Cheap Kansas Auto Insurance in 2025 (Cash Savings With These 10 Companies!)

USAA, Geico, and State Farm offer cheap Kansas auto insurance. Our top recommendation, USAA, has rates starting as low as $18 per month. These companies excel in affordability, and customer service, providing tailored coverage options that cater drivers needs who seeks a budget-friendly auto insurance in Kansas.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Nov 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage in Kansas

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage in Kansas

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews

USAA, Geico, and State Farm offer the cheap Kansas auto insurance, with rates starting at just $18 per month. USAA is particularly noteworthy for its comprehensive comparison tools.

Understanding auto insurance in Kansas is important to be sure you’ve purchased the right coverage. Drivers in Kansas must carry mandatory insurance coverages to be able to legally drive in the state. Before you buy Kansas auto insurance, read the guide below to be sure you know what coverage you need.

Our Top 10 Company Picks: Cheap Kansas Auto Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $18 A++ Military Benefits USAA

#2 $24 A++ Competitive Rates Geico

#3 $26 B Extensive Network State Farm

#4 $28 A++ Diverse Options Travelers

#5 $29 A+ Customer Focused Nationwide

#6 $36 A Loyalty Rewards American Family

#7 $41 A+ Innovative Tools Progressive

#8 $46 A Customizable Coverage Farmers

#9 $51 A+ Comprehensive Coverage Allstate

#10 $56 A Financial Strength Liberty Mutual

Securing affordable auto insurance can be challenging for high-risk drivers, but you don’t have to navigate it alone. Enter your ZIP code above to discover the affordable instant auto insurance quotes in your area.

- Cheap Kansas Auto Insurance

- Get Affordable Shawnee Mission, KS Auto Insurance Quotes (2025)

- Get Affordable Oakley, KS Auto Insurance Quotes (2025)

- Get Affordable Haysville, KS Auto Insurance Quotes (2025)

- Get Affordable Hartford, KS Auto Insurance Quotes (2025)

- Get Affordable Edna, KS Auto Insurance Quotes (2025)

- Get Affordable Dexter, KS Auto Insurance Quotes (2025)

#1 – USAA: Top Overall Pick

Pros

- Competitive Rates: USAA offers some of the most affordable premiums for cheap Kansas auto insurance, with rates starting as low as $18 per month. This makes it a top choice for budget-conscious drivers in Kansas. See more details on what information I need to provide when filing an auto insurance claim with USAA.

- Excellent Customer Service: Known for outstanding customer support, USAA has consistently high ratings for service and claims handling. Their focus on military families and veterans ensures specialized care and support.

- Comprehensive Coverage Options: USAA provides a wide array of coverage options that cater specifically to military families. This includes tailored policies that meet diverse needs and preferences for cheap Kansas auto insurance.

Cons

- Eligibility Restrictions: USAA’s coverage is only available to military members, veterans, and their families. This limitation means many drivers seeking cheap Kansas auto insurance won’t be able to access their rates.

- Limited Local Agents: With fewer physical branches, those who prefer face-to-face interactions might find it inconvenient. This can be a drawback for drivers who value in-person assistance when managing cheap Kansas auto insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#2 – Geico: Best for Competitive Rates

Pros

- Affordable Premiums: As mentioned in our Geico auto insurance review, Geico is well-known for its competitive pricing, with monthly rates starting at $24 for cheap Kansas auto insurance. This makes it a budget-friendly option for many drivers.

- User-Friendly Digital Tools: Geico’s mobile app and online tools are highly rated, making it easy to manage your policy and file claims. This technological convenience enhances the overall experience for cheap Kansas auto insurance customers.

- Broad Coverage Options: Geico provides a range of coverage options suitable for various needs, including high-risk drivers. This flexibility helps ensure you get the right policy for cheap Kansas auto insurance.

Cons

- Limited Customization: Some customers may find Geico’s policy options less flexible compared to other providers. This lack of customization might be a drawback for those with specific needs in cheap Kansas auto insurance.

- Mixed Reviews on Claims: Although generally positive, some customers report issues with the speed and efficiency of claims processing. This can be a concern for those prioritizing reliable service with cheap Kansas auto insurance.

#3 – State Farm: Best for Extensive Network

Pros

- Extensive Network: State Farm’s vast network of agents and offices ensures that you have access to local support and personalized service. This extensive reach makes it a strong choice for cheap Kansas auto insurance.

