Cheap Hyundai Auto Insurance in 2025 (Unlock Big Savings From These 10 Companies!)

When it comes to cheap Hyundai auto insurance, Progressive, Geico, and State Farm stand out as the top choices, with rates starting at $45/mo. These companies offer comprehensive coverage and competitive prices, making them the best options for car insurance who seeks for a reliable and cost-effective solution.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for Hyundai

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage for Hyundai

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews

If looking for cheap Hyundai auto insurance, look no further than Progressive, Geico, and State Farm. These companies offer competitive rates and comprehensive coverage, making them the top choices for Hyundai owners.

Like all drivers, Hyundai drivers have many things to consider when looking for affordable Hyundai auto insurance quotes. Whether you drive a Hyundai Sonata Hybrid or a Hyundai Tucson, these insurers have you covered.

Our Top 10 Company Picks: Cheap Hyundai Auto Insurance| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $45 | A+ | Coverage Options | Progressive | |

| #2 | $48 | A++ | Affordable Rates | Geico | |

| #3 | $50 | B | Many Discounts | State Farm | |

| #4 | $52 | A | Unique Benefits | Liberty Mutual |

| #5 | $53 | A+ | Commercial Insurance | Nationwide |

| #6 | $55 | A+ | Customer Service | Allstate | |

| #7 | $57 | A | Discount Selection | Farmers | |

| #8 | $58 | A | Discount Availability | American Family | |

| #9 | $60 | A++ | IntelliDrive Program | Travelers | |

| #10 | $61 | A+ | Exclusive Benefits | The Hartford |

Here’s more on the best auto insurance for Hyundais. To find cheap Hyundai auto insurance, compare quotes and start saving today. If you want to learn more about the company, head to our “Auto Insurance Comparison.”

Start saving on your auto insurance by entering your ZIP code above and comparing quotes.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Hyundai Auto Insurance Monthly Rates: Comparing Minimum and Full Coverage

When it comes to insuring your Hyundai, understanding the cost of coverage is essential. Below is a table detailing the monthly rates for minimum and full coverage from top insurance providers.

Hyundai Auto Insurance Monthly Rates by Coverage Level & Provider| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $55 | $140 |

| American Family | $58 | $148 |

| Farmers | $57 | $145 |

| Geico | $48 | $125 |

| Liberty Mutual | $52 | $135 |

| Nationwide | $53 | $138 |

| Progressive | $45 | $120 |

| State Farm | $50 | $130 |

| The Hartford | $61 | $155 |

| Travelers | $60 | $150 |

The rates for minimum coverage vary among providers, with Progressive offering the lowest at $45 per month and American Family the highest at $58. For full coverage, Geico offers the most affordable option at $125 per month, while The Hartford has the highest rate at $155. More information is available about this provider in our “Affordable Full Coverage Auto Insurance.”

These rates are based on factors such as the model of the Hyundai and the driver’s profile, so it’s important to compare quotes to find the best rate for your specific needs.

Understanding the Different Types of Hyundai Auto Insurance Coverage

Auto insurance exists to protect drivers and their vehicles and is required in most states. When purchasing auto insurance, most drivers choose between liability, comprehensive, collision, uninsured motorist, personal injury protection, and gap insurance. Most insurance companies offer each of these coverages in addition to various optional coverages.

- Liability Insurance: Liability insurance, which is required by almost all states, covers bodily injury and property damage expenses for other drivers and passengers involved in an accident you caused, up to a certain limit.

- Comprehensive Insurance: Comprehensive insurance covers non-collision damage to your vehicle, such as weather, theft, vandalism, fire, and animal collisions. Lenders and dealerships often require this for leased or financed vehicles.There is a key difference between comprehensive and collision coverage, which is detailed below.

- Collision Insurance: Covers property damage after a vehicle has collided with another vehicle or object. Similar to comprehensive insurance, lenders and dealerships may require drivers to purchase collision insurance for leased or financed vehicles.

- Uninsured Motorist: Some drivers have no insurance, or their coverage limit doesn’t cover the full cost of bodily injury or property damage. Uninsured/underinsured motorist insurance, which is required in select states, covers bodily injury and/or property damage expenses when the at-fault driver is uninsured or underinsured.

