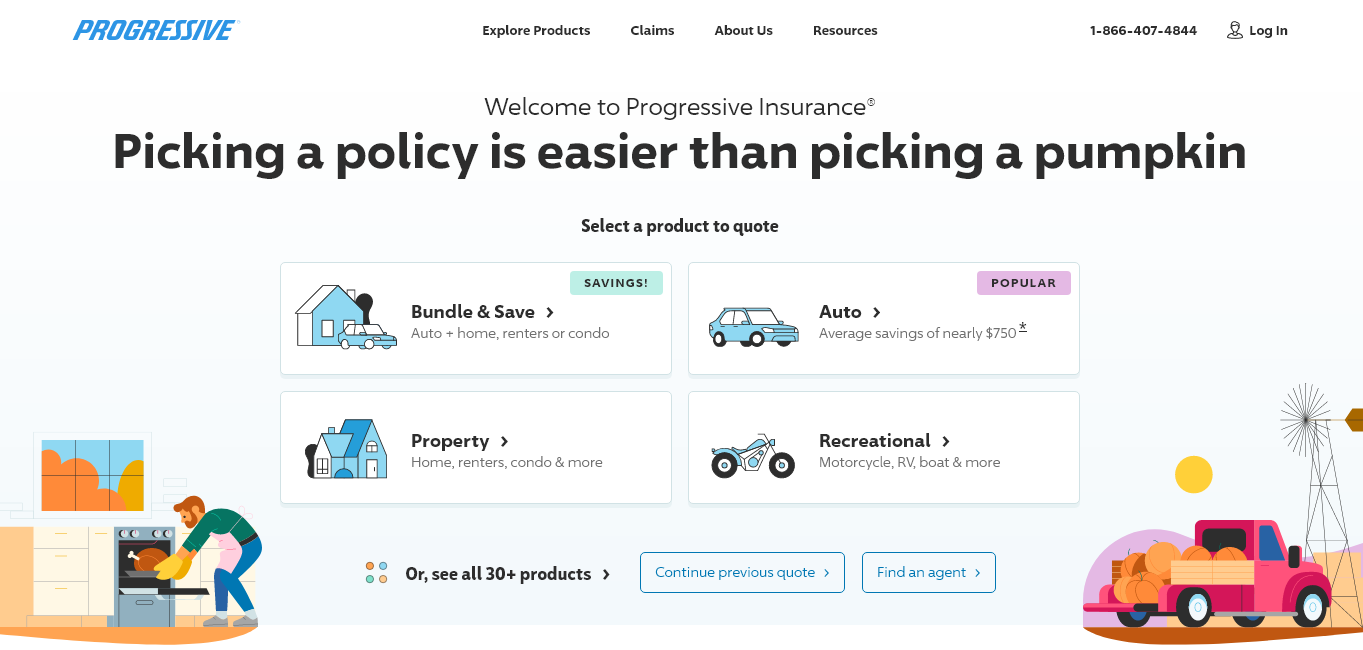

#1 – Progressive: Top Overall Pick

Pros

- User-Friendly Platform: Progressive’s online tools and mobile app make it easy to manage policies and file claims.

- Snapshot Program: Offers significant discounts based on driving behavior monitored through their telematics program.

- Flexible Payment Options: Progressive provides a variety of payment plans to fit different budgets. Read up on the Progressive auto insurance review for more information.

Cons

- Customer Service: Some users report inconsistent customer service experiences.

- High Rates for High-Risk Drivers: Premiums can be higher for those with less-than-perfect driving records.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#2 – Geico: Best for Cheap Rates

Pros

- Competitive Pricing: Geico is known for its low rates, making it a top choice for budget-conscious drivers.

- Easy Quote Process: The online quote process is straightforward and quick. See more details on our Geico auto insurance review.

- Membership Discounts: Offers additional discounts for members of certain professional and alumni organizations.

Cons

- Limited Local Agents: Fewer physical locations for in-person assistance compared to some competitors.

- Customer Support: While generally good, some customers find phone support to be less satisfactory.

#3 – AAA: Best for Local Agent

Pros

- Personalized Service: AAA Auto insurance review has access to knowledgeable local agents who provide tailored advice.

- Roadside Assistance: Excellent roadside assistance program included with membership.

- Comprehensive Coverage Options: Wide range of coverage options including specialty vehicles.

Cons

- Membership Requirement: Must be a AAA member to access insurance services.

