Best Temporary Auto Insurance in 2025 (Find the Top 10 Companies Here!)

Discover the best temporary auto insurance with State Farm, Geico, and Progressive, leading the pack with rates starting at $67 per month. These providers offer the most reliable and cost-effective options for short-term coverage needs, ensuring top-notch service and comprehensive benefits.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kalyn Johnson

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Insurance Claims Support & Sr. Adjuster

UPDATED: Nov 3, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 3, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Temporary Auto Insurance

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Temporary Auto Insurance

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews

The best temporary auto insurance providers are State Farm, Geico, and Progressive, known for their excellent coverage and customer service.

Temporary auto insurance is available from some providers and is often offered by car dealerships when purchasing a vehicle, providing short-term coverage. Learn more in our “Understanding How Auto Insurance Works.”

Our Top 10 Company Picks: Best Temporary Auto Insurance

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

#1 10% A++ Many Discounts State Farm

#2 15% A++ Cheap Rates Geico

#3 12% A+ Online Convenience Progressive

#4 10% A+ Add-on Coverages Allstate

#5 25% A++ Military Savings USAA

#6 10% A Customizable Polices Liberty Mutual

#7 5% A+ Usage Discount Nationwide

#8 10% A Local Agents Farmers

#9 8% A Student Savings American Family

#10 10% A++ Accident Forgiveness Travelers

This article explores the specifics of these policies, including whether they are temporary or standard, and offers advice on choosing the right insurance for new and used cars.

The best way to get the cheapest auto insurance coverage is to get multiple quotes to compare. Use our free tool to get multiple temporary car insurance quotes.

#1 – State Farm: Top Overall Pick

Pros

- Bundling Policies: State Farm offers significant discounts for bundling multiple insurance policies.

- High Low-Mileage Discount: State Farm provides a substantial discount for low-mileage usage.

- Wide Coverage: State Farm offers various coverage options tailored for different business needs. Learn more in our “State Farm Auto Insurance Review: Can you get affordable quotes?“

Cons

- Limited Multi-Policy Discount: The multi-policy discount of State Farm is not as high compared to some competitors.

- Premium Costs: Despite discounts, State Farm’s premiums might still be relatively higher for certain coverage levels.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#2 – Geico: Best for Cheap Rates

Pros

- Competitive Pricing: Geico offers some of the lowest rates in the industry, especially for safe drivers. See more details on our Geico auto insurance review.

- Extensive Discounts: Geico provides a range of discounts including military, federal, and student discounts.

- Fast Claims Process: Geico is known for its efficient claims processing, enhancing customer satisfaction.

Cons

- Coverage Limitations: Geico’s basic coverage options might not meet the needs of all customers looking for comprehensive benefits.

- Customer Service Variability: Service quality can vary significantly depending on the region and agent.

#3 – Progressive: Best for Online Convenience

Pros

- Online Tools: Progressive offers innovative online tools for quotes, claims, and policy management. More information is available about this provider in our Progressive auto insurance review.

- Loyalty Rewards: Customers benefit from loyalty rewards programs including continuous insurance discounts.

- Flexible Policies: Progressive provides flexibility in customizing policies and choosing payment plans.

Cons

- Higher Rates for High-Risk Drivers: Progressive’s rates can be higher for drivers with poor driving records.

- Inconsistent Agent Experience: Customer experience can vary depending on the agent or representative.

#4 – Allstate: Best for Add-on Coverages

Pros

- Customizable Coverage: Allstate allows extensive customization of policies with various add-ons. Read up on the “Allstate vs. USAA: Which Offers More Affordable Auto Insurance Quotes” for more information.

- Safe Driving Bonuses: Safe drivers can earn bonuses and discounts, promoting safe driving habits.

- Effective Mobile App: Allstate’s mobile app offers comprehensive tools for policy management and claims.

Cons

- Higher Premiums: Allstate’s premiums are generally higher, especially without discounts.

- Claim Resolution Time: Some users report slower claim resolution times which can be inconvenient.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#5 – USAA: Best for Military Savings

Pros

- Military Focus: Tailored services for military members and their families with excellent rates. Check out how to cancel USAA auto insurance in 5 steps.

- Superior Customer Service: Consistently high ratings for customer service and claims satisfaction.

- Extensive Discounts: USAA offers multiple discounts for vehicle storage, family members, and more.