- Variety of Discounts: State Farm offers numerous discounts, including those for safe driving and multiple policies. These savings can help lower your costs when choosing cheap Kansas auto insurance.

- Good Customer Service: State Farm generally receives positive feedback for its customer service and claims support. This reputation contributes to a more satisfactory experience with cheap Kansas auto insurance.

Cons

- Higher Premiums: In some cases, State Farm’s rates may be higher than those of other providers. This could be a consideration if you’re specifically looking for the cheapest options in cheap Kansas auto insurance.

- Inconsistent Pricing: Premiums can vary greatly depending on location and driver profile, leading to less predictable rates for cheap Kansas auto insurance. Learn more in our State Farm auto insurance review.

#4 – Travelers: Best for Diverse Options

Pros

- Flexible Coverage Options: Travelers offers a wide range of coverage options and add-ons, allowing you to tailor your policy to meet specific needs. This flexibility is beneficial for obtaining cheap Kansas auto insurance.

- Innovative Tools: The IntelliDrive app and other tools from Travelers can help monitor driving habits and potentially reduce premiums. These innovative features contribute to savings on cheap Kansas auto insurance.

- Strong Financial Ratings: With an A++ rating from A.M. Best, Travelers is recognized for its strong financial stability, ensuring reliable claims handling for cheap Kansas auto insurance. Access comprehensive insights into our Travelers auto insurance review.

Cons

- Complex Policy Options: The extensive range of options and discounts can be overwhelming and confusing for some customers. This complexity might make it harder to find the best cheap Kansas auto insurance policy.

- Customer Service Issues: Some customers report mixed experiences with Travelers’ customer service, which could affect the ease of managing cheap Kansas auto insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Customer Focused

Pros

- Customer-Centric Approach: Nationwide is known for its focus on customer satisfaction, making it a reliable choice for those seeking cheap Kansas auto insurance. Their commitment to service enhances the overall experience.

- Wide Range of Coverage Options: As mentioned in our Nationwide auto insurance review, the company offers diverse coverage options and unique add-ons like accident forgiveness, which can be beneficial for cheap Kansas auto insurance.

- Strong Financial Stability: With an A+ rating from A.M. Best, Nationwide’s solid financial health ensures reliable payouts and stability for cheap Kansas auto insurance.

Cons

- Higher Costs for Some: Depending on your profile and location, Nationwide’s premiums might be higher than those of other providers, which could be a concern when seeking the cheapest option for cheap Kansas auto insurance.

- Mixed Claims Experience: Some customers report inconsistent experiences with claims processing, which could impact the overall value of cheap Kansas auto insurance.

#6 –American Family: Best for Loyalty Rewards

Pros

- Loyalty Rewards: American Family offers rewards for long-term customers, which can lead to savings over time. This approach helps make cheap Kansas auto insurance more affordable in the long run.

- Flexible Coverage Options: Provides a wide range of coverage choices and optional add-ons, allowing for personalized policies tailored to your needs for cheap Kansas auto insurance.

- Good Customer Service: Generally positive reviews for customer service ensure a satisfactory experience when managing your cheap Kansas auto insurance. Find out more about American Family in our American Family review.

Cons

- Higher Premiums for Younger Drivers: Premiums may be higher for younger or less experienced drivers, which can impact the affordability of cheap Kansas auto insurance.

- Regional Variability: Coverage options and pricing can vary significantly by region, which might affect the availability of the best cheap Kansas auto insurance deals in some areas.

#7 – Progressive: Best for Innovative Tools

Pros

- Innovative Tools: Progressive’s Snapshot program monitors driving habits to potentially lower premiums. This innovative approach can help make cheap Kansas auto insurance more affordable.

- Competitive Rates: Known for offering competitive pricing with various discount opportunities, Progressive is a solid choice for cheap Kansas auto insurance. Our complete Progressive auto insurance review goes over this in more detail.

- Strong Online Presence: The user-friendly website and mobile app make it easy to manage your policy and file claims, enhancing convenience for cheap Kansas auto insurance customers.

Cons

- Complex Pricing Structure: The pricing and discount structure can be difficult to navigate, which may complicate finding the best cheap Kansas auto insurance policy.

- Customer Service Concerns: Some customers report issues with the quality and responsiveness of Progressive’s customer service, affecting the overall experience with cheap Kansas auto insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#8 – Farmers: Best for Customizable Coverage

Pros

- Customizable Coverage: As outlined in our Farmers auto insurance review, Farmers offers highly customizable policies, which can be tailored to fit your specific needs for cheap Kansas auto insurance.

