Cheap Acura Auto Insurance in 2025 (Big Savings With These 10 Companies!)

Farmers, Erie, and Travelers are the top providers for cheap Acura auto insurance, offering competitive rates and comprehensive coverage. With monthly rates starting at $72, these companies provide the best options for car insurance, combining affordability, reliability, and excellent customer service.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

1,883 reviews

1,883 reviewsCompany Facts

Min. Coverage for Acura

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews 1,733 reviews

1,733 reviewsCompany Facts

Min. Coverage for Acura

A.M. Best Rating

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviews

The best providers for cheap Acura auto insurance are Farmers, Erie, and Travelers, offering competitive rates and comprehensive coverage. This article delves into how these companies excel in providing affordable options while maintaining reliability and excellent customer service.

Our Top 10 Company Picks: Cheap Acura Auto Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $72 A Bundle Savings Farmers

#2 $75 A+ Online Discounts Erie

#3 $76 A++ Affordable Rates Travelers

#4 $78 A+ Customer Service Progressive

#5 $80 A Custom Coverage American Family

#6 $82 A Good Drivers Liberty Mutual

#7 $85 A+ Roadside Assistance Allstate

#8 $88 B New Vehicles State Farm

#9 $90 A++ Safe Drivers Kemper

#10 $92 A++ Competitive Rates Geico

Discover how to find affordable insurance for your Acura and save more, despite its luxury status and other price-increasing factors. Then, get instant auto insurance quotes to compare rates and find the best Acura insurance policy for you.

- Affordable Acura Auto Insurance Quotes

Get started on comparing full coverage auto insurance rates by entering your ZIP code above.

#1 – Farmers: Top Overall Pick

Pros

- Bundle Discounts: Save significantly by bundling multiple policies. Learn more in our guide “Farmers auto insurance review.”

- Strong Customer Support: Known for exceptional customer service.

- Comprehensive Coverage: Offers a wide range of coverage options.

Cons

- Limited Online Tools: Fewer online tools and resources compared to some competitors.

- Higher Premiums: Premiums might be higher without bundling.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#2 – Erie: Best for Online Discounts

Pros

- Online Discounts: Offers substantial discounts for purchasing policies online.

- Accident Forgiveness: Includes accident forgiveness to prevent premium increases.

- Excellent Ratings: A+ rating for financial stability. See more details on our article titled “Erie Auto Insurance Review: Can you get affordable quotes?“

Cons

- Limited Availability: Coverage is not available in all states.

- Fewer Agents: Fewer local agents compared to larger insurers.

#3 – Travelers: Best for Affordable Rates

Pros

- Competitive Rates: Offers some of the most affordable rates in the market.

- Extensive Coverage Options: Wide range of coverage options available.

- Strong Financial Stability: A++ rating from A.M. Best. Access comprehensive insights into our titled Travelers auto insurance review.

Cons

- Average Customer Service: Customer service is rated as average.

- Complex Discounts: Discounts can be complex and difficult to understand.

#4 – Progressive: Best for Customer Service

Pros

- Superior Customer Service: Known for top-notch customer service.

- Usage-Based Discounts: Discounts for low-mileage drivers. More information is available about this provider in our guide “Progressive Auto Insurance Review.”

- Innovative Tools: Advanced online tools and mobile app features.

Cons

- Higher Rates: Premiums can be higher compared to competitors.

- Policy Complexity: Some policies can be complex to understand.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#5 – American Family: Best for Custom Coverage

Pros

- Customizable Policies: Highly customizable coverage options.

- Family-Friendly Discounts: Discounts tailored for families. Read up on the “American Family Insurance Auto Insurance Review” for more information.

- Strong Customer Satisfaction: High ratings for customer satisfaction.

Cons

- Higher Premiums: Premiums can be higher without discounts.

- Limited Availability: Not available in all states.

#6 – Liberty Mutual: Best for Good Drivers

Pros

- Good Driver Discounts: Substantial discounts for good drivers.

