Cheap Non-Owner SR22 Insurance in 2025 (10 Most Affordable Companies)

Progressive, Geico, and State Farm offer cheap non-owner SR22 insurance, with rates starting as low as $39. These companies are the best choices due to their affordable rates, extensive coverage options, and tailored policies designed to meet the specific needs of high-risk drivers requiring SR-22 certification.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

UPDATED: Mar 5, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 5, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage for Non-Owner SR22

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 3,071 reviews

3,071 reviewsCompany Facts

Min. Coverage for Non-Owner SR22

A.M. Best Rating

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviewsGetting cheap non-owner SR22 insurance is crucial for high-risk drivers, and Progressive, Geico, and State Farm stand out as the top providers. These companies offer competitive rates starting at just $39, coupled with comprehensive coverage options tailored to meet the needs of those required to file an SR-22.

In some situations, you may be required to buy SR-22 auto insurance even if you don’t own a vehicle. But, what is an SR-22 form and why do you need it? Does SR-22 cover my car? Yes, that is the main purpose. Does SR-22 insurance cover any car you drive? That depends.

Our Top 10 Company Picks: Cheap Non-Owner SR22 Insurance

Company Rank Monthly Rates Safe Driver Discount Best For Jump to Pros/Cons

#1 $39 22% Cost Efficiency Geico

#2 $43 30% Military Families USAA

#3 $47 25% Comprehensive Plans Nationwide

#4 $49 25% Dependable Service Farmers

#5 $51 30% Overall Excellence State Farm

#6 $53 30% Broad Coverage Allstate

#7 $55 31% Flexible Terms Progressive

#8 $57 25% Risk Accommodation Dairyland

#9 $59 30% Custom Choices Liberty Mutual

#10 $65 25% Easy Access The General

If you are looking for the cheapest SR22 insurance, use our free tool above to find great quotes now from more than one insurance company.