- Good Customer Support: Generally positive feedback for customer service ensures a satisfactory experience when dealing with your cheap Kansas auto insurance.

- Discounts for Bundling: Significant savings are available when bundling multiple policies, which can help reduce costs for cheap Kansas auto insurance.

Cons

- Higher Rates for Some: Premiums might be higher compared to other insurers, particularly in high-risk areas, which could impact the affordability of cheap Kansas auto insurance.

- Inconsistent Service: Some customers experience inconsistent service and claims handling, which may affect the value of cheap Kansas auto insurance.

#9 – Allstate: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage Options: Offers a broad range of coverage options and add-ons, ensuring that you can tailor your policy to meet your specific needs for cheap Kansas auto insurance.

- Strong Financial Ratings: With an A+ rating from A.M. Best, Allstate is known for its financial stability, ensuring reliable coverage and claims handling for cheap Kansas auto insurance.

- Solid Customer Service: Generally receives positive feedback for customer service, enhancing the overall experience of managing cheap Kansas auto insurance. See more details in our Allstate Auto Insurance Review.

Cons

- Higher Premiums: Rates can be higher compared to some other insurers, which might be a drawback for those seeking the most affordable cheap Kansas auto insurance.

- Inconsistent Pricing: Premiums can vary widely based on location and driver profile, leading to less predictable costs for cheap Kansas auto insurance.

#10 – Liberty Mutual: Best for Financial Strength

Pros

- Strong Financial Stability: Liberty Mutual’s A rating from A.M. Best indicates strong financial health, ensuring reliable coverage and claims processing for cheap Kansas auto insurance.

- Comprehensive Coverage Options: Offers a wide range of coverage choices and add-ons, allowing you to tailor your cheap Kansas auto insurance policy to your specific needs.

- Good Customer Service: Generally positive feedback for customer service and support helps ensure a satisfactory experience with cheap Kansas auto insurance. Check out insurance savings in our complete Liberty Mutual auto insurance review.

Cons

- Higher Rates for Some: Premiums may be higher than those of other providers, which could be a concern if you’re seeking the most cost-effective cheap Kansas auto insurance.

- Mixed Reviews on Claims: Some customers report issues with the efficiency and responsiveness of claims processing, which might impact the value of cheap Kansas auto insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Kansas Insurance Laws and Requirements

All drivers in Kansas must adhere to the state’s auto insurance laws, which require carrying a minimum amount of insurance. The minimum liability coverage in Kansas includes: $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $10,000 for property damage per accident.

Kansas Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $51 $160

American Family $36 $114

Farmers $46 $144

Geico $24 $75

Liberty Mutual $56 $174

Nationwide $29 $92

Progressive $41 $127

State Farm $26 $81

Travelers $28 $87

USAA $18 $56

Bodily injury liability insurance covers the medical treatment costs for the other parties in an accident where you are at fault for causing the accident. Other costs covered by this insurance policy include rehabilitation costs, lost wages, and funeral expenses.

State law requires that drivers purchase a minimum coverage of $25,000 per person, per accident, and $50,000 for all parties in a single accident.

Property damage liability insurance is similar to BIL insurance except it covers costs associated with damages to the other person’s automobile and surrounding property when you cause an accident.

Personal injury protection (PIP) insurance is the “no-fault” part of the Kansas system. This policy pays out for medical treatment and injury costs for the driver that holds the insurance and their passengers, regardless of who is at fault for the accident.

It’s recommended to increase your PIP coverage by as much as you can afford, to avoid any unnecessary out-of-pocket expenses should you be involved in an accident.

Finally, Kansas law also requires that drivers purchase uninsured motorist coverage. This insurance acts much like Bodily Injury Liability insurance, except it covers the policy holder and their passengers when they are in an accident caused by a driver with no insurance. Like BIL, the mandatory minimum coverage for UMP is $25,000 per person, per accident, and $50,000 for all parties in a single accident.

Kansas Auto Insurance Rates

On average, Kansas auto insurance rates are very competitive with those in the rest of the country. Statewide, the majority of drivers in Kansas actually pay less than the national average of $1,440 per year, coming in at around $1,267 or about $105 per month.

Drivers in Kansas’ major cities will of course pay a bit more, thanks to the increased accident and theft risk involved. Those in Overland Park are looking at an average of $1,588 per year for auto insurance, and drivers in Wichita will pay an average of $1,715 per year.

