Cheap Mazda Auto Insurance in 2025 (Save Big With These 10 Companies!)

Secure cheap Mazda auto insurance starting at $38 per month from leading providers such as Geico, State Farm, and Progressive. These companies offer exceptional customer service, diverse coverage options, and significant discounts. Discover how these top providers can save you money on your Mazda auto insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michael Leotta

Insurance Operations Specialist

Michael earned a degree in Business Management with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Automatio...

Insurance Operations Specialist

UPDATED: Oct 28, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 28, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage for Mazda

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 13,283 reviews

13,283 reviewsCompany Facts

Min. Coverage for Mazda

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsGeico, State Farm, and Progressive are the top choices for cheap Mazda auto insurance, with rates beginning at $38 per month.

You can shop online for Mazda coverage by comparing instant auto insurance quotes from several insurance companies.

Comparing quotes will help you find the most affordable Mazda auto insurance without paying too much in monthly or annual rates.

Our Top 10 Company Picks: Cheap Mazda Auto Insurance| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $38 | A++ | Cheap Rates | Geico | |

| #2 | $42 | B | Customer Service | State Farm | |

| #3 | $46 | A+ | Qualifying Coverage | Progressive | |

| #4 | $53 | A+ | Vanishing Deductible | Nationwide |

| #5 | $59 | A++ | Bundling Policies | Travelers | |

| #6 | $64 | A | Policy Options | Farmers | |

| #7 | $68 | A | Costco Members | American Family | |

| #8 | $74 | A+ | Infrequent Drivers | Allstate | |

| #9 | $79 | A+ | Tailored Policies | The Hartford |

| #10 | $84 | A | Affinity Discounts | Liberty Mutual |

If you drive a Mazda, you need proper auto insurance before you can legally drive. The monthly cost of Mazda insurance is around starting at $38. Start saving on your auto insurance by entering your ZIP code above and comparing quotes.

- The monthly cost of Mazda insurance is $38

- Geico offers the cheapest auto insurance coverage for Mazdas

- Compare quotes from multiple insurers before selecting your policy

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – Geico: Top Overall Pick

Pros

- Affordable Rates: Geico offers some of the lowest rates for cheap Mazda auto insurance, starting at just $38 per month, making it an excellent choice for budget-conscious drivers.

- User-Friendly Online Tools: Their website and mobile app are highly rated, allowing you to manage your cheap Mazda auto insurance policy with ease and efficiency.

- Wide Range of Discounts: Geico provides numerous discounts, including those for safe driving and military personnel, which can further lower your cheap Mazda auto insurance premium. Check out on our “Geico Auto Insurance Review” for more details.

Cons

- Limited Customer Service Options: Geico’s customer service might not be as accessible, potentially impacting your experience with their cheap Mazda auto insurance.

- Claims Process Complexity: The claims process can be cumbersome, which might delay the resolution of your cheap Mazda auto insurance claims.

#2 – State Farm: Best for Customer Service

Pros

- Local Agents: Availability of local agents means you can get face-to-face assistance, making it easier to manage your cheap Mazda auto insurance.

- Comprehensive Coverage Options: State Farm offers a range of coverage options, allowing you to customize your cheap Mazda auto insurance to fit your needs. Explore our “State Farm Auto Insurance Review” for additional insights.

- Discounts for Safe Driving: They provide significant discounts for good driving behavior, helping to reduce your cheap Mazda auto insurance premiums.

Cons

- Higher Premiums: State Farm’s rates may be higher compared to some other providers, which could make your cheap Mazda auto insurance more expensive.

- Inconsistent Claims Experience: Some customers report varying experiences with claims, which might affect your satisfaction with State Farm’s cheap Mazda auto insurance.

#3 – Progressive: Best for Qualifying Coverage

Pros

- Competitive Rates: Progressive offers competitive pricing, helping you secure cheap Mazda auto insurance, especially for drivers with a clean record.

- Usage-Based Insurance: Their “Snapshot” program rewards good driving habits with lower rates, potentially making your cheap Mazda auto insurance even more affordable. Explore our “Progressive Auto Insurance Review” for more insights.

- Extensive Coverage Options: Progressive provides a wide range of coverage options, allowing you to customize your cheap Mazda auto insurance to meet your needs.

Cons

- Customer Service Issues: Some users report dissatisfaction with customer service, which could impact your experience with Progressive’s cheap Mazda auto insurance.

- Higher Rates for High-Risk Drivers: Drivers with a history of claims or violations might face higher rates, affecting the affordability of cheap Mazda auto insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#4 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Nationwide’s vanishing deductible program reduces your deductible over time, potentially making your cheap Mazda auto insurance more cost-effective.

