Cheap Infiniti Auto Insurance in 2025 (Secure Low Rates With These 10 Companies)

Cheap Infiniti auto insurance can be found with Geico, Progressive, and Farmers, with monthly rates starting around $92. These providers offer the cheapest rates and extensive discounts, making them top choices for Infiniti owners seeking affordable coverage. Discover how these companies help you save.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

13,283 reviews

13,283 reviewsCompany Facts

Min. Coverage for Infiniti

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 3,072 reviews

3,072 reviewsCompany Facts

Min. Coverage for Infiniti

A.M. Best Rating

Complaint Level

3,072 reviews

3,072 reviews

The top pick overall for cheap Infiniti auto insurance is Geico, with Progressive and Farmers also offering some of the cheapest rates. This article delves into how these providers stand out for their competitive pricing and extensive discounts, making them ideal choices for Infiniti owners.

We explore key factors influencing insurance premiums, such as driving history, location, and coverage levels, to help you navigate the insurance market effectively.

Explore further details in our “Affordable Auto Insurance.”

Our Top 10 Company Picks: Cheap Infiniti Auto Insurance| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $92 | A++ | Competitive Rates | Geico | |

| #2 | $99 | A+ | Snapshot Program | Progressive | |

| #3 | $104 | A | Discount Variety | Farmers | |

| #4 | $107 | B | Local Agents | State Farm | |

| #5 | $111 | A++ | Coverage Options | Travelers | |

| #6 | $114 | A+ | Customized Policies | Allstate | |

| #7 | $118 | A+ | Accident Forgiveness | Nationwide |

| #8 | $121 | A | 24/7 Support | Liberty Mutual |

| #9 | $128 | A | Claims Service | American Family | |

| #10 | $133 | A+ | Bundling Savings | The Hartford |

- Affordable Infiniti Auto Insurance Quotes

Whether you’re looking for basic liability or comprehensive protection, our guide will empower you to secure the most cost-effective policy for your Infiniti vehicle. Enter your ZIP code to start saving on your auto insurance today.

Start saving on your auto insurance by entering your ZIP code and comparing quotes.

- Geico offers cheap Infiniti auto insurance at $92/month

- Factors like driving record and coverage options impact rates

- Progressive and Farmers provide competitive rates and discounts

Infiniti Auto Insurance Monthly Rates by Coverage Level & Provider

Choosing the right auto insurance for your Infiniti is crucial. To help you decide, we’ve compared monthly rates for minimum and full coverage from top providers.

Infiniti Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $114 | $149 |

| American Family | $128 | $154 |

| Farmers | $104 | $179 |

| Geico | $92 | $143 |

| Liberty Mutual | $121 | $173 |

| Nationwide | $118 | $166 |

| Progressive | $99 | $157 |

| State Farm | $107 | $162 |

| The Hartford | $133 | $186 |

| Travelers | $111 | $171 |

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Infiniti Auto Insurance Explained

Auto insurance is a type of insurance policy that provides financial protection against physical damage or bodily injury resulting from traffic collisions and against liability that could also arise from incidents in a vehicle.

It covers the cost of repairs, medical bills, and lawsuits related to an accident. In addition, every state has enacted laws requiring drivers to carry proof of financial responsibility in their auto insurance. Without this proof, drivers can be fined or even have their licenses suspended. Find out what does auto insurance do.

Auto insurance is important because it protects drivers from financial losses due to accidents and other incidents. It also covers any damage caused to another person’s vehicle or property if the driver is at fault for an accident. Depending on the type of policy, it may cover medical expenses, rental cars, and legal fees resulting from an incident. Additionally, it can cover theft and vandalism to a vehicle.

Geico offers the best overall value for Infiniti auto insurance with competitive rates starting at $92 per month and extensive discounts.Eric Stauffer Licensed Insurance Agent

Having adequate auto insurance coverage is essential for protecting against large out-of-pocket costs associated with car accidents. Owning a vehicle without having proper coverage exposes drivers to significant financial risk in the event of an accident. In addition, many states require drivers to have auto insurance to drive legally.

