Cheap Massachusetts Auto Insurance in 2025 (Cash Savings With These 10 Companies)

In the need for cheap Massachusetts auto insurance? Leading options are USAA, Geico, and State Farm, with rates beginning around $21 per month. These top and highly rated providers effectively balance affordable costs with extensive coverage for Massachusetts drivers looking for quality insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

UPDATED: Nov 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage in MA

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage in MA

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews

Leading options for cheap Massachusetts auto insurance are USAA, Geico, and State Farm. Looking for cost-effective coverage? Start by using our free comparison tool above to kick off your search.

Massachusetts auto insurance is required by law. Key coverage includes property damage liability insurance, which covers damage to others’ property. We’ll help you confidently buy Massachusetts auto insurance.

Our Top 10 Company Picks: Cheap Massachusetts Auto Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $21 A++ Military Focused USAA

#2 $28 A++ Competitive Pricing Geico

#3 $30 B Reliable Coverage State Farm

#4 $34 A++ Competitive Rates Travelers

#5 $37 A+ Budgeting Tools Progressive

#6 $39 A Comprehensive Options American Family

#7 $40 A+ Broad Discounts Nationwide

#8 $47 A Strong Service Farmers

#9 $56 A+ Comprehensive Coverage Allstate

#10 $61 A Customizable Policies Liberty Mutual

Finding affordable Massachusetts auto insurance quotes is as easy as entering your ZIP code above.

You’ll be able to compare Massachusetts auto insurance rates in seconds.

#1 – USAA: Top Overall Pick

Pros

- Excellent Customer Service: USAA provides top-notch customer service, crucial for those seeking reliable support with their cheap Massachusetts auto insurance. Their A++ rating from A.M. Best further underscores their commitment to service excellence.

- Highly Competitive Rates: With monthly rates as low as $21, USAA offers some of the cheapest Massachusetts auto insurance available, making it a cost-effective choice for eligible members.

- Comprehensive Coverage: USAA’s cheap Massachusetts auto insurance includes a wide range of coverage options tailored to military families, ensuring extensive protection at an affordable price.

Cons

- Eligibility Restrictions: USAA’s cheap Massachusetts auto insurance is only available to military members, veterans, and their families, limiting access for others who might benefit from their services.

- Limited Local Presence: With fewer physical locations, accessing in-person support for USAA’s cheap Massachusetts auto insurance might be challenging for some members. Find our more through our Allstate vs. USAA insurance review.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#2 – Geico: Best for Competitive Pricing

Pros

- Affordable Pricing: Geico’s monthly rates starting at $28 make their cheap Massachusetts auto insurance accessible to many, providing competitive pricing in the market.

- User-Friendly Digital Tools: Geico’s app and website enhance the experience of managing cheap Massachusetts auto insurance, offering easy access to policy management and claims filing.

- Diverse Discount Options: Geico provides a variety of discounts, including those for safe driving and bundling, which help reduce the cost of cheap Massachusetts auto insurance even further. Read more through our Geico insurance review.

Cons

- Customer Service Variability: While generally positive, customer service experiences with Geico can be inconsistent, potentially affecting the overall experience of managing cheap Massachusetts auto insurance.

- Limited Coverage Options: Geico’s offerings for cheap Massachusetts auto insurance may be less comprehensive compared to other providers, potentially limiting customization.

#3 – State Farm: Best for Reliable Coverage

Pros

- Nationwide Availability: State Farm’s extensive network of local agents makes it easy to access cheap Massachusetts auto insurance services across the country.

- Reliable Coverage: With a B rating from A.M. Best, State Farm is known for offering dependable coverage options for cheap Massachusetts auto insurance. Delve more through our State Farm insurance review.

- Variety of Discounts: State Farm’s numerous discounts, including those for safe driving and bundling, make their cheap Massachusetts auto insurance even more affordable.

Cons

- Potentially Higher Rates: Monthly rates starting at $30 can be higher compared to other options, potentially impacting the affordability of cheap Massachusetts auto insurance.

- Discount Variability: The availability of discounts for cheap Massachusetts auto insurance can vary by location, which may affect overall savings.

#4 – Travelers: Best for Competitive Rates

Pros

- Competitive Monthly Rates: Travelers offers monthly rates beginning at $34, making their cheap Massachusetts auto insurance a cost-effective choice for many drivers.

