Cheap Alaska Auto Insurance for 2024

At $120 per month, average Alaska auto insurance quotes are a little higher than the national average. There are several reasons for higher rates, including extreme weather risks and high Alaska auto insurance laws, but drivers can save by finding discounts and comparing quotes.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kalyn Johnson

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Insurance Claims Support & Sr. Adjuster

UPDATED: Dec 13, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Dec 13, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Alaska auto insurance rates tend to be higher than the national average despite having one of the smallest populations of drivers

- Rates in Alaska are higher for several reasons, including uninsured drivers, extreme weather risks, and strict insurance requirements

- Drivers can save by taking advantage of discounts and comparing quotes

Despite having one of the smallest driving populations in the U.S., Alaska auto insurance rates are higher than the national average. Higher rates are partially due to larger Alaska auto insurance requirements, a high percentage of uninsured drivers, and extreme weather risks.

Although rates are higher, there are plenty of ways to find cheap Alaska auto insurance. From taking advantage of the best insurance discounts to comparing quotes from the best Alaska car insurance companies, you can learn everything you need to know about lowering your rates below.

Alaska Auto Insurance Laws

Alaska’s car insurance requirements are the highest of any state in the nation. Only Maine has equally high requirements.

In Alaska, the state auto liability insurance coverage minimums are:

- Bodily Injury — $50,000 per person

- Bodily Injury — $100,000 per accident

- Property Damage — $25,000 per accident

Take a look at how Alaska’s minimum rates compare with surrounding states.

Optional coverage options in Alaska:

- Comprehensive Coverage

- Collision Coverage

- Medical Payments Coverage

- Rental Car Reimbursement Coverage

- Roadside Assistance Coverage

- Uninsured/Underinsured Motorist Bodily Injury Coverage

There are a few key points that drivers new to Alaska’s auto insurance system must know. First, Alaska (like many states) follows what is known as the “tort” system. This means that whenever there is an accident, one of the drivers will be determined to have caused the accident and is labeled the “at fault” party.

This person and their insurance will be responsible for paying out claims and dealing with any lawsuits. While this means your insurance premiums likely won’t rise if you don’t cause accidents, it does expose one if they happen to be in an accident caused by an uninsured driver.

The Alaskan government has determined that all drivers must have auto insurance coverage in a couple of different areas to be considered legally allowed to drive. Bodily injury liability insurance is auto insurance that pays medical bills for the other parties in an accident where you are found to be at fault.

For instance, if the at-fault party rear-ends the car in front of them, causing the driver to get whiplash, the at-fault party’s bodily injury liability insurance will cover their treatment, lost wages, and other financial claims from the accident. The minimum amount of this insurance that Alaskans must have is $50,000 per person in a single accident and $100,000 for all parties in a single accident.

The other Alaska auto insurance policy that is legally mandatory is called Property Damage Liability insurance. This type of insurance covers claims for property damage against the at-fault driver when they cause an accident.

For example, suppose a driver swerved to avoid an obstacle in the road and hit a parked car. In that case, the driver’s Property Damage Liability insurance will cover the repair and bodywork costs for the parked car. The minimum amount of coverage here is $25,000.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

