Cheap Auto Insurance for Teachers in 2025 (Save Big With These 10 Companies!)

State Farm, Progressive, and Allstate offer the best cheap auto insurance for teachers, with rates starting as low as $50 per month. These providers stand out for their comprehensive benefits and significant discounts tailored specifically to educators, ensuring optimal coverage and savings.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

UPDATED: Nov 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage for Teachers

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 13,283 reviews

13,283 reviewsCompany Facts

Min. Coverage for Teachers

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 11,638 reviews

11,638 reviewsCompany Facts

Min. Coverage for Teachers

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews

The best providers of cheap auto insurance for teachers are State Farm, Progressive, and Allstate, offering specialized policies that cater specifically to educators.

These companies provide significant discounts and tailored coverage that address the unique needs and challenges faced by teachers. Learn more in our Understanding how auto insurance works.

Our Top 10 Company Picks: Cheap Auto Insurance for Teachers

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $50 A++ Teacher Discounts State Farm

#2 $55 A+ Custom Coverage Progressive

#3 $60 A+ Safe Driving Allstate

#4 $65 A Educator Discount Farmers

#5 $70 A Teacher Appreciation Liberty Mutual

#6 $75 A+ Educator Discounts Nationwide

#7 $80 A Teacher Membership AAA

#8 $85 A++ Teacher Endorsement Travelers

#9 $90 A+ Educator Advantage Erie

#10 $95 A Teacher Rewards American Family

By choosing one of these top insurers, educators can enjoy peace of mind and substantial savings.

This article delves into how these providers meet the specific insurance requirements of teachers and why they are a preferred choice.

Looking for teachers’ auto insurance companies in New Jersey or other states? Enter your ZIP code above. Affordable auto insurance for teachers from local companies in your state is just a click away.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Bundling Policies: Offers significant discounts for bundling multiple insurance policies.

- High Low-Mileage Discount: Provides a substantial discount for low-mileage usage.

- Wide Coverage: Offers various coverage options tailored to different business needs. If you want to learn more about the company, head to our “State Farm Auto Insurance Review: Can you get affordable quotes?“

Cons

- Limited Multi-Policy Discount: The multi-policy discount is not as competitive as some rivals.

- Premium Costs: Despite discounts, premiums might still be higher for certain coverage levels.

#2 – Progressive: Best for Custom Coverage

Pros

- Customizable Policies: Allows customers to tailor their coverage extensively.

- Loyalty Rewards: Offers discounts and perks for long-term customers. Discover insights in our Progressive auto insurance review.

- Online Tools: Provides innovative online tools for policy management and claims.

Cons

- Higher Rates for New Customers: New customers may face higher initial rates.

- Complex Policy Options: The variety of options can be overwhelming for some customers.

#3 – Allstate: Best for Safe Driving

Pros

- Safe Driving Bonuses: Rewards safe drivers with premium reductions and bonus checks. Unlock details in our “Allstate vs. USAA: Which Offers More Affordable Auto Insurance Quotes.”

- Accident Forgiveness: Offers accident forgiveness programs to prevent rate increases after a first accident.

- Multiple Discounts: Provides a range of discounts including a new car, multiple policies, and a safe driver.

Cons

- Higher Base Prices: Generally higher base prices before discounts are applied.

- Customer Service Variability: Customer service quality can vary by region.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#4 – Farmers: Best for Educator Discount

Pros

- Educator-Specific Discounts: Offers special pricing and benefits for educators. Delve into our evaluation of Farmers auto insurance review.

- Custom Coverage Packages: Allows educators to choose packages that fit their unique needs.

- Dedicated Claims Service: Provides a streamlined claims process for faster resolution.

Cons

- Limited Availability: Discounts and specific coverages might not be available in all states.

- Higher Premiums Without Discounts: Without the applicable discounts, premiums can be high.

#5 – Liberty Mutual: Best for Teacher Appreciation

Pros

- Teacher Appreciation Discounts: Offers discounts specifically designed for teachers.