- Wide Coverage Options: Travelers provides a range of coverage options for cheap Massachusetts auto insurance, including unique add-ons that cater to various needs. Look for more details through our Travelers insurance review.

- Flexible Payment Plans: Various payment plans for cheap Massachusetts auto insurance help customers manage their insurance expenses according to their financial situations.

Cons

- Discount Availability: Compared to some competitors, Travelers may offer fewer discount opportunities for cheap Massachusetts auto insurance, which could impact overall savings.

- Mixed Claims Experience: Inconsistencies in claims handling reported by some customers might affect satisfaction with their cheap Massachusetts auto insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#5 – Progressive: Best for Budgeting Tools

Pros

- Innovative Tools: Progressive’s Name Your Price tool and Snapshot program allow for personalized adjustments in cheap Massachusetts auto insurance, offering flexibility in budgeting. Find out more through our Progressive insurance review.

- Comprehensive Coverage: Progressive offers a range of coverage options and add-ons for cheap Massachusetts auto insurance, allowing for extensive customization.

- User-Friendly Digital Experience: Progressive’s strong digital tools make managing cheap Massachusetts auto insurance policies and claims easy and efficient.

Cons

- Customer Service Issues: Some feedback indicates less satisfactory customer service experiences, which could impact the management of cheap Massachusetts auto insurance.

- Policy Complexity: The extensive coverage options can be complex, potentially making it challenging for customers to fully understand their cheap Massachusetts auto insurance.

#6 – American Family: Best for Comprehensive Options

Pros

- Comprehensive Coverage Options: American Family’s cheap Massachusetts auto insurance includes a broad range of coverage options and unique benefits tailored to various needs.

- Excellent Customer Service: Known for strong support, American Family’s customer service enhances the experience of managing cheap Massachusetts auto insurance. Learn more through our American Family auto insurance review.

- Flexible Payment Options: American Family provides various payment plans, making it easier to manage premiums for cheap Massachusetts auto insurance.

Cons

- Higher Monthly Rates: Starting at $39, American Family’s rates can be higher compared to other providers, affecting the affordability of their cheap Massachusetts auto insurance.

- Limited Availability: Not all states offer American Family’s services, potentially restricting access to their cheap Massachusetts auto insurance.

#7 – Nationwide: Best for Broad Discounts

Pros

- Extensive Discounts: Nationwide offers a variety of discounts, including those for good driving and bundling, making their cheap Massachusetts auto insurance more affordable. Read more through our Nationwide auto insurance review.

- Comprehensive Coverage: A wide range of coverage options ensures that customers can find the right cheap Massachusetts auto insurance to meet their needs.

- Positive Customer Feedback: Generally positive reviews highlight Nationwide’s strong customer service and support for cheap Massachusetts auto insurance.

Cons

- Rate Variability: Nationwide’s rates can vary based on location and driver profile, which may lead to inconsistencies in pricing for cheap Massachusetts auto insurance.

- Limited Local Agents: Fewer local agents compared to competitors can affect access to in-person support for cheap Massachusetts auto insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#8 – Farmers: Best for Strong Service

Pros

- Excellent Customer Service: Farmers is known for strong customer service, enhancing the experience of managing cheap Massachusetts auto insurance. Read more through our Farmers auto insurance review.

- Numerous Discounts: Discounts for bundling and safety features contribute to making Farmers’ cheap Massachusetts auto insurance more affordable.

- Flexible Payment Plans: Various payment options for cheap Massachusetts auto insurance help customers manage their premiums more effectively.

Cons

- Higher Premiums: Monthly rates starting at $47 may be higher compared to some other providers, affecting the affordability of cheap Massachusetts auto insurance.

- Mixed Claims Handling: Reports of inconsistent claims handling could impact satisfaction with cheap Massachusetts auto insurance.

#9 – Allstate: Best for Comprehensive Coverage

Pros

- Extensive Coverage Options: Allstate offers comprehensive coverage, including unique add-ons, for cheap Massachusetts auto insurance. Read more through our Allstate insurance review.

- Good Discount Opportunities: Discounts for safe driving, bundling, and safety features help reduce the cost of cheap Massachusetts auto insurance.

- Strong Financial Stability: An A+ rating from A.M. Best reflects Allstate’s reliable financial standing, supporting their cheap Massachusetts auto insurance offerings.