- Progressive, Geico, and State Farm offer cheap non-owner SR-22 insurance

- SR22 requirement vary from state-to-state

- Certain DUIs requires installation of interlock device on your own vehicle

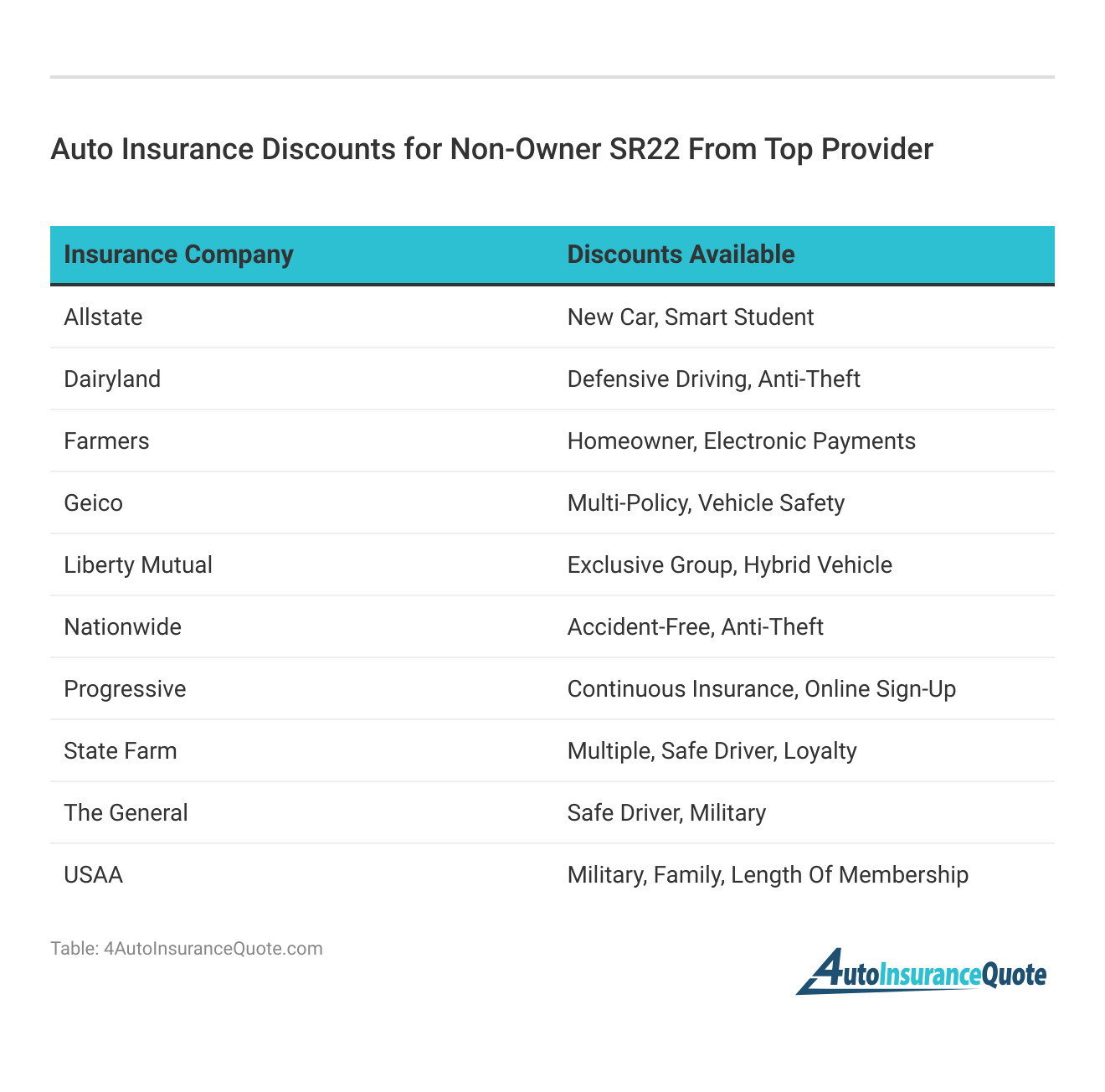

#1 – Geico: Top Overall Pick

Pros

- National Coverage: Geico has a nationwide presence, ensuring coverage and support across the country.

- Competitive Pricing: Offers a low monthly rate starting at $15, making it a budget-friendly option for non-owner SR-22 insurance.

- User-Friendly Online Tools: Provides extensive online resources and a mobile app for easy policy management. See more details on our Geico auto insurance review.

Cons

- Customer Service: Some customers report less personalized service compared to smaller insurers.

- Discount Options: Discounts may not be as substantial or varied as those offered by some competitors.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Families

Pros

- Affordable Rates: USAA offers competitive rates for non-owner SR-22 insurance, making it a cost-effective choice for high-risk drivers.

- Military-Specific Benefits: The company provides extensive coverage options tailored to meet the specific needs of those required to file an SR-22.

- Reputation and Customer Service: USAA’s strong reputation and customer service ensure reliable support and assistance for policyholders.

Cons

- Membership Restrictions: USAA is only available to military members, veterans, and their families, limiting its accessibility.

- Limited Physical Locations: Fewer branches compared to other insurers, which might be inconvenient for some. See more details on what information do I need to provide when filing an auto insurance claim with USAA.

#3 – Nationwide: Best for Comprehensive Plans

Pros

- Personalized Service: Nationwide is known for providing tailored customer service and support. Learn more on how do I file an auto insurance claim with Nationwide.

- Vanishing Deductible: Unique feature that reduces your deductible for safe driving.

- Wide Coverage Options: Comprehensive coverage options to meet diverse needs.

Cons

- Higher Rates: Monthly rates at $47 are on the higher side compared to some competitors.

- Lower Safe Driver Discount: They offer only a 25% discount for safe drivers, which is lower than what some other insurers provide.

#4 – Farmers: Best for Dependable Service

Pros

- Affordable Rates: Farmers can benefit from competitive rates for non-owner SR-22 insurance, starting as low as $15 per month, which can be significantly cheaper than other options.

- Extensive Coverage Options: Farmers provides comprehensive coverage options that cater specifically to the needs of high-risk drivers requiring SR-22 certification.

- Tailored Policies: Farmers offers policies that are tailored to meet the specific requirements of high-risk drivers, ensuring they have the necessary coverage while complying with legal obligations. Learn more about their policies in our Farmers auto insurance review.

Cons

- Limited Availability: Farmers may not be available in all states or may have limited availability for non-owner SR-22 insurance, which could restrict options for some drivers.

