Cheap Arizona Auto Insurance in 2025 (Unlock Big Savings From These 10 Companies!)

Leading companies such as USAA, Geico, and State Farm offer cheap Arizona auto insurance quotes that start at $24/mo. These firms are known for their affordable prices, extensive coverage, and exceptional customer service, making them the top options for Arizona residents looking for cheap Arizona auto insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage in Arizona

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage in Arizona

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsUSAA, Geico, and State Farm are the top picks for cheap Arizona auto insurance, with monthly rates starting at $24.

With the cost of everything rising, finding cheap Arizona auto insurance might seem impossible. However, affordable Arizona auto insurance doesn’t have to be a challenge.

Our Top 10 Company Picks: Cheap Arizona Auto Insurance

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $24 | A++ | Military Focus | USAA | |

| #2 | $25 | A++ | Affordable Rates | Geico | |

| #3 | $30 | B | Customer Satisfaction | State Farm | |

| #4 | $32 | A+ | Innovative Options | Progressive | |

| #5 | $39 | A++ | Comprehensive Coverage | Travelers | |

| #6 | $43 | A | Family Oriented | American Family | |

| #7 | $44 | A++ | Personalized Policies | Nationwide |

| #8 | $51 | A | Extensive Discounts | Farmers | |

| #9 | $67 | A | Flexible Plans | Liberty Mutual |

| #10 | $68 | A++ | Trusted Reputation | Allstate |

As long as you compare Arizona auto insurance quotes with multiple companies, you’ll be able to find the right policy no matter how much insurance coverage you need.

Read on to learn more about where to find the best Arizona auto insurance rates. Then, enter your ZIP code in our free tool to get quotes and find the best car insurance in Arizona for any driver.

- Arizona auto insurance costs $24 a month, below the national average

- Geico, Travelers, and Progressive often offer the lowest rates in Arizona

- Compare rates to find the cheapest Arizona auto insurance

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – USAA: Top Overall Pick

Pros

- Military Focus: Tailored services for military families, offering specialized coverage options and perks. This is ideal for those seeking cheap Arizona auto insurance with added benefits for service members. Delve more through this USAA auto insurance review.

- Low Premiums: Offers some of the lowest rates at $24/month, making it a top choice for cheap Arizona auto insurance. The affordability doesn’t compromise the quality of coverage.

- Exceptional Customer Service: Known for high customer satisfaction, particularly among military members. This support adds value to its cheap Arizona auto insurance offerings, ensuring a hassle-free experience.

Cons

- Restricted Availability: Only available to military members and their families, which limits access to this cheap Arizona auto insurance option. Civilians will need to look elsewhere.

- Limited Local Offices: Few in-person locations may be inconvenient for those preferring face-to-face service for their cheap Arizona auto insurance. This could be a drawback for customers who need more personalized assistance.

#2 – Geico: Best for Affordable Rates

Pros

- Affordable Rates: Geico offers one of the cheapest Arizona auto insurance options at $25/month, making it a popular choice for budget-conscious drivers. It balances low rates with comprehensive coverage options.

- User-Friendly Online Tools: Geico’s easy-to-navigate website and mobile app make managing your cheap Arizona auto insurance policy simple. These tools save time and enhance the overall customer experience.

- Discounts for Safe Drivers: Multiple discounts, including for safe driving, help further reduce costs, making Geico an even more attractive option for cheap Arizona auto insurance. This can lead to significant savings over time. Uncover more by delving into our article entitled “Geico Auto Insurance Review.”

Cons

- Customer Service Variability: While generally positive, Geico’s customer service can be inconsistent, which might affect satisfaction for cheap Arizona auto insurance shoppers. This inconsistency can be a concern for those who value reliable support.

