Cheap Kia Auto Insurance in 2025 (Save Big With These 10 Companies!)

Cheap Kia auto insurance from Geico, State Farm, and AAA, with monthly rates averaging $30, offers the best options for affordable coverage. These companies provide competitive prices, excellent customer service, and multiple discounts, making them the cheapest and most reliable choices for Kia drivers.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michael Leotta

Insurance Operations Specialist

Michael earned a degree in Business Management with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Automatio...

Insurance Operations Specialist

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage for Kia

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 3,027 reviews

3,027 reviewsCompany Facts

Min. Coverage for Kia

A.M. Best Rating

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviews

Our Top 10 Company Picks: Cheap Kia Auto Insurance

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $30 | A++ | Many Discounts | Geico | |

| #2 | $35 | B | Customer Service | State Farm | |

| #3 | $37 | A++ | Membership Perks | AAA |

| #4 | $40 | A | Loyalty Rewards | American Family | |

| #5 | $42 | A+ | Vanishing Deductible | Nationwide |

| #6 | $45 | A++ | Usage-Based | Travelers | |

| #7 | $48 | A+ | Customization | Progressive | |

| #8 | $50 | A | Personalized Service | Farmers | |

| #9 | $55 | A+ | Safe Driving | Allstate | |

| #10 | $60 | A | Coverage Options | Liberty Mutual |

Compare quotes from these top providers to secure the best rates today. Explore your auto insurance options by entering your ZIP code into our free comparison tool today.

- Find cheap Kia auto insurance by comparing quotes and using discounts

- Geico, the top pick, offers comprehensive coverage starting at $30/month

- Explore liability, comprehensive, and collision coverage for the best protection

#1 – Geico: Top Overall Pick

Pros

- Low Monthly Rates: At $30 per month, Geico offers some of the most affordable rates for Kia auto insurance.

- Excellent Financial Stability: Geico boasts an A++ rating from A.M. Best, indicating superior financial health.

- Many Discounts: Geico provides a wide range of discounts, which can further reduce the cost of insurance.

- Strong Online Presence: User-friendly website and mobile app make it easy to manage policies and claims.

Cons

- Limited Local Agents: May not offer as much personalized service as companies with a stronger local agent presence.

- Roadside Assistance: Additional cost for roadside assistance coverage. Check out our Geico auto insurance review for more details.

- Policy Renewal Rates: Some customers report significant rate increases upon policy renewal.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#2 – State Farm: Best for Customer Service

Pros

- Customer Service: Known for excellent customer service and support.

- Competitive Rates: Reasonably low monthly rates at $35. Explore our State Farm auto insurance review for more insights.

- Financial Strength: A++ rating from A.M. Best ensures reliability.

- Local Agents: Strong network of local agents for personalized service.

Cons

- Discount Availability: Fewer discount options compared to competitors like Geico.

- Digital Experience: Website and mobile app usability may not be as advanced as some competitors.

- Claims Process: Mixed reviews on the speed and efficiency of the claims process.

#3 – AAA: Best for Membership Perks

Pros

- Membership Perks: Additional benefits and discounts for AAA members.

- Financial Stability: A++ rating from A.M. Best indicates strong financial health.

- Roadside Assistance: Renowned for excellent roadside assistance services.

- Discounts: Offers various discounts, especially for members. Please review our AAA auto insurance review for additional information.

Cons

- Membership Requirement: Must be a AAA member to access the best rates and perks.

- Higher Rates: Monthly rates are slightly higher at $37.

- Limited Availability: Some services and discounts may vary by region.

#4 – American Family: Best for Loyalty Rewards

Pros

- Loyalty Rewards: Offers rewards for long-term customers.

- Competitive Rates: Affordable monthly rates at $40.

- Financial Strength: Solid A rating from A.M. Best. Explore our American Family insurance auto insurance review for additional insights.

- Customer Service: Good reputation for personalized customer service.

Cons

- Discounts: Fewer discount options compared to some competitors.

- Digital Tools: Online tools and mobile app could be improved for better user experience.