Cons

- Higher Rates: Monthly rates starting at $56 can be higher compared to other options, potentially impacting the affordability of cheap Massachusetts auto insurance.

- Complex Policies: The complexity of Allstate’s coverage options might make it difficult for some customers to fully understand their cheap Massachusetts auto insurance.

#10 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Policies: Liberty Mutual offers customizable policies for cheap Massachusetts auto insurance, allowing for tailored coverage options.

- Broad Coverage Options: Provides a range of coverage and add-ons, making it possible to find suitable cheap Massachusetts auto insurance for diverse needs. Read more through our Liberty Mutual auto insurance review.

- Good Customer Support: Generally positive feedback on customer service highlights Liberty Mutual’s commitment to assisting customers with their cheap Massachusetts auto insurance.

Cons

- Higher Premiums: Monthly rates starting at $61 can be higher compared to other providers, affecting the affordability of cheap Massachusetts auto insurance.

- Limited Discount Options: Fewer discount opportunities compared to some competitors might impact the overall savings for cheap Massachusetts auto insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Massachusetts Auto Insurance Minimum Requirements

Auto insurance in Massachusetts follows what is referred to as a no-fault system, which means that should you get in an accident, your insurance company will pay for any claims you make up to your limits.

State law requires that drivers have a minimum amount of insurance coverage in four different areas: bodily injury liability, property damage liability, uninsured motorist bodily injury liability, and finally personal injury protection. Let’s take a quick look at each of these.

Massachusetts Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $56 $143

American Family $39 $99

Farmers $47 $120

Geico $28 $72

Liberty Mutual $61 $155

Nationwide $40 $103

Progressive $37 $95

State Farm $30 $78

Travelers $34 $88

USAA $21 $53

Bodily injury liability insurance essentially covers you for any injury that is caused to others in an automobile accident. This extends to medical treatment costs, rehabilitation costs, lost wages, and the like.

The minimum coverage required by state law is $20,000 per person in a single accident and $40,000 in total claims per accident (for all people involved).

Property damage liability insurance covers you for any damage that is done to someone else’s property, whether it’s their car, their fence, or a city lamp post. The minimum required coverage amount is $5,000 in Massachusetts.

This is considered somewhat low – a high-speed collision will cause much more than this amount in bodywork alone – and drivers may want to consider getting a higher amount if they can afford it.

Uninsured motorist bodily injury liability covers bodily injuries to you and your passengers in the event that you’re in an accident with someone who doesn’t have automobile insurance.

Again, this pays medical treatment costs and other associated costs stemming from injuries. The minimums are the same $20,000 per person, per accident, and $40,000 for all parties in a single accident.

Personal injury protection (PIP) auto insurance coverage takes care of you and those in your automobile in an accident regardless of fault. For instance, if you happen to swerve to avoid a deer and end up in a crash, PIP insurance will cover the costs associated with your injuries.

Massachusetts Average Auto Insurance Rates

It’s worth noting that Massachusetts drivers have a watchful state government to thank for decreasing auto insurance rates over the past few years.

In 2008, the administration of Governor Patrick and State President Murray worked to get “managed competition” auto insurance installed to ensure that drivers were able to choose from a wider variety of auto insurance companies and insurance packages.

This was considered a success; since 2008, there have been over a dozen new insurance companies that have entered the Massachusetts marketplace to offer policies to drivers, which has driven prices down through increased competition.

Average insurance rates in Massachusetts are considered to be pretty fair. Drivers can expect to pay a little over $1,100 per year for auto insurance, which works out to around $96 per month. In the first six months of 2011, this put Massachusetts at 17th overall out of the 50 states when ranked by the median auto insurance premium.

Thanks to incomes that are mostly higher than average when compared to the rest of the country, Massachusetts actually ranks first for auto insurance affordability in the nation, with just 2.5% of the average household income dedicated to auto insurance. Enter your ZIP code now to begin comparing.

Car Accident and Theft Statistics

In regards to crash statistics and traffic accident fatalities, Massachusetts drivers have been greatly improving and have a lot to be proud of. In 2008 (the most recent year for which data are available), the state saw a total of 136,384 automobile crashes and 363 fatalities as a result of these accidents.

This improvement underscores the importance of having comprehensive auto insurance coverage, which can provide financial protection against the high costs associated with car accidents, including medical expenses and vehicle repairs.