- Limited Coverage Customization: Geico may offer fewer customization options compared to other providers, potentially limiting flexibility for those seeking tailored cheap Arizona auto insurance. This might be a downside for customers with specific needs.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#3 – State Farm: Best for Customer Satisfaction

Pros

- Customer Satisfaction: Known for high levels of customer satisfaction, State Farm offers a reliable experience for those seeking cheap Arizona auto insurance. This reputation ensures confidence in their services.

- Strong Agent Network: With a vast network of local agents, State Farm provides personalized service, which is valuable for those looking for cheap Arizona auto insurance with in-person support. This network makes it easy to get help when needed. Find out more by exploring this State Farm auto insurance review.

- Discounts for Multiple Policies: State Farm offers discounts when bundling auto with other types of insurance, making it a more affordable option for cheap Arizona auto insurance. These savings can significantly lower your overall insurance costs.

Cons

- Higher Rates: At $30/month, State Farm’s rates are slightly higher than some competitors, which could be a drawback for those focused on finding the cheapest Arizona auto insurance. This price difference might steer budget-conscious customers elsewhere.

- B Rating from A.M. Best: The lower B rating may concern some, as it reflects less financial strength compared to other cheap Arizona auto insurance providers. This could impact confidence in their long-term reliability.

#4 – Progressive: Best for Innovative Options

Pros

- Innovative Options: Progressive offers unique coverage options like “Name Your Price,” making it a flexible choice for cheap Arizona auto insurance. This feature allows you to find a policy that fits your budget.

- Snapshot Program: Usage-based discounts through the Snapshot program can lower your premiums, making Progressive even more competitive for cheap Arizona auto insurance. Safe drivers can benefit greatly from these savings.

- Extensive Online Tools: Progressive’s robust online and mobile tools simplify managing your cheap Arizona auto insurance policy. These tools make it easy to get quotes, file claims, and track your policy details.

Cons

- Average Customer Service: Progressive’s customer service is not always top-tier, which can be a drawback for those seeking comprehensive support with their cheap Arizona auto insurance. This may lead to frustrations during the claims process.

- Potentially High Rates: While starting at $32/month, Progressive’s rates can increase depending on the coverage options selected, making it less competitive for cheap Arizona auto insurance. This variability might affect budget-conscious drivers. Get more information from this Progressive auto insurance review.

#5 – Travelers: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage Options: Travelers offers a wide range of coverage choices, making it a versatile option for cheap Arizona auto insurance. This flexibility allows for tailored policies that meet specific needs.

- Bundling Discounts: Significant discounts for bundling multiple policies make Travelers an appealing choice for cheap Arizona auto insurance. These savings can make comprehensive coverage more affordable.

- Accident Forgiveness: Travelers offer accident forgiveness to prevent rate increases after the first accident, adding long-term value to their cheap Arizona auto insurance. This feature is particularly beneficial for maintaining low premiums.

Cons

- Higher Base Premiums: Starting at $39/month, Travelers’ rates are higher than some competitors, which might be a concern for those seeking cheap Arizona auto insurance. This price point could deter cost-sensitive shoppers. Expand your knowledge through our Travelers auto insurance review.

- Limited Local Agents: Fewer local agents compared to other providers may limit in-person service options for cheap Arizona auto insurance customers. This could be a disadvantage for those who prefer face-to-face interactions.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#6 – American Family: Best for Family Oriented

Pros

- Family-Oriented Coverage: Tailored options for families make American Family a strong choice for cheap Arizona auto insurance. These options include discounts for teen drivers and bundled policies, making it easier to insure the whole family affordably.

- Solid Financial Rating: With an A rating from A.M. Best, American Family is financially stable, ensuring reliable support for your cheap Arizona auto insurance needs. This stability provides peace of mind in case of claims. For additional insights, refer to our American Family auto insurance review.

- Flexible Payment Plans: American Family offers customizable payment options, making it easier to manage your cheap Arizona auto insurance budget. These plans help ensure you can maintain coverage without financial strain.