Auto insurance can be a complex and confusing process for new drivers or those unfamiliar with the different types of coverage. However, it’s important to understand the various options and ensure adequate coverage for your needs. Shopping around and comparing quotes from multiple companies can help ensure you get the best deal on car insurance.

Geico offers the best overall value for Infiniti auto insurance with competitive rates and substantial discounts

However, it’s also important to periodically review your policy and adjust as needed so that you don’t end up paying more than necessary for your coverage. By taking the time to research your options and compare rates, you can save money on the best Infiniti auto insurance while ensuring you’re protected at all times.

Understanding the Different Types of Auto Coverage for Infiniti

Regarding auto insurance coverage for Infiniti vehicles, several types of auto insurance coverage are available.

Comprehensive auto insurance coverage helps pay for damage to your car resulting from events unrelated to collisions, such as theft, weather, and vandalism. On the other hand, collision coverage pays for repairs when your vehicle gets damaged due to a collision with another car or object.

Liability auto insurance coverage will help protect you financially if you cause an accident and someone sues you. This type of protection typically covers bodily injury to other people or property damage caused by your vehicle. Most U.S. states require liability coverage, whereas comprehensive and collision coverages are optional unless you have a car loan or lease.

Both comprehensive and collision coverages usually require deductibles, which are out-of-pocket costs that must be paid before the insurer provides benefits.

It’s important to choose the right coverage for your specific needs. Knowing what type of risks you face and what kind of protection you need will help you make an informed decision.

For instance, comprehensive coverage may be worth considering if you live in a high-crime area. On the other hand, if you live in an area with many bad drivers or hazardous weather conditions, collision coverage might be the more relevant choice for your situation.

When choosing a car insurance policy for your Infiniti vehicle, it’s also worth looking at optional coverages, such as uninsured/underinsured motorist protection and rental reimbursement. Find out whether insurance includes rental car reimbursement.

Uninsured/underinsured motorist coverage helps protect you from financial losses caused by drivers without insurance. In contrast, rental reimbursement coverage helps you cover the cost of a rental car if your car gets damaged or stolen. Find out what happens if you hit an uninsured driver.

Finally, remember that auto insurance rates can vary significantly between companies. Taking the time to shop around and compare quotes from different insurers can help ensure you get cheap Infiniti auto insurance rates.

Doing your research will also help you decide which coverage levels are right for you and ensure you always have adequate protection.

Overall, auto insurance is an important part of being a responsible driver and owning a vehicle. Knowing what Infiniti car insurance coverage options are available and ensuring adequate protection can help protect against out-of-pocket costs associated with accidents and other unexpected events.

Comparing Infiniti Auto Insurance Rates and Coverage Options

When shopping for auto insurance for your Infiniti vehicle, it’s important to compare rates and coverage options to find the best policy for you.

Several factors can affect your auto insurance cost, such as your driving record and vehicle type. So, it’s important to consider discounts and other ways to save on auto insurance when selecting a policy.

The first step in comparing rates and coverage options is researching companies that offer auto insurance for Infiniti vehicles. You can do this by searching online or asking friends and family who have Infinitis themselves.

