Cheap South Carolina Auto Insurance in 2025 (Get Low-Cost Coverage With These 10 Companies)

You can find cheap South Carolina auto insurance with USAA, Geico, and State Farm, with monthly rates starting at $28. These companies offer the lowest rates along with discounts, excellent options from South Carolina looking for budget-friendly coverage. Learn more about how these providers can help you save.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

UPDATED: Oct 28, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 28, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage in SC

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage in SC

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsGetting cheap South Carolina auto insurance is a quick and simple process. If you’re looking for information about South Carolina auto insurance policies, you’re in the right place. With millions of people in cars driving around the state, understanding auto insurance policies in South Carolina is important.

We examine essential elements that affect insurance premiums, including driving history, location, and coverage options, to assist you in navigating the insurance market efficiently.

Our Top 10 Company Picks: Cheap South Carolina Auto Insurance

Company Rank Monthly Rate Good Driver Discount Best For Jump to Pros/Cons

#1 $28 10% Military Families USAA

#2 $33 25% Cheap Rates Geico

#3 $36 15% Financial Strength State Farm

#4 $42 10% Qualifying Coverage Progressive

#5 $43 10% Bundling Policies Travelers

#6 $49 10% Deductible Savings Nationwide

#7 $50 15% Customer Service American Family

#8 $55 20% Customized Policies Allstate

#9 $69 15% Safe Drivers Farmers

#10 $76 12% Affinity Discounts Liberty Mutual

Before you buy the cheap South Carolina auto insurance, make sure you shop around. Enter your ZIP code now for free South Carolina auto insurance quotes.

- South Carolina drivers are required to have 25/50/10 liability insurance

- The starting cost of insurance in South Carolina is $28 per month

- Comparing quotes can help divers find additional savings on their insurance

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – USAA: Top Overall Pick

Pros

- Exclusive Discounts: Military families can benefit from special discounts that are not available to the general public, significantly lowering premiums.

- Top-Rated Customer Service: USAA consistently receives high ratings for customer support and claims processing, reflecting a commitment to excellent service.

- Comprehensive Coverage Options: Provides a wide range of coverage tailored to military needs, including unique options like deployment coverage. Read more through our USAA auto insurance review.

Cons

- Limited Eligibility: Only available to active duty military, veterans, and their families, excluding the general population from access.

- Few Local Offices: Limited physical locations may make in-person support less accessible for some customers.

#2 – Geico: Best for Cheap Rates

Pros

- Low Rates: Known for competitive pricing, often providing some of the most affordable premiums in the industry.

- Wide Accessibility: Geico operates in all 50 states, ensuring coverage is available nationwide.

- Variety of Discounts: Provides multiple discounts for various customer profiles, including good drivers, students, and military members.

Cons

- Mixed Customer Service: Some customers report less satisfactory experiences with customer service, which can impact overall satisfaction.

- Limited Personal Interaction: The emphasis on online and call-center support can result in less personalized service compared to face-to-face interactions. Check out our Geico auto insurance review for more details.

#3 – State Farm: Best for Financial Strength

Pros

- Extensive Local Agent Network: A large network of local agents offers personalized advice and support, which can be beneficial for complex insurance needs. Explore our State Farm auto insurance review for additional insights.

- Flexible Coverage: Provides a wide array of coverage options and add-ons, allowing customization based on individual needs.

- Good Discounts: Offers multiple discounts for safe driving, bundling policies, and more, potentially lowering overall costs.

Cons

- Potentially Higher Premiums: Premiums can be higher than some competitors, particularly for drivers with less-than-perfect records.

- Varied Agent Experience: The quality of service can vary depending on the local agent, leading to inconsistent experiences.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#4 – Progressive: Best for Qualifying Coverage

Pros

- Innovative Programs: The Snapshot program allows drivers to potentially earn discounts based on their driving behavior, encouraging safe driving.

- Competitive Pricing: Generally offers affordable rates with a range of discounts to help reduce premiums.

- Diverse Coverage Options: Provides a broad selection of coverage types and optional add-ons to suit various needs. Explore our Progressive auto insurance review for more insights.

Cons

- Inconsistent Customer Service: Customer service reviews are mixed, with some users reporting issues with claim processing and support.

- Rates May Fluctuate: Premiums can vary based on factors like driving behavior tracked by the Snapshot program, which might not be predictable.