- Personal Injury Protection (PIP): Depending on the state, it is required to cover both the driver and their passengers’ medical expenses, lost wages, replacement services, and funeral expenses, regardless of who is at fault for an accident.

- Gap Insurance: Pays the difference between the totaled vehicle’s value and the remaining loan or lease balance. For example, if your Hyundai Elantra is worth $9,000, and the remaining loan balance is $12,500, if your vehicle is totaled, gap insurance covers the $3,500 difference.

Two considerations to keep in mind when choosing your insurance coverage are coverage limits and deductibles.

In states where liability insurance is mandated, drivers are expected to have a certain amount of coverage. Regardless of states, the coverage limits are displayed as three different numbers. If you see 25/50/20, this means your liability insurance will cover $25,000 bodily injury liability per person, $50,000 bodily injury liability per accident, and $20,000 property damage liability.

Comprehensive collision and sometimes personal injury protection carry a deductible. An auto insurance deductible is the amount of the cost of repairs the policyholder is asked to pay before insurance steps in.

For example, if your chosen deductible is $750 and an accident caused $1,500 in property damage, your insurance company pays the remaining balance of the repair bill, which would be $750. However, the auto insurance company will pay out the value of the vehicle, minus the deductible, for totaled vehicles.

Comparing Hyundai Auto Insurance Rates and Coverage Options

If you’ve purchased auto insurance before, then you know rates vary. The vehicle make, model, and year are important factors that impact rates, but insurance companies consider more than that. While the insurance company reviews certain information to determine rates, drivers have to review a few things as well, specifically rates and coverage options.

Popular Hyundai models are Hyundai Veloster, Hyundai Tucson, Hyundai Sonata Hybrid, Hyundai Sonata, Hyundai Santa Fe, Hyundai Elantra, Hyundai Azera, and Hyundai Accent.

In addition to what model of Hyundai you drive, insurance companies will also have varying rates based on the amount of coverage you choose. Below is a table comparing a full coverage policy to one that only has minimum coverage.

Whether you choose a full coverage auto insurance policy or just the state-required minimum amount of coverage will depend on what you need. Here are a few questions to ask to help you find the best auto insurance for your Hyundai.

- Does the auto insurance company offer the state minimum required insurance?

- What optional coverages are available?

- Does the cost of the auto insurance policy fit into your budget?

- Are you getting the coverage you want for a good price?

- Does the auto insurance company offer common auto insurance discounts?

- Are there discounts unique to the auto insurance company?

In conclusion, deciding between a full coverage auto insurance policy and the state-required minimum depends on your specific needs. Asking key questions about coverage options, budget, and available discounts can help you find the best auto insurance for your Hyundai. It’s important to balance cost with the coverage you desire to ensure you’re adequately protected on the road.

See more details on our “What are the different types of auto insurance coverage?”

When it comes to finding the best car insurance for Hyundai vehicles, understanding Hyundai Elantra insurance rates, Hyundai Azera car insurance costs, and Hyundai Accent car insurance premiums is crucial. Are Hyundais expensive to insure? Generally, Hyundai Santa Fe insurance costs are manageable, and Hyundai Veloster car insurance rates can vary based on the model and year.

For Hyundai owners, comparing quotes from insurers like Progressive, Geico, and State Farm is essential to secure competitive rates and comprehensive coverage.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