- Customer Service Concerns: Some customers may have concerns regarding the customer service and claims process with Farmers, which could impact their experience when needing to file an SR-22.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#5 – State Farm: Best for Overall Excellence

Pros

- Comprehensive Coverage Options: As outlined in our State Farm auto insurance review they offer extensive coverage options for non-owner SR-22 insurance, ensuring that high-risk drivers have adequate protection while meeting legal requirements.

- Reputation and Trustworthiness: State Farm is a well-established insurance provider known for its reliability and strong reputation. Customers can feel confident in the company’s stability and financial strength.

- Customer Service: State Farm is known for its strong customer service, offering support and assistance to policyholders, including help with SR-22 filings and other paperwork.

Cons

- Availability: Non-owner SR-22 insurance from State Farm may not be available in all states or may have limited availability, which could restrict options for drivers in certain areas.

- Potential Cost Concerns: While State Farm offers competitive rates, the actual cost of non-owner SR-22 insurance can vary based on individual circumstances, which may not always align with budget expectations.

#6 – Allstate: Best for Broad Coverage

Pros

- Wide Range of Coverage: Allstate offers a variety of coverage options for non-owner SR-22 insurance, ensuring that high-risk drivers have the necessary protection while fulfilling legal requirements.

- Customer Service Excellence: Allstate is recognized for its strong customer service, offering support to policyholders including assistance with SR-22 filings and other administrative tasks. (Read more: How long does it typically take for Allstate to process an auto insurance claim?)

- Strong Reputation: Allstate is a well-established and reputable insurance provider known for its reliability and customer service, providing peace of mind to policyholders.

Cons

- Availability Limitations: Non-owner SR-22 insurance from Allstate may not be available in all states or may have limited availability, potentially restricting options for drivers in certain locations.

- Cost Variability: While Allstate offers competitive rates, the actual cost of non-owner SR-22 insurance can vary widely depending on individual circumstances, which may not always meet budget expectations.

#7 – Progressive: Best for Flexible Terms

Pros

- Affordable Rates: As outlined in our Progressive auto insurance review they offer competitive rates for non-owner SR-22 insurance, making it an attractive option for high-risk drivers needing SR-22 certification.

- Extensive Coverage Options: Progressive provides comprehensive coverage options tailored to meet the specific needs of high-risk drivers requiring SR-22 certification, ensuring they have adequate protection.

- User-Friendly Experience: Progressive is known for its user-friendly online tools and resources, making it easy for customers to get quotes, manage their policies, and file claims.

Cons

- Customer Service Concerns: Some customers may have concerns about Progressive’s customer service, including claims processing and responsiveness, which could impact their experience.

- Availability Limitations: Non-owner SR-22 insurance from Progressive may not be available in all states or may have specific restrictions, potentially limiting options for drivers in certain areas.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#8 – Dairyland: Best for Risk Accommodation

Pros

- Specialization in High-Risk Insurance: Dairyland specializes in providing insurance for high-risk drivers, including those needing non-owner SR-22 insurance, offering tailored solutions. (Read more: Affordable High-Risk Auto Insurance)

- Affordable Options: Dairyland offers competitive rates for non-owner SR-22 insurance, making it a cost-effective choice for drivers in need of SR-22 certification.

- Accessibility: Dairyland may offer policies to drivers who have difficulty obtaining insurance elsewhere due to a high-risk status or SR-22 requirement.

Cons

- Limited Availability: Dairyland may not be available in all states, which could restrict options for drivers needing non-owner SR-22 insurance in certain geographical areas.

- Customer Service Concerns: Some customers have reported concerns about Dairyland’s customer service, including claims processing and responsiveness, which may impact the overall customer experience.

#9 – Liberty Mutual: Best for Custom Choices

Pros

- Wide Range of Coverage Options: As mentioned in our Liberty Mutual auto insurance review they offer a variety of coverage options, ensuring high-risk drivers have adequate protection while fulfilling their legal requirements.

- Strong Reputation: Liberty Mutual is a well-known and reputable insurance provider, known for its reliability and customer service, which can provide peace of mind to policyholders.

- Customer Service Excellence: Liberty Mutual is recognized for its strong customer service, providing support to policyholders including assistance with SR-22 filings and other administrative tasks.