- Higher Premiums: Can be more expensive compared to other providers, especially for non-members.

#4 – State Farm: Best for Many Discounts

Pros

- Bundling Policies: State Farm offers significant discounts for bundling multiple insurance policies.

- High Low-Mileage Discount: State Farm provides a substantial discount for low-mileage usage.

- Wide Coverage: Offers various coverage options tailored for different business needs. Learn more in our State Farm auto insurance review.

Cons

- Limited Multi-Policy Discount: The multi-policy discount is not as high compared to some competitors.

- Premium Costs: Despite discounts, premiums might still be relatively higher for certain coverage levels.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#5 – Allstate: Best for Add-On Coverages

Pros

- Comprehensive Add-Ons: Offers a variety of optional coverages such as accident forgiveness and new car replacement.

- Discounts for Safe Drivers: Provides significant savings for drivers with clean records. More information is available about this provider in our “Allstate vs. USAA: Which Offers More Affordable Auto Insurance Quotes.”

- Innovative Tools: Useful tools like the Drivewise program for monitoring and improving driving habits.

Cons

- Higher Base Rates: Generally higher base premiums compared to some other insurers.

- Customer Service Variability: Inconsistent customer service experiences reported by some policyholders.

#6 – Nationwide: Best for Usage Discount

Pros

- SmartRide Program: Usage-based discounts can significantly lower premiums based on driving habits.

- Vanishing Deductible: Deductible decreases the longer you go without an accident. Learn more on how do I file an auto insurance claim with Nationwide.

- Strong Financial Ratings: High financial stability ensures reliability and security.

Cons

- Limited Availability: Discounts and programs may not be available in all states.

- Higher Premiums for Young Drivers: Can be costly for younger, less experienced drivers.

#7 – Liberty Mutual: Best for Customizable Policies

Pros

- Flexible Coverage Options: Customizable policies to fit unique needs. Check out insurance savings in our complete Liberty Mutual auto insurance review.

- Multi-Policy Discounts: Significant savings when bundling auto with home or other insurance.

- Accident Forgiveness: Keeps rates from increasing after your first accident.

Cons

- High Premiums: Generally higher premiums compared to some competitors.

- Customer Service: Mixed reviews on customer support quality.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#8 – USAA: Best for Military Savings

Pros

- Exclusive Military Benefits: Special discounts and benefits for military members and their families.

- Excellent Customer Service: High satisfaction ratings from policyholders.

- Financial Strength: Strong financial stability ensures dependable coverage. See more details on what information do I need to provide when filing an auto insurance claim with USAA.

Cons

- Eligibility Restrictions: Only available to military members, veterans, and their families.

- Limited Physical Locations: Fewer branch locations for in-person services.

#9 – Farmers: Best for Local Agents

Pros

- Agent Expertise: Access to local agents who provide personalized service. Discover more about offerings in our Farmers auto insurance review.

- Range of Discounts: Various discounts available, including those for safe drivers and good students.

- Innovative Programs: Unique programs like Signal, a telematics app to monitor driving behavior.

Cons

- Higher Rates: Can be more expensive compared to some other insurers.

- Complex Policy Structures: Some customers find policy options and discounts confusing.

#10 – Travelers: Best for Accident Forgiveness

Pros

- Accident Forgiveness: First accident doesn’t increase premiums. Access comprehensive insights into our Travelers auto insurance review.

- New Car Replacement: Replaces totaled new cars with brand-new ones of the same make and model.

- Multi-Policy Discounts: Offers savings when bundling with other insurance types.

Cons

- Above-Average Premiums: Generally higher premiums compared to some competitors.

- Limited Availability: Certain discounts and features may not be available in all states.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Explore Car Insurance Discounts for Nurses

There are plenty of ways to find out which insurance companies offer auto insurance discounts to nurses. The best way to get car insurance discounts for nurses is to talk to your insurance company. Ask if they have specific nurse discounts.

Or, if you’re shopping around for auto insurance, compare quotes online today. Some auto insurance companies are known for offering preferential rates for nurses and other medical professionals.

| Company | Discount Percentage | Discount Details |

|---|---|---|

| 12% | Multi-Policy Discount |

| 10% | Drivewise Program | |

| 10% | Signal Program | |

| 8% | Good Driver Discount | |

| 12% | RightTrack Program |

| 10% | SmartRide Program | |

| 10% | Safe Driving Bonus | |

| 15% | Drive Safe & Save Program | |

| 10% | IntelliDrive Program | |

| 5% | SafePilot Discount |

Car insurance discounts for nurses vary among insurance companies. They also vary between states. A company might offer nurse discounts in one state, but not others. For example, in some states, Nationwide Insurance is currently offering a 10 percent discount to those within the nursing profession.