Cons

- Higher Starting Rates: At $43/month, American Family’s rates are higher than some competitors, which may be a disadvantage for those seeking the cheapest Arizona auto insurance. This could make it less appealing to budget-conscious drivers.

- Regional Availability: American Family’s services are not available in all areas, potentially limiting access to their cheap Arizona auto insurance. This geographic restriction may require some drivers to look for alternatives.

#7 – Nationwide: Best for Personalized Policies

Pros

- Personalized Policies: Nationwide offers customizable policies that allow you to choose the coverage that best fits your needs, making it a flexible option for cheap Arizona auto insurance. These tailored policies help ensure you only pay for what you need.

- Vanishing Deductible: Nationwide’s vanishing deductible program rewards safe driving, gradually reducing your deductible over time, and making it an attractive option for cheap Arizona auto insurance. This feature can lead to significant savings in the long run.

- Wide Range of Discounts: From multi-policy discounts to savings for safe driving, Nationwide offers various ways to lower your premiums, enhancing its appeal for cheap Arizona auto insurance. These discounts can make comprehensive coverage more affordable. Read more through our Nationwide auto insurance review.

Cons

- Moderate Starting Rates: With a starting rate of $44/month, Nationwide is not the cheapest Arizona auto insurance option, which might be a drawback for those focused solely on price. This could make it less competitive for budget shoppers.

- Limited Local Agents: Fewer local agents compared to some competitors could mean less personalized service for cheap Arizona auto insurance customers. This might be an issue for those who value face-to-face interactions.

