Best Fleet Vehicle Auto Insurance in 2025 (Your Guide to the Top 10 Companies)

Progressive, Farmers, and Geico provide the best fleet vehicle auto insurance, with premiums beginning at just $85 per month. Our goal is to help you compare quotes from these reputable insurers, ensuring you find the perfect coverage and take advantage of customized discounts for your fleet.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

UPDATED: Jan 17, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 17, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

3,072 reviews

3,072 reviewsCompany Facts

Full Coverage for Fleet Vehicle

A.M. Best Rating

Complaint Level

3,072 reviews

3,072 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Fleet Vehicle

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsProgressive is distinguished as the leading option for the best fleet vehicle auto insurance, offering competitive rates that start at just $85 per month for comprehensive coverage.

By partnering with Farmers and Geico, they provide affordable rates and an extensive range of comprehensive coverage options designed to meet your unique driving needs.

Our Top 10 Company Picks: Best Fleet Vehicle Auto Insurance| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 12% | A+ | Customized Policies | Progressive | |

| #2 | 10% | A | Fleet Expertise | Farmers | |

| #3 | 15% | A++ | Competitive Rates | Geico | |

| #4 | 10% | B | Reliable Coverage | State Farm | |

| #5 | 15% | A+ | Specialized Services | The Hartford |

| #6 | 12% | A+ | Nationwide Presence | Nationwide |

| #7 | 12% | A++ | Comprehensive Options | Travelers | |

| #8 | 15% | A | Flexible Solutions | Liberty Mutual |

| #9 | 10% | A | Personalized Attention | American Family | |

| #10 | 10% | A+ | Strong Reputation | Allstate |

If your company uses vehicles, you’ll need commercial auto insurance. Fleet auto insurance protects your company and employees in case of accidents involving a company vehicle and is exclusively offered to businesses.

Discover policies from top auto insurance companies in your area by entering your ZIP code into our tool above. Keep reading to learn more about fleet policies. For further details, check out our “Affordable Commercial Lines Insurance”.