It’s worth noting that companies that offer nurse discounts also usually offer discounts for most other medical professionals.

Check out which auto insurance companies offer discounts to nurses in the section below.

Read more: Doctor Auto Insurance Discount: Save on Auto Insurance

Companies That Offer Car Insurance Discounts for Nurses

Certain auto insurance companies are known for offering a discount to nurses, including all of the following:

- AAA auto insurance

- California Casualty auto insurance

- Farmers auto insurance

- The Hartford auto insurance

- Nationwide Car Insurance

- USAA Car Insurance

The amount of the discount will vary based on the insurance company and state law, but most offer discounts of between three and 15 percent.

Keep in mind, these discounts may not be offered in every state. So if, for example, you are wondering about car insurance discounts for nurses in California, you would need to contact an agent in California.

If you’re a Geico auto insurance customer, you may be wondering if Geico has nurse discounts. In fact, Geico offers car insurance discounts to members of the Association of Women’s Health, Neonatal Nurses, and other medical organizations.

In the table below, you can see average auto insurance rates for registered nurses.

Auto Insurance Monthly Rates for Nurses by Coverage Level| Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $83 | $202 |

| $94 | $224 | |

| $79 | $175 | |

| $89 | $180 | |

| $86 | $219 |

| $82 | $209 | |

| $90 | $155 | |

| $70 | $162 | |

| $78 | $193 | |

| $82 | $183 |

In most states, nurse discounts are considered profession-specific discounts. The average profession-specific discount on policies is around five percent. Again, this all depends on the company.

If you can’t find Progressive nurse discounts, Allstate nurse discounts, Nationwide insurance nurse discounts, or Farmers Insurance nurse discounts, you should probably contact the company and ask anyway.

Compare quotes online today to make sure you’re getting the best possible price on auto insurance as a nurse and find the cheapest car insurance for medical professionals.

How Nursing Students Can Get Car Insurance Discounts for Nurses

Car insurance nurse discounts aren’t just for full-time nurses; they may also be available to student nurses. Students studying medicine or nursing may be eligible for special student nurse discounts on their auto insurance policies.

Some companies offer discounts for students with good grades on car insurance if they maintain a GPA of 3.0 or higher, for example. If you’re getting good grades in nursing school, you may be able to save between 10 and 20 percent off the cost of auto insurance.

Studies have shown that students who maintain good grades are less likely to make a claim, so auto insurance companies reward your hard work with lower rates.

Auto insurance companies might also provide nursing students with an auto insurance discount if they live far away from home.

If your car is parked at your parents’ house while you’re away at college, for example, but you still want to be covered when you go home, then you might get a distant student auto insurance discount.

Talk to your auto insurance provider to ask about student nurse discounts on policies.

Read more:

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

How Occupation as a Nurse Affects Auto Insurance Rates

There are many ways insurers calculate your auto insurance rate when setting the price. They consider your age and gender, for example, as well as your driving history.

A growing number of auto insurance companies, however, are also taking something else into account: they’re analyzing your risk based on your profession.

A few examples of auto insurance rates by occupation can be found in the chart below.

Full Coverage Auto Insurance Monthly Rates by Occupation| Occupation | Rates |

|---|---|

| Admin. Asst./Secretary | $115 |

| Administrator | $120 |

| Architect | $118 |

| Attorney | $125 |

| Construction | $135 |

| CPA/Comptroller | $115 |

| Engineer | $118 |

| Executive | $125 |

| Judge | $130 |

| Lawyer | $125 |

| Manager/Director | $120 |

| Nurse | $110 |

| Nursing Student | $105 |

| Office Staff | $115 |

| Statistician | $112 |

Certain professions are associated with lower risk than others. For example, a nurse or a doctor might have a lower chance of making a claim than an individual in another profession.

Some auto insurance companies offer discounts for those working in “preferred occupations.” Sometimes, these discounts are given because the occupation is genuinely associated with lower risk.

In other cases, auto insurance companies provide discounts as a reward for people working in certain occupations military personnel and first responders, for example, might receive preferential auto insurance rates.