Compare this to the numbers in 2006 – 149,860 crashes and 429 fatalities – and it’s clear that driving is becoming much safer in the state. This is likely due to both increased driver care, and more stringent enforcement of driving laws and policing of roads and highways.

Tim Bain

Licensed Insurance Agent

Auto theft rates have also seen an incredible drop in the past decade in all areas throughout the state. In 2009 there were 11,735 instances of grand theft auto reported, which is quite low considering 2001 saw 27,828 vehicle thefts.

Again, this is likely due to increased law enforcement, harsher penalties for those who engage in auto theft, and better use of anti-theft devices by vehicle owners.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

State of Massachusetts Auto Insurance Resources

Explore the best auto insurance agents across Massachusetts, from the bustling urban hubs to the serene countryside. Our guide highlights top agents to protect your vehicle wherever you roam in the Bay State, ensuring you understand the various types of auto insurance coverage available to meet your needs.

Don’t buy Massachusetts auto insurance without comparing your options. Enter your ZIP code now to obtain car insurance quotes from top companies and see who has the cheapest car insurance in Massachusetts.

Frequently Asked Questions

What are the minimum auto insurance requirements in Massachusetts?

In Massachusetts, the minimum auto insurance requirements are 20/40/5 for bodily injury and property damage liability, as well as 20/40 for uninsured motorist coverage.

Additionally, personal injury protection (PIP) coverage is required with a minimum of $8,000 per person, per accident.

What is the meaning of 20/40/5 in Massachusetts auto insurance requirements?

The numbers 20/40/5 represent the minimum liability coverage limits required in Massachusetts.

It means you must have at least $20,000 in bodily injury liability coverage per person, $40,000 in bodily injury liability coverage per accident, and $5,000 in property damage liability coverage per accident. Enter your ZIP code now to begin.

What is personal injury protection (PIP) coverage?

In Massachusetts, personal injury protection (PIP) coverage is mandatory and provides benefits for medical expenses, lost wages, and other costs for you and your passengers, regardless of fault in an accident.

The minimum PIP coverage required is $8,000 per person, per accident. For women seeking affordable auto insurance quotes, understanding the specifics of PIP coverage is crucial.

It can influence your overall insurance premium and the type of coverage options available to you, ensuring you get the best value for your insurance needs.

Is Massachusetts an at-fault or no-fault state for auto insurance?

Massachusetts follows a no-fault system for auto insurance. This means that regardless of who is at fault in an accident, each person’s insurance company pays for their own medical expenses and damages up to their policy limits.

How can I find affordable auto insurance in Massachusetts?

To find affordable auto insurance in Massachusetts, it’s important to compare quotes from multiple insurance companies. By comparing rates, you can find the best coverage options at the most competitive prices.

Use our online quote comparison tool or work with an independent insurance agent to gather and compare quotes. Enter your ZIP code now to begin.

What are the average monthly rates for cheap Massachusetts auto insurance from the top 10 providers listed in the article?

When considering “How much auto insurance coverage do I need?,” it’s essential to balance cost and protection. In Massachusetts, the average monthly rates for cheap auto insurance from the top 10 providers range from $21 to $61.

USAA offers the lowest rate at $21 per month, but it’s crucial to ensure that this coverage meets your specific needs.

Evaluating your coverage requirements will help you determine if the lowest rate provides adequate protection or if you might need a policy with more comprehensive coverage.

Which company offers the lowest monthly rate for cheap Massachusetts auto insurance?

USAA provides the lowest monthly rate for cheap Massachusetts auto insurance at $21. This rate reflects their strong focus on military families and extensive coverage options.

How does the A.M. Best rating of each provider influence the reliability of their cheap Massachusetts auto insurance?

The A.M. Best rating indicates the financial strength and reliability of an insurance provider. Providers with higher ratings, like USAA and Geico, are considered more reliable for cheap Massachusetts auto insurance. Enter your ZIP code now to begin.

What are the key benefits of USAA’s cheap Massachusetts auto insurance compared to other providers?

USAA’s cheap Massachusetts auto insurance stands out not only for its military focus and exceptional customer service but also for its efficient handling of auto insurance claims.

The company is known for its streamlined claims process, which can be a significant advantage for military families who need quick and reliable support.