Cons

- Limited Eligibility: Services are only available to military members, veterans, and their families.

- Fewer Physical Locations: Limited physical branch locations, which might be a drawback for some customers.

#6 – Liberty Mutual: Best for Customizable Policies

Pros

- Personalization: Liberty Mutual offers highly customizable policies to fit individual needs. Discover more about offerings in our Liberty Mutual auto insurance review.

- Accident Forgiveness: Includes options for accident forgiveness to prevent premium increases after one’s first accident.

- Multiple Discounts: Offers a variety of discounts including multi-car, new vehicle, and online purchase discounts.

Cons

- Variable Customer Service: Customer service quality can vary significantly.

- Pricing Inconsistency: Premiums can be inconsistent, with some customers reporting higher than average rates.

#7 – Nationwide: Best for Usage Discount

Pros

- SmartRide Program: Offers discounts based on driving behavior tracked through the SmartRide device.

- Wide Range of Coverages: Nationwide provides a broad array of coverage options, including pet coverage in auto accidents. Access comprehensive insights into our Nationwide auto insurance review.

- Strong Financial Stability: Maintains a strong financial stability rating, ensuring reliability.

Cons

- Premiums Higher Without Discounts: Premiums can be high unless qualifying for discounts.

- Mixed Online Feedback: Some customers report issues with the online platform and mobile app functionalities.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#8 – Farmers: Best for Local Agents

Pros

- Local Agent Network: Farmers has a strong presence with local agents available to provide personalized service.

- Customizable Options: Offers a variety of customizable coverage options and endorsements to suit different needs.

- Initiative Discounts: Farmers offer discounts for eco-friendly practices and electronic payments. Delve into our evaluation of Farmers auto insurance review.

Cons

- Higher Rates for Some Policies: Rates can be on the higher side compared to competitors, especially for standard coverage.

- Customer Service Complaints: Some customers have reported dissatisfaction with response times and support.

#9 – American Family: Best for Student Savings

Pros

- Good Student Discounts: Offers substantial discounts for students maintaining a B average or higher. Unlock details in our American Family auto insurance review.

- Young Driver Safety Programs: Implement programs aimed at educating young drivers, reducing rates upon completion.

- Strong Community Involvement: Actively engages in community projects and safety programs, enhancing brand trust.

Cons

- Limited Availability: American Family insurance is not available in all states, which can limit access for some.

- Inconsistent Premium Adjustments: Some customers report frequent changes in their premiums without clear explanations.

#10 – Travelers: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Travelers offers accident forgiveness policies, preventing rate increases after the first accident.

- Hybrid/Electric Car Discounts: Provides discounts for owning or leasing hybrid and electric vehicles. Discover insights in our “Travelers Auto Insurance Review: Can you get affordable quotes?“

- Intuitive Online Management: Offers an easy-to-use online portal for managing policies and filing claims.

Cons

- Higher Pricing Without Discounts: Pricing can be competitive but tends to be higher without specific discounts.

- Complex Claim Process: Some customers find the claims process to be complex and time-consuming.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Comparative Monthly Rates for Temporary Auto Insurance

When comparing temporary auto insurance, it’s crucial to consider both the minimum and full coverage rates offered by various providers. This helps in understanding the cost-effectiveness of each insurance company when deciding on the appropriate level of insurance coverage required.

Temporary Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $67 $160

American Family $76 $173

Farmers $79 $181

Geico $85 $178

Liberty Mutual $79 $207

Nationwide $83 $217

Progressive $80 $200

State Farm $86 $153

Travelers $75 $191

USAA $90 $222

Allstate, for instance, offers minimum coverage at $67 and full coverage at $160 per month, making it a moderate option among others. American Family and Farmers present slightly higher rates with minimum coverages at $76 and $79 and full coverages at $173 and $181, respectively.

Geico and Liberty Mutual offer their minimum coverages at $85 and $79, with full coverages at $178 and $207, highlighting a more significant jump in full coverage rates. Delve into our evaluation of “Affordable Full Coverage Auto Insurance.”

Nationwide and Progressive are on the higher end for full coverage, costing $217 and $200, respectively, while their minimum coverage stands at $83 and $80. State Farm shows a competitive edge with the highest minimum coverage cost at $86 but the lowest full coverage rate at $153.