- Accident Forgiveness: Offers accident forgiveness policies. Check out insurance savings in our complete “Liberty Mutual Auto Insurance Review.”

- Flexible Payment Plans: Various payment plans to fit different budgets.

Cons

- Higher Rates for Risky Drivers: Higher premiums for drivers with past incidents.

- Mixed Customer Reviews: Customer service reviews are mixed.

#7 – Allstate: Best for Roadside Assistance

Pros

- Comprehensive Roadside Assistance: Exceptional roadside assistance services.

- Safe Driving Rewards: Rewards programs for safe drivers. Discover more about offerings in our article called “Allstate vs. USAA: Which Offers More Affordable Auto Insurance Quotes.”

- Extensive Coverage Options: Wide range of coverage choices.

Cons

- High Premiums: Higher than average premiums.

- Complex Discounts: Discounts can be difficult to qualify for.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#8 – State Farm: Best for New Vehicles

Pros

- New Vehicle Discounts: Discounts for insuring new vehicles.

- Nationwide Coverage: Available nationwide with numerous local agents.

- Financial Stability: Strong financial stability ratings. Access comprehensive insights into our guide “State Farm Auto Insurance Review: Can you get affordable quotes?“

Cons

- Limited Discounts: Fewer discount options compared to competitors.

- Higher Rates: Premiums can be higher without discounts.

#9 – Kemper: Safe Drivers Specialist

Pros

- Safe Driver Discounts: Significant discounts for safe drivers.

- Flexible Coverage: Offers a variety of flexible coverage options.

- Accident Forgiveness: Includes accident forgiveness policies. Delve into our evaluation of “Kemper Auto Insurance Review: Can you get affordable quotes?“

Cons

- High Premiums for High-Risk Drivers: Higher rates for drivers with past incidents.

- Limited Online Tools: Fewer online tools and resources available.

#10 – Geico: Best for Competitive Rates

Pros

- Competitive Rates: Known for offering some of the lowest rates.

- Strong Financial Ratings: A++ rating from A.M. Best. If you want to learn more about the company, head to our guide “Geico Auto Insurance Review.”

- Easy Online Tools: User-friendly online tools and mobile app.

Cons

- Mixed Customer Service: Customer service experiences are mixed.

- Limited Customization: Fewer options for policy customization.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Acura Auto Insurance Monthly Rates: Minimum vs. Full Coverage

When it comes to insuring your Acura, understanding the different coverage levels and associated rates is crucial. Below is a comparison of the monthly insurance rates for minimum coverage and full coverage from top insurance providers, helping you make an informed decision based on your budget and coverage needs.

Acura Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $85 $160

American Family $80 $155

Erie Insurance $75 $150

Farmers Insurance $72 $145

Geico $92 $170

Kemper $90 $165

Liberty Mutual $82 $160

Progressive $78 $155

State Farm $88 $165

Travelers $76 $150

The rates vary significantly between minimum and full coverage options. For minimum coverage, Farmers Insurance offers the lowest rate at $72 per month, followed closely by Erie Insurance at $75. On the other hand, Geico has the highest minimum coverage rate at $92 per month.

For full coverage, Farmers Insurance also leads with the lowest rate at $145 per month, while Geico has the highest rate at $170 per month.

Understanding these rates can help you choose the right coverage for your Acura without compromising on protection. Learn more in our article called “Affordable Full Coverage Auto Insurance.”

Understanding Acura Auto Insurance Quotes

Auto insurance is a contract between an insurance company and a policyholder that provides financial protection in the event of an accident or other loss. It helps cover medical expenses, repair costs, legal fees, and any other related financial losses resulting from the accident. See more details on our guide “Auto Accident FAQs.”

In addition to providing coverage for damages caused by a car accident, most auto insurance policies also provide liability coverage if you are found liable for causing another person’s injury or property damage.

Carrying auto insurance is not only important but necessary. Many states require drivers to carry at least minimum levels of auto insurance as defined by state law.

Insurance companies set rates based on factors like age, driving history, credit score, and more to determine how much coverage you will need and how much you should pay for it. The higher the risk of an accident, the more expensive your policy will be.