- Total Loss Replacement: Provides new car replacement for cars less than a year old. Access comprehensive insights into our Liberty Mutual auto insurance review.

- Accident Forgiveness: Includes accident forgiveness policies to mitigate rate increases.

Cons

- Pricey Without Discounts: Costs can be high in the absence of teacher-specific discounts.

- Mixed Customer Reviews: Customer satisfaction varies significantly across different areas.

#6 – Nationwide: Best for Educator Discounts

Pros

- Educator Discounts: Offers exclusive discounts for teachers and educators. Discover more about offerings in our Nationwide auto insurance review.

- Vanishing Deductible: Reduces your deductible for each year of safe driving.

- Flexible Payment Options: Provides various payment plans to suit different budgets.

Cons

- Coverage Costs: Base coverage costs can be higher compared to competitors.

- Claims Process: Some users report a slower claims process.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#7 – AAA: Best for Teacher Membership

Pros

- Membership Extras: Offers benefits and discounts to members, including teachers.

- Comprehensive Coverage Options: Wide range of coverage options, including travel insurance.

- Roadside Assistance: Renowned for its superior roadside assistance services. Check out insurance savings in our complete “AAA Auto Insurance Review: Can you get affordable quotes?“

Cons

- Membership Required: Must be a member to benefit from insurance services, adding to costs.

- Varied Service Levels: Service can vary significantly between different regional clubs.

#8 – Travelers: Best for Teacher Endorsement

Pros

- Endorsements for Educators: Special endorsements are available for teacher-specific risks.

- Green Home Discount: Offers discounts for certified green homes, promoting sustainability.

- Loss Prevention Benefits: Provides benefits for installing protective devices in homes. More information is available about this provider in our “Travelers Auto Insurance Review: Can you get affordable quotes?“

Cons

- Higher Premiums for Some Policies: Certain policies come with higher premiums.

- Complexity in Policy Customization: Customizing policies can be complex and time-consuming.

#9 – Erie: Best for Educator Advantage

Pros

- Educator Advantage Package: Offers unique coverage enhancements for educators.

- Rate Lock Feature: Provides an option to lock in rates to avoid yearly increases. See more details on our “Erie Auto Insurance Review: Can you get affordable quotes?“

- Local Agent Support: A strong local agent network provides personalized service.

Cons

- Geographical Limitations: Limited to certain states, reducing availability.

- Fewer Online Resources: Less robust online resources compared to larger insurers.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#10 – American Family: Best for Teacher Rewards

Pros

- Teacher Reward Programs: Offers specific rewards and discounts for teaching professionals.

- Gap Coverage: Provides gap insurance for newer cars, covering the difference between value and loan.

- Proactive Protection: Includes proactive protection features in auto policies. Learn more in our American Family Insurance auto insurance review.

Cons

- Limited State Availability: Not available in all states, which may limit options for some.

- Rate Adjustments: Potential for unexpected rate adjustments based on regional claims rates.

Teacher Auto Insurance Rates: Minimum vs Full Coverage Comparison

Understanding the monthly rates for auto insurance based on the coverage level and provider is crucial for teachers seeking both financial efficiency and adequate protection. The table below illustrates how different insurance companies offer varying rates for minimum and full coverage policies, providing a clear snapshot for informed decision-making.

Auto Insurance Monthly Rates for Teachers by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $80 $180

Allstate $60 $140

American Family $95 $210

Erie $90 $200

Farmers $65 $150

Liberty Mutual $70 $160

Nationwide $75 $170

Progressive $55 $130

State Farm $50 $120

Travelers $85 $190

The data reveals a range of costs, with State Farm offering the most competitive rates at $50 for minimum coverage and $120 for full coverage. Progressive and Allstate also present affordable options.

On the higher end, American Family’s full coverage rate reaches $210, while AAA provides minimum coverage at $80.

This variability emphasizes the importance of comparing rates to find the best match for one’s specific needs and budget constraints, ensuring that teachers can secure comprehensive auto insurance without compromising on quality or coverage extent. Learn more in our “Affordable Full Coverage Auto Insurance.”