- Regional Availability: Coverage and service levels can vary significantly by location.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Unique vanishing deductible feature rewards safe driving.

- Financial Stability: A+ rating from A.M. Best ensures reliability.

- Customization: Offers a variety of customizable coverage options.

- Customer Service: Generally positive reviews for customer service. Please read our 10 best auto insurance companies for more information.

Cons

- Monthly Rates: Slightly higher rates at $42 per month.

- Claims Processing: Some customers report slower claims processing times.

- Digital Experience: Online and mobile experience may not be as seamless as other insurers.

#6 – Travelers: Best for Usage-Based

Pros

- Usage-Based Insurance: Offers usage-based insurance options for potential savings.

- Financial Strength: A++ rating from A.M. Best indicates excellent financial health.

- Comprehensive Coverage: Wide range of coverage options. Check out our Travelers auto insurance review for additional details.

- Discounts: Various discounts available, including for safe driving.

Cons

- Monthly Rates: Higher monthly rates at $45.

- Digital Tools: The online platform and mobile app could be more user-friendly.

- Availability: Discounts and coverage options may vary by region.

#7 – Progressive: Best for Customization

Pros

- Customization: Offers a high degree of policy customization.

- Financial Stability: A+ rating from A.M. Best indicates strong financial health.

- Discounts: Wide variety of discounts available. For further information, read our Progressive auto insurance review.

- Digital Experience: User-friendly website and mobile app for policy management.

- Snapshot Program: Usage-based program can lead to significant savings for safe drivers.

Cons

- Monthly Rates: Higher monthly rates at $48.

- Claims Satisfaction: Mixed reviews on claims handling and customer satisfaction.

- Rate Increases: Some customers report significant rate increases after the first policy term.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#8 – Farmers: Best for Personalized Service

Pros

- Personalized Service: Known for personalized customer service through local agents.

- Financial Strength: Solid A rating from A.M. Best. For more information, please refer to our Farmers auto insurance review.

- Comprehensive Coverage: Wide range of coverage options.

- Discounts: Good range of discounts, especially for safe drivers.

Cons

- Monthly Rates: Higher monthly rates at $50.

- Digital Tools: Online platform and mobile app are not as advanced as some competitors.

- Availability: Coverage and service quality can vary by location.

#9 – Allstate: Best for Safe Driving

Pros

- Safe Driving Discounts: Rewards safe driving with significant discounts.

- Financial Stability: A+ rating from A.M. Best indicates strong financial health.

- Customer Service: Good reputation for customer service and claims handling.

- Coverage Options: Wide range of coverage options is available. To find out more, please refer to our Cheapest auto insurance with no credit check.

- Local Agents: Strong network of local agents for personalized service.

Cons

- Monthly Rates: Higher monthly rates at $55.

- Discounts: Not as many discount options compared to some competitors.

- Digital Experience: Online tools and mobile app could be more user-friendly.

#10 – Liberty Mutual: Best for Coverage Options

Pros

- Coverage Options: Offers a wide variety of coverage options.

- Customer Service: Generally positive reviews for customer service.

- Financial Stability: Solid A rating from A.M. Best. To gather additional information, please read our Liberty Mutual auto insurance review.

- Discounts: Various discounts available, including for bundling policies.

Cons

- Monthly Rates: Highest monthly rates at $60.

- Claims Handling: Mixed reviews on the efficiency of claims handling.

- Digital Tools: Online platform and mobile app could be improved for better user experience.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Kia Auto Insurance Rates: Compare Top Providers

Find affordable Kia auto insurance by comparing monthly rates for minimum and full coverage. Geico offers the cheapest rates at $30/month for minimum coverage and $110/month for full coverage. Discover how other top providers like State Farm, AAA, and Progressive compare.