In addition to protecting yourself financially in case of an accident, having auto insurance is also important because it provides peace of mind knowing that if something goes wrong, you are covered.

Without auto insurance, drivers would be solely responsible for any damages or injuries they cause while operating a vehicle. This could lead to serious financial repercussions beyond what most people can handle.

Farmers offers the most competitive rates for Acura insurance.Kristen Gryglik Licensed Insurance Agent

Although many drivers think they can get away with driving without auto insurance, the consequences far outweigh the costs of purchasing a policy. Not only does it keep you legal, but buying car insurance makes sure you and your car are protected while you’re driving.

Having appropriate auto insurance coverage is essential for anyone on the roads today and is required by law in most states. For luxury vehicles like Acuras, having the right coverage is even more important, as expensive repairs and replacement parts can quickly add up.

Progressive, The Hartford, and Travelers offer competitive rates not only for Acura auto insurance but also for Acura TLX car insurance. Acura quotes vary widely based on factors like model year and driving history, influencing Acura insurance cost significantly.

When considering luxury vehicles, such as Acuras, prospective buyers often wonder, “Are Acuras expensive to insure?” The answer depends on the specific model and its safety features, with comprehensive coverage options like liability and collision being crucial for protecting your investment.

Types of Insurance for Acuras

When it comes to protecting your Acura, there are several types of coverage available that can provide the financial protection you need. Liability auto insurance is one of the most important forms of coverage and is typically required by law in most states.

Liability auto insurance coverage helps protect other drivers and their property if you are found responsible for causing an accident. This type of coverage generally covers medical bills and repair costs for the other driver.

In addition to liability insurance, comprehensive and collision coverage is another important form of auto insurance to consider when insuring your Acura.

This type of coverage pays out for any damage caused to your vehicle from a variety of events like theft or vandalism, as well as accidents resulting from things like hail, fire, or flooding. If you’re involved in a collision, it can help cover the cost of repairs or replacements for your Acura and any related medical costs.

When selecting an auto insurance policy with coverage tailored to your specific needs, there are several factors to consider. The type of car you own is important as luxury vehicles tend to be more expensive to repair than other types of cars.

Your driving history, age, and where you live will also affect the rate you pay for coverage. It’s important to shop around and compare different coverage policies from multiple companies so that you can get the best deal for your specific needs.

Ultimately, having appropriate auto insurance is essential for anyone who owns an Acura. Not only does it provide financial protection in case of an accident, but it can also give you peace of mind knowing that if something goes wrong, you’re covered.

By being informed on different types of auto insurance coverage options and understanding their importance, you can make sure your Acura is properly protected from potential accidents or other damages.

While there may be some upfront costs associated with purchasing a policy for protection, the cost of not carrying auto insurance far outweighs any financial savings for drivers who choose to go uninsured.

Tailor your coverage with Farmers for the best Acura insurance policy.Jeffrey Manola Licensed Insurance Agent

Liability coverage is essential for providing protection to other drivers and their property, while comprehensive and collision coverage are just as important for protecting your own vehicle.

Taking the time to compare policies from different companies is one of the best ways to ensure that you’re getting the right coverage at the lowest rate possible.

With proper auto insurance coverage in place, owners of Acuras can enjoy peace of mind when they hit the road.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Compare Companies to Find Affordable Acura Auto Insurance Quotes

Comparing rates and coverage options for Acura vehicles is essential in order to ensure that you get the best auto insurance policy at the lowest rate possible.

Shopping around and comparing different policies from multiple companies is one of the most effective ways to save on auto insurance for your Acura.

When comparing policies, it’s important to consider a variety of factors, including the type of coverage, deductible amount, limits, and premiums.

Knowing what type of coverage you need is also important, as luxury vehicles like Acuras often require more comprehensive coverage than other types of cars.

Comprehensive and collision coverage are typically recommended for owners of these types of cars as they provide protection against damages resulting from a variety of events, such as theft or vandalism, accidents caused by weather, and collisions. It is important to note that there are differences between collision and comprehensive coverage.