What’s the Best Auto Insurance for Teachers

According to the United States Bureau of Labor Statistics, teachers make an average of $59,420 per year. The best auto insurance for teachers would cost no more than ten percent of that or $60/mo.

Unfortunately, average car insurance rates for teachers are double that at $126 per month.

Auto insurance rates for teachers can vary drastically based on individual factors, like where you live, how old you are, and what kind of car you drive. In fact, the question, “Is it cheaper to insure a new car or an old car?” is relevant for all drivers, teachers included.

The best auto insurance for educators is pretty subjective, and you’ll have to compare shop online to find the best car insurance rates for a teacher.

Compare over 200 auto insurance companies at once! Secured with SHA-256 Encryption

The good news is that teachers are cheap to insure. The risk and liability you pose to the insurer determine your car insurance rate, and teachers are simply less likely to file a claim or be involved in a collision.

You’ll find that teachers’ auto insurance claims are handled the same way as any other drivers’ claims when it comes to determining fault, but you may be entitled to specific discounts and personal property coverage for teachers that other drivers do not get.

Finding the best car insurance rate for teachers is as easy as asking an agent, can you get an auto insurance discount from your job?

Call the toll-free number above to speak with a local agent today for free and learn how teachers can qualify for occupational discounts on auto insurance and how much you can save with their auto policy.

What Are the Cheapest Providers of Auto Insurance for Teachers

Auto insurance for educators is available from most insurance companies, including specialty insurance providers. Some larger companies, like Esurance, offer teacher car insurance discounts, while other companies exclusively offer coverage for certain occupations.

The five cheapest auto insurance companies for teachers are:

- USAA

- State Farm

- Progressive

- Nationwide

- Liberty Mutual

Cheap providers aren’t always the best, and you want to make sure you have enough coverage to protect you in an accident. Invest a little time in comparison shopping online to find the cheapest auto insurance companies for teachers that also offer the best auto insurance for low-income individuals

What Kind of Auto Insurance Coverage Do Teachers Need

Teachers need to carry at least the minimum liability coverage required by their home state. Additional coverage, like collision and comprehensive policies, isn’t required by law and costs more per month.

Despite the extra cost, we recommend that all drivers, including teachers, carry full coverage.

What is full coverage auto insurance? Full coverage auto insurance includes the minimum liability policy on top of comprehensive and collision coverage. It’s the only way to ensure you are fully protected while you drive.

Fortunately, teachers qualify for auto insurance discounts and deductible forgiveness programs based on their occupation to reduce these rates.

Scroll through the next section for more information on car insurance discounts for teachers and what types of special insurance discounts teachers can qualify for based on certain occupational-based circumstances.

Are There Car Insurance Discounts for Teachers

When you’re looking for cheap auto insurance for educators, finding the best auto insurance discounts for you are a great place to start. There may be ways for you to get a car insurance teacher discount.

Asking about teacher-specific insurance companies in your region is the quickest way to determine which educator discounts are available.

You’ll find that every company calls its teacher discount program something slightly different.

For example, Geico calls their teacher discounts “Educational Organization Membership Discounts,” while Esurance calls it the “Auto Insurance Discount for Certified Educators, Engineers, & Scientists.”

Remember: Car insurance companies won’t just take your word for it. You’ll need to prove your employment with a pay stub or a letter of proof of employment from your school to get your teacher discount.

How to Get Discount Car Insurance for Teachers

If you already have coverage, ask your current provider about what types of auto insurance discounts they offer teachers. Most teachers have advanced college degrees and can qualify for discounts that way, too.