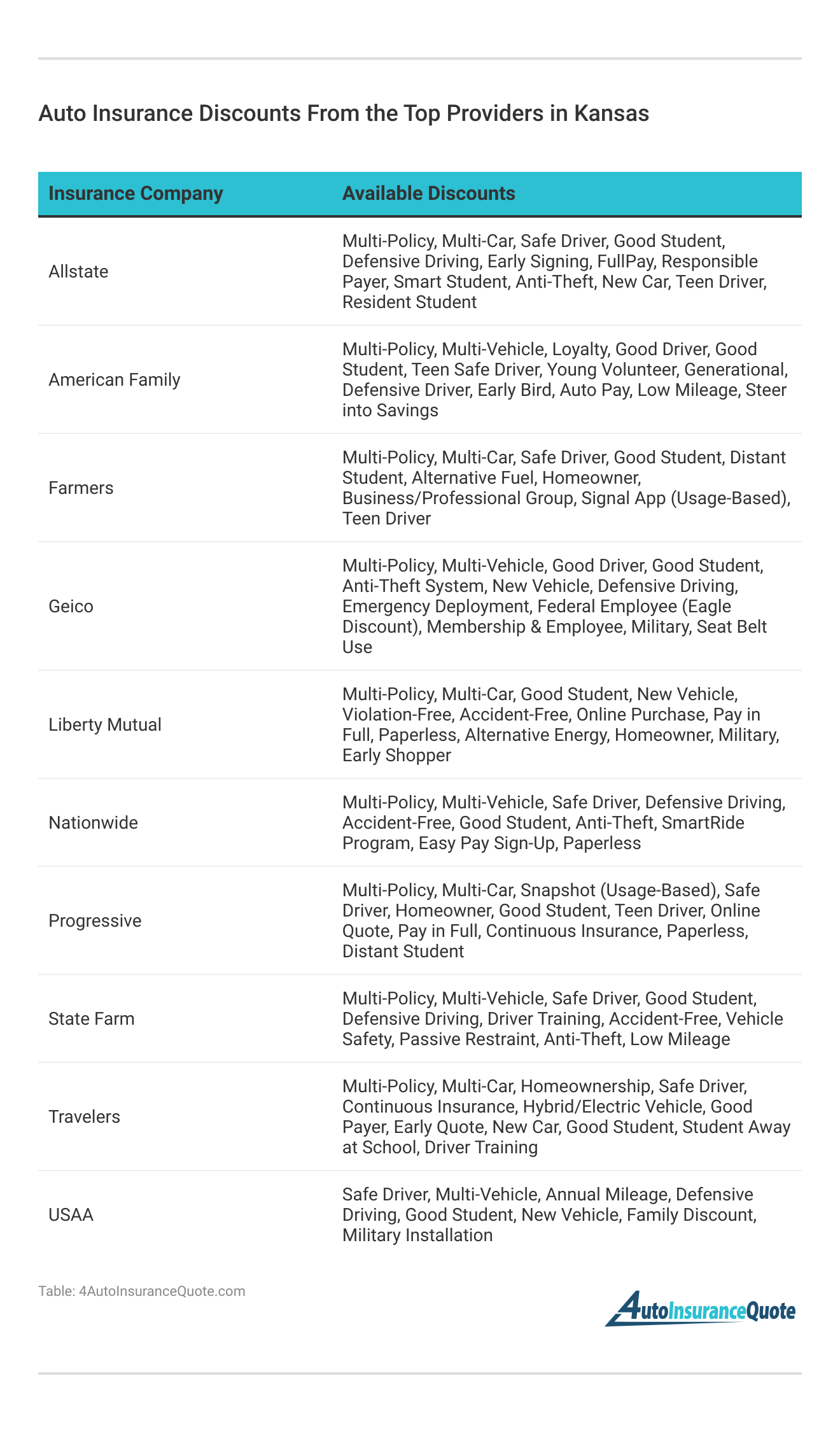

However, by exploring various auto insurance discounts, such as safe driver discounts or multi-policy discounts, Kansas residents might be able to reduce these costs and find more affordable rates.

While many of these factors are simply based on your own driving record, two things that affect even the safest of drivers are age and gender. As with most states, males typically pay higher auto insurance rates than females. Enter your ZIP code below to compare.

Theft and Accident Statistics

Vehicle accident trends in Kansas are looking very positive, which will help bring down car insurance rates throughout the state as fewer crashes mean fewer insurance claims and payouts. In 2008, Kansas saw a statewide total of 65,858 crashes, with 385 fatalities reported.