Kia Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $37 | $125 |

| Allstate | $55 | $155 |

| American Family | $40 | $130 |

| Farmers | $50 | $150 |

| Geico | $30 | $110 |

| Liberty Mutual | $60 | $160 |

| Nationwide | $42 | $135 |

| Progressive | $48 | $145 |

| State Farm | $35 | $120 |

| Travelers | $45 | $140 |

Understanding Different Types of Insurance for Kias

The Kia you drive is more than a mere vehicle meant to shuttle you from A to B. In fact, if you don’t own your home, it may be your single largest financial asset. If that’s the case, insuring it properly is imperative to protect yourself from unnecessary risks. Every insurance provider has a slew of options worth considering. Let’s take a look at the different types of auto insurance coverage.

Liability Coverage

Required in most states, liability auto insurance coverage is the foundation of all auto insurance policies. Whether you cause an accident, a pile-up, run over a neighbor’s mailbox, or cause injuries to another party, your vehicle’s liability coverage protects you in some of the most common — and most dangerous – situations.

Uncover more by delving into our article entitled “Does my auto insurance cover damage caused by road rage?“

Comprehensive Coverage

To protect your asset, comprehensive auto insurance coverage may very well be a necessity. In today’s economy, windshields commonly run north of $1,000 to replace, and many states waive auto insurance deductibles for windshield repair/replacement.

Geico offers the best overall value for Kia auto insurance with comprehensive coverage and competitive rates.Zach Fagiano Licensed Insurance Broker

Comprehensive coverage also kicks in when you need to file claims regarding theft, falling objects, floods, or a variety of other external causes which don’t involve your vehicle colliding with another object.

Get a better grasp by checking out our article titled “Does my auto insurance cover damage to my windshield?“

Collision Coverage

Suppose you’ve still got payments to make, whether loan or lease. Comprehensive and collision will be required by your lienholder/lessee to protect their investment. If it’s paid off, neither is required, but both are worth looking into.

Liability (listed above) pays for damages or injury to the other party’s person/vehicle in the event that you cause an accident, but liability does not pay to fix your vehicle in such an instance. Collision coverage is offered as a means of repairing or replacing your vehicle in the event of an at-fault accident. Learn the differences between comprehensive and collision coverage.

Uninsured/Underinsured Motorist Coverage

This largely unknown coverage could be a lifesaver under the right circumstances. In many states, the required liability coverage one needs to drive covers far less in property damage than would be necessary to replace your vehicle.

For instance, let’s consider the Kia Telluride. Nowadays, they start just shy of $36,000. If someone totals your vehicle in a state which requires that they carry only $25,000 in property damage liability, you could be left responsible for paying over $10,000 for an accident you didn’t cause.

Underinsured coverage steps in to make up the difference between the offending driver’s liability limit and the cost of the resulting medical/property damage. Find out what happens if you get caught driving without auto insurance.

Roadside Assistance

This is a relatively cheap option at most insurance companies, but it may help you evade the costliest of claims. Abandoning a vehicle raises the chances of vandalism and theft, so a few extra bucks a year may protect your purchase and give you peace of mind. Find the best roadside assistance companies here.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