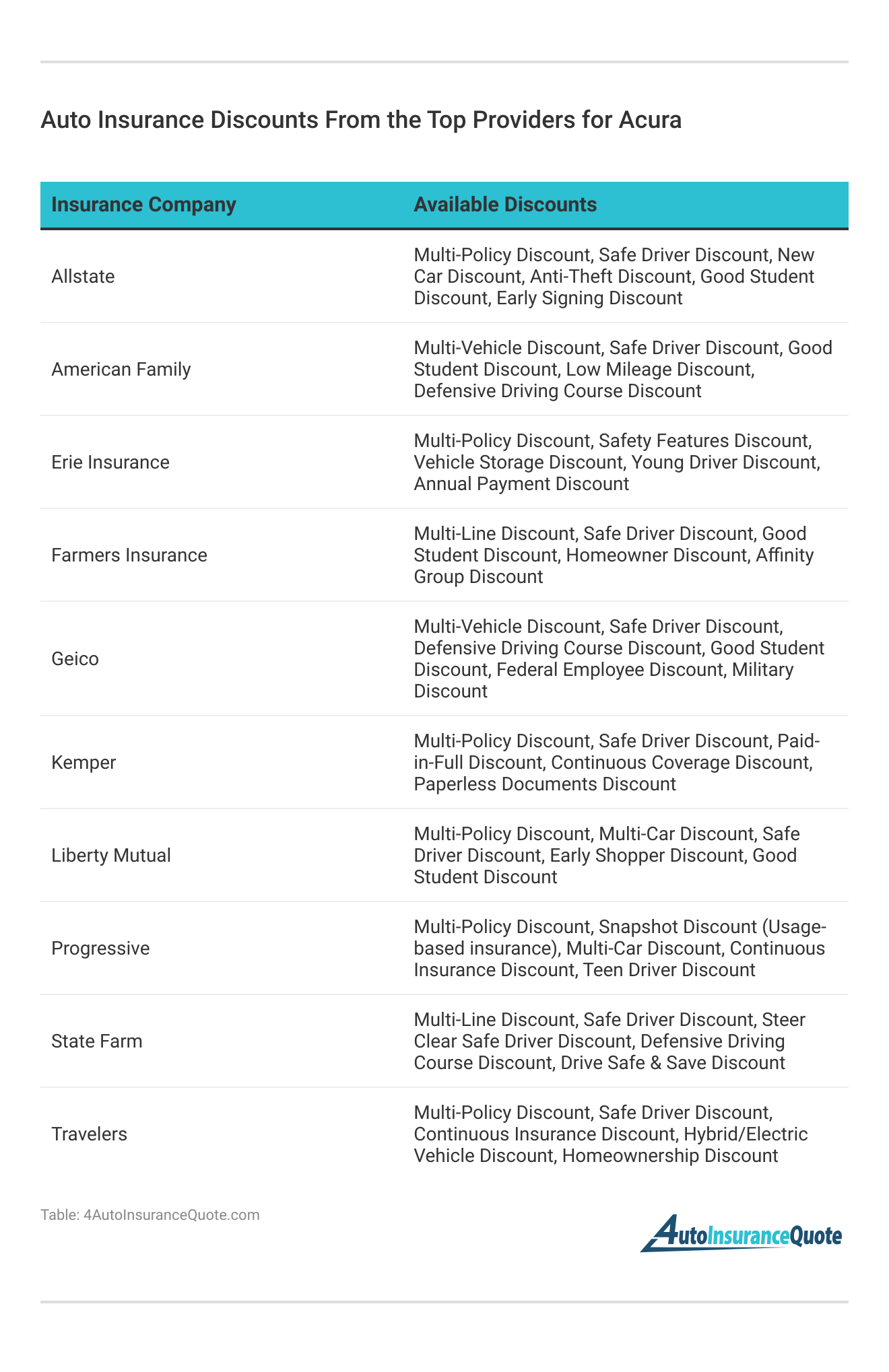

It’s also good to ask your insurance provider about any discounts they may offer that can help reduce the cost of your coverage.