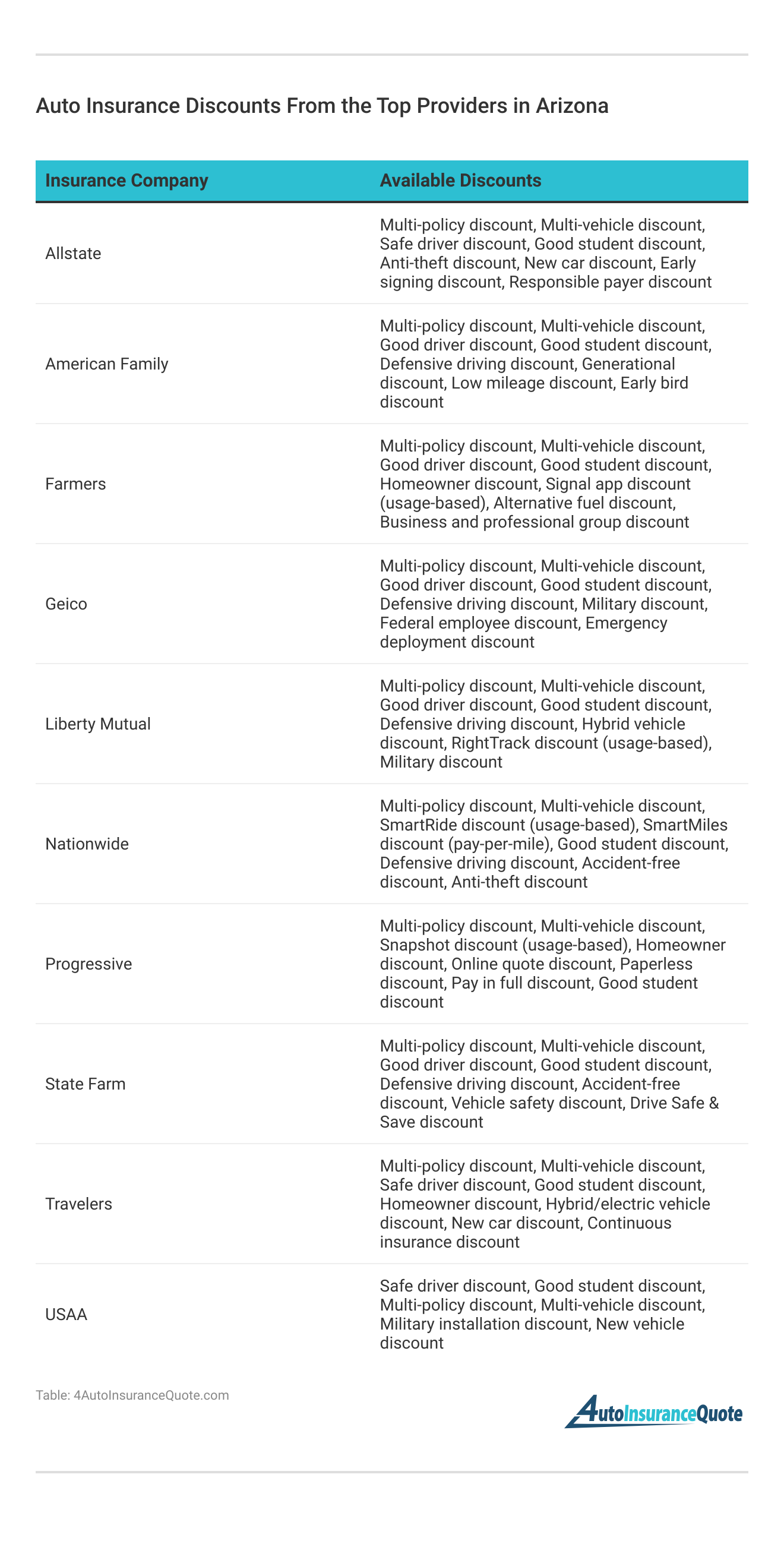

#8 – Farmers: Best for Extensive Discounts

Pros

- Extensive Discounts: Farmers offers a broad range of discounts, including for multiple policies and safe driving, which can significantly lower your cheap Arizona auto insurance costs. These savings make it an appealing option for various types of drivers. Learn more through our Farmers auto insurance review.

- Strong Customer Service: Farmers is known for its strong customer service, offering support and assistance throughout the insurance process, which adds value to its cheap Arizona auto insurance. This focus on customer satisfaction can enhance the overall experience.

- Personalized Coverage Options: With various add-ons and customization options, Farmers allows you to tailor your cheap Arizona auto insurance policy to fit your specific needs. This flexibility ensures that you get the coverage you want without paying for unnecessary extras, making it a practical choice.

Cons

- Higher Starting Rates: At $51/month, Farmers is on the pricier side for those seeking cheap Arizona auto insurance, which might deter budget-conscious customers. This higher cost could make it less attractive compared to other more affordable options.

- Complex Discounts: While Farmers offers many discounts, navigating these options can be complex, and potentially confusing for those looking for straightforward cheap Arizona auto insurance. This complexity might make it harder to maximize savings.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#9 – Liberty Mutual: Best for Flexible Plans

Pros

- Flexible Coverage Plans: Liberty Mutual offers a range of customizable plans, allowing you to adjust coverage to your needs, which is beneficial for those seeking cheap Arizona auto insurance with specific requirements. This flexibility can help you avoid overpaying for unnecessary coverage.

- Wide Range of Discounts: Liberty Mutual offers discounts for various factors, including bundling, safe driving, and vehicle safety features, making it easier to find cheap Arizona auto insurance. These discounts can significantly reduce your overall premium.

- 24/7 Claims Support: Liberty Mutual provides round-the-clock claims support, ensuring that you can get help whenever you need it, adding value to their cheap Arizona auto insurance offerings. This constant availability enhances the customer experience.

Cons

- Higher Premiums: With a starting rate of $67/month, Liberty Mutual is one of the more expensive options for cheap Arizona auto insurance, which could be a drawback for price-sensitive customers. This higher cost might make it less competitive. Uncover more by reviewing this Liberty Mutual auto insurance review.