- Strong Customer Satisfaction: Positive reviews for customer service enhance your experience with Nationwide’s cheap Mazda auto insurance.

- Good for Bundling: Bundling auto with home insurance can lead to significant savings, helping lower your overall cheap Mazda auto insurance costs. For further information, read our “Nationwide Auto Insurance Review” for more details.

Cons

- Higher Average Premiums: Nationwide’s rates can be higher compared to other providers, potentially impacting the affordability of your cheap Mazda auto insurance.

- Limited Discounts: Fewer discount opportunities may be available, making it more challenging to find cheaper rates for your Mazda auto insurance.

#5 – Travelers: Best for Bundling Policies

Pros

- Bundling Discounts: Travelers offers substantial discounts for bundling your auto insurance with other policies, which can lower your cheap Mazda auto insurance costs.

- Comprehensive Coverage Options: With extensive coverage options, you can customize your cheap Mazda auto insurance to include features like gap insurance.

- Flexible Payment Plans: Various payment options make managing your cheap Mazda auto insurance more convenient. Please read our “Travelers Auto Insurance Review” for more information.

Cons

- Higher Rates for High-Risk Drivers: Rates can be higher for drivers with a poor record, which may affect the affordability of cheap Mazda auto insurance.

- Customer Service Variability: Quality of customer service might vary, which could impact your experience with Travelers’ cheap Mazda auto insurance.

#6 – Farmers: Best for Policy Options

Pros

- Extensive Policy Options: Farmers offers a broad range of coverage options, allowing you to customize your cheap Mazda auto insurance to meet your needs.

- Strong Local Presence: With a network of local agents, you can receive personalized service for your cheap Mazda auto insurance. Please review our “Farmers Auto Insurance Review” for additional information.

- Good Customer Support: Generally positive reviews for customer service enhance your experience with Farmers’ cheap Mazda auto insurance.

Cons

- Higher Premiums: Rates can be higher compared to some competitors, which might make your cheap Mazda auto insurance more expensive.

- Complex Discounts: The discount structure can be difficult to navigate, potentially complicating your search for cheap Mazda auto insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#7 – American Family: Best for Costco Members

Pros

- Comprehensive Coverage Options: Offers a range of coverage options, including rental car coverage, to tailor your cheap Mazda auto insurance.

- Strong Customer Service: Known for responsive customer service, enhancing your experience with American Family’s cheap Mazda auto insurance.

- Flexible Payment Options: Various payment plans make managing your cheap Mazda auto insurance easier. To find out more, please refer to our “American Family Insurance Auto Insurance Review.”

Cons

- Higher Rates for Some Drivers: Premiums may be higher for drivers with poor records, affecting the cost-effectiveness of your cheap Mazda auto insurance.

- Limited Availability: Not available in all states, which could limit your access to their cheap Mazda auto insurance.

#8 – Allstate: Best for Costco Members

Pros

- Wide Range of Coverage Options: Offers extensive coverage options, allowing you to customize your cheap Mazda auto insurance to suit your needs.

- Strong Financial Stability: High ratings for financial stability ensure reliable support for your cheap Mazda auto insurance. Check out our “Allstate Auto Insurance Review” for additional details.

- Good Customer Service: Generally positive feedback for customer service enhances your experience with Allstate’s cheap Mazda auto insurance.

Cons

- Higher Premiums: Rates can be on the higher side, impacting the affordability of your cheap Mazda auto insurance.

- Complex Pricing Structure: The pricing can be difficult to understand, which might complicate your search for cheap Mazda auto insurance.

#9 – The Hartford: Best for Tailored Policies

Pros

- Tailored Policies: The Hartford offers customized policies that can be tailored to your needs, making it easier to find cheap Mazda auto insurance that fits you.

- Good for Older Drivers: Provides benefits and discounts for senior drivers, which can help lower your cheap Mazda auto insurance premiums.

- Strong Customer Support: Positive reviews for customer service ensure a satisfactory experience with The Hartford’s cheap Mazda auto insurance. Learn more on auto insurance policy with The Hartford.

Cons

- Higher Premiums: Rates can be higher than some competitors, which might affect the affordability of your cheap Mazda auto insurance.

- Limited Discounts: Fewer discount opportunities may be available, which could impact the cost of your cheap Mazda auto insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for Affinity Discounts

Pros

- Affinity Discounts: Liberty Mutual offers substantial discounts for members of certain organizations and professional groups, making it easier to secure cheap Mazda auto insurance and maximize savings.

- Wide Range of Coverage Options: With a variety of coverage options available, you can customize your cheap Mazda auto insurance policy to suit your specific needs and preferences. For more information, please refer to our “Liberty Mutual Auto Insurance Review.”