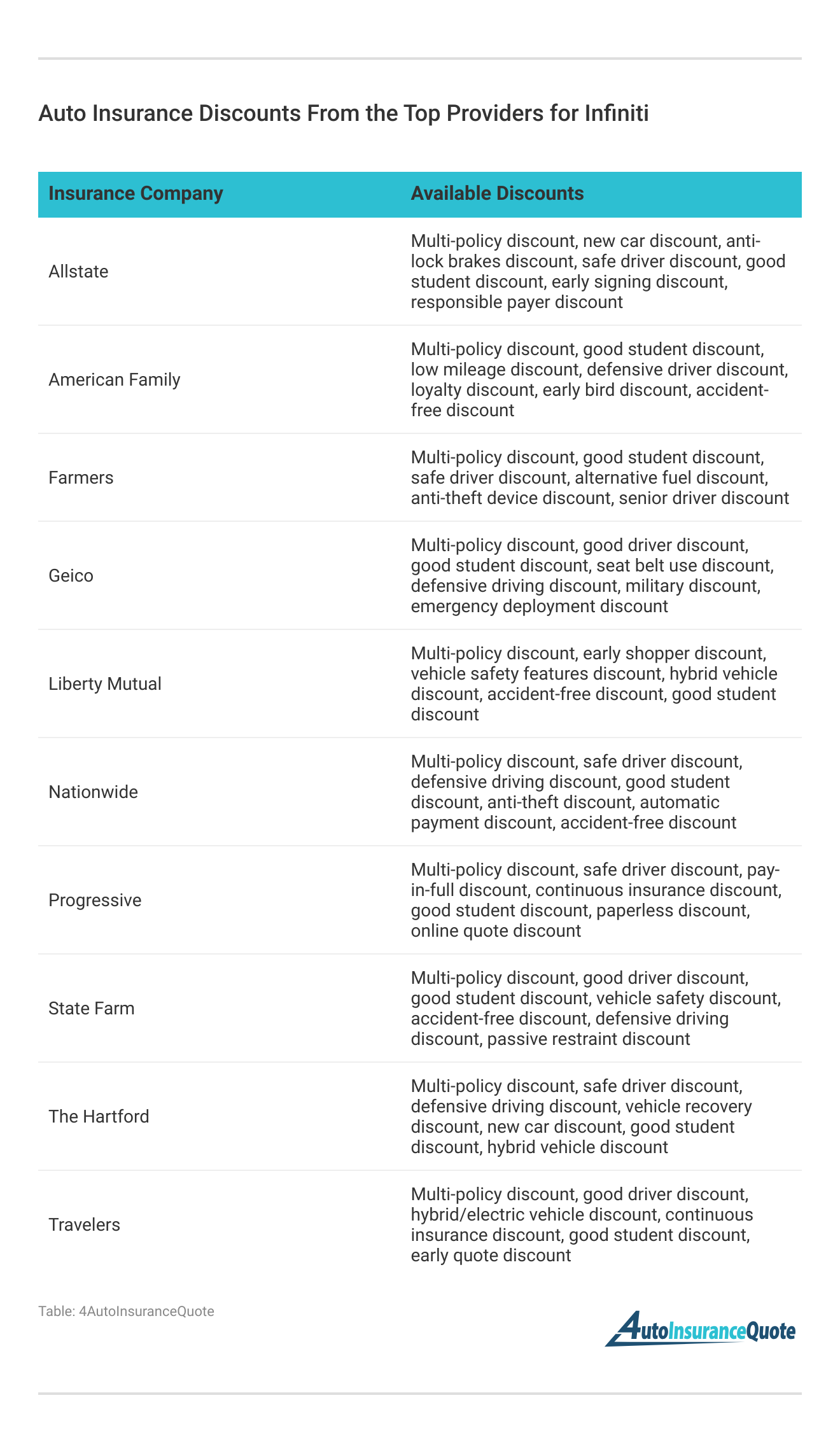

Once you have some potential insurers in mind, ask about their specific coverage levels, deductibles, limits, and auto insurance discounts. When researching, make sure to look into the company’s customer service record and its financial stability.

Geico offers the best overall value for Infiniti auto insurance with its competitive rates and substantial discounts.Scott W. Johnson Licensed Insurance Agent

When comparing different car insurance companies, it’s also important to research their Infiniti car insurance discounts and other ways to save on premiums. For example, many insurers offer discounts based on age, driving history, and location.

Additionally, most companies offer loyalty discounts for drivers who stay with them for a certain period. You may also be eligible for a multi-car discount if you have multiple cars covered under one policy.

Finally, when selecting an auto insurance company for your Infiniti vehicle, it is important to consider their customer service record and ratings from industry organizations such as JD Power or AM Best.

Researching and comparing rates and coverage options can help you get the best deal on your car insurance policy. Learn how to get auto insurance.