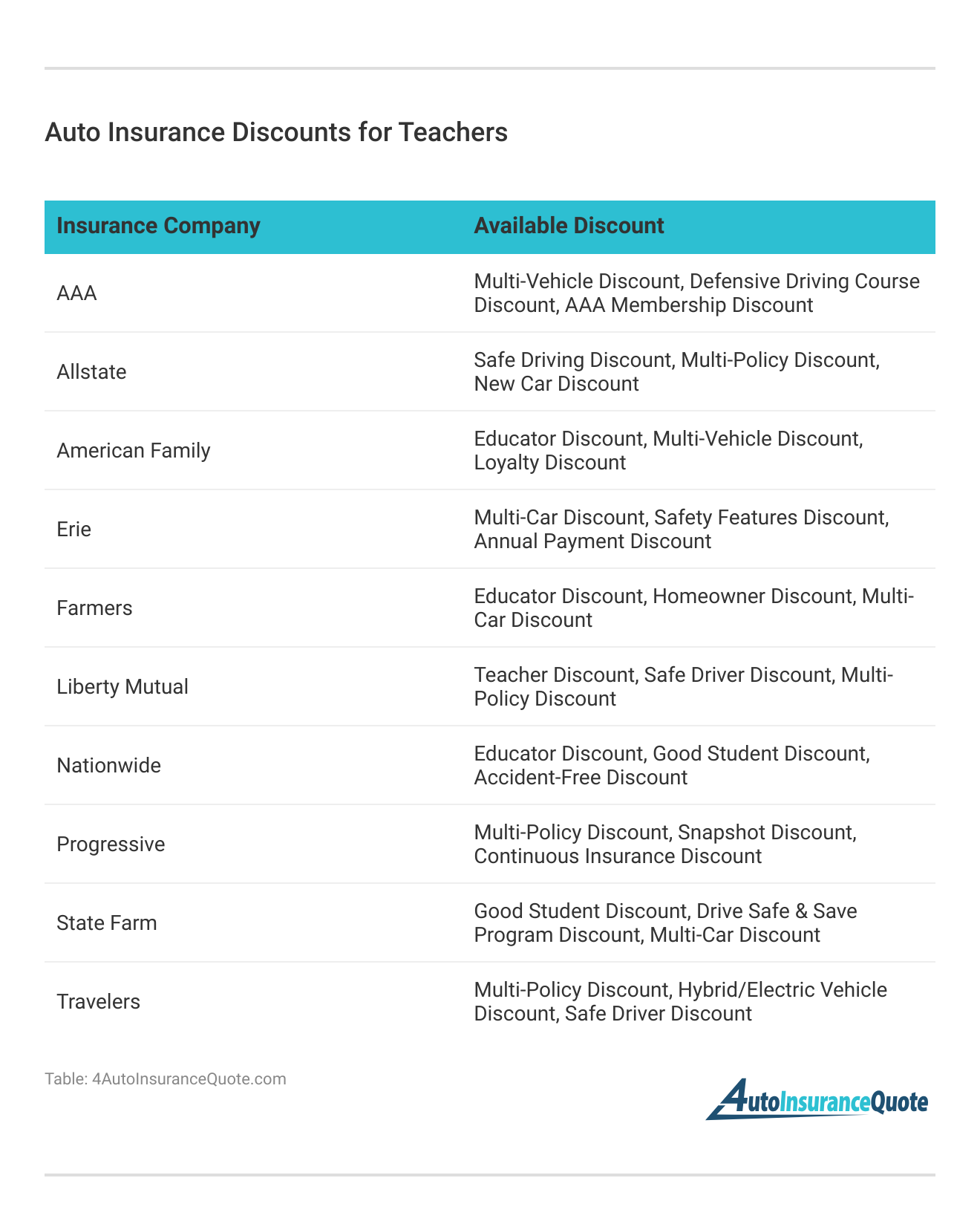

Which Companies Offer Car Insurance With Teacher Discounts

As a result of the trust insurance companies place on teachers, insurance companies are more than willing to extend discounts their way. Large insurance companies like Geico, State Farm, Allstate, and Progressive all offer auto insurance discounts for teachers.

Farmer’s Insurance also offers an educator discount of four percent off premiums.

Some smaller insurance companies offer discounted insurance plans exclusively to educators. California Casualty, for example, offers car insurance in 45 states, but policies are only available for teachers, firefighters, police officers, and nurses.