It’s very rare to see a nearly double-digit drop in crash totals in just a single year; it’s very clear that law enforcement initiatives to help encourage safer driving, as well as Kansas drivers showing more care on the roads, are leading to a reduction in crashes, injuries, and fatalities.

Additionally, with these positive trends, it’s a great time to compare auto insurance quotes to ensure you’re getting the best coverage at competitive rates, reflecting the decreased risk on the roads.

News is also pretty stellar when auto theft rates in Kansas are considered. In 2009, just 5,954 vehicles were reported stolen throughout the state; this compares to 7,418 a year prior and is a significant decrease. Auto thefts in Kansas peaked just a few years ago in 2005, when a record 9,338 automobiles went missing.

Since then, the state has seen a 36% reduction in auto thefts, which is spectacular given that it took just four years to accomplish. Again, this drop can be attributed to an increased law enforcement presence deterring auto thieves, as well as drivers going the extra mile and ensuring their vehicles are protected from theft.

With thefts and crashes trending downward in Kansas, it’s likely the state will continue to enjoy reduced auto insurance premiums for quite some time. Don’t forget that there are a number of Kansas car insurance companies on the market, and many will have discounts available for individuals that qualify. Spend a bit of time doing research, and you’re likely to save money on your auto insurance in Kansas.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Additional State of Kansas Auto Insurance Resources

For official sources of Kansas insurance and driver information, check out the resources below.

- Kansas Department of Revenue – Division of Vehicles

- The official Website of the Kansas Insurance Department

- Introduction to Auto Insurance – Kansas Insurance Department

- Kansas Highway Safety Laws

In summary, navigating auto insurance in Kansas is crucial for ensuring you have the proper coverage to comply with state regulations and protect yourself on the road.

Tim Bain

Licensed Insurance Agent

By understanding the mandatory requirements and utilizing the resources provided, you can make an informed decision and secure the right insurance for your needs. To compare Kansas auto insurance quotes right now, enter your ZIP code below.

Frequently Asked Questions

What are the auto insurance requirements in Kansas?

Kansas requires drivers to have minimum liability coverage of $25,000 for bodily injury per person, $50,000 per accident, and $10,000 for property damage. Additionally, drivers must have Personal Injury Protection (PIP) and uninsured motorist coverage.

What does liability insurance cover?

Liability insurance covers costs associated with injuries and damages to others if you are at fault in an accident. This includes medical expenses, lost wages, and property damage incurred by the other party. To compare Kansas auto insurance quotes right now, enter your ZIP code below.

Do I need uninsured motorist coverage?

Yes, Kansas law requires uninsured motorist coverage to protect you and your passengers in the event of an accident caused by a driver with no insurance. The minimum coverage required is $25,000 per person and $50,000 per accident. Learn how to find your car make and model in our guide.

How much does auto insurance cost in Kansas?

On average, auto insurance in Kansas costs about $1,267 per year or $105 per month. Rates can vary based on factors like location, driving history, and coverage options.

How can I find affordable auto insurance in Kansas?

To find affordable auto insurance in Kansas, compare quotes from multiple insurance companies to see which offers the best rates for your coverage needs. Exploring discounts and considering different coverage options can also help lower costs. To compare Kansas auto insurance quotes right now, enter your ZIP code below.

Which company is highlighted as the best for extensive network coverage?

State Farm is noted as the best for extensive network coverage. They offer a wide network of agents and repair shops, providing comprehensive support and service. For additional details, explore our comprehensive resource titled “Auto Insurance Discounts for Affordable Coverage.”

What is the average monthly auto insurance rate in Overland Park, Kansas?

The average monthly auto insurance rate in Overland Park is approximately $132. This is higher than the statewide average due to increased accident and theft risks.

What is the minimum required coverage for uninsured motorist protection in Kansas?

Kansas requires a minimum of $25,000 per person and $50,000 per accident for uninsured motorist coverage. This insurance protects drivers and their passengers from accidents caused by uninsured drivers. To compare Kansas auto insurance quotes right now, enter your ZIP code below.

How much has auto theft in Kansas decreased since 2005?

Auto theft in Kansas has decreased by 36% since 2005. This significant reduction is attributed to improved law enforcement and increased vehicle security measures. Read more: How do auto insurance claims work?

Which auto insurance provider is recommended for innovative tools?

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.