Factors That Impact Infiniti Auto Insurance Rates

When shopping for auto insurance for your Infiniti vehicle, it’s important to understand how different factors can affect your rate. The primary factors that insurers look at when determining rates are driving record, age, gender, location, and type of car.

Overall, understanding how different factors can affect your auto insurance rate is essential to find the best policy for your needs.

Best Auto Insurance Rates for Your Infiniti Model

Delve into the Infiniti Q50, comparing rates and exploring its distinctive features. This guide helps you make an informed decision quickly, finding the best fit for your preferences and needs.

Infiniti Auto Insurance Cost by Model

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Affordable Infiniti Auto Insurance Quotes: Final Words

When shopping for auto insurance for your Infiniti, it’s important to compare rates and coverage options to find the best policy for you. By researching different insurers and taking advantage of discounts and other ways to save, you can get an affordable car insurance rate that fits your needs.

Finally, understanding how different factors such as driving record, age, gender, location, and type of car can affect your rate is essential in getting the most out of your auto insurance policy.

Taking the time to shop around and research can help you get the best deal for your Infiniti vehicle. Use our free quote comparison tool to find the most affordable Infiniti auto insurance quotes from companies in your area. Find out more by reading our article titled “Affordable Comprehensive Auto Insurance Coverage.“

Finding cheap auto insurance rates can be difficult for high-risk drivers, but you don’t have to do it alone. Enter your ZIP code to find the most affordable quotes in your area.

Frequently Asked Questions

How much does it cost to insure an Infiniti G35?

The average cost to insure an Infiniti G35 is around $233 monthly.

Gain insights by reading our article titled “Is it cheaper to insure a new car or an old car?“

What is auto insurance?

Auto insurance is a type of policy that provides financial protection in case of car accidents, covering repair costs, medical bills, and liability.

What factors affect Infiniti auto insurance rates?

Factors like driving record, age, gender, location, and type of car can impact auto insurance rates for Infinitis.

Explore your auto insurance options by entering your ZIP code into our free comparison tool today.

How can I compare rates and coverage options for Infinitis?

Compare rates and coverage options by researching different insurers, asking about discounts, and considering factors like customer service and financial stability.

How do I find affordable Infiniti auto insurance quotes?

To find affordable Infiniti auto insurance, shop around and compare quotes from multiple companies. Research discounts and coverage options to get the best deal.

For further details, consult our article named “Affordable Volvo XC40 Auto Insurance Quotes.”

Are Infiniti cars expensive to insure?

Insuring an Infiniti can vary based on factors like model, driver’s profile, and location. Generally, luxury cars such as Infiniti may have higher insurance costs due to their higher value and potentially higher repair costs.

Is Infiniti expensive to fix?

Repair costs for Infiniti vehicles can be higher compared to non-luxury cars due to the specialized parts and technology they often incorporate. Maintenance costs can also vary based on the specific model and the availability of parts.

Find your cheapest auto insurance quotes by entering your ZIP code into our free comparison tool.

Is Infiniti expensive to maintain?

Maintenance costs for Infiniti vehicles can be higher than average due to the need for specialized servicing and parts. However, routine maintenance schedules and careful driving can help manage these costs effectively over time.

Uncover additional insights in our article called “Cheap Tesla Auto Insurance.”

Why is Infiniti so expensive?

Infiniti vehicles are expensive due to their high-quality materials, advanced technology, and superior performance. These cars often feature luxurious interiors, powerful engines, and innovative safety and entertainment systems, all of which contribute to their higher price tag. Additionally, the brand’s commitment to craftsmanship and attention to detail in both design and engineering further elevate the cost.

Is Infiniti considered a luxury car?

Yes, Infiniti is considered a luxury car brand. Infiniti, a division of Nissan, is known for producing vehicles that offer premium features, superior comfort, and high performance, positioning it firmly in the luxury segment of the automotive market.

Are Infinitis expensive to insure?

Yes, Infinitis is generally more expensive to insure due to its higher market value, costly repairs, and advanced features.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.