- Convenient Online Tools: Their user-friendly online tools and mobile app simplify managing your cheap Mazda auto insurance policy, including easy access to policy details and claims filing.

Cons

- Higher Average Premiums: Compared to some competitors, Liberty Mutual’s rates can be higher, which may impact the affordability of your cheap Mazda auto insurance.

- Complex Discount Structure: The discount structure can be intricate, potentially making it challenging to fully understand and apply all available savings to your cheap Mazda auto insurance.

Companies That Offer the Cheapest Mazda Auto Insurance

The monthly cost of Mazda insurance is around $38 per month. Still, the cost of coverage varies based on several factors. Geico offers the affordable instant auto insurance quotes for Mazda owners, though rates vary depending on the model you drive.

Mazda Auto Insurance Monthly Rates by Coverage Level & Provider| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $74 | $157 |

| American Family | $68 | $152 |

| Farmers | $64 | $147 |

| Geico | $38 | $112 |

| Liberty Mutual | $84 | $168 |

| Nationwide | $53 | $133 |

| Progressive | $46 | $129 |

| State Farm | $42 | $118 |

| The Hartford | $79 | $163 |

| Travelers | $59 | $141 |

The CX-30 crossover SUV is the cheapest Mazda to insure. Coverage for the CX-30 is around $67 less monthly than for the Mazda3 Hatchback, which is one of the most expensive Mazdas to insure.

The Type of Mazda You Drive Impacts Your Rates

The model of Mazda you have will directly impact your car insurance rates. For example, coverage for the CX-30 costs around $221 each month.

On the other hand, coverage for the Mazda3 Sedan Hatchback — the most expensive model to insure — costs $140 per month.

Mazda CX-30 insurance is cheaper than the monthly insurance cost for a Mazda CX-5. However, rates for Mazda vary, so it’s a good idea to find and compare quotes from different types of auto insurance coverage companies to see which offers the most affordable rates for your model.

Discontinued Mazda Auto Insurance

If you own a discontinued Mazda model, your insurance rates may vary based on the vehicle’s age, condition, and the availability of parts.

To find the largest insurers by market share in the region, look at those offering the best auto insurance discounts for affordable coverage.

Older or harder-to-repair models might lead to higher premiums. Discuss these factors with your insurer to understand their impact on your rates.

We can also take a closer look at the ZIP code within the state to see how rates changed based on different areas.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Cheap Insurance for a Mazda

Compared to insurance costs for other vehicles, Mazdas fall in the middle. Mazdas are cheaper to insure than a Lexus, Mercedes, or BMW, but your Mazda will likely cost more than a Toyota or Honda.

Age, gender, driving history, and credit score also affect how much you’ll pay for your Mazda coverage. Learn more about how car insurance rates are calculated here.

Find the Most Affordable Mazda Auto Insurance Today

If you’re searching for cheap Mazda auto insurance, finding the most affordable auto insurance rates coverage is crucial. Geico often offers some of the lowest monthly rates, making it a popular choice for Mazda owners. However, your specific Mazda model plays a significant role in determining your insurance costs.

Comparing quotes is a great way to find the best auto insurance companies for Mazda coverage in your area.Ty Stewart Licensed Insurance Agent

Along with Geico, State Farm and Progressive are also top providers to consider, each offering competitive rates and options tailored to your Mazda’s needs. Comparing quotes from these three insurers can help you secure the best deal on your Mazda auto insurance today.

To secure the best deal, it’s crucial to compare quotes from various car insurance companies. Start by entering your ZIP code below to find and compare rates for cheap Mazda auto insurance.

Frequently Asked Questions

Are Mazdas expensive to insure?

Your Mazda may cost more to insure than a Toyota or Honda, but coverage will likely be less than insurance for a BMW or Lexus.

Is a Mazda6 expensive to insure?

The monthly cost of coverage for a Mazda6 is $138. Coverage with State Farm costs around $129 monthly. Enter your ZIP code. Quote for today.

Is a Mazda worth buying?

According to Consumer Reports, Mazda is the most reliable car brand on the market. So, you may find that investing in a Mazda is a great choice, making it a popular choice for those seeking affordable auto insurance.

Why is Mazda3 insurance so high?

Mazda3 insurance costs are often high. While the Mazda3 Sedan is an affordable car, coverage for the car costs around $140 each month.

Does the location where I live affect Mazda auto insurance rates?

Yes, your location can impact Mazda auto insurance rates. Factors such as the crime rate, population density, and traffic conditions in your area can influence the cost of insurance. Enter your ZIP code now to begin comparing.

How can I find the cheapest Mazda auto insurance?

Compare quotes from multiple providers online and look for discounts to find the cheapest Mazda auto insurance.

Gain insights by reading our article titled “Is it cheaper to insure a new car or an old car?”