- Progressive offers competitive rates starting at $85 per month

- Top insurance companies provide plans for fleet vehicles

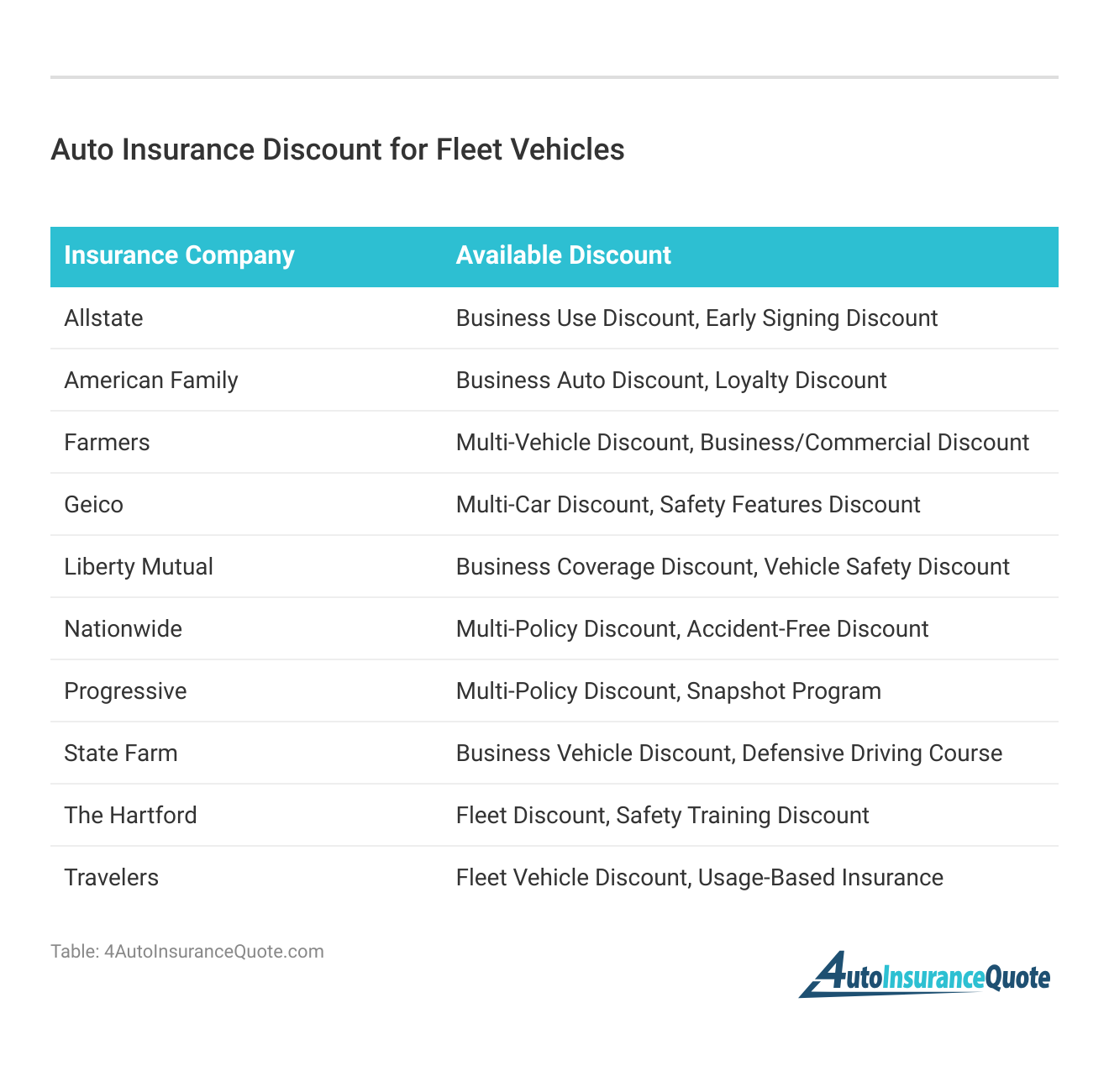

- There are several discount opportunities for fleet vehicle auto insurance

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – Progressive: Top Overall Pick

Pros

- Customizable Policies: Progressive offers a wide range of customizable policies, allowing fleet owners to tailor coverage options to their specific needs.

- Advanced Technology Integration: Progressive is known for its innovative use of technology in the insurance industry.

- 24/7 Customer Support: Progressive offers round-the-clock customer support, ensuring fleet owners can access assistance and file claims at any time of day or night.

Cons

- May Not Be the Cheapest Option: In our Progressive auto insurance review, while Progressive offers competitive rates, it may not always be the most affordable option for fleet insurance.

- Limited Local Agent Availability: While Progressive provides online and phone support, some fleet owners prefer the personal touch of a local insurance agent.

#2 – Farmers: Best for Fleet Expertise

Pros

- Comprehensive Coverage Options: Farmers, as mentioned in our Farmers auto insurance review, offers a comprehensive range of coverage options for fleet vehicles, including liability, collision, comprehensive, and specialized endorsements.

- Strong Financial Stability: With a solid financial standing and high ratings from agencies like A.M. Best, Farmers provides reassurance to fleet owners regarding the insurer’s ability to fulfill claims and provide long-term support.

- Dedicated Agent Support: Farmers’ network of local agents provides personalized assistance and guidance throughout the insurance process.

Cons

- Potentially Higher Premiums: While Farmers offers comprehensive coverage, it may come with higher premiums compared to some competitors.

- Limited Availability in Some Regions: Farmers’ availability varies by region, and in certain areas, it may not have as strong a presence or offer as many coverage options as other insurers.

#3 – Geico: Best for Competitive Rates

Pros

- Competitive Rates: Geico is renowned for its competitive rates, often offering cost-effective insurance solutions for fleet owners.

- Convenient Online Tools: Geico’s user-friendly website and mobile app provide convenient access to policy information, claims filing, and account management.

- Fast Claim Processing: Geico is known for its efficient claim processing, aiming to minimize downtime for fleet vehicles in the event of an accident or damage.

Cons

- Limited Coverage Options: While Geico offers competitive rates, its coverage options may be more standardized compared to other insurers. Read more in our Geico auto insurance review.

- Limited Local Agent Support: Geico primarily operates online and through phone support, which may be a drawback for fleet owners who prefer face-to-face interactions with local agents.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#4 – State Farm: Best for Reliable Coverage

Pros

- Extensive Network of Agents: State Farm boasts a vast network of local agents, providing personalized assistance and guidance throughout the insurance process. Find out more in our State Farm auto insurance review.

- Strong Reputation for Customer Service: State Farm is renowned for its excellent customer service, offering prompt assistance and efficient claims processing to fleet owners.

- Flexible Policy Options: State Farm offers flexible policy options, allowing fleet owners to customize coverage to meet specific business needs and budget constraints.

Cons

- Potentially Higher Premiums: While State Farm provides comprehensive coverage, its premiums may be higher compared to some competitors, particularly for certain types of fleet vehicles or driver demographics.

- Limited Discounts: State Farm’s discount offerings may be relatively limited compared to other insurers, potentially resulting in fewer opportunities for fleet owners to save on insurance costs.

#5 – The Hartford: Best for Specialized Services

Pros

- Specialized Services for Businesses: The Hartford specializes in providing insurance solutions for businesses, offering tailored coverage options and risk management strategies for fleet owners.

- Flexible Solutions: The Hartford offers flexible policy options, allowing fleet owners to customize coverage to meet specific business needs and budget requirements.