Travelers and USAA round out the list with Travelers offering a minimum of $75 and full coverage at $191, and USAA marking the highest rates for both minimum and full coverage at $90 and $222, respectively. This range of rates provides a broad spectrum for consumers to choose from, depending on their coverage needs and budget constraints.

Temporary Auto Insurance Explained

First, let’s clarify what temporary auto insurance is and how it works.

Most auto insurance works on a long-term basis: you buy insurance for a 6-month or 12-month term, and your car insurance is automatically renewed for the lifetime of your vehicle. This is ordinary car insurance. You can pay for monthly car insurance, but you will be buying it from the same company.

For those seeking robust coverage without breaking the bank, State Farm's $153 full coverage rate is unrivaled.Kristen Gryglik Licensed Insurance Agent

Temporary car insurance works in a different way. You can get one-day auto insurance, week-long insurance, or month-long insurance. It will generally provide the same coverages as ordinary car insurance, just for a shorter time.

When Can You Get Temporary Auto Insurance

You must first determine when to buy car insurance and what coverage is needed.

Let’s say you’re renting a moving truck from U-Haul for the day. You might buy temporary car insurance to cover the rental van as moving truck insurance.

Alternatively, you might buy temporary car insurance if you’re only in a location for two or three months. Let’s say you’re flying to Hawaii for work on a 2 or 3-month contract. Rental car insurance can get messy when renting for periods beyond 30 days.

Meanwhile, traditional car insurance providers may require a 6-month or 12-month commitment. You might need special temporary car insurance.

Some people also buy temporary car insurance if they’re away for a long vacation. You might be a snowbird flying south for the winter, for example. You buy temporary car insurance to cover your car up north during the summer months.

There are all sorts of reasons to buy temporary car insurance. Let’s take a closer look at how it’s used when purchasing a car.

Dealer Temporary Auto Insurance

The automobile dealer’s insurance will cover any vehicles on its lot. Once a vehicle is purchased, the buyer will need to carry insurance on the vehicle.

You will need to know if car dealerships give temporary insurance. If they do not offer it, you would need to ask your insurance company about coverage.

In this section, we will cover some of the most common concerns about car dealerships and temporary car insurance. Keep reading to get your questions answered.

Can I Buy a Car From a Dealership Without Insurance

Can you buy a car if you don’t have insurance? When buying a new car, insurance grace periods will typically cover you for a couple of days until you can get regular insurance, such as Geico’s new car grace period.

Some dealerships, for example, won’t allow you to drive off the lot unless you buy temporary car insurance or have concrete proof that your insurance extends to newly purchased vehicles.

Do Dealerships Offer Temporary Insurance on New Cars

Yes, most dealerships offer temporary insurance on new cars. Some dealers even will require you to have insurance in place when buying a new car.

You can also check with your usual car insurance company for temporary insurance.

Do I Need Insurance Before I Buy a Used Car

Temporary car insurance is typically used when purchasing a used vehicle from somewhere other than the dealership.

You need insurance before you buy a used car from an independent seller. You need to buy temporary car insurance to protect your car on the drive to your home. The car dealership allows you to buy temporary car insurance that covers you for the day or even the week; however, a private seller won’t have that option.

Once your car is safe at home in your garage, you can buy a full-term auto insurance policy. You can compare quotes online as you normally would. Your temporary car insurance expires, and your full-term car insurance begins.

If you are buying a used car, you will also want to check the vehicle’s history to make sure you know everything about it.

Do Car Dealers Offer Temporary Insurance on Used Cars

Yes, they offer the same temporary insurance when you buy used cars and new cars.

Again, check with your normal car insurance company to see what coverages they offer and if you even need temporary coverage.

Do I Have to Have Auto Insurance at All

In most states, auto insurance is mandatory, although the minimum auto insurance that you have to sign up for differs on the amount of auto liability insurance needed by state. Temporary auto insurance will have the same coverage, just for a shorter period of time.

In addition to liability insurance, comprehensive and collision coverage are also common. These coverages help protect your car and people in your car, while liability coverage only extends to the property damage and bodily injury for others in an accident that you cause.

This video goes into detail about the types of car insurance available.

As you can see, there are many different types of car insurance coverage available to you. Pick your coverage based on your specific needs.

What Happens if I Drive Without Insurance

Each state has its own penalties for driving without auto insurance. The table below lists the penalties by state. Use the search box to find your state.