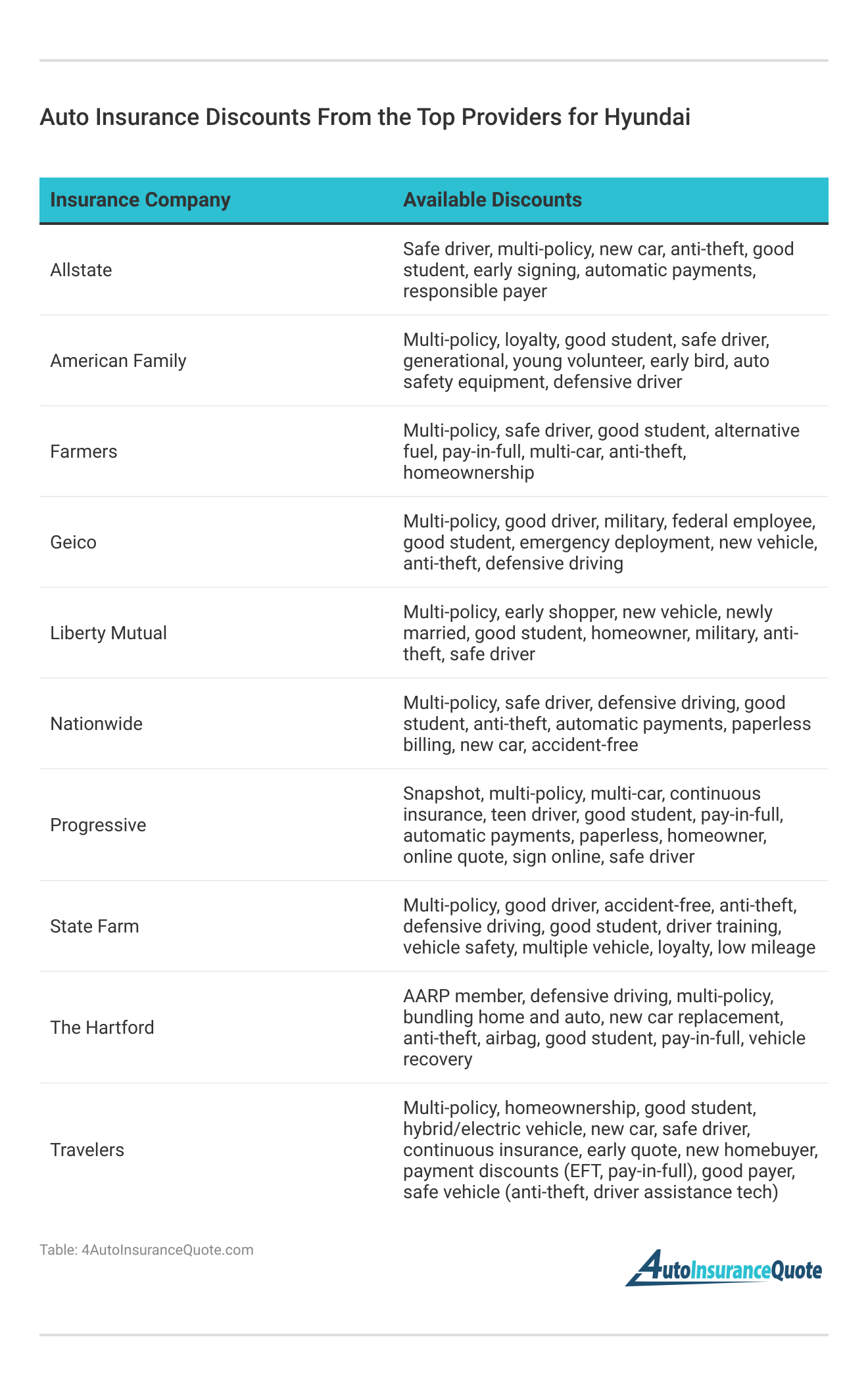

Common Discounts Provided by Auto Insurance Companies

In today’s digital age, insurance companies offer a variety of cost-saving options for policyholders. The following are the few common discounts offered by auto insurance companies.

- Paperless: Policyholders can save by receiving auto insurance documents online instead of through the mail.

- Good Student: Policyholders can save by having high school and college drivers with good grades on their policies.

- Multi-Policy: Policyholders can save by purchasing more than one insurance policy, such as home and auto.

- Multi-Car: Policyholders can save by purchasing insurance for two or more vehicles.

- Auto Pay: Policyholders can save by having their premium payments deducted from their payment account automatically.

- Paid-In-Full: Policyholders can save by paying their auto insurance premium in one payment.

Although finding low-cost auto insurance is a priority, choosing the insurance company with a slightly higher premium that offers the coverage you need allows you to save in the event of an accident.

Progressive stands out for its customizable coverage and competitive rates, making it an excellent choice for Hyundai owners.Chris Abrams Licensed Insurance Agent

For example, if you decide not to purchase collision insurance to pay a lower premium and you’re involved in an accident, you’ll pay out of pocket for damages to your vehicle. Discover insights in our “Auto Accident & Insurance Claim.”