Cons

- Availability Limitations: Non-owner SR-22 insurance from Liberty Mutual may not be available in all states or may have limited availability, potentially restricting options for drivers in certain locations.

- Cost Variability: While Liberty Mutual offers competitive rates, the actual cost of non-owner SR-22 insurance can vary based on individual circumstances, which may not always meet budget expectations.

#10 – The General: Best for Easy Access

Pros

- Specialization in High-Risk Drivers: The General specializes in providing insurance for high-risk drivers, making them a reliable choice for those needing non-owner SR-22 insurance.

- Affordable Premiums: The General offers competitive rates for non-owner SR-22 insurance, which can be beneficial for drivers looking to meet their legal requirements without breaking the bank.

- Flexible Payment Options: The General provides flexible payment plans, which can be helpful for drivers managing their budgets while maintaining insurance coverage.

Cons

- Customer Service Challenges: Some customers have reported concerns about The General’s customer service, including difficulties with claims processing and responsiveness.

- Limited Policy Features: The General may have more basic policy features compared to other insurers, potentially limiting the coverage options available to policyholders.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

How Non-Owner SR-22 Car Insurance Works

If you are wondering, “Do I need an SR-22 but don’t own a car?” the answer is most likely “yes.” If you want to drive, you still need car insurance without a car.

Auto Insurance Monthly Rates by Driving Record & Provider

Insurance Company Clean Record One Accident One DUI One Ticket

$318 $416 $522 $374

$318 $310 $361 $252

$318 $377 $393 $340

$318 $266 $406 $220

$318 $517 $634 $475

$318 $283 $379 $259

$318 $398 $331 $334

$318 $283 $303 $266

$318 $357 $478 $355

$318 $210 $292 $183

Non-owner SR-22 insurance is a special type of car insurance policy required in certain states. If you have been convicted of driving under the influence, and you drive someone else’s vehicle, then you may be required to buy SR-22 insurance for that vehicle – even if you don’t own the vehicle.

Read more: Affordable SR-50 Auto Insurance

When convicted of a DUI, you often lose the ability to drive a car. However, you may be able to legally drive someone else’s vehicle.

Some states allow you to drive someone else’s vehicle with no additional paperwork.

Other states require you to buy non-owners auto insurance. Information about your state’s requirements can be easily found. For example, requirements for non-owner SR-22 insurance in Missouri can be found on their Department of Revenue’s website.

Non-Owner SR-22 Insurance: Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $53 $70

Dairyland $57 $76

Farmers $49 $64

Geico $39 $61

Liberty Mutual $59 $77

Nationwide $47 $62

Progressive $55 $73

State Farm $51 $67

The General $65 $85

USAA $43 $58

When buying SR-22 coverage for your own car, it functions as a normal car insurance policy. SR-22 insurance is a type of car insurance available for drivers who need high-risk car insurance and who have been convicted of driving under the influence or reckless driving. When buying SR-22 car insurance as a non-owner, however, it works in a slightly different way than ordinary car insurance.

What Non-Owner SR-22 Insurance Covers

What does the SR22 cover? When you buy non-owner coverage, it provides you with for basic liability auto insurance coverages when you get behind the wheel of someone else’s vehicle.

Some items covered by non-owner SR-22 car insurance include:

- Medical bills of the other driver and passenger

- Property damage, including vehicle repair expenses

- Other personal injury expenses incurred by the other driver and passengers, including lost wages and emotional trauma

If you cause an accident while driving someone else’s vehicle, then your non-owners SR-22 car insurance policy will cover the expenses of the other party, including medical bills, vehicle damage, and personal injury expenses.

What Does Non-Owner Sr-22 Insurance not Cover

A non-owner car insurance policy doesn’t cover everything. It does not cover damage to your own vehicle, for example. It’s exclusively designed to protect other people and vehicles on the road.

However, if you’re in an accident where the other person is at fault, then the other driver’s car insurance should cover the cost of repairing the vehicle, as well as the personal injury expenses of you (the driver) and passengers within the vehicle.

Specific rules on what is covered by car insurance vary in each state. Twelve states in America are no-fault states, in which case your car insurance may automatically cover certain medical expenses regardless of who is at fault.