Nurses often fall into the “preferred occupation” category, along with many other medical professionals. If you’re a nurse or otherwise work in the medical field, you may be eligible for occupation-specific savings on auto insurance.

Nurse discount car insurance is generally available because nurses are considered safer drivers. There are lower rates for other occupations as well, such as firefighter and police officer auto insurance discounts.

In addition to lower auto insurance rates, there are also many other free products and car insurance discounts for nurses.

Other Ways Nurses can Save Money on Auto Insurance

While many factors influence car insurance rates, such as age, gender, driving record, and credit score, there are numerous strategies nurses can use to lower their premiums and take advantage of car insurance discounts for nurses.

Occupation-specific discounts, such as a nurse car insurance discount, are just one method for nurses to save money on auto insurance. Here are some additional tips for securing discount car insurance for nurses:

- Bundle Policies: Combining auto insurance with other policies, like home or renters insurance, can lead to significant savings and may result in additional car insurance discounts for nurses. Explore this comprehensive guide titled “What Are the Best Insurance Companies for Bundling Home and Auto Insurance?“.

- Maintain a Good Credit Score: A higher credit score can result in lower insurance rates, so it’s beneficial to keep your credit in good standing for the best car insurance discount for nurses.

- Utilize Telematics Programs: Participating in telematics programs, which monitor your driving habits, can offer discounts for safe driving behaviors and help with securing auto insurance discounts for nurses.

- Increase Deductibles: Opting for a higher deductible can lower your premium. Just ensure you can afford the deductible in case of a claim to benefit from nurse discount car insurance.

- Compare Quotes Regularly: Regularly comparing quotes from different insurance providers ensures you get the best rates available and can find the best car insurance nurse discount.

- Look for Additional Discounts: Many insurers offer various discounts, such as safe driver discounts, multi-policy discounts, good student discounts, and low-mileage discounts. Ask your agent about all available options to maximize your nurses car insurance discount.

- Take a Defensive Driving Course: Completing a defensive driving course can sometimes result in lower rates and contribute to a healthcare worker car insurance discounts.

- Reduce Coverage on Older Vehicles: If you have an older car, consider dropping comprehensive and collision coverage if the cost outweighs the vehicle’s value, potentially lowering your nurse car insurance discount.

- Limit Annual Mileage: Reducing the number of miles you drive annually can lower your rates, as less time on the road means a lower risk of accidents, contributing to a travel nurse car insurance discount.

- Maintain a Clean Driving Record: Avoiding traffic violations and accidents can help keep your premiums low and ensure you qualify for the best insurance discounts for nurses.

By implementing these strategies, nurses can effectively reduce their auto insurance costs while maintaining adequate coverage. For example, taking advantage of a geico nurse discount or other healthcare worker car insurance discounts can lead to substantial savings. Regularly exploring and applying for these discounts can help nurses find the best possible rates and benefit from various car insurance discounts for healthcare workers.

Common Driver Discounts Available on Auto Insurance as a Nurse

There are multiple discounts you can be eligible for if you ask. Some of the more common ones are:

- Multi-car insurance discount

- Multi-policy discount

- Good student discount

- Car safety features discount

- Defensive driving discount

- Paid in full discount

- Paperless billing discount

Make sure to ask your agent what discounts are available to you. If you are able to bundle your policies and discounts, you can really lower your rates significantly.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Affect of Coverage and Claims on Auto Insurance Rates

Choosing a lower coverage level can also save you money. There are multiple coverages that you can choose from, including add-ons like roadside assistance or towing that you can remove from your policy to lower your rates.

You can also raise your auto insurance deductible. This way you are paying more out of pocket for damages on claims so the auto insurance company won’t have to pay as much. This will lead to lower car insurance rates.

Avoiding claims is another way to keep your rates low. If you do have damages in which the cost to fix them is less than your deductible, you can choose to pay out of pocket to keep your rates low.

Affect of Credit Score on Auto Insurance Rates

Did you know that your credit score and auto insurance quotes go hand in hand?

Insurance companies use your credit score to assess your risk. If you have a credit score of 650 or higher, for example, then you may be eligible for better auto insurance rates than someone with a lower credit score.

If you have a low credit score, start trying to improve it. Not only will it lower your car insurance rates, but it will also help you get lower rates on home and auto loans.

How Telematics Lowers Auto Insurance Rates

A growing number of insurance companies offer telematics car tracking programs. You install a temporary tracker on your vehicle, and your insurance company charges a customized rate based on your driving habits.