Many companies offer discounts for safe drivers who have a clean driving record or those who maintain multiple policies with the same company. Other common discounts include those for younger drivers, military personnel, and people who pay their premiums in full upfront rather than on a monthly basis.

When it comes to selecting an insurance company, there are several factors to consider. Doing research on multiple companies can help you determine which one is best for your specific needs.

Reading customer reviews and looking at financial ratings from independent rating agencies are two great ways to get an idea of how well each company performs.

Farmers stands out for its comprehensive and affordable Acura insurance options.Justin Wright Licensed Insurance Agent

Additionally, you should make sure to consider the company’s customer service record and how helpful they are when it comes to filing claims or answering questions. Check out insurance savings in our complete guide “How to File an Auto Insurance Claim.”

By taking the time to compare policies from several companies, researching discounts and rating agencies, and considering customer service reviews, you can be sure that you’ll find the best insurance for an Acura at an affordable price.

With the right coverage in place, you can enjoy peace of mind knowing that your luxury car is protected against damages or other unfortunate events.

Navigating Auto Insurance Rates for Your Acura Model

This table presents a comprehensive summary of auto insurance rates for the Acura TLX model. It includes detailed information to help Acura TLX owners and potential buyers understand the insurance cost implications associated with this specific vehicle.

Acura Auto Insurance Cost by ModelFactors That Affect Finding Affordable Acura Auto Insurance Quotes

One of the most significant factors that can influence your insurance premium is the type of coverage you choose. If you select a policy with comprehensive and collision coverage, for instance, your premiums will likely be higher than if you only chose liability coverage.

This is because these types of policies provide more extensive protection in the event of an accident or other damage to your vehicle.

Your driving record is also an important factor in determining what your insurance premium will be, as drivers who have a history of traffic violations or accidents will generally pay higher rates than those with clean records. Check out insurance savings in our complete guide “How long does it take for an accident to get off your record?”

Additionally, the gender and age of the driver may also affect premiums, as younger and male drivers are often seen as higher risk due to their inexperience behind the wheel or their tendency to drive faster. Your age will affect auto insurance in various stages of your life, with teens and seniors paying the most.

The choice of your vehicle plays a crucial role in determining your insurance premiums. Affordable sports car auto insurance quotes are essential to consider, especially since luxury or sports cars typically incur higher rates compared to vehicles deemed safer and less expensive to insure.

The age of your vehicle also impacts your rates. For example, insurance for a new Acura usually costs more than coverage for an older model.

Additionally, the region in which you live may affect your rates, as some areas may be more prone to car theft than others.

Finally, many insurance companies offer discounts for certain types of drivers or policies. For instance, safe drivers who maintain a clean driving record may qualify for discounts, as well as those who bundle multiple policies with the same company or pay their premiums in full upfront rather than every month.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Get Affordable Acura Auto Insurance Quotes

Acura vehicles are known for their luxury and style but can also be expensive to insure. Fortunately, there are a variety of ways you can get affordable insurance for an Acura.

By researching multiple companies, taking advantage of any discounts that may be available, and considering customer service reviews and ratings from independent rating agencies, you can ensure that you will find the best coverage at an affordable price.

Finally, staying up to date with your driving record and maintaining a safe driving history will help you get lower premiums on your policy in the long run. You can learn how to lower your auto insurance rates here.

Uncover affordable auto insurance rates from the top providers by entering your ZIP code below.

Frequently Asked Questions

Is an Acura expensive to insure?

Finding affordable Acura auto insurance quotes can be difficult because of its luxury status and performance capabilities. However, by researching multiple companies and taking advantage of any discounts available, you may be able to find an affordable insurance policy for your Acura vehicle.

To find out more, explore our guide titled “Auto Insurance Quotes by Vehicle.”

How much is insurance for an Acura?

Acura insurance rates depend on a variety of factors, but the average driver pays $146 per month for coverage.

