Cheap Montana Auto Insurance for 2025 (Save With These 10 Companies)

Liberty Mutual, State Farm, and Geico offer the cheapest auto insurance in Montana. Liberty Mutual leads with rates of $16/month and customizable policies. State Farm excels in customer service, while Geico provides the best rates with an A++ rating. Save more on car insurance in Montana with these top picks.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage in Montana

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage in Montana

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews

State Farm and Geico also offer competitive pricing and reliable coverage, making them strong contenders in the quest for affordable insurance. Consider these top providers to secure the best value and coverage tailored to your Montana auto insurance needs. For additional details, explore our comprehensive resource titled “What are the different types of auto insurance coverage?“

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $16 | A | Customizable Policies | Liberty Mutual |

| #2 | $19 | B | Customer Service | State Farm | |

| #3 | $23 | A++ | Cheap Rates | Geico | |

| #4 | $24 | A+ | Vanishing Deductible | Nationwide |

| #5 | $34 | A | Costco Members | American Family | |

| #6 | $42 | A+ | Infrequent Drivers | Allstate | |

| #7 | $45 | A | Policy Options | Farmers | |

| #8 | $47 | A+ | Qualifying Coverage | Progressive | |

| #9 | $52 | A | Roadside Assistance | AAA |

| #10 | $73 | A+ | Tailored Policies | The Hartford |

Uncover affordable auto insurance rates from the top providers by entering your ZIP code above.

- Liberty Mutual offers the cheapest auto insurance in Montana at $16/month

- State Farm and Geico provide competitive rates for Montana drivers

- These top providers ensure affordable auto insurance in Montana

#1 – Liberty Mutual: Top Overall Pick

Pros

- Affordable Rates: Liberty Mutual offers some of the lowest rates for cheap Montana auto insurance, making it an ideal choice for budget-conscious drivers.

- Customizable Policies: Flexible coverage options can be tailored to meet the specific needs of Montana residents.

- Discounts Available: Explore our Liberty Mutual auto insurance review to discover how numerous discounts can help further reduce the cost of cheap Montana auto insurance.

Cons

- Premium Changes: Rates can fluctuate due to driving habits, potentially affecting the affordability of cheap Montana auto insurance.

- Customer Service: Mixed reviews on service quality, which could impact overall satisfaction with cheap Montana auto insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#2 – State Farm: Best for Customer Service

Pros

- Competitive Pricing: State Farm offers affordable rates for cheap Montana auto insurance, making it a strong contender for those seeking low-cost coverage.

- Budget-Friendly Options: A variety of discounts, including those for multi-car and safe driving, help reduce the cost of cheap Montana auto insurance.

- Strong Customer Service: See our State Farm auto insurance review to understand how excellent support and claims handling enhance the value of cheap Montana auto insurance.

Cons

- Coverage Limitations: May not offer the broadest range of coverage options for those seeking cheap Montana auto insurance.

- Rate Variability: Premiums can vary significantly by location, potentially affecting the consistency of cheap Montana auto insurance.

#3 – Geico: Best for Cheap Rates

Pros

- Cheap Rates: View our Geico auto insurance review to learn why it offers some of the lowest rates for cheap Montana auto insurance.

- Discount Opportunities: Various discounts, such as for good driving, make Geico’s cheap Montana auto insurance even more affordable.

- Financial Stability: Reliable payouts ensure that Geico’s cheap Montana auto insurance delivers when it matters most.

Cons

- Service Quality: Customer service experiences can be inconsistent, which might affect satisfaction with cheap Montana auto insurance.

- Claims Process: The claims process can be slow and complex, potentially impacting the overall experience.

#4 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: This feature can help reduce deductibles over time, making Nationwide’s cheap Montana auto insurance even more appealing.

- Affordable Plans: Offers many discounts, including those for bundling and good driving, which can lower the cost of cheap Montana auto insurance.

- Affordable Rates: Discover our Nationwide auto insurance review to see how competitive pricing makes it a solid option for cheap Montana auto insurance.

Cons

- Premium Variability: Rates can change, which may affect the long-term affordability of Nationwide’s cheap Montana auto insurance.

- Customer Service: Inconsistent service quality can lead to mixed experiences with Nationwide’s cheap Montana auto insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#5 – American Family: Best for Costco Members

Pros

- Costco Members: Delve into our American Family auto insurance review to find out how special benefits for Costco members can enhance the affordability of cheap Montana auto insurance.

- Discounts: Various discounts help reduce the overall cost of cheap Montana auto insurance with American Family.

- Broad Coverage Options: Offers a wide range of coverage choices, catering to different needs for cheap Montana auto insurance.