Registered nurses who drive during safe hours of the day (outside of rush hour, for example) or have short commutes might find themselves paying 10 to 30 percent less for auto insurance after installing telematics systems. For further insights, read thorough this guide titled “10 Best Auto Insurance Companies That Do Not Monitor Your Driving”

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

How Comparing Auto Insurance Quotes Online Can Lower Your Rates

It takes just a few minutes to compare auto insurance quotes online to ensure you’re paying the best possible rates for auto insurance as a nurse. Remember, some companies offer nurse special discounts and others don’t.

Even if your insurance company doesn’t offer car insurance discounts for nurses, there are many more ways to save on auto insurance.

How Annual Mileage Affects Auto Insurance Rates

Another factor that insurance companies consider when setting rates is how many miles you tend to drive. Check out the table below to see what different companies are charging based on a driver’s commute. To gain more knowledge, check out this comprehensive guide “Average Miles Driven Per Year by State”

Full Coverage Auto Insurance Monthly Rates by Annual Mileage & Provider| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| $403 | $411 | |

| $283 | $290 | |

| $348 | $351 | |

| $264 | $272 | |

| $500 | $513 |

| $286 | $289 |

| $336 | $337 | |

| $265 | $279 | |

| $367 | $372 | |

| $207 | $216 |

As you can see, some insurance companies charge considerably more if a driver spends a lot of time on the road, while for other companies the difference in rates is negligible.

Case Studies: Best Auto Insurance Discounts for Nurses

Explore how nurses have benefited from tailored auto insurance discounts provided by Progressive, Geico, and AAA. These case studies highlight the unique needs of nurses and how these top providers have delivered exceptional service and savings.

- Case Study #1– Savings With Progressive: Sarah, a registered nurse, chose Progressive, which reduced her monthly premium to $70. She saved over $300 annually and enjoyed excellent coverage and customer service.

- Case Study #2– Experience With Geico: Mike, a nurse practitioner, received a 15% discount from Geico due to his profession. This lowered his premium significantly, providing necessary coverage at a reduced cost.

- Case Study #3– Journey With AAA: Emma, a nursing student, got a discount from AAA for being a student nurse and maintaining good grades. This reduced her insurance costs, helping her focus on her studies.

This demonstrate how Progressive, Geico, and AAA provide the best auto insurance discounts for nurses, ensuring affordable and comprehensive coverage tailored to their unique needs. To find out more, explore our guide titled “Auto Insurance Quotes by Vehicle.”

Whether you are a registered nurse, nurse practitioner, or nursing student, these providers offer significant savings and excellent service, helping you focus on what matters most. If you’re looking to lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool below to compare your rates against the top insurers.

Frequently Asked Questions

How much auto insurance should I buy?

The amount of insurance coverage you need depends on your specific situation. It’s a good idea to share your driving history and projected needs with your potential insurance company for help determining the exact type of coverage necessary.

Are there car insurance discounts for nurses?

Yes, many insurance companies offer discounts for nurses, ranging from 3 to 15 percent off auto insurance rates.

Enter your ZIP code into our free quote tool below to find the best auto insurance providers for your needs and budget.

Which companies offer car insurance discounts for nurses?

Some companies known for offering nurse discounts include Geico, Nationwide Insurance, and more. Discounts may vary by state.

Can nursing students get car insurance discounts?

Yes, student nurses may be eligible for special discounts based on good grades or living away from home for college.

How much auto insurance is required in my state?

While most state auto insurance requirements include bodily injury (BI) and property damage liability insurance, some states have different requirements.

Does credit score impact auto insurance rates?

Yes, a higher credit score can lead to better rates, so it’s beneficial to improve your credit score.

Does annual mileage affect auto insurance rates?

Yes, the number of miles driven can impact rates, with some companies charging more for longer commutes.

What are the different types of auto insurance?

Explaining auto insurance coverage types doesn’t need to be difficult. There are many different types of auto insurance coverage available, including liability coverage, collision coverage, and comprehensive coverage.

How can nurses save more on auto insurance?

Nurses can save by bundling policies, maintaining a good credit score, opting for telematics programs, and comparing quotes from different providers.

What are common driver discounts available to nurses?

Common discounts include safe driver discounts, multi-policy discounts, good student discounts, and low-mileage discounts. Ask your agent about available options.

Find your cheapest auto insurance quotes by entering your ZIP code below into our free comparison tool.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.