Not every provider will offer car insurance discounts for educators.

Take a look at the table below to see the insurance companies that give teacher insurance discounts, the ones that don’t, and which companies provide more discounts for advanced degrees and group memberships:

Auto Insurance Discounts From the Top Providers for Teachers

Insurance Company Further Education Membership/Group Occupation

NA NA NA

NA 10% NA

NA NA 15%

NA NA NA

12% 10% NA

NA NA NA

8% NA 12%

10% 10% 15%

NA NA 10%

12% 12% 10%

10% 12% 10%

NA 10% 12%

15% 15% 12%

NA NA NA

NA NA NA

10% 15% 15%

NA NA NA

NA NA NA

12% 15% 10%

NA 10% 15%

10% 10% 12%

NA NA NA

While it’s becoming less common for companies to consider education level when adjusting rates (for example, it’s prohibited in New York), that doesn’t mean companies will stop offering discounts.

Companies like Horace Mann Insurance are explicitly designed with teachers in mind. Horace Mann was created by two high school teachers, giving them a great perspective on the unique needs of teacher drivers.

And if you’re looking for teacher’s insurance in New Jersey, for example, Plymouth Rock offers a special Teachers Insurance Plan with lower rates for educators and better coverage.

Compare over 200 auto insurance companies at once! Secured with SHA-256 Encryption

There are many ways to find companies with cheap auto insurance for teachers in California, Michigan, Texas, and other states across the country by comparison shopping online.

Use our free online quote comparison tool above to find local companies with auto insurance discounts for teachers.

Do Teachers Get Special Insurance Discounts When Using Their Vehicles for School-Related Business

Teachers enjoy a number of unique advantages when parked on school property.

You can get a discount on your overall car insurance premiums as a teacher and discounts on deductibles and other insurance-related expenses—especially when incidents occur on school property.

These are some of the most common special auto insurance discounts for teachers:

- Vandalism Loss Protection: Does auto insurance cover vandalism? Many auto insurance companies offer special vandalism loss protection insurance for teachers. If your vehicle is vandalized on school property or while attending a school-related event, you’ll pay a $0 deductible.

- Personal Property Coverage: Many insurance companies offer bonus personal property coverage for teachers to protect materials or school-owned property that are stolen or damaged while in your vehicle.

- Additional Liability Coverage When Transporting Students: Many insurance companies offer additional liability coverage to students when traveling in a teacher’s vehicle.

- Collision Coverage: Some insurance companies offer a general educator discount to teachers who get involved in accidents while driving for work. For example, you may pay a $0 deductible in a collision while driving on school business.

These discounts are available through multiple insurance companies across all states, and they’re surprisingly common for teachers across the country.

Where Do I Get the Cheapest Quotes on Auto Insurance for Teachers

The easiest way to get the cheapest auto insurance quotes for teachers is to comparison shop online.

There’s no need to leave your house or step into an insurance office. Finding auto insurance quotes online will be your best strategy to compare policies.

Shop and compare auto insurance quotes for teachers every six months so you can always get the best rate possible.

Compare over 200 auto insurance companies at once! Secured with SHA-256 Encryption

To get free auto insurance quotes online, gather the following:

- Full name and address of all drivers

- Drivers’ license numbers and dates of birth for each driver

- Make, model, and VIN of your vehicle

- Estimated annual mileage

Many different auto insurance rate factors affect your auto insurance costs, including where you live and the kind of car you drive, so make sure this information is as accurate as possible before shopping for insurance quotes online.

Because so many different things influence teachers’ insurance rates, it’s more important than ever to get auto insurance quotes before you buy.

Save money on auto insurance for teachers today with our free quote comparison tool below. Enter your ZIP code to get started.

How to Save on Auto Insurance as a Teacher

Get free car insurance quotes from top auto insurance companies that offer teacher discounts in your city.

No matter which auto insurance provider you choose, the fact remains: teachers can save a lot of money on car insurance, and getting these teacher discounts is as easy as pointing and clicking.