Cons

- Higher Premiums: Rates may be higher compared to other providers, potentially affecting the affordability of cheap Montana auto insurance.

- Service Quality: Mixed reviews on customer service may influence satisfaction with their cheap Montana auto insurance.

#6 – Allstate: Best for Infrequent Drivers

Pros

- Affordable Options: Based on our Allstate auto insurance review, it provides competitive rates for cheap Montana auto insurance, especially for infrequent drivers.

- Infrequent Driver Discounts: Special discounts for low-mileage drivers help make Allstate’s cheap Montana auto insurance more affordable.

- Comprehensive Coverage: Offers a wide range of coverage options, ensuring thorough protection for Montana drivers seeking cheap auto insurance.

Cons

- Premium Costs: Rates may be higher in certain areas, which could impact the affordability of Allstate’s cheap Montana auto insurance.

- Customer Service: Mixed reviews on service quality might affect overall satisfaction with Allstate’s cheap Montana auto insurance.

#7 – Farmers: Best for Policy Options

Pros

- Policy Options: Farmers offers a variety of policy options, making it a versatile choice for cheap Montana auto insurance.

- Discounts: Numerous discounts, including those for bundling and safe driving, help reduce the cost of cheap Montana auto insurance.

- Financial Stability: In our Farmers auto insurance review, reliable claims support ensures that it is dependable for cheap Montana auto insurance.

Cons

- Higher Premiums: Farmers may have higher premiums compared to other providers, affecting the affordability of their cheap Montana auto insurance.

- Service Variability: Customer service experiences can vary, which might impact satisfaction with Farmers’ cheap Montana auto insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#8 – Progressive: Best for Qualifying Coverage

Pros

- Qualifying Coverage: Progressive offers a range of coverage options that qualify as cheap Montana auto insurance.

- Cost-Reduction Programs: Multiple discounts, including for bundling and safe driving, help lower the cost of Progressive’s cheap Montana auto insurance.

- Online Tools: According to our Progressive auto insurance review, it offers a range of coverage options that qualify as cheap Montana auto insurance.

Cons

- Premium Fluctuations: Rates can fluctuate based on driving behavior, potentially impacting the affordability of Progressive’s cheap Montana auto insurance.

- Customer Service: Service quality can be inconsistent, which might affect satisfaction with Progressive’s cheap Montana auto insurance.

#9 – AAA: Best for Roadside Assistance

Pros

- Roadside Assistance: Includes roadside assistance with their cheap Montana auto insurance, adding value to their policies.

- Cost-Saving Programs: Explore our AAA auto insurance review to see how various discounts, including those for safe driving, help reduce the cost of cheap Montana auto insurance.

- Affordable Rates: AAA offers competitive rates, making it a viable option for cheap Montana auto insurance.

Cons

- Higher Premiums: AAA can be more expensive compared to other providers, which might affect the affordability of their cheap Montana auto insurance.

- Service Quality: Mixed reviews on customer service may impact overall satisfaction with AAA’s cheap Montana auto insurance.

#10 – The Hartford: Best for Tailored Policies

Pros

- Tailored Policies: The Hartford provides personalized coverage options that meet the specific needs of those seeking cheap Montana auto insurance.

- Savings Opportunities: Various discounts are available to help lower the cost of The Hartford’s cheap Montana auto insurance.

- Comprehensive Coverage: With our The Hartford auto insurance review, you can learn about the broad range of coverage options that ensures thorough protection for cheap Montana auto insurance.

Cons

- Higher Premiums: The Hartford’s rates may be higher than other providers, potentially affecting the affordability of their cheap Montana auto insurance.

- Customer Service: Service quality can vary, leading to mixed customer experiences with The Hartford’s cheap Montana auto insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Our Guide to Save on Montana Auto Insurance Rates

Navigating Montana auto insurance can feel like a journey through its diverse landscape. Factors like clean driving record, location, and vehicle type impact your rates. Finding the right policy that balances cost and coverage is essential for all drivers.

We’ve gathered monthly rates for minimum and full coverage from affordable Montana auto insurers. Compare to find the best coverage for you.

Montana Auto Insurance Monthly Rates by Coverage Level & Provider| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $52 | $175 |

| Allstate | $42 | $154 |

| American Family | $34 | $125 |

| Farmers | $45 | $164 |

| Geico | $23 | $82 |

| Liberty Mutual | $16 | $59 |

| Nationwide | $24 | $88 |

| Progressive | $47 | $171 |

| State Farm | $19 | $70 |

| The Hartford | $73 | $213 |

Liberty Mutual offers exceptional value with rates as low as $16 for minimum coverage. State Farm and Geico provide affordable comprehensive auto insurance coverage, while Nationwide and American Family, though slightly higher, still offer excellent coverage.