- Mediocre Customer Satisfaction: Some customers report mixed experiences with Liberty Mutual’s customer service, which can be a downside for those seeking reliable support with their cheap Arizona auto insurance. This inconsistency might affect your overall satisfaction.

#10 – Allstate: Best for Trusted Reputation

Pros

- Trusted Reputation: Allstate has a long-standing reputation for reliability, making it a solid choice for cheap Arizona auto insurance. This trustworthiness ensures that you’re dealing with a reputable company that stands behind its policies.

- Drivewise Program: Allstate’s Drivewise program offers rewards and discounts for safe driving, helping to lower your premiums, and making it a competitive option for cheap Arizona auto insurance. This program incentivizes good driving habits.

- Extensive Local Agent Network: With a large network of local agents, Allstate provides personalized service, which is valuable for those looking for face-to-face support with their cheap Arizona auto insurance. This accessibility makes managing your policy easier.

Cons

- Higher Starting Rates: At $68/month, Allstate is one of the more expensive options for cheap Arizona auto insurance, which might be a drawback for those focused on finding the lowest rates. This higher price point could be a barrier for budget-conscious drivers.

- Potential Rate Increases: Some customers have reported unexpected rate increases, which can be concerning for those seeking stable cheap Arizona auto insurance premiums. This unpredictability might cause frustration over time. Broaden your knowledge with our Allstate auto insurance review.

Essential Auto Insurance in Arizona

With a high population and 8 metropolitan cities, auto insurance policies in Arizona are crucial. Arizona mandates several auto insurance minimums, including coverage for bodily injury liability, accidents, and property damage.

Arizona Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $68 | $180 |

| American Family | $43 | $114 |

| Farmers | $51 | $135 |

| Geico | $25 | $65 |

| Liberty Mutual | $67 | $178 |

| Nationwide | $44 | $116 |

| Progressive | $32 | $84 |

| State Farm | $30 | $81 |

| Travelers | $39 | $104 |

| USAA | $24 | $63 |

The state requires bodily injury liability coverage of $25,000 per person and $50,000 per incident. While this is lower than in some other states, serious accidents can easily exceed these limits, making it wise to opt for higher coverage to ensure adequate protection.

Auto insurance covers medical bills if you’re at fault in an accident, and higher bodily injury liability limits offer better financial protection. Arizona mandates a minimum of $15,000 for property damage coverage, but opting for more coverage can safeguard you against larger repair costs.

Remember, liability coverage only addresses injuries and damage to others. To cover damage to your vehicle, you’ll need additional coverage options.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Understanding Arizona Auto Insurance Costs

Often you may hear complaints about the price of insurance, but in most cases, you are paying for what you need. By paying a certain premium now, you can ensure that you will have enough to cover all expenses if anything ever happens.

Some people can drive their whole lives without ever having an accident, but it’s never a good idea to gamble on an imperative thing such as your well-being. In Arizona, the average cost of auto insurance is about $1,057.63, which is almost $400 less than the national average.

Although driving records play a significant role, age and gender also impact insurance costs. Typically, males and younger drivers face higher rates, while seniors usually enjoy lower rates compared to teen drivers, even if they have a clean record. Read our guide on how age affects auto insurance rates for more information.

Enter your ZIP code below for fast, free quotes from top Arizona auto insurance companies.

Comparing Auto Insurance Rates in Arizona

While Arizona generally offers very affordable auto insurance rates, it’s important to explore how different companies compare. Although the state benefits from low rates overall, individual premiums can vary significantly between providers.

Arizona’s low auto insurance rates may be influenced by its relatively low incidence of weather-related fatal crashes, contributing to its lower overall costs. To make the most of these savings, it’s crucial to compare rates from leading insurers.

Let’s examine how rates from some of the largest insurance companies in Arizona stack up against each other. Identifying which companies dominate the market and understanding their rate structures can help you find the most cost-effective coverage for your needs.