#5 – Travelers: Best for Bundling Policies

Pros

- Bundling Savings: Offers significant discounts when combining auto insurance with other policies, such as home or renters insurance.

- Customizable Policies: Provides a wide range of options and add-ons to tailor coverage to specific needs.

- Reliable Claims Process: Generally known for efficient and reliable claims processing. Please read our Travelers auto insurance review for more information.

Cons

- Potentially Higher Costs: Premiums may be higher compared to some competitors, particularly if bundling is not an option.

- Customer Service Issues: Some customers experience delays or issues with customer service, which can affect overall satisfaction.

#6 – Nationwide: Best for Deductible Savings

Pros

- Deductible Savings Program: Allows customers to reduce their deductible with certain policy options, potentially lowering out-of-pocket expenses.

- Wide Range of Discounts: Offers various discounts, including those for safe driving, multiple policies, and more, which can help lower premiums.

- Positive Customer Reviews: Generally favorable reviews for customer service and support contribute to overall satisfaction. For further information, read our Nationwide auto insurance review for more details.

Cons

- Higher Premiums for Some Drivers: Premiums can be higher, particularly for drivers with less-than-ideal records or high-risk profiles.

- Mixed Claims Experience: Some customers report inconsistent experiences with the claims process, impacting satisfaction.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#7 – American Family: Best for Customer Service

Pros

- High Customer Satisfaction: Known for excellent customer service, with high ratings for support and claims handling. To find out more, please refer to our American Family insurance auto insurance review.

- Variety of Coverage Options: Offers a comprehensive range of coverage types and add-ons to meet diverse needs.

- Discount Opportunities: Provides multiple discounts for safe driving, bundling policies, and other factors to help reduce premiums.

Cons

- Premiums Can Be Higher: Generally has higher premiums compared to some other insurance providers, which might be a concern for budget-conscious customers.

- Availability: Not available in every state, limiting options for some potential customers.

#8 – Allstate: Best for Customized Policies

Pros

- Good Digital Tools: Provides strong online tools and a mobile app for managing policies, tracking claims, and accessing information.

- Local Agent Network: Extensive network of local agents for personalized service and support.

- Variety of Discounts: Includes discounts for safe driving, bundling, and more, potentially lowering premiums. Check out our Allstate auto insurance review for additional details.

Cons

- Higher Premiums: Premiums can be higher than some competitors, especially for drivers with higher risk profiles.

- Variable Service Quality: Customer service experiences can vary, with some reports of inconsistent support and service quality.

#9 – Farmers: Best for Safe Drivers

Pros

- Good Discounts for Safe Drivers: Offers notable discounts for maintaining a clean driving record, rewarding safe driving behavior.

- Financial Stability: Strong financial ratings ensure the insurer can handle claims and provide reliable coverage. Please review our Farmers auto insurance review for additional information.

- Broad Range of Discounts: Includes discounts for bundling policies, good driving, and other factors to help lower costs.

Cons

- Potentially Higher Costs: Premiums may be higher compared to some other insurance providers, impacting affordability.

- Customer Service Concerns: Some customers report issues with the quality of service and claims handling, affecting overall satisfaction.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for Affinity Discounts

Pros

- Affinity Discounts: Offers discounts for various memberships and affiliations, potentially lowering premiums.

- Comprehensive Coverage Options: Provides a wide selection of coverage types and optional add-ons for personalized protection.

- Good Online Tools: The mobile app and website are user-friendly for managing policies, filing claims, and accessing information. For more information, please refer to our Liberty Mutual auto insurance review.

Cons

- Higher Rates for Some Drivers: Premiums can be higher, particularly for drivers with high-risk profiles or less-than-perfect records.

- Customer Service Variability: Mixed reviews on customer service and claims processing can impact overall satisfaction.

South Carolina Auto Insurance Rates

When thinking about auto insurance, price is usually the top concern. In South Carolina, the average premium is $1,339.44, which is about $100 less than the national average. To find the best deals, it’s important to know how to compare auto insurance quotes.

South Carolina Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $55 $133

American Family $50 $118

Farmers $69 $166

Geico $33 $79

Liberty Mutual $76 $185

Nationwide $49 $118

Progressive $42 $105

State Farm $36 $88

Travelers $43 $105

USAA $28 $69

This rate doesn’t fluctuate much in urban areas either. In the cities of Columbia and Charleston, the prices increase by about $100, making them on par with the premiums of the United States in general.