The best way to find cheap auto insurance for teachers, regardless of where you live, is to shop around, speak to licensed agents, and make sure you qualify for discounts, which can potentially save you up to 30 percent off your rates.

Have a few more questions about auto insurance for teachers? Unsure which car insurance company for teachers is best for you? Check out some common questions below.

Learn more: Affordable Auto Insurance Quotes for State Employees

Who Actually Has the Cheapest Auto Insurance

If you’re wondering who actually has the cheapest auto insurance, it ultimately depends on where you live, your age, your credit score, and understanding what is considered a clean driving record. Take a look at this table for average auto insurance rates from major insurance companies across the country.

Auto Insurance Monthly Rates by Provider & State

State Allstate American Family Farmers Geico Liberty Mutual Nationwide Progressive State Farm Travelers USAA

Alaska $285 $262 $346 $300 $240 $441 $350 $255 $186 $260

Alabama $297 $276 $320 $349 $239 $334 $222 $371 $400 $308

Arkansas $344 $429 $400 $355 $290 $380 $322 $443 $232 $498

Arizona $314 $409 $420 $417 $189 $300 $291 $298 $396 $257

California $307 $378 $420 $417 $240 $253 $388 $237 $350 $279

Colorado $323 $462 $311 $441 $258 $233 $312 $353 $273 $278

Connecticut $385 $486 $400 $450 $256 $607 $306 $410 $248 $500

Delaware $499 $526 $450 $480 $311 $1,530 $361 $348 $372 $349

Florida $390 $620 $480 $500 $315 $447 $362 $465 $283 $400

Georgia $414 $351 $400 $450 $248 $838 $540 $375 $282 $300

Hawaii $213 $181 $397 $280 $266 $266 $213 $182 $87 $150

Iowa $248 $247 $252 $203 $191 $368 $228 $200 $185 $452

Idaho $248 $341 $311 $264 $231 $192 $253 $200 $156 $269

Illinois $275 $434 $318 $384 $232 $190 $226 $295 $195 $208

Indiana $285 $332 $307 $287 $189 $482 $325 $324 $201 $283

Kansas $273 $334 $179 $309 $268 $399 $206 $345 $227 $362

Kentucky $433 $595 $450 $480 $386 $494 $459 $462 $280 $546

Louisiana $476 $500 $490 $600 $513 $550 $480 $622 $382 $520

Maine $246 $306 $280 $231 $235 $361 $300 $303 $183 $188

Maryland $382 $436 $420 $480 $319 $775 $243 $341 $330 $365

Massachusetts $223 $226 $200 $260 $126 $362 $285 $319 $113 $295

Michigan $875 $1,909 $710 $536 $1,667 $527 $447 $1,047 $731 $302

Minnesota $367 $378 $293 $261 $292 $1,130 $244 $287 $172 $238

Missouri $277 $341 $274 $359 $240 $377 $189 $285 $224 $300

Mississippi $305 $412 $380 $430 $341 $380 $230 $359 $248 $311

Montana $268 $389 $360 $326 $300 $110 $290 $361 $201 $169

North Carolina $283 $599 $390 $380 $245 $182 $237 $199 $257 $261

North Dakota $347 $389 $318 $258 $222 $1,071 $213 $302 $213 $240

Nebraska $274 $267 $185 $333 $320 $520 $217 $313 $203 $194

New Hampshire $263 $227 $210 $270 $135 $704 $208 $224 $182 $159

New Jersey $460 $476 $635 $229 $564 $531 $331 $627 $355 $350

New Mexico $289 $350 $360 $366 $372 $280 $293 $260 $195 $200

Nevada $405 $448 $453 $466 $305 $517 $290 $338 $483 $447

New York $357 $395 $420 $450 $202 $545 $334 $314 $374 $381

Ohio $226 $266 $126 $285 $156 $369 $275 $286 $209 $261

Oklahoma $345 $310 $345 $345 $286 $573 $310 $403 $235 $280

Oregon $289 $397 $294 $313 $268 $361 $265 $302 $228 $241

Pennsylvania $336 $332 $350 $317 $217 $505 $233 $371 $229 $653

Rhode Island $417 $413 $520 $467 $467 $515 $367 $436 $201 $576

South Carolina $315 $325 $391 $265 $302 $335 $302 $381 $256 $285

South Dakota $332 $394 $337 $314 $245 $626 $228 $313 $192 $240

Tennessee $305 $402 $390 $286 $274 $517 $285 $305 $220 $228

Texas $337 $457 $404 $420 $272 $350 $322 $389 $240 $300

Utah $301 $297 $308 $326 $247 $361 $249 $319 $387 $290

Virginia $196 $282 $260 $210 $172 $218 $173 $208 $189 $185

Vermont $269 $266 $210 $218 $191 $376 $210 $254 $181 $194