Penalties for Driving Without Auto Insurance by State| States | Penalties |

|---|---|

| Alabama | Up to $500, Registration suspension with $200 reinstatement fee |

| Alaska | License suspension for 90 days |

| Arizona | $500 (or more), License/registration/license plate suspension for three months |

| Arkansas | $50 to $250, Suspended registration/no plates until proof of car insurance coverage plus $20 reinstatement fee; court may order impoundment |

| California | $100-$200 plus penalty assessments, Court may order impoundment |

| Colorado | $500 minimum fine, 4 points against your license; license suspension until you can show proof to the DMV that you are insured. Courts may add up to 40 hours community service |

| Connecticut | $100-$1000, Suspended registration/license for one month (show proof of insurance) with $175 reinstatement fee |

| Delaware | $1,500 minimum fine, License/privilege suspension for six months |

| Florida | Suspension of license and registration until reinstatement fee is paid and non-cancelable coverage is secured; $150 fee for first reinstatement |

| Georgia | Suspended registration with $25 lapse fee and $60 reinstatement fee. Pay any other registration fees and vehicle ad valorem taxes due |

| Hawaii | $500 fine or community service granted by judge, Either license suspension for three months or a required nonrefundable car insurance policy in force for six months |

| Idaho | $75, License suspension until financial proof. No reinstatement fee. |

| Illinois | $500 minimum, License plate suspension until $100 reinstatement fee and insurance proof |

| Indiana | License/registration suspension for 90 days to one year |

| Iowa | $500 if in accident; Otherwise, fine: $250, Community service in lieu of fine. Possible citation/warning if pulled over plus removal of plates and registration possible when pulled over without insurance and reissued upon payment of fine or completed community service, proof of insurance, and $15 fee; possible impoundment when pulled over |

| Kansas | $300 to $1,000, Fine and/or confinement in jail up to six months; license/registration suspension; reinstatement fee: $100 |

| Kentucky | $500 to $1,000, Fine and/or sentenced up to 90 days in jail; license plates and registration revoked for one year or until proof of insurance is shown |

| Louisiana | $500 to $1,000, If in car accident, fine plus registration revoked and driving privileges suspended for 180 days |

| Maine | $100 to $500, Suspension of license and registration until proof of insurance |

| Maryland | Lose license plates and motor vehicle registration privileges; pay uninsured motorist penalty fees for each lapse of insurance — $150 for the first 30 days, $7 for each day thereafter; Pay a restoration fee of up to $25 for a vehicle's registration |

| Massachusetts | $500 to $5,000, Fine and/or imprisonment for one year or less |

| Michigan | $200 to $500, Fine and/or imprisonment for one year or less; license suspension for 30 days or until proof of insurance; $25 service fee to Secretary of State |

| Minnesota | $200 to $1,000, Fine (or community service) and/or imprisonment for up to 90 days; License and registration revoked for no more than 12 months |

| Mississippi | $1,000, Driving privileges suspended for one year or until proof of insurance |

| Missouri | Four points against driving record; driver may be supervised; suspended until proof of insurance with $20 reinstatement fee |

| Montana | $250 to $500, Fine and/or imprisonment for no more than 10 days |

| Nebraska | License and registration suspension; reinstatement fee of $50 for each; proof of insurance to remain on file for three years |

| Nevada | $250 to $1,000, Registration suspension — until payment of reinstatement fee and, depending on circumstances, an SR-22 (proof of financial responsibility) if lapsed more than 90 days; reinstatement fee: $250 |

| New Hampshire | Not a mandatory insurance state. Proof of insurance may be required as the result of a conviction, crash involvement, or administrative action. If you are required to file proof of insurance and vehicles are registered in your name, you will be required to file an Owner’s SR-22 Certificate of Insurance. |

| New Jersey | $300 to $1,000, License suspension for one year; pay surcharges for three years in the amount of $250 per year |

| New Mexico | Up to $300, Fine and/or imprisoned for 90 days; license suspension |

| New York | Up to $1,500 if involved in accident plus $750 civil penalty, "License and registration suspension – revoked for one year; suspension of license if without insurance for 90 days; suspension lasts as long as registration suspension; Suspension of registration: equal to time without insurance or pays $8/day up to thirty days for which financial security was not in effect, $10/day from the thirty-first to the sixtieth day $12/day from the sixtieth to the ninetieth day and proof of security is provided. Or for the same time as the motor vehicle was operated without insurance. " |