South Carolina Auto Insurance Minimums and Laws

Now that the price is out of the way, you should be asking yourself is: What am I getting for this $1,400 in insurance premiums? Well, the state of South Carolina requires that you get many different types of coverage, so it can be assumed that you’ll be getting quite a bit for the premium you pay.

First of all, the state follows a tort system, which makes it so that someone must be at fault for the accident and that person’s insurance company is responsible for paying for all the damages of the accident.

As with all other states, South Carolina has a set of liability limits that you must meet when you purchase auto insurance. These liability limits are for bodily injury and property damage.

The state of South Carolina requires that you have at least $25,000 in coverage per person for bodily injury, with a maximum of $50,000 per accident.

This coverage ensures that any medical expenses incurred by the other driver, passengers, or even pedestrians as a result of the accident will be paid for when you are found at fault.

Medical bills can be incredibly expensive, so you should consider increasing this coverage to protect yourself financially.

Along with the bodily injury requirement, South Carolina sets a minimum limit on the coverage for property damage at $25,000. This covers the damages to the vehicle you damaged if you are found to be at fault for the accident.

South Carolina state law also requires other areas of coverage that many states do not. The state has a set of uninsured motorist bodily injury and property damage liabilities.

Since the state follows a tort system, these required coverages make sure that you will still be covered if you are not at fault and the person who caused the accident does not have insurance.

With a minimum limit of $25,000 for both bodily injuries and property damages, this would be personal safety coverage to prevent you from paying anything out of pocket because someone caused an accident without any insurance.

We can also take a closer look at the ZIP code within the state to see how rates changed based on different areas.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

South Carolina Auto Insurance Rates by Company

Though the state boasts cheap South Carolina auto insurance rates overall, let’s take a look at how rates vary between some of the largest companies.