What factors affect cheap Mazda auto insurance rates?

Rates are influenced by your Mazda model, driving history, location, age, and available discounts.

Which Mazda models are cheaper to insure?

Models like the Mazda CX-30 are generally cheaper to insure than others like the Mazda3 Hatchback. Enter your ZIP code now to begin comparing.

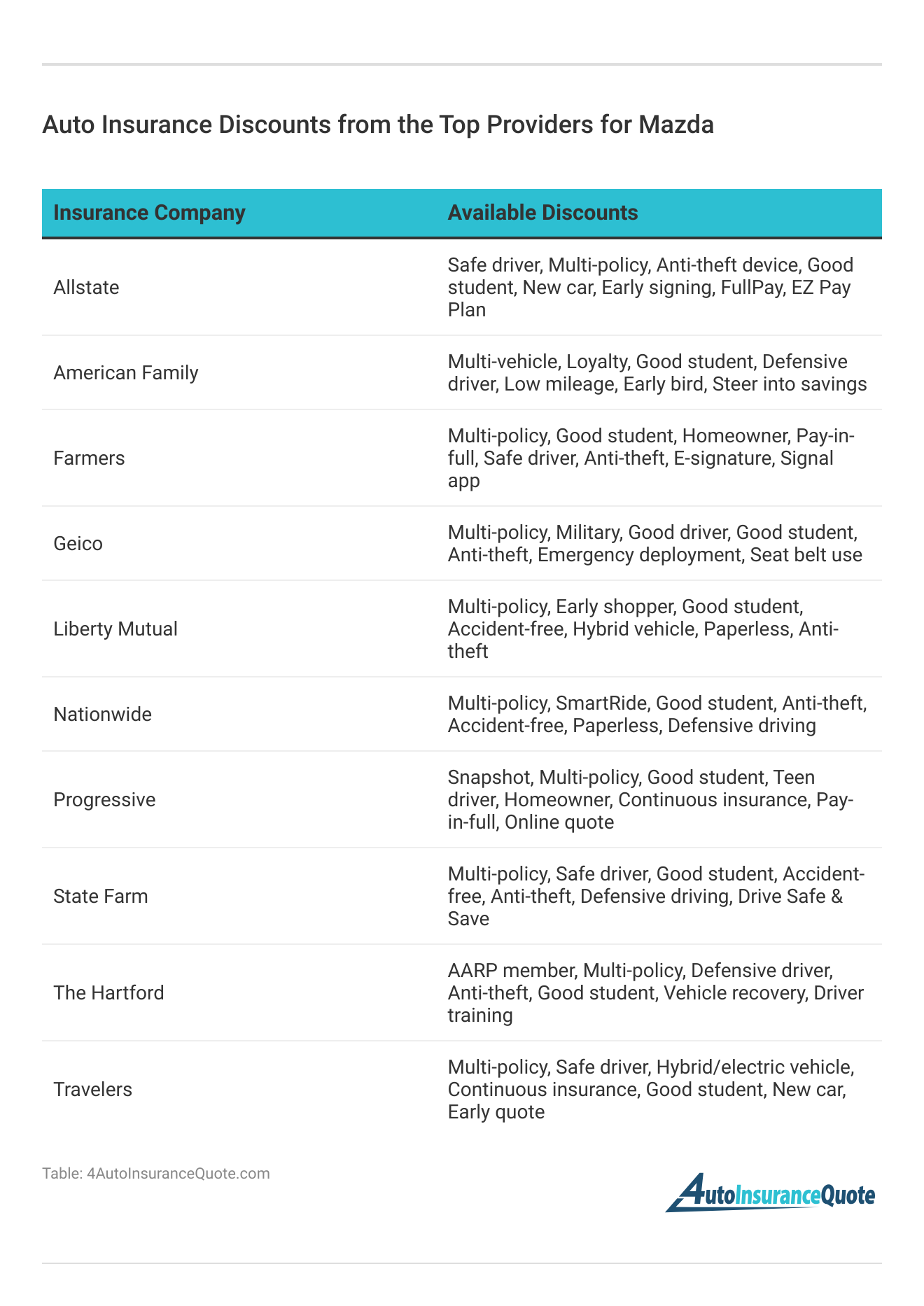

How do discounts affect Mazda auto insurance costs?

Discounts for safe driving, bundling, and memberships can lower the cost of cheap Mazda auto insurance which is significantly lower than the average cost of auto insurance.

What types of discounts can help reduce my Mazda auto insurance costs?

Discounts such as safe driver discounts, multi-policy bundles, and organizational memberships can help reduce your Mazda auto insurance costs.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Michael Leotta

Insurance Operations Specialist

Michael earned a degree in Business Management with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Automatio...

Insurance Operations Specialist

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.