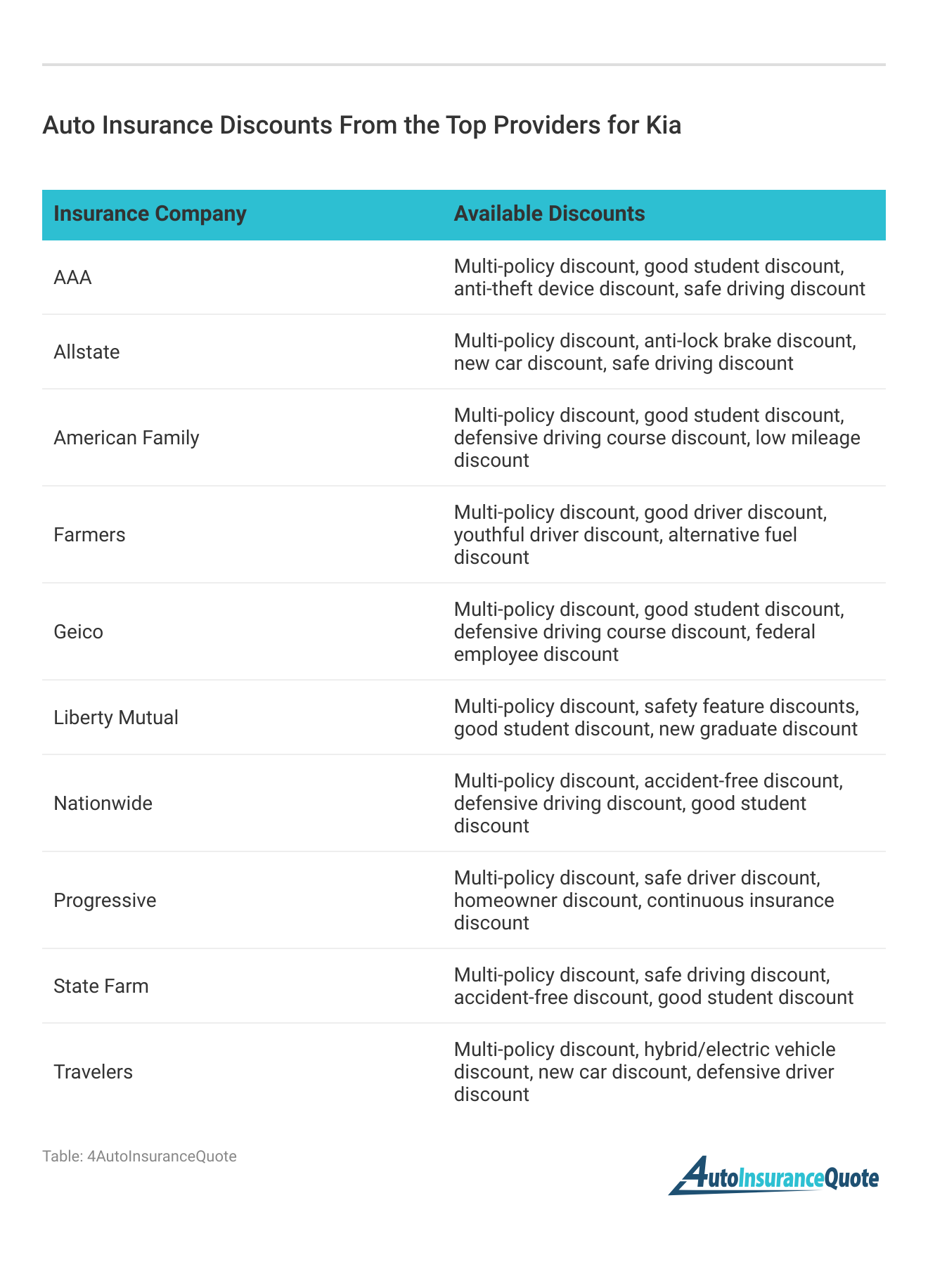

How to Find Cheap Kia Auto Insurance: Best Options and Tips

Finding auto insurance for Kia vehicles can be a challenge, but with a bit of research, you can secure the best car insurance for Kia models that suits your budget and needs. Various insurance companies that cover Kia offer different rates and discounts, making it essential to compare options thoroughly.

Understanding different types of insurance is crucial, as it helps you select the right coverage, whether it’s liability, comprehensive, or collision insurance. For example, AAA Kia insurance provides comprehensive options with member benefits that can help lower your premiums.

Geico offers the best overall coverage for Kia drivers with competitive rates and excellent discounts

Securing affordable auto insurance involves getting quotes from multiple affordable auto insurance companies. Look for affordable auto insurance quotes online and consider location-specific options like affordable auto insurance in Virginia if you live in that state.

Additionally, choosing affordable insurance for cars that come with safety features can help reduce costs. By comparing rates and leveraging available discounts, you can find the most affordable auto insurance to protect your Kia without breaking the bank.

Finding Affordable Kia Auto Insurance Quotes

While Kias are economically savvy, they aren’t cheap vehicles. Kia drivers should expect reasonable car insurance rates landing slightly above average.

Kia insurance rates vary greatly widely by model. A Kia EV6 sells for over double the Kia Soul, so you can expect your monthly rate to reflect such a discrepancy. Still, the vehicle you drive is but a single data point that factors into your overall cost. Your age, driving history, credit score, insurance history, location, and other personal information also forms part of the picture.