Washington $263 $413 $358 $289 $230 $249 $250 $267 $234 $222

Wisconsin $271 $271 $234 $206 $173 $440 $167 $227 $168 $218

West Virginia $351 $384 $360 $348 $266 $476 $315 $400 $256 $364

Wyoming $261 $356 $290 $240 $298 $315 $301 $255 $246 $193

As you can see, USAA and Geico have the cheapest auto insurance rates, but you’ll need to shop around and compare quotes to find the cheapest auto insurance for your needs.

Does Geico Offer Discounts for Teachers

No, there is currently no Geico insurance teacher discount. However, the company offers discounts of up to eight percent for people who are members of various organizations.

If a teacher is a member of a participating organization, they may qualify for a discount.

Additionally, the car insurance company may automatically offer lower rates to teachers than if you work in another field. Take a look at this table to see what we mean.

Geico Average Rates by Occupation

Occupation Geico Monthly Rate Geico 6-Month Rate Geico Annual Rate

Teacher/Dean/Education Degree $151.00 $906.00 $1,812.00

Farm Manager, Owner $157.98 $947.90 $1,895.80

Student $157.98 $947.90 $1,895.80

Actor $165.33 $992.00 $1,984.00

As you can see, Geico offers lower rates to a Psychiatrist, for example, than to a teacher, but teachers will receive more affordable rates than farmers, students, actors, etc.

Read more:

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Case Studies: Auto Insurance Scenarios for Teachers

Below are case studies based on real-world scenarios. These examples highlight how teachers might experience different insurance needs and how the top auto insurance companies—State Farm, Progressive, and Allstate—can meet those needs.

- Case Study #1 – State Farm: Minimal Commute, Maximum Savings: John is a high school teacher in a suburban area who drives less than 5 miles to work each day. Recognizing the potential for savings due to his low mileage, John opts for State Farm’s low-mileage discount. With State Farm, he pays only $50 for minimum coverage, which is the most economical option for his simple commuting needs.

- Case Study #2 – Progressive: Custom Coverage for Diverse Needs: Sarah teaches at a city school and uses her car not only for commuting but also for field trips and other school-related activities. She requires a policy that can be tailored to her busy urban driving schedule and diverse usage. Progressive offers her custom coverage for $130 a month for full coverage, which includes added protection for occasional longer trips and school events.

- Case Study #3 – Allstate: Safe Driving Rewards: Tom, an experienced middle school teacher, has a pristine driving record and values incentives for safe driving. Allstate’s safe driving rewards program appeals to him, offering significant discounts and premium reductions. His full coverage policy costs him $140 a month, reflecting discounts due to his accident-free history.

These scenarios demonstrate how different factors such as driving distance, car use, and driving records influence the choice of auto insurance, emphasizing the importance of choosing a policy that aligns with individual circumstances and needs. See more details on our “Auto Insurance Rate Factors.”

Find the best auto insurance company near you by entering your ZIP code into our free quote tool below.

Frequently Asked Questions

What’s the best auto insurance for teachers?

The best auto insurance for teachers varies based on individual factors such as location, age, and vehicle type. Comparison shopping online is the best way to find the most affordable rates.

For additional details, explore our comprehensive resource titled “Occupation Auto Insurance Discount.”