| North Carolina | $50, Registration suspension until proof of financial responsibility but 30-day suspension if in car accident or knowingly driving without insurance; $50 restoration fee plus license plate fee |

| North Dakota | Up to $1,500, "Fine and/or 30 days in prison; 14 points against license plus suspension; Proof of insurance must be provided for one year; license with a notation requiring that person keep proof of liability insurance on file with the department. The fee for this license is $50, and the fee to remove this notation is $50." |

| Ohio | License/plates/registration suspension until requirements are met and $100 reinstatement fee is paid; maintain special high-risk coverage on file with the BMV for three to five years; If involved in accident without insurance: all above penalties and a security suspension for two plus years and an indefinite judgment suspension (until all damages are satisfied) |

| Oklahoma | $250, Jail time up to 30 days; license suspension with $275 reinstatement fee. Police can seize license plates and assign temporary plates and liability insurance — in effect for 10 days and can also impound the vehicle. The cost of the temporary coverage is added to the administrative fee and any fines paid for plates to be returned. If the car isimpounded, the owner must also pay towing and storage fees. |

| Oregon | $130-$1000 ($260 is the presumptive fine), If involved in accident — at least a one year license suspension; proof of financial responsibility required for three years |

| Pennsylvania | Registration suspended for three months (unless lapse was for less than 31 days and vehicle not operated during that time); $88 restoration fee plus proof of insurance required to get it back; $500 civil penalty fee is optional in lieu of registration suspension plus $88 restoration fee — can only use this option once within a 12-month period |

| Rhode Island | $100 to $500, License and registration suspension up to three months; reinstatement fee: $30 to $50 |

| South Carolina | $100-$200, Fine or 30-day imprisonment; failure to surrender registration and plates when insurance lapses; license/registration suspended until proof of insurance plus $200 reinstatement fee |

| South Dakota | $100, Fine and/or 30 days imprisonment; license suspension for 30 days to one year; filing proof of insurance (SR-22) with the state for three years from date of conviction. Failure to file proof will result in suspension of vehicle registration, license plates, and driver license. |

| Tennessee | Pay $25 coverage failure fee within 30 days of notice; if not paid, then an additional $100 coverage failure fee with suspension or revocation of registration plus reinstatement fee of no more than $25 |

| Texas | $175 to $350, Pay up to a $250 surcharge every year for three years (may be reduced with certain requirements) |

| Utah | $400, License suspension until proof of insurance (maintained for three years) and $100 reinstatement fee |

| Vermont | Up to $500, License suspended until proof of insurance |

| Virginia | May pay $500, Uninsured Motorists Vehicle fee to drive without insurance at your own risk. If this fee is not paid in lieu of insurance, all driving and vehicle registration privileges will be suspended until a $500 statutory fee is paid, proof of insurance is filed for three years, and a reinstatement fee (if applicable) is paid |

| Washington, D.C. | Up to $250 or more |

| West Virginia | $200 to $5,000, License suspended for 30 days with reinstatement fees, unless there's proof of insurance and $200 penalty fee |

| Wisconsin | Up to $500 |

| Wyoming | Up to $750, Up to six months in jail |

As you can see, there are stiff penalties for driving without car insurance. Make sure you are covered, either with a normal policy or temporary insurance.

Can I Drive a Car Without Insurance if I Just Bought It

That depends on if you currently have car insurance. Many companies will give you a grace period where they cover any new cars purchased. You will want to check with your car insurance company to make sure they have this service. If not, you can’t drive a car without being insured.

How to Find Cheap Temporary Auto Insurance

Many of America’s leading best auto insurance companies also provide temporary auto insurance. Other companies specialize in providing short-term auto insurance.

Is Temporary Car Insurance Expensive

The first thing to consider is just how much is temporary car insurance. Temporary car insurance is not expensive if you are only using it for a short amount of time. It can get very expensive if you keep it long-term.