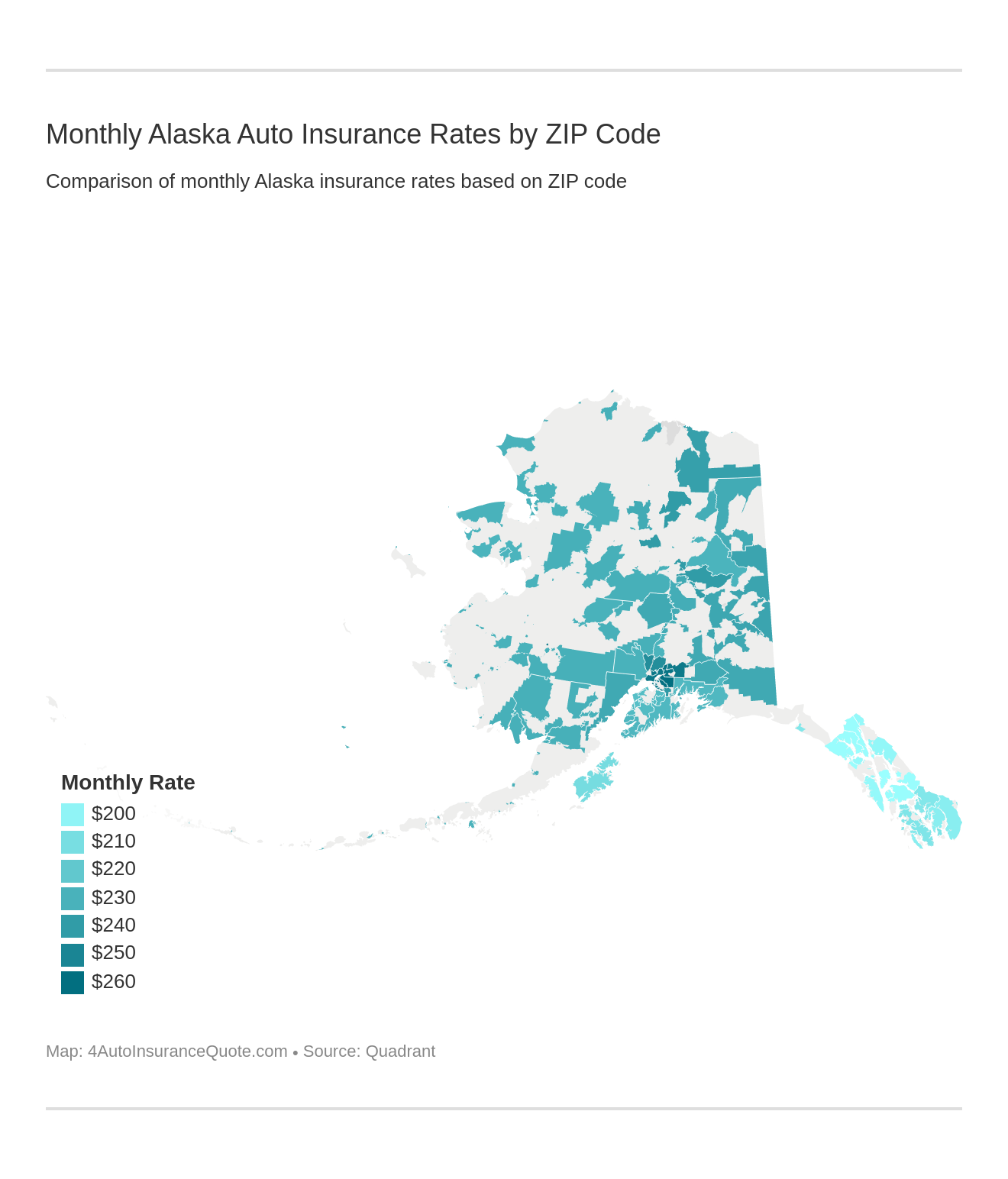

Compare Alaska Auto Insurance Quotes

Despite being a little higher than the national average, finding affordable Alaska auto insurance doesn’t have to be a challenge. In June of this year, Alaska auto insurance rates averaged $1443 per year, which is just a couple of dollars higher than the annual $1439 national median.

Read more: Cheap Alaska Auto Insurance

At an annual average rate of $2095, drivers in Anchorage pay quite a bit more for their auto insurance; this is typical for most metropolitan areas in the country. Drivers in Juneau pay about $1450 per year for their auto insurance.

There are a lot of factors that auto insurance companies take into consideration when determining your rates. Take a look at our overview here.

While many of these factors are simply based on your own driving record, two things that affect even the safest of drivers are age and gender. As with most states, males typically pay higher auto insurance rates than females.

With all things considered, the best car insurance in Alaska can be very affordable.

Alaska Auto Insurance Rates by Company

Though the state boasts affordable auto insurance rates overall, let’s take a look at how rates vary between some of the largest companies.

But which companies are the largest, holding the most market share percentage in the region?

Alaska Auto Accidents and Theft Rates

In regards to crash statistics, the news is both good and bad for Alaskan drivers. In 2007 (the most recent year for which official crash data is available), there were a total of 10,578 crashes reported on Alaska’s roads. This represents a decrease of over 1200 total crashes in just a year, as there were 11,728 crashes reported in 2006.

The bad news is that while the total number of crashes decreased, there was an increase in fatalities resulting from these crashes. 2006 saw just 74 fatalities, and that number jumped to 82 in 2007. If the accident fatality totals continue to trend upward, it could mean higher Alaska auto insurance rates. With luck, these numbers have already declined.

As one can imagine, the auto theft risk is somewhat limited for Alaska residents. There are few ways for criminal elements to move enough stolen automobiles out of Alaska to make it profitable, so total auto theft numbers remain low.

In 2009, Alaska residents reported 1689 incidences of auto theft, which was slightly up from 2008’s total of 1630 stolen vehicles. These numbers are down more than 35% since 2001 and are likely to trend downwards as time goes on and vehicle owners continue to be more careful about protecting their automobiles.

4AutoInsuranceQuote.com is proud to help Alaskans track down the best possible rates for auto insurance. Our handy search tool will help you compare auto insurance rates from multiple insurance companies and learn more about how to save on your insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Alaska Auto Insurance Agents

Below you’ll find a list of auto insurance agents in Alaska so that you can locate one near you.

Alaska Auto Insurance Agents

Additional State of Alaska Insurance Information

If you need more information, visit the official sources below.

- Alaska Division of Motor Vehicles – Official Alaska Department of Administration website.

- Alaska Division of Insurance – From the Department of Commerce, Community, and Economic Development.

- Mandatory Insurance – From the Alaska Division of Motor Vehicles website.

- Alaska Highway Safety Laws – Key laws from the GHSA.

Ready to get the best Alaska car insurance for your needs? Enter your ZIP code now to compare rates for free.

Frequently Asked Questions

What are the minimum auto insurance requirements in Alaska?

Alaska auto insurance requirements are a minimum of 50/100/25 liability coverage.

How much does auto insurance cost in Alaska?

Average Alaska auto insurance costs in Alaska is around $120.35 per month.

Where can I find the cheapest auto insurance in Alaska?

To find cheap Alaska auto insurance, compare quotes from multiple companies.

Are there optional coverage options in Alaska?

Yes, optional Alaska auto insurance options include collision, comprehensive, uninsured/underinsured motorist, and personal injury protection.

How can I save money on auto insurance in Alaska?

You can save money on Alaska auto insurance by maintaining a clean driving record, raising deductibles, and taking advantage of discounts.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Kalyn Johnson

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Insurance Claims Support & Sr. Adjuster

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.