- Damages to your own vehicle

- Medical expenses and injuries incurred by you (the driver) or your passengers

- Other damages incurred by you or your passengers in a collision where you were at-fault

There’s another caveat with an SR-22 non-owners policy. In some cases, it does not cover you when driving the vehicle of someone you live with. If you borrow your roommate’s car, for example, or live with your parents and drive their vehicle, then your non-owner policy may not provide coverage.

In this situation, you may be required to be specifically listed on your housemate’s policy in order to be covered. If you have a DUI or DWI conviction, then this can raise the cost of your housemate’s policy substantially as DUIs affect auto insurance rates greatly, which is why your housemate may want to list you as an excluded driver.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Who Can Buy Non-Owner Car Insurance Policies

In certain cases, drivers convicted of a DUI or DWI are unable to buy a non-owner SR-22 policy. Certain DUI/DWI convictions require you to install an interlock device or similar device on your own vehicle, in which case you are prohibited from driving anybody else’s vehicle. In this situation, you cannot buy an SR22 non-owners policy. (Read more: Does auto insurance cover a DUI accident?)

Typically, the court will explain your situation and requirements to you. The court will explain whether you need non-owner car insurance, including any other restrictions attached to your conviction. Laws vary widely between states. In fact, not all states require SR-22 insurance. Check out the graph below to see if your state requires SR-22.

SR-22 Auto Insurance Requirements by State| States | SR-22 Required |

|---|---|

| Alabama | Yes |

| Alaska | Yes |

| Arizona | Yes |

| Arkansas | Yes |

| California | Yes |

| Connecticut | Yes |

| Delaware | No |

| Florida | Yes |

| Georgia | Yes |

| Hawaii | Yes |

| Idaho | Yes |

| Illinois | Yes |

| Indiana | Yes |

| Iowa | Yes |

| Kansas | Yes |

| Kentucky | No |

| Louisiana | Yes |

| Maine | Yes |

| Maryland | Yes |

| Massachusetts | Yes |

| Michigan | Yes |

| Minnesota | No |

| Mississippi | Yes |

| Missouri | Yes |

| Montana | Yes |

| Nebraska | Yes |

| Nevada | Yes |

| New Hampshire | Yes |

| New Jersey | Yes |

| New Mexico | No |

| New York | No |

| North Carolina | No |

| North Dakota | Yes |

| Ohio | Yes |

| Oklahoma | No |

| Oregon | Yes |

| Pennsylvania | No |

| Rhode Island | Yes |

| South Carolina | Yes |

| South Dakota | Yes |

| Tennessee | Yes |

| Texas | Yes |

| Utah | Yes |

| Vermont | Yes |

| Virginia | Yes |

| Washington | Yes |

| Washington D.C. | Yes |

| West Virginia | Yes |

| Wisconsin | Yes |

| Wyoming | Yes |

As you can see, non-owner SR-22 car insurance is required in most states, though there are many exceptions.

What Happens if a Payment is Miss on an SR-22 Insurance Policy

Whether the SR-22 insurance policy is for your own vehicle or for someone else’s vehicle, missing a payment can be very serious. If you fail to make an on-time payment on your SR-22 car insurance policy, then you may face the following consequences:

- Your license may be suspended immediately

- Your SR-22 filing period will start over

- You may need to pay a license reinstatement fee to your DMV

Now that you know a little more about SR-22 Insurance, read on to learn about purchasing it.

Read more: What does it mean when a policy is fully paid up?

How to Find Out if You still Need an SR-22

The best thing to do is to contact your local Department of Motor Vehicles. They should be able to answer any questions about your current driver’s status.

Read more: How Your Driving Record Impacts Your Auto Insurance Rates

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

How to Buy SR-22 Car Insurance

Most of the best auto insurance companies provide some type of SR-22 car insurance coverage. By shopping around for car insurance policies today, you should be able to find the SR-22 car insurance that works for you.

Is SR-22 a one-time fee? No, it is part of your monthly or annual auto insurance rate. Some car insurers do not offer non-owner car insurance quotes online. In these cases, you may need to contact an insurance agent directly.

Compare car insurance quotes online today using our simple online form. Whether you need SR-22 non-owners car insurance or you’re looking for the best auto insurance companies after a DUI, you can easily find car insurance policies to suit your budget and lifestyle.