Here’s what you should expect on average on the insurance front:

Kia Auto Insurance Monthly Rates by Coverage Type & Model

| Vehicle Model | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Kia Cadenza | $31 | $55 | $42 | $143 |

| Kia Forte | $32 | $50 | $37 | $135 |

| Kia K900 | $37 | $67 | $42 | $161 |

| Kia Niro | $27 | $47 | $42 | $131 |

| Kia Optima | $32 | $53 | $42 | $145 |

| Kia Rio | $24 | $49 | $47 | $138 |

| Kia Sedona | $27 | $44 | $35 | $120 |

| Kia Sorento | $32 | $56 | $37 | $141 |

| Kia Soul | $31 | $50 | $37 | $134 |

| Kia Sportage | $28 | $47 | $37 | $128 |

Check auto insurance requirements by state.

Best Auto Insurance Rates for Your Kia Model

Explore and compare insurance rates for the Kia Sportage with our user-friendly tool. Find the best coverage at the most competitive rates.

Kia Auto Insurance Cost by Model

Finding the best auto insurance rates for your Kia model is simple with our comparison tool. Easily explore and compare rates for the Kia Sportage to find the best coverage at the most competitive prices. Secure affordable and reliable insurance for your Kia today.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Tips for Finding the Cheapest Kia Auto Insurance: Best Strategies and Providers

Finding cheap Kia auto insurance requires a strategic approach, especially when considering factors like the Audi A6 insurance cost for comparison. Identifying the best cars for low insurance can help you understand why some Kia models may be more affordable to insure.

For those in specific regions, seeking the best cheap car insurance Hawaii can highlight regional variations in pricing. When looking for the cheapest car insurance for Kia, starting with a Geico car insurance quote is a smart move, as they often offer competitive rates. Your Kia car insurance policy should be tailored to your needs, balancing coverage and affordability.

Understanding the Kia car insurance price involves evaluating factors such as model-specific Kia safety insurance features. Reading a Kia safety insurance review can provide insights into how safety ratings impact insurance costs.

Additionally, for those in the Northeast, finding the cheapest auto insurance in Massachusetts can significantly affect your overall expenses. By comparing quotes and considering safety features, you can secure a comprehensive and affordable insurance policy for your Kia.

Gain insights by reading our article titled “How To Budget for Auto Insurance.”

Tips for Comparing Affordable Kia Auto Insurance Quotes

Coverage options and discounts vary from provider to provider. Fish for as many quotes as you can and look them over thoroughly before making a decision. Keep these discounts in mind along the way:

- Vehicle Safety: Safety’s all the rage these days. Many Kia models have high-tech safety features that may slash your premiums. When requesting quotes, entering your VIN increases the chances of safety features being taken into account.

- Anti-Theft: If your Kia’s ready to ward off would-be carjackers with anti-theft features, ask your insurance carrier to be sure that you’re seeing those savings. For additional insights, refer to our “Anti-Theft Recovery Systems.”

- Multi-Car: Does your Kia have company in the garage? Quote your other vehicle(s), too. Bundling vehicles with the same company often garners one of the biggest discounts available.

- Multi-Line: Bundling multiple policies from the same company can help you save on each. If your insurance is more expensive than it should be and you don’t own your home, ask for a renters quote with your auto quote.

- Drivers Training: Maybe it’s been since you’ve taken a driver’s training course. Most insurers offer discounts for taking updated classes, even online.

- Usage-Based Discounts: Many major insurance companies offer discounts for drivers who allow monitoring of their driving habits, whether through a device or by downloading and maintaining an app.

Maximize your savings on Kia auto insurance by comparing quotes and utilizing available discounts. Focus on safety features, bundling policies, and driver training to get the best rates. Start comparing today for affordable coverage.

Where to get Affordable Kia Auto Insurance Quotes

In truth, there’s no direct answer. The cheapest car insurance available varies from place to place and person to person, even if quoting the exact same car. Finding the best Kia auto insurance company depends on several factors.