- Comprehensive Risk Management: The Hartford goes beyond insurance coverage by offering comprehensive risk management services.

Cons

- Limited Availability: The Hartford’s availability may be limited in certain regions, restricting access for fleet owners outside of their service areas. Read more through our The Hartford auto insurance review.

- Complex Application Process: The application process for fleet insurance with The Hartford may be more complex compared to some competitors, requiring additional documentation or underwriting procedures.

#6 – Nationwide: Best for Nationwide Presence

Pros

- Nationwide Presence: Nationwide’s extensive coverage extends across the country, making it a convenient option for fleet owners with operations in multiple states.

- Comprehensive Coverage Options: Nationwide, as mentioned in our Nationwide insurance review, provides a diverse range of coverage options tailored to fleet owners’ needs. From liability and collision to specialized endorsements for fleet vehicles, Nationwide offers comprehensive protection for various business requirements.

- Dedicated Agent Support: Nationwide’s network of local agents offers personalized assistance and guidance to fleet owners. Having a dedicated agent can simplify the insurance process and provide valuable advice on coverage options and risk management.

Cons

- Potentially Higher Premiums: Nationwide’s comprehensive coverage may come with higher premiums compared to some competitors, particularly for fleets with unique risk factors or specialized vehicles.

- Limited Discounts: Nationwide’s discount offerings may be limited compared to other insurers, potentially reducing opportunities for fleet owners to save on insurance costs.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#7 – Travelers: Best for Comprehensive Options

Pros

- Comprehensive Options: Travelers provides comprehensive coverage options for fleet vehicles, including liability, collision, and comprehensive coverage. Fleet owners can customize their policies to suit their specific business needs and risk profile.

- Nationwide Presence: With a nationwide presence, Travelers offers coverage across the country, making it a convenient option for fleet owners with operations in multiple states.

- Risk Management Resources: Travelers offers a range of risk management resources and tools to help fleet owners identify and mitigate potential risks. Read more through our Travelers auto insurance review.

Cons

- Limited Agent Availability: Despite its nationwide presence, Travelers may have limited local agent availability in certain areas. Fleet owners who prefer face-to-face interactions with agents may find this aspect challenging.

- Complex Claims Process: Some customers have reported experiencing a complex claims process with Travelers, which can lead to frustration and delays in claim resolution for fleet owners.

#8 – Liberty Mutual: Best for Flexible Solutions

Pros

- Flexible Solutions: Liberty Mutual offers flexible policy options, allowing fleet owners to tailor coverage to their specific business needs and budget constraints. Find out more through our Liberty Mutual auto insurance review.

- Comprehensive Coverage: With a wide range of coverage options, including liability, collision, and comprehensive coverage, Liberty Mutual ensures fleet owners can protect their vehicles and assets comprehensively.

- Discount Opportunities: Liberty Mutual provides various discount opportunities, such as safe driver discounts and multi-policy discounts, helping fleet owners save on insurance premiums.

Cons

- Potentially Higher Premiums: While Liberty Mutual offers comprehensive coverage, its premiums may be higher compared to some competitors, particularly for fleets with unique risk factors.

- Limited Local Agent Availability: Liberty Mutual’s reliance on online and phone support may be a drawback for fleet owners who prefer face-to-face interactions with local agents. This may result in a less personalized experience for some customers.

#9 – American Family: Best for Personalized Attention

Pros

- Personalized Attention: American Family provides personalized attention and dedicated support to fleet owners through its network of local agents.

- Discount Opportunities: American Family offers various discount opportunities for fleet owners, such as safe driver discounts and multi-policy discounts. Read more through our American Family auto insurance review.

- Community Involvement: American Family is committed to supporting local communities and initiatives. Fleet owners who value social responsibility may appreciate partnering with an insurer that actively gives back to the community.

Cons

- Limited Coverage Options: Some fleet owners may find American Family’s coverage options to be somewhat limited compared to other insurers, particularly for specialized endorsements or unique business needs.

- Regional Availability: American Family’s availability may be limited to certain regions, which could pose challenges for fleet owners operating outside of those areas.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#10 – Allstate: Best for Strong Reputation

Pros

- Strong Reputation: Allstate is known for its strong reputation and financial stability, providing fleet owners with confidence in the insurer’s ability to fulfill claims and provide long-term support.

- Innovative Technology: Allstate offers innovative technology solutions, such as telematics and usage-based insurance programs, that can help fleet owners monitor and incentivize safe driving behaviors.

- Wide Range of Coverage: Allstate offers a wide range of coverage options for fleet vehicles, including liability, collision, and comprehensive coverage. Fleet owners can tailor their policies to meet their specific business needs and budget constraints.

Cons

- Higher Premiums: Some fleet owners may find Allstate’s premiums to be higher compared to other insurers, particularly for fleets with unique risk factors or specialized vehicles. Use our Allstate auto insurance review as your guide.