Non-Owner SR-22 Insurance Explained: The Bottom Line

What is SR22 insurance and what is the difference between SR22 and regular insurance? Why would you need SR22 insurance? Quite simply, SR22 is required insurance in some states if you’ve been convicted of driving under the influence.

Non-owner SR22 insurance is required in certain states for individuals convicted of a DUI/DWI. If you have been convicted of a DUI/DWI and you drive someone else’s vehicle, then you may require non-owner SR22 car insurance.

You may also be asking yourself, “Does SR-22 cover any car I drive, even if I’m not the owner?” The short answer is “yes,” but you have to obtain an Operator’s Certificate. Read on to have non-owner SR-22 insurance explained.

A non-owner SR-22 auto insurance policy is a special kind of car insurance required by some states. If you’ve been convicted of driving under the influence (DUI), and you’re driving someone else’s car, then you may be legally required to purchase SR-22 insurance for the vehicle.

If you’re convicted of a DUI, your license may be suspended. You may be able to legally borrow someone else’s car. Some states allow you drive someone else’s car without any additional paperwork.

You can also enter your ZIP code below to find a quote on SR-22 insurance today and compare average costs from multiple insurers.

Read more: Affordable Non-Owner Auto Insurance Coverage

Frequently Asked Questions

What is non-owner SR-22 insurance, and how does it differ from regular insurance?

Non-owner SR-22 insurance is a special type of car insurance required in certain states for individuals convicted of driving under the influence. It differs from regular insurance as it covers liability when driving someone else’s vehicle, rather than a vehicle you own.

Does non-owner SR-22 insurance cover any car I drive?

Non-owner SR-22 insurance covers the liability expenses of the other party if you cause an accident while driving someone else’s vehicle. However, it does not cover damage to your own vehicle.

Finding affordable car insurance doesn’t have to be a challenge. Enter your ZIP code below into our free comparison tool to find the lowest prices in your area.

Who can purchase non-owner car insurance policies?

In certain cases, drivers convicted of a DUI or DWI may not be eligible to buy a non-owner SR-22 policy. Restrictions may apply depending on the specific circumstances and requirements of the conviction.

Read more: How a DUI and DWI Affect Your Auto Insurance Rate

What happens if I miss a payment on my SR-22 insurance policy?

Missing a payment on your SR-22 car insurance policy can lead to serious consequences, including potential policy cancellation, license suspension, or other penalties. It’s important to stay up to date with your payments to maintain coverage.

How do I find out if I still need an SR-22?

To determine if you still need an SR-22, it’s best to contact your local Department of Motor Vehicles (DMV). They can provide specific information regarding your driver’s status and any ongoing requirements.

What documentation do I need to get non-owner SR-22 insurance?

To obtain non-owner SR-22 insurance, you’ll typically need to provide your driver’s license, proof of your current address, and details about any previous auto insurance policies. Some insurers may also require information about your driving history, including any recent violations or accidents. (Read more: How do I file an auto insurance claim with Geico?)

Can I cancel my non-owner SR-22 insurance once my requirement period ends?

Yes, you can cancel your non-owner SR-22 insurance once your requirement period ends. However, it’s important to ensure that the DMV has updated their records and that your SR-22 requirement has been officially lifted before canceling the policy to avoid any legal complications or license suspension.

Will non-owner SR-22 insurance affect my ability to get regular car insurance in the future?

Non-owner SR-22 insurance can affect your ability to get regular car insurance in the future because it indicates a high-risk status. While it may not prevent you from obtaining standard car insurance, you may face higher premiums until you maintain a clean driving record for a certain period.

Is non-owner SR-22 insurance more expensive than regular car insurance?

Non-owner SR-22 insurance is generally more expensive than standard car insurance due to the high-risk designation associated with SR-22 filings. However, because it only provides liability coverage and not comprehensive or collision coverage, the total cost might be lower than a full-coverage policy for an owned vehicle.

Read more: Affordable High-Risk Auto Insurance

How long do I need to maintain non-owner SR-22 insurance?

The duration you need to maintain non-owner SR-22 insurance varies by state and the specific circumstances of your violation. Typically, the requirement lasts for about three years, but it can be longer or shorter depending on the state’s regulations and the severity of the offense. Always check with your local DMV for specific requirements.

Ready to find affordable car insurance? Get started today by entering your ZIP code below into our free comparison tool.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.