Temporary coverage is around $15 a day, which is pretty cheap. But if you kept that coverage for a month, that adds up to $450. It can get more expensive the longer you keep it.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

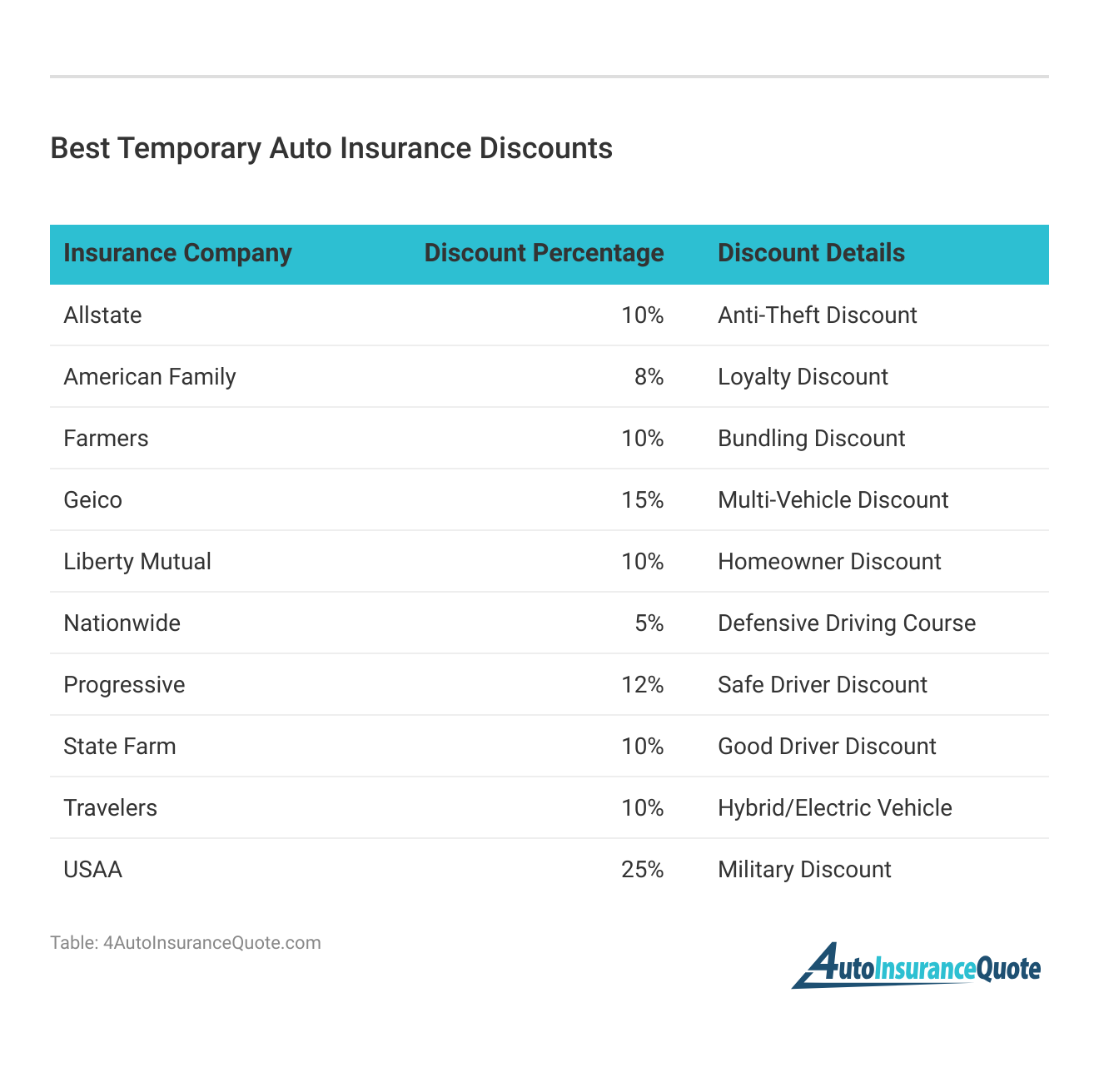

With an ordinary policy, you can qualify for additional auto insurance discounts to help bring down your rates and make your policy even cheaper.

Reasons to Buy Temporary Insurance

In other situations, you might buy temporary car insurance when lending a vehicle to someone else. You might trust your own driving skills but are less certain about someone else’s driving ability. In this situation, you may wish to buy temporary car insurance during the day on which you plan to lend the vehicle to a friend.

You might add supplemental insurance – like higher coverage limits – when lending your vehicle, for example. Or, you could buy an entirely new policy to cover the borrowing period.