- Limited Local Agent Support: While Allstate offers online and phone support, fleet owners who prefer face-to-face interactions with local agents may find the limited availability of agents to be a drawback.

Fleet Vehicle Insurance

According to Merriam-Webster.com, fleet insurance is “insurance by which a number of ships, automobiles, or airplanes are covered under one contract.” Fleet insurance covers multiple vehicles and drivers under a single policy, protecting your business and employees. For example, a car rental company would need fleet insurance.

Auto Insurance Monthly Rates for Fleet Vehicles by Coverage Level & Provider| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $100 | $190 |

| American Family | $95 | $185 |

| Farmers | $95 | $185 |

| Geico | $85 | $175 |

| Liberty Mutual | $105 | $195 |

| Nationwide | $95 | $185 |

| Progressive | $90 | $180 |

| State Farm | $100 | $190 |

| The Hartford | $105 | $195 |

| Travelers | $100 | $190 |

Companies must provide a safe work environment, and commercial fleet auto insurance is necessary to protect vehicles and drivers. The cost depends on the types of vehicles in your fleet, but we can explore general rates to find Affordable Commercial Auto Insurance Coverage.

Driving With Fleet Insurance

“Can I get auto insurance for a car that is used for business purposes?” Yes, you can typically obtain auto insurance for a vehicle used for business activities. However, it’s essential to inform your insurance provider about the business use of the vehicle to ensure you have the appropriate coverage.

Many insurance companies offer commercial auto insurance policies tailored specifically for vehicles used in business operations, providing the necessary protection for both the vehicle and the business. Enter your ZIP code now to begin.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Inclusion in Fleet Coverage

Fleet auto insurance covers vehicles and drivers in accidents but typically excludes coverage for company materials like tools and products. If your vehicles carry valuable items, consider additional auto liability insurance.

Speak with your agent to ensure complete coverage beyond fleet insurance. This helps protect your business assets and minimizes financial risks.

Cost Factors

The best way to save on fleet insurance is by hiring drivers with clean records. Finding affordable rates in your area is easy—simply use our free comparison tool and enter your ZIP code. This ensures you get the best coverage at the best price.

Additionally, maintaining a good driving record yourself can also help lower insurance costs for your fleet.

Other Quick Tips

Check if your fleet insurance provider offers auto insurance discounts for GPS device installation, as it’s an affordable way to save on insurance and track your vehicles efficiently. Not only does it help with cost reduction, but GPS tracking also ensures quick recovery of any stolen vehicles and helps monitor fleet activities.

Look into various inexpensive fleet GPS tracking providers once you receive approval from your auto insurance company, and get your fleet tracking set up promptly to maximize benefits.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

The Bottom Line: Fleet Vehicle Auto Insurance

For optimal results, maintain regular communication with your insurance company and designate a point-of-contact within your team. Prioritize quality over cost when selecting policies, especially when covering your company and assets.

Additionally, when finding auto insurance for vintage or custom cars, ensure the policy meets the unique needs of these vehicles. By comparing fleet insurance quotes and following these guidelines, you can secure comprehensive coverage tailored to your business needs and budget. Enter your ZIP code now to begin comparing.

Frequently Asked Questions

How much does fleet insurance cost?

The fleet insurance company calculates risk partly based on who is driving the vehicles, so they need to know this information to accurately calculate how much your commercial fleet insurance cost will be.

What companies offer fleet insurance?

Most big-name companies offer this type of insurance. You could purchase fleet insurance from a company like Nationwide, but many other companies offer this type of coverage as well. For example, Allstate, Esurance, and Liberty Mutual auto insurance all have policy options with A-ratings from A.M. Best. Enter your ZIP code now to begin.

Can families purchase fleet policies?

How do I file a fleet insurance claim?

Fleet insurance claims should be filed with your insurance company immediately after an accident.

However, if you are unable to do so, each state has a minimum waiting period of at least one year after the accident to file a claim (in some cases up to six years).

Call the fleet insurance phone number on your policy as soon as possible after an accident.

What are some tips for maintaining a safe fleet of vehicles?

Follow state regulations, select qualified drivers, provide adequate training, and have your drivers perform routine inspections. Enter your ZIP code now to begin.

What is SR-50 insurance?

Where can I get fleet insurance quotes?

What are the top three companies recommended for fleet vehicle auto insurance in 2024?

According to the article, the top three companies recommended for fleet vehicle auto insurance in 2024 are Progressive, Farmers, and Geico. Enter your ZIP code now to begin.

How does Progressive differentiate itself from other insurers in terms of coverage options and pricing?

What are some key factors fleet owners should consider when selecting auto insurance?

Fleet owners should consider factors such as coverage options, pricing, customer service quality, and discounts when selecting auto insurance, as outlined in the article’s guidelines.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.