For further details, consult our article named “What are the different types of auto insurance coverage?“

Driving Risks in Arizona

Driving in Arizona poses risks, with 106,767 accidents in 2009, including 709 fatalities, many involving alcohol. Fatal accidents are more common in rural areas, while most accidents occur in urban regions.

Auto theft is also a concern, though incidents have decreased to 37,218 since 2002. Anti-theft recovery systems have contributed to 61.7% of stolen vehicles being returned, while the rest are often lost to overseas shipping or dismantling.

The efficiency of driving is a miraculous thing, but it is plagued with many dangers such as accidents and theft, which makes it important to be covered in case anything happens.Ty Stewart Licensed Insurance Agent

It takes a lot of thought and consideration to buy cheap Arizona auto insurance online and find the personal policy that fits you best. Ready to compare cheap Arizona auto insurance rates and save? Enter your ZIP code to begin comparing rates now.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Making Smart Choices for Cheap Arizona Auto Insurance

Finding the right balance between cost and coverage is crucial when securing cheap Arizona auto insurance. With affordable options from providers like USAA, Geico, and State Farm, Arizona drivers can protect their vehicles without overspending.

To maximize savings, it’s important to shop around, compare rates, and utilize auto insurance discounts tailored to your needs. By considering factors like age, driving history, and location, you can find a policy that offers comprehensive protection at a budget-friendly price.

Stay informed and proactive to navigate the Arkansas insurance market confidently and secure the best rates. Enter your ZIP code below for fast, free quotes from top Arizona auto insurance companies.

Frequently Asked Questions

Are Arizona auto insurance rates more expensive than other states?

The average price of Arizona auto insurance is $81 a month, which is slightly lower than the national average.

What should I do if I’m involved in an accident in Arizona?

If you’re involved in an accident in Arizona, it’s important to first ensure the safety of all parties involved. Then, exchange information with the other driver(s) and report the accident to the police. Contact your insurance company to report the accident and begin the claims process.

Get fast and cheap auto insurance coverage today by entering your ZIP code below.

Can I get auto insurance coverage for a rental car in Arizona?

Many comprehensive auto insurance coverage policies include coverage for rental cars, but it’s important to review your policy or contact your insurance company to confirm. If your comprehensive auto insurance coverage doesn’t include rental cars, you may consider purchasing additional coverage from the rental car company to ensure you’re fully protected.

What are the minimum Arizona auto insurance requirements?

Arizona requires all drivers to have a 25/50/25 plan for liability insurance.

Can I get auto insurance if I have a suspended license?

It may be challenging to find auto insurance if you have a suspended license. However, some insurance companies specialize in providing coverage to high-risk drivers, so it’s worth exploring your options. Keep in mind that the premiums may be higher.

Get fast and cheap auto insurance coverage today by entering your ZIP code below.

What factors can affect my auto insurance rates in Arizona?

Understanding how auto insurance works is essential, as several factors can impact your rates in Arizona. These factors include your driving record, age, gender, location, type of vehicle, and annual mileage. Additionally, your credit history and marital status can also play a significant role in determining your insurance rates.

Which insurance company offers the lowest monthly rate for cheap Arizona auto insurance?

USAA offers the lowest monthly rate at $24. However, it’s primarily available to military members and their families.

Which Arizona auto insurance provider is highlighted for offering the most extensive discounts?

Farmers is highlighted for offering the most extensive discounts. This includes savings for safe driving, bundling policies, and more.

Get fast and cheap auto insurance coverage today by entering your ZIP code below.

What is Arizona’s minimum required bodily injury liability coverage for auto insurance?

Arizona requires a minimum bodily injury liability coverage of $25,000 per person and $50,000 per accident. This ensures basic financial protection in case of an accident.

How does Liberty Mutual’s starting rate compare to other cheap Arizona auto insurance providers?

Liberty Mutual’s starting rate is $67/month, making it one of the more expensive options. This is higher than most other providers mentioned in the article.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.