With competitive rates and comprehensive coverage tailored specifically to the needs of service members, USAA ensures that its customers receive excellent value and peace of mind.

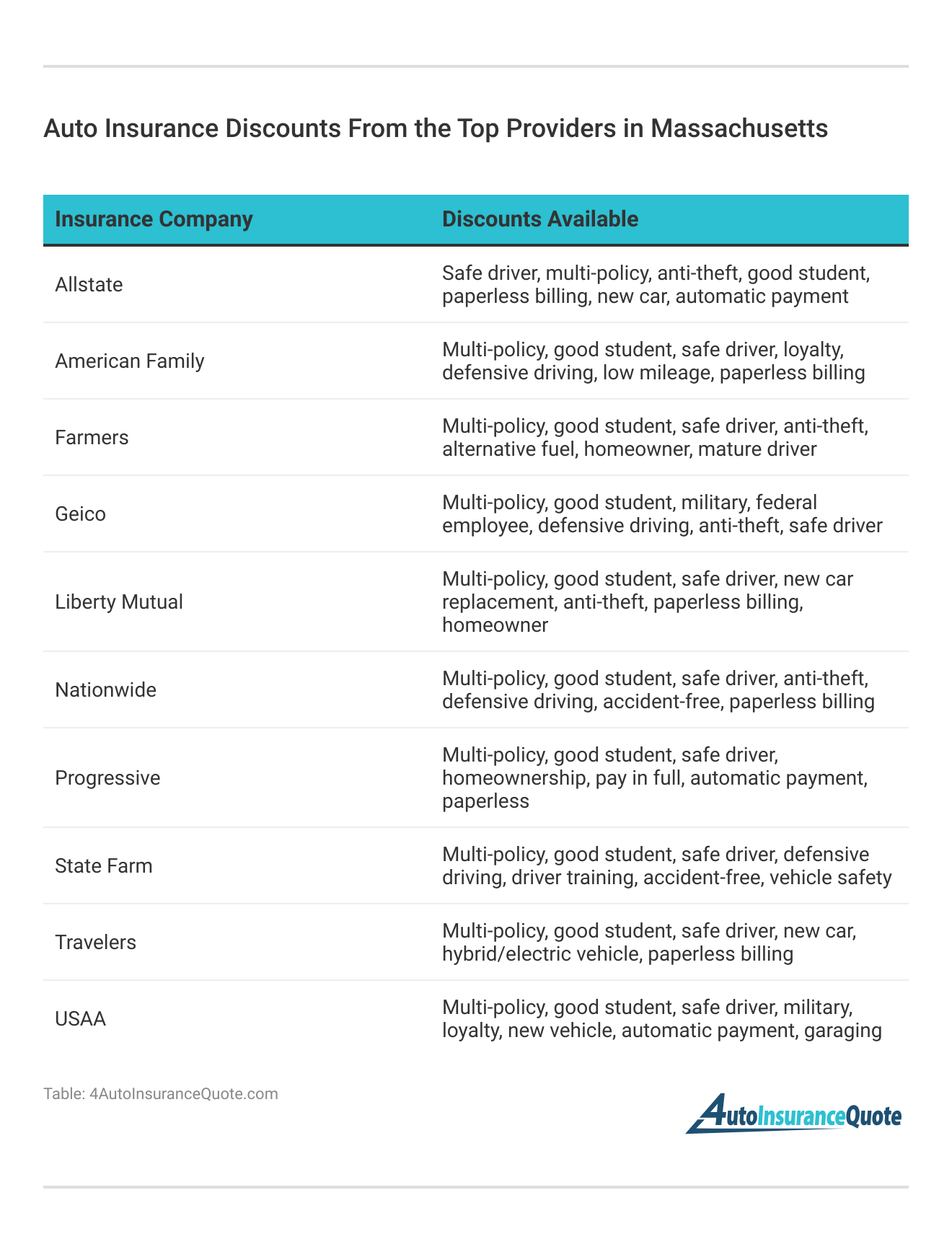

How do the discount options for cheap Massachusetts auto insurance compare among Geico, Progressive, and Nationwide?

Geico, Progressive, and Nationwide all offer competitive discounts for cheap Massachusetts auto insurance. Geico is noted for its overall competitive pricing, Progressive for its budgeting tools, and Nationwide for its broad discount options.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.