Others use temporary insurance when moving RVs, motorcycles, sports cars, or other types of vehicle only driven at certain times of the year. You might have purchased an RV in another state, for example, and are planning to drive it home. You buy temporary insurance to cover the RV while you get it to its final destination. Snowbirds may use a similar strategy when relocating from south to north and vice versa.

Finally, some people use temporary car insurance if they simply cannot afford to buy a 6-month or 12-month insurance policy at this time. If you cannot afford a long-term insurance policy and don’t have enough credit to set up a monthly payment plan with your insurer, then you may need to buy temporary car insurance.

Learn more: Affordable Non-Cancellable Auto Insurance

When Is Temporary Car Insurance Needed

Some of the most common reasons to buy temporary car insurance include:

- You are in between car insurance policies, but you still need to drive

- You are insuring a rental car or another vehicle for a cross-country road trip; say, when relocating to a new state or driving south for the winter

- Friends, relatives, or house guests are renting your vehicle for a brief period of time

- You only have possession of the vehicle temporarily

- You are leaving your car in storage but still want some level of insurance on the vehicle

- You are preparing to sell a vehicle; you want to temporarily insure it to move it around or show it to potential buyers

- A university student is home for a break and needs to drive the vehicle for a brief period of time

- You give your child a vehicle to put in his or her name

- You just purchased a vehicle from a car dealership and need temporary car insurance to drive it home

In some of the situations above, you may not need to buy temporary car insurance at all. Your car insurance might provide adequate coverage.

When lending your car to someone else, for example, your car insurance should remain active. As long as the other individual has permission to drive your vehicle, your car insurance follows the vehicle.

Do I Need Temporary Car Insurance When Renting a Car

When renting a car, your credit card company might extend coverage. As long as you buy the rental car using your credit card and your credit card has rental car coverage, then you may not need to buy temporary car insurance for your rental car.

Your credit card’s rental car insurance coverage may not cover non-standard vehicles: it would cover an economy vehicle but not a moving truck, for example.

We recommend reading your car insurance policy or contacting your insurance agent to determine if you need temporary coverage.

Short-Term Car Insurance Factors

Short-term car insurance may be the right choice for you. Other things you need to know about temporary auto insurance include:

- Typically, a temporary auto insurance policy is taken out for a period of 1 to 28 days. If you are planning to have insurance for more than, say, 1 month, then you may want to find a monthly auto insurance policy

- Alternatively, many temporary auto insurance companies allow you to extend your coverage beyond the 28-day limit

- Avoid buying low coverage limits on your temporary car insurance coverage if driving a high-end vehicle; many people buy the cheapest possible temporary coverage, only to get into an accident and find the insurance barely covers any of the costs

- Make sure you understand the temporary auto insurance coverage; some temporary car insurance policies have many exclusions that make it difficult to make a claim

- Check your temporary car insurance policy to verify it has coverage for “Acts of God”, for example; some temporary car insurance policies will not pay out a claim if your car was damaged during a storm, a hurricane, or a similar “Act of God” scenario

- Verify whether the temporary car insurance provides just basic liability coverage or if it’s a full coverage car insurance policy; a full coverage policy would include coverage for theft, vandalism, and environmental damage, while a basic liability policy may only include coverage for collisions with other vehicles

You might already have automatic temporary car insurance through your existing policy, your credit card company, or your rental car company. Make sure you’re not over-insuring yourself and paying for car insurance that you don’t need.

State Farm leads with the most competitive full coverage rate at just $153 monthly, making it an exceptional choice for comprehensive protection.Chris Abrams Licensed Insurance Agent

Just like with ordinary insurance, rates, and coverages offered will differ from company to company. The best way to get the coverage and rates you want is to get multiple quotes.

Compare temporary car insurance quotes online to find the right policy for you. Start saving on your auto insurance by entering your ZIP code below and comparing quotes.

Frequently Asked Questions

Can I get temporary auto insurance if I’m a new driver or have a learner’s permit?

Yes, new drivers or individuals with learner’s permits can often obtain temporary auto insurance. However, insurance rates may be higher for inexperienced drivers due to the increased risk associated with their limited driving experience.

For additional details, explore our comprehensive resource titled “Finding Auto Insurance Quotes Online.”

Can I get temporary auto insurance if I own multiple vehicles?