Price should always be a determining factor in picking new insurance, don’t let it be the sole measure. By all means, find out who has the best rates but also check their consumer ratings. Remember: Every minute you spend worrying about your car insurance is a slice of time you don’t get back.

In an emergency, who will address your needs quickly? Who will help you secure a rental vehicle or find the right body shop? Finding cheap car insurance is simple enough, but can you find affordable car insurance you can trust? That takes a little more legwork.

To find the best car insurance for your Kia, you should also consider your personal preferences. Should you prefer face-to-face interaction, opt for an agent. Captive agents can quote you with a single company, while independent agents (brokers) can quote you from a variety of companies at once. Agents serve as your direct contact in the event of an emergency, claim, or crisis.

Geico stands out as the best company for Kia auto insurance, offering comprehensive coverage and multiple discounts at competitive rates

Some companies prefer to operate without local agents at all. This can save on expenses, but if you’re an in-person customer, then saving a couple of bucks may not be worth the headache. If, however, you prefer to do your business online or via an app, the reverse could be true.

In today’s auto market, claims are expensive, and reliable vehicles are in higher demand than usual, so finding the right insurance is invaluable. Do yourself a favor and track down the insurer who provides you with the peace of mind you’re paying your hard-earned dollars for. If they take your money, but they don’t have your trust, it’s time to shop around.

Expand your understanding with our article called “What is the difference between a captive and independent auto insurance agent?“

Find your cheapest auto insurance quotes by entering your ZIP code into our free comparison tool.

Frequently Asked Questions

Is car insurance expensive on a Kia?

Prices vary by individual model. Kia car insurance runs slightly above the average, but they’re far from the priciest among car manufacturers.

Learn more about our “Affordable Kia Sportage Auto Insurance Quotes” for a broader perspective.

Does Kia provide insurance?

Yes. Kia Premier Motor Insurance offers comprehensive coverage with a small array of coverage selections.

How is Kia’s insurance?

Kia Premier Motor Insurance is offered through Allianz Australia Insurance Limited, a provider that isn’t particularly well-known in the United States.

Find the best auto insurance rates no matter how much coverage you need by entering your ZIP code into our comparison tool today.

Which company has the cheapest car insurance for Kias?

It can vary from place to place and model to model, but Geico is most commonly the cheapest car insurance for Kias.

Can I transfer my insurance policy if I sell my Kia and buy a new one?

In most cases, you cannot directly transfer your insurance policy to a new vehicle. However, you can usually make adjustments to your existing policy or obtain a new policy for your new Kia. It’s important to notify your insurance provider promptly to ensure continuous coverage and avoid any gaps or overlaps in insurance protection.

Enter your ZIP code to explore which companies have the cheapest auto insurance rates for you.

Is insurance for Kias more expensive than other cars?

While it’s not the most expensive brand to cover, Kia auto insurance is higher than the national average. Many factors play into these rates, but one of the primary reasons is that Kias are some of the most stolen cars in America.

Look at our “Vehicles With the Most Affordable Auto Insurance Quotes” for expanded insights.

What insurance covers Kia cars?

Insurance for Kia cars includes liability, collision, comprehensive, PIP, and uninsured/underinsured motorist coverage, offered by major providers like GEICO, State Farm, and Allstate.

Why are Kias so cheap?

Kias are affordable due to efficient manufacturing, global supply chains, economies of scale, and value-oriented brand positioning.

Why are Kias so expensive to insure?

Kias may be costly to insure due to high repair costs, theft rates, lower safety ratings, and model popularity.

How much is insurance on a Kia Soul?

The cost of insurance for a Kia Soul can vary widely based on factors such as the driver’s age, location, driving history, and the level of coverage selected. On average, the monthly insurance cost for a Kia Soul might range from $100 to $150. However, obtaining quotes from multiple insurance providers will give a more accurate estimate tailored to an individual’s specific circumstances.

Find out more by reading our “Finding Auto Insurance Quotes Online.”

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Michael Leotta

Insurance Operations Specialist

Michael earned a degree in Business Management with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Automatio...

Insurance Operations Specialist

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.