Liberty Mutual leads Montana’s auto insurance market with its unbeatable $16/month rates and a remarkable 92% customer approval.Chris Abrams Licensed Insurance Agent

Dive into the details and explore how each insurer stacks up to find the perfect match for your Montana driving adventures. With the right policy, you can navigate the roads with confidence and peace of mind.

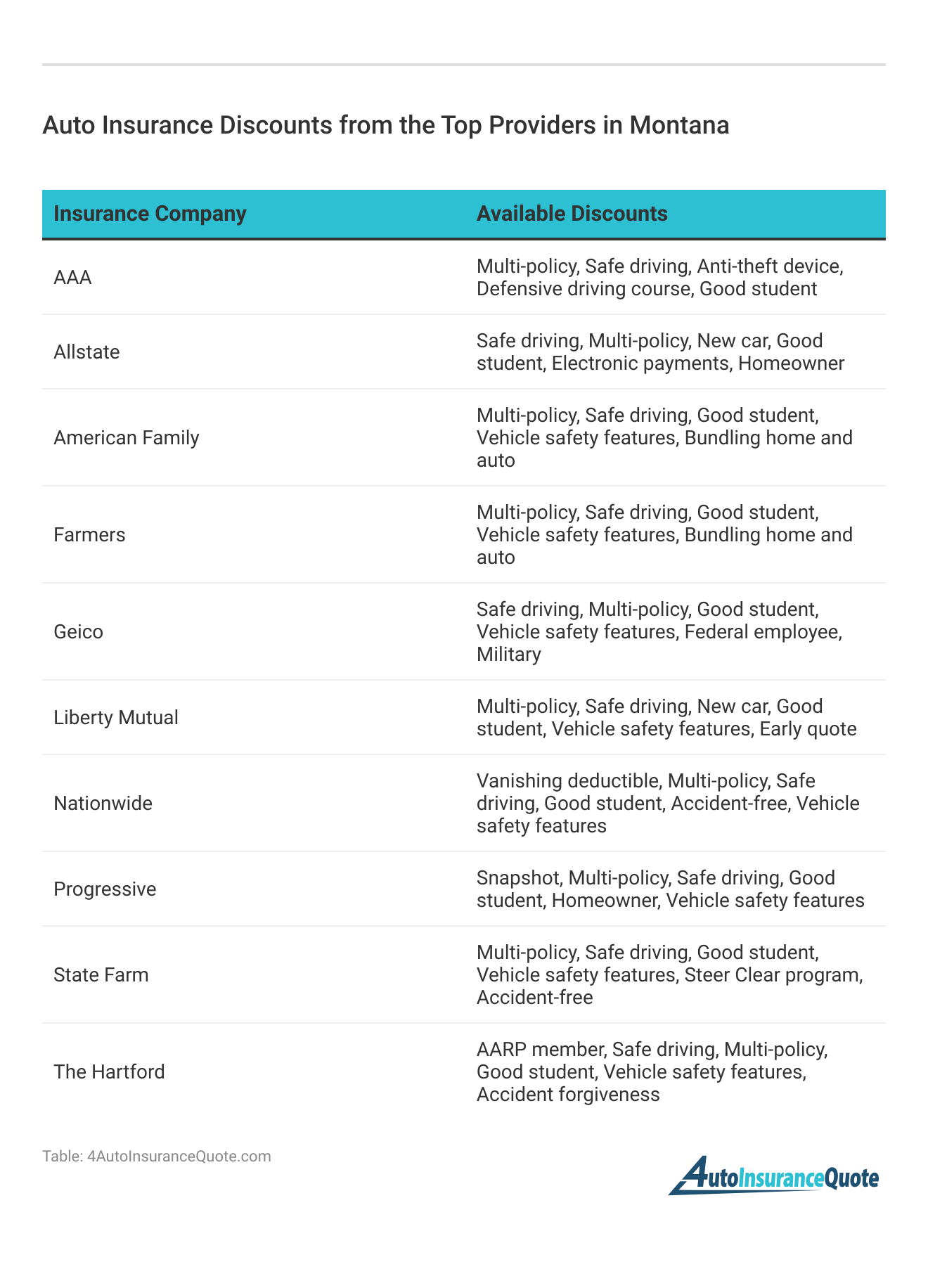

Score Big Savings with Montana Auto Insurance Discounts

Securing budget-friendly auto insurance in Montana is all about smart choices and taking advantage of available perks. Start by keeping your driving record spotless and look for best insurance companies for bundling—these are often gold mines for savings.

If your vehicle boasts advanced safety features like anti-lock brakes and electronic stability control, you could snag additional discounts. Students, especially those with top grades, can also benefit from special savings.