Yes, if you own multiple vehicles, you can typically get temporary auto insurance to cover any specific vehicle for a temporary period. This allows you to have insurance tailored to the vehicle you’ll be driving during that time.

Can I get temporary auto insurance if I only need coverage for a few hours?

Yes, some insurance providers offer short-term policies that provide coverage for a few hours. This can be useful if you need insurance for a specific time-limited activity, such as test-driving a car or renting a vehicle for a few hours.

Can I get temporary auto insurance for a specific event or occasion?

Yes, you can often get temporary auto insurance for a specific event or occasion. For example, if you’re borrowing a friend’s car for a weekend trip, you can obtain temporary insurance to cover you during that period.

Can I renew my temporary auto insurance policy if I need coverage for a longer period?

In some cases, you may be able to renew your temporary auto insurance policy if you need coverage for a longer period. However, the availability of renewal options may vary depending on the insurance provider, so it’s best to check with them directly.

To find out more, explore our guide titled “Can I buy auto insurance online?“

Do car dealerships offer temporary insurance?

Yes, many car dealerships provide temporary insurance when you purchase a vehicle, covering you until you secure long-term insurance.

What is 30-day car insurance?

30-day car insurance is a short-term policy that provides coverage for a month, ideal for temporary driving needs or transitional periods.

Is temporary car insurance available when buying a new car?

Absolutely, temporary car insurance is often offered at the point of sale by dealerships to cover new cars until permanent insurance is arranged.

Can I buy a car from $500 down car lots no driver’s license required?

Some $500 down car lots may allow you to purchase a vehicle without a driver’s license, focusing instead on proof of identity and residence.

To learn more, explore our comprehensive resource on “Auto Insurance Quotes by Vehicle.”

What is one-day auto insurance?

One-day auto insurance is a policy that covers your vehicle for a single day, perfect for short-term use like borrowing a car or moving.

How do I add a temporary driver to my insurance?

You can add a temporary driver to your insurance policy by contacting your insurer and providing the temporary driver’s details; some insurers may allow you to manage this directly through their website or app.

Start saving on your auto insurance by entering your ZIP code below and comparing quotes.

Where can I find affordable car insurance near me?

To find affordable car insurance near you, use online comparison tools, check local insurance broker listings, or inquire at local agencies for the best rates and discounts available.

What are auto dealer insurance companies?

Auto dealer insurance companies specialize in providing coverage tailored for car dealerships, protecting their inventory and operations against various risks.

Learn more by reading our guide titled “How to File an Auto Insurance Claim.”

Do I need auto insurance for a test drive?

While dealerships typically have insurance that covers test drives, it’s wise to confirm with the dealer that their policy will cover you during the drive.

What options are available for auto insurance short term?

Short-term auto insurance can range from 1-day to several months and is ideal for borrowing or renting cars, temporary vehicle ownership, or when traveling with your car for short periods.

What is the shortest term for car insurance?

What day is the cheapest for car insurance?

However, you should avoid automatically renewing your policy because you’re likely to end up paying more than necessary. It’s important to regularly compare rates, and our research shows that purchasing car insurance 20 to 26 days in advance typically results in the lowest prices.

Access comprehensive insights into our guide titled “Auto Insurance Discounts for Affordable Coverage.”

Who normally has the cheapest car insurance?

According to our research team’s analysis of national average prices for minimum coverage, Geico offers the lowest car insurance rate at $38 per month. The top 10 most affordable car insurance providers include Nationwide, Geico, State Farm, Travelers, Progressive, AAA, Allstate, Chubb, Farmers, and USAA.

What is fully comprehensive insurance?

Comprehensive car insurance, often referred to as fully comprehensive coverage, provides payouts for damage to your car or another person’s vehicle and covers injuries in an accident, no matter who is at fault. This type of insurance additionally safeguards against risks like fire and theft.

What is 3rd party insurance?

Third-party insurance provides coverage for any harm done to another party by the insured vehicle. This includes bodily injuries, vehicle damage, property damage, and fatalities. However, it does not offer compensation if the accident occurs as a result of driving under the influence of alcohol.

Finding cheap auto insurance rates can be difficult for high-risk drivers, but you don’t have to do it alone. Enter your ZIP code below to find the most affordable quotes in your area.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Kalyn Johnson

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Insurance Claims Support & Sr. Adjuster

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.