What are the cheapest providers for auto insurance for teachers?

Some of the cheapest auto insurance providers for teachers include Geico, State Farm, Allstate, Progressive, and Farmer’s Insurance. However, it’s important to consider coverage needs in addition to cost.

What kind of auto insurance coverage do teachers need?

Teachers need to carry at least the minimum liability coverage required by their home state. It’s recommended to have full coverage, including comprehensive and collision, for better protection.

Are there car insurance discounts for teachers?

Yes, many insurance companies offer car insurance discounts specifically for teachers. Discounts can vary, so it’s important to ask about available discounts and provide proof of employment as a teacher.

How can teachers save on auto insurance?

Teachers can save on auto insurance by comparison shopping, asking about available discounts, and maintaining a clean driving record. Shopping online and comparing quotes from different companies can help find the best rates for teachers.

To find out more, explore our guide titled “Average Cost of Auto Insurance: Find Affordable Quotes.”

Does Progressive offer a teacher discount?

Yes, Progressive provides discounts for educators under their custom coverage options, tailoring policies to include benefits specifically for teachers.

What is the best car insurance for teachers?

State Farm is considered the best car insurance for teachers, offering the lowest rates and discounts that cater specifically to the educational profession.

Where can I find A Affordable Auto Insurance?

A Affordable Auto Insurance is available in several states, offering competitive rates that can be accessed by visiting their local offices or their official website.

How do I get AAA insurance quotes online?

You can obtain AAA insurance quotes online by visiting AAA’s website and entering your personal and vehicle information into their insurance quote tool.

To learn more, explore our comprehensive resource on “How To Cancel AAA Auto Insurance in 5 Steps.”

Is there an Acura teacher discount available?

Currently, Acura does not offer a specific teacher discount; however, local dealerships might have special offers, so it’s worth asking.

What are some options for affordable auto insurance in South Carolina?

In South Carolina, companies like State Farm, Geico, and Progressive offer competitive and affordable auto insurance rates suitable for various budgets.

Find the best auto insurance company near you by entering your ZIP code into our free quote tool below.

What is affordable car insurance for college students?

Many insurers offer special rates for college students, including companies like Geico, which provides discounts for good grades and safe driving.

What kinds of auto discounts does Allstate offer?

Allstate offers a variety of auto discounts including new car discounts, smart student discounts, and safe driving bonuses.

Learn more by reading our guide titled “How do I file an auto insurance claim with Allstate?“

Are there Allstate employee discounts available?

Yes, Allstate provides employee discounts on their insurance products, which include auto, home, and life insurance policies.

What is Allstate’s first accident forgiveness?

Allstate’s first accident forgiveness is a feature that prevents your insurance rates from increasing after your first accident, provided you maintain a clean driving record.

Who is known for cheapest car insurance?

According to our research, the most affordable car insurance providers across the country include USAA, Nationwide, Travelers, Erie, Geico, and Progressive.

Which insurance cover is best for a car?

Comprehensive car insurance provides extensive protection, covering accidental damage, theft, vandalism, and any harm or injury you might inflict on another person or their property. This type of insurance is ideal for new car owners or those purchasing brand-new vehicles.

Access comprehensive insights into our guide titled “Affordable Comprehensive Auto Insurance Coverage.”

What is the most expensive type of auto insurance?

Our data indicates that full-coverage car insurance tends to be priciest for high-end luxury and sports vehicles. Specifically, the Dodge Charger ranks as the most costly vehicle to insure, with average premiums amounting to $354 monthly or $4,242 annually for full coverage.

What is the cheapest insurance for a new driver?

State Farm offers the most affordable comprehensive auto insurance for new drivers nationwide, with an average yearly cost of $4,078, or about $340 per month.

What are the three levels of insurance?

The three primary forms of car insurance typically recognized are liability, comprehensive, and collision. Liability insurance is mandated by law in many states, while comprehensive and collision coverage are usually necessary for most car loans and leases.

Enter your ZIP code into our free quote tool below to find the best auto insurance providers for your needs and budget.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.