Dive into the competitive offerings from top insurers like Liberty Mutual, State Farm, and Geico to find the best rates and coverage that fit your needs perfectly.

Finding affordable auto insurance in Montana is easier with the right discounts. Here’s how to save:

- Good Driver Discounts: Maintaining a clean driving record can earn you significant savings.

- Multi-Policy Discounts: Bundle your auto insurance with other policies like home insurance to get multi-policy discounts.

- Safety Feature Discounts: Drive a vehicle equipped with safety features such as anti-lock brakes and electronic stability control to qualify for additional discounts.

- Good Student Discounts: Insurers often provide student auto insurance discount with good grades, recognizing them as lower-risk drivers.

Other ways to save include completing a certified driver’s education course, which can lead to lower rates, and opting for higher deductibles to reduce your premium. Enrolling in usage-based insurance programs that reward safe driving habits can also help you save.

Maximize your savings on Montana auto insurance by using discounts, maintaining a clean driving record, and comparing quotes from top insurers.

Case Studies: Auto Insurance Options in Montana

These fictional case studies are designed to illustrate the benefits and coverage options from the top auto insurance companies in Montana:

- Case Study #1 – Unmatched Affordability: Emily, a recent graduate in Billings, chooses Liberty Mutual for its $16/month rates and customizable options, benefiting from a 92% customer satisfaction rating.

- Case Study #2 – Top-Tier Service: Michael, a small business owner in Missoula, picks State Farm for its superior customer service and competitive rates, valuing the company’s high customer satisfaction.

- Case Study #3 – Cost-Effective Coverage: Sarah, a young professional in Great Falls, opts for Geico due to its affordable auto insurance options and A++ financial strength, enjoying an 89% customer satisfaction rating.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Find the Cheapest Montana Auto Insurance Today

Securing affordable auto insurance in Montana involves leveraging discounts, maintaining a clean driving record, and choosing policies with customizable options. Comparing quotes, considering higher auto insurance deductibles, and exploring usage-based programs help keep costs down.

Liberty Mutual offers unbeatable affordability with customizable options, making it the top choice for Montana drivers.Eric Stauffer Licensed Insurance Agent

Liberty Mutual offers unbeatable affordability with customizable options, making it the top choice for Montana drivers

Companies like Liberty Mutual, State Farm, and Geico offer excellent rates and coverage. These strategies ensure comprehensive and budget-friendly auto insurance in Montana.

To find out if you can get cheaper auto insurance rates, enter your ZIP code into our free quote tool below to instantly compare prices from various companies near you.

Frequently Asked Questions

What is the average cost of auto insurance in Montana?

The average cost of auto insurance in Montana varies, but cheap Montana auto insurance options can start around $16/month for basic coverage from top providers.

How much is auto insurance per month in Montana?

For cheap Montana auto insurance, monthly rates can start as low as $16 with Liberty Mutual, making it a top choice for budget-conscious drivers.

Get fast and cheap auto insurance coverage today with our quote comparison tool below.

What is the lowest auto insurance group?

The lowest auto insurance group refers to categories with the most affordable rates. To find cheap Montana auto insurance, look for providers like Liberty Mutual that offer competitive pricing.

How much does auto insurance cost in Montana?

The cost of auto insurance in Montana varies. However, for cheap Montana auto insurance, rates can begin at around $16/month, depending on the insurer and coverage.

How can I find the cheapest Montana auto insurance?

To find the cheapest Montana auto insurance, compare quotes from top providers like Liberty Mutual, State Farm, and Geico. Understanding how auto insurance works can help you identify the best rates and coverage options available.

Who is known for the cheapest auto insurance?

Liberty Mutual, State Farm, and Geico are known for offering the cheapest auto insurance in Montana, with Liberty Mutual leading with rates starting at $16/month.

Who offers the most affordable auto insurance billings in Montana?

Liberty Mutual provides the most affordable auto insurance in Billings, Montana, with rates starting at $16 per month and customizable policy options.

How does auto insurance work in Montana?

Auto insurance in Montana works by providing coverage for liability, collision, and comprehensive damages. For cheap Montana auto insurance, providers like Liberty Mutual, State Farm, and Geico offer affordable and customizable policies.

What is the minimum coverage for the state of Montana?

The minimum coverage for the state of Montana includes liability insurance for bodily injury and property damage liability insurance. Cheap Montana auto insurance providers offer policies that meet these state-mandated requirements.

Is it illegal to drive without insurance in Montana?

Yes, it is illegal to drive without insurance in Montana. To avoid penalties and find cheap Montana auto insurance, ensure you meet the state’s minimum coverage requirements.

Uncover affordable auto insurance rates from the top providers by entering your ZIP code below.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.