How much does Acura MDX insurance cost?

Acura insurance rates for an MDX average $134 per month, which is a little cheaper than the overall average for Acuras.

What factors can affect my Acura auto insurance premium?

Finding affordable Acura auto insurance quotes depends on several factors. These include the type of coverage you choose, your driving record, the type of car you own, your age and gender, and the region you live in. Insurance companies also offer discounts for safe drivers, bundling policies, and paying premiums upfront.

How can I compare auto insurance rates and coverage options for my Acura?

To compare Acura insurance rates and coverage options, it’s important to research multiple companies, consider the type of coverage you need, compare deductibles, limits, and premiums, and inquire about available discounts. Reading customer reviews, checking financial ratings, and evaluating customer service are also helpful in selecting the right insurance company.

To find out more, explore our guide titled “Affordable Auto Insurance.”

What factors influence Acura car insurance rates?

Acura car insurance rates are influenced by factors such as the model’s MSRP, safety ratings, repair costs, and the driver’s location and driving history.

How can I find an Acura for cheap insurance?

To find an Acura for cheap insurance, compare quotes from multiple insurers, consider higher deductibles, and look for discounts such as multi-policy or safe driver discounts.

Where can I get Acura insurance in Irving, TX?

You can get Acura insurance in Irving, TX from local insurance agencies, national insurers with local offices, or online insurance providers that serve the Irving area.

What are typical Acura insurance rates?

Acura insurance rates vary based on the model, driver’s profile, and location. Generally, Acuras are considered mid-range in insurance cost due to their safety features and moderate repair expenses.

To learn more, explore our comprehensive resource on Features.

How do I get Acura insurance quotes?

You can get Acura insurance quotes online by visiting insurance provider websites, using comparison websites, or contacting insurance agents directly.

Are Acura TLX expensive to insure compared to other models?

Acura TLX insurance costs can vary, but generally, they are moderate due to their safety features and reliable reputation in insurance circles.

Uncover affordable auto insurance rates from the top providers by entering your ZIP code below.

Are Acuras expensive to maintain?

Acuras typically have average maintenance costs compared to luxury vehicles, with factors like model and age influencing expenses.

Are Acuras expensive to repair?

Acuras can have higher repair costs due to their luxury status and advanced technology, which may require specialized parts and skilled technicians.

Learn more by reading our guide titled “Auto Repair & Maintenance FAQs.”

How does Fiat car insurance compare to Acura insurance rates?

Fiat car insurance rates can vary widely based on model and driver profile, but generally, they tend to be lower compared to Acura insurance rates due to differences in vehicle type and market positioning.

Why are Acuras so expensive to some buyers?

Acuras can be perceived as expensive due to their luxury branding, advanced technology features, and higher initial purchase price compared to non-luxury vehicles.

Which category of car insurance is best?

Comprehensive auto insurance provides the most extensive coverage possible.

What year car is the cheapest to insure?

Opting for compact engines helps minimize insurance expenses, while choosing vehicles manufactured after 2012 or 2013 can prevent additional costs related to a car’s age. Similar to the Kia Picanto, the Hyundai i10 has traditionally been chosen for its practicality rather than its emotional appeal, although the latest models boast impressive aesthetics.

Access comprehensive insights into our guide titled “Does auto insurance cover engine or electrical fires?”

Which insurance is best for a car after 5 years?

Is opting for the zero-depreciation add-on cover a superior choice compared to comprehensive car insurance? Indeed, the zero-depreciation add-on cover enhances a standard comprehensive car insurance policy by augmenting the claim amount to cover repair and depreciation expenses.

What is the cheapest insurance for full coverage?

American National, Country Financial, Nationwide, Erie, and USAA provide the most affordable full-coverage insurance policies. Based on our rate data, the average monthly cost for a full-coverage car insurance policy nationwide is $167.

What type of insurance has lowest premium?

Term life insurance offers the most affordable premium rates.

Find your cheapest auto insurance quotes by entering your ZIP code below into our free comparison tool.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.