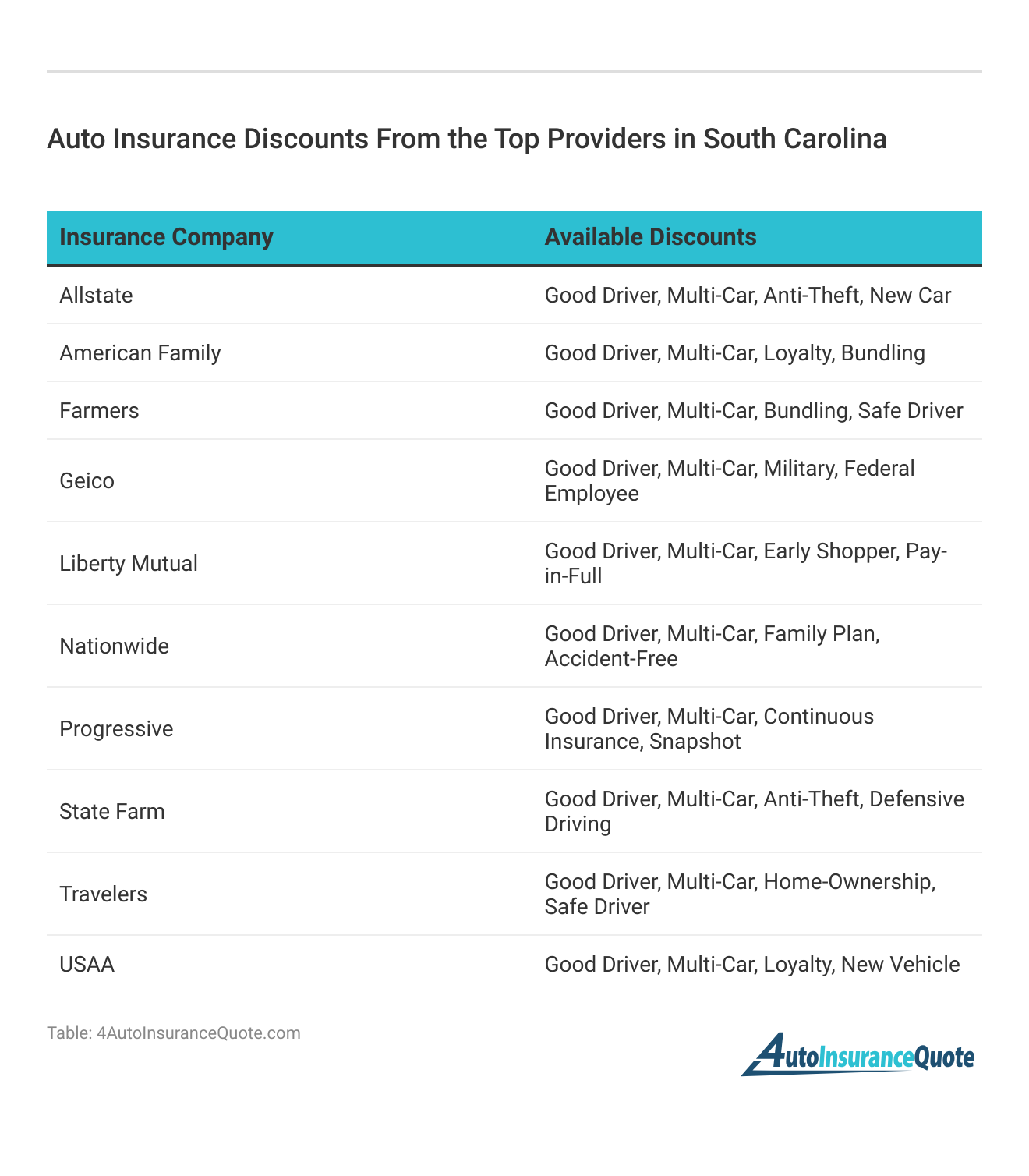

To find the largest insurers by market share in the region, look at those offering the best auto insurance discounts for affordable coverage. These companies often lead the market due to their attractive pricing and discount options.

Comparing Auto Insurance Quotes in South Carolina

With the pricing and packages explained, it’s still important to do as much research as possible before making any big buys. Along with that, you should also consult more than one insurance provider to see what they can offer you apart from the policy itself.

Tim Bain Licensed Insurance Agent

All of these should be considered when deciding on an auto insurance policy. At 4AutoInsuranceQuote.com we try our best to provide the most accurate and comprehensive information for you so you can find the best deals for auto insurance.

If you’re ready to find affordable South Carolina auto insurance, we can help. Compare South Carolina auto insurance rates by entering your ZIP code below.

Frequently Asked Questions

What are the minimum auto insurance coverage requirements in South Carolina?

In South Carolina, the state liability coverage minimums are $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $25,000 for property damage per accident.

Additionally, the state requires uninsured motorist coverage with minimum limits of $25,000 for bodily injury and $25,000 for property damage.

What is the average cost of auto insurance in South Carolina?

The average cheap South Carolina auto insurance rate is $28 per month. This average rate is lower than the national average. Enter your ZIP code. quote for today.

Does South Carolina follow a tort system for auto insurance?

Yes, South Carolina follows a tort system, which means that someone must be found at fault for an accident, and that person’s insurance company is responsible for paying for the damages.

Uncover additional insights in our article called “Cheap Tesla Auto Insurance.”

Are there any optional coverage choices available in South Carolina?

Yes, South Carolina allows for optional coverage choices, which include additional types of coverage such as comprehensive coverage, collision coverage, and medical payments coverage.

How can I find affordable auto insurance in South Carolina?

To find affordable auto insurance in South Carolina, it is recommended to shop around and compare quotes from multiple insurance companies. Using online tools and resources can help you compare rates and find the best coverage options for your needs.

Explore your auto insurance options by entering your ZIP code into our free comparison tool today.

What factors influence the cost of auto insurance in South Carolina?

Factors include driving history, age, gender, location, vehicle type, and credit score. Insurance companies also consider claims history and coverage amounts.

Gain insights by reading our article titled “Is it cheaper to insure a new car or an old car?“

Are there specific discounts available for South Carolina drivers that can lower their premiums?

Yes, discounts may include safe driver, multi-policy, good student, and safety feature discounts. Completing defensive driving courses can also lower premiums.

How can South Carolina drivers improve their chances of getting cheaper auto insurance?

Maintain a clean driving record, improve your credit score, and take defensive driving courses. Shopping around for quotes can also help.

Enter your ZIP code to find the most affordable quotes in your area.

Can you find affordable auto insurance in South Carolina if you have a poor driving record?

It’s challenging but possible. Some insurers specialize in high-risk drivers, so shopping around and comparing quotes is crucial.

Discover a wealth of knowledge in our “Affordable Preferred Auto Insurance.”

What are some tips for comparing auto insurance rates and finding the best deal in South Carolina?

Compare quotes from multiple insurers, check for available discounts, and evaluate coverage options. Consider insurer reputation and adjust deductibles to balance cost and protection.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.