Compare Auto Insurance Rates for Your Hyundai Model

In this comparison, we’ll explore the key features of the Hyundai Accent and Hyundai Sonata. Whether you prioritize compact efficiency or seek the spacious elegance of a midsize sedan, this analysis will help you make an informed decision.

Hyundai Auto Insurance Cost by ModelCompare rates to get started on your journey. If you want to learn more about the company, head to our “Auto Insurance Coverage Types.”

Quotes for Cheap Hyundai Auto Insurance

Cost is one of the first things drivers consider when shopping for auto insurance. Various factors impact rates, so it is up to drivers to decide which auto insurance company is offering the best rate as well as the best coverage.

If you keep your budget and coverage needs in mind as you shop for auto insurance for your Hyundai, you should be able to make the best choice. Check out insurance savings in our complete “How To Compare Auto Insurance Quotes.”

Find the best auto insurance company near you by entering your ZIP code into our free quote tool below.

Frequently Asked Questions

Are there insurance companies that refuse to cover Hyundai vehicles?

This varies based on each individual company. You will want to ask before you make your choice.

For additional details, explore our comprehensive resource titled “Understanding How Auto Insurance Works.”

How can I get affordable Hyundai auto insurance?

Compare quotes from different insurance companies and ask about discounts.

What types of coverage do I need for my Hyundai?

Common coverage options include liability, comprehensive, collision, uninsured motorist, personal injury protection, and gap insurance.

How do I compare rates and coverage options?

Consider your Hyundai’s make, model, and year, and review rates and coverage options from multiple insurance companies.

What should I consider when choosing auto insurance for my Hyundai?

Consider both your needs and budget, compare rates and coverage options, and read customer reviews.

To find out more, explore our guide titled “How To Budget for Auto Insurance.”

What is the average insurance cost for a 2023 Hyundai Elantra Hybrid?

Insurance costs for a 2023 Hyundai Elantra Hybrid vary based on factors like location, driving history, and coverage levels. It’s best to get a personalized quote from insurance providers.

Are Hyundai Elantras considered expensive to insure?

Hyundai Elantras are generally affordable to insure compared to other vehicles in the same class. Insurance rates can vary based on individual factors.

Are Hyundais known for being expensive to insure?

Hyundais are generally affordable to insure, but insurance costs can vary depending on the model, year, and other factors.

How do insurance costs for Hyundai Sonatas compare to other vehicles?

Hyundai Sonatas are typically affordable to insure compared to similar vehicles. Insurance rates can vary based on individual circumstances.

To learn more, explore our comprehensive resource on “Affordable Comprehensive Auto Insurance Coverage.”

What factors affect auto insurance rates for Hyundai vehicles?

Auto insurance rates for Hyundai vehicles are influenced by factors like the model, year, driver’s age, location, and driving history.

What are some recommended car insurance companies for Hyundai owners?

Some popular car insurance companies for Hyundai owners include Progressive, Geico, State Farm, and Allstate. It’s advisable to compare quotes from multiple insurers.

Stop overpaying for auto insurance. Enter your ZIP code below to find out if you can get a better deal.

Is car insurance mandatory for Hyundai vehicles?

Yes, car insurance is mandatory for all vehicles, including Hyundais, in most states. Minimum coverage requirements vary by state.

How can I find cheap insurance for my Hyundai?

To find cheap insurance for your Hyundai, compare quotes from multiple insurance providers, consider bundling policies, and inquire about discounts.

Learn more by reading our guide titled “Auto Insurance Discounts for Affordable Coverage.”

What factors determine insurance costs for a Hyundai Santa Fe?

Insurance costs for a Hyundai Santa Fe depend on factors like the driver’s age, location, driving history, and the model year of the vehicle.

How does the cost of insurance for a Hyundai Accent compare to other Hyundai models?

The cost of insurance for a Hyundai Accent is typically lower compared to other Hyundai models due to its smaller size and lower value.

Which category of car insurance is best?

Comprehensive auto insurance provides the most extensive coverage options to ensure maximum protection.

What is the lowest level of car insurance?

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.