Cheap Indiana Auto Insurance in 2025 (Earn Savings With These 10 Companies)

For the cheap Indiana auto insurance, USAA, Geico, and Progressive are the top providers. With USAA offering rates as low as $15 per month, these providers deliver great value. Known for their extensive coverage and competitive pricing, they are ideal for Indiana drivers seeking reliable insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: Nov 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage in Indiana

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,283 reviews

13,283 reviewsCompany Facts

Min. Coverage in Indiana

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews

When seeking for the cheap Indiana auto insurance, our top pick overall is USAA, known for its comprehensive coverage and competitive rates.

Understanding auto insurance in Indiana makes it easier to make sure you are buying the right coverage. We’ve got everything you need to know to buy Indiana auto insurance with confidence right here.

Our Top 10 Company Picks: Cheap Indiana Auto Insurance| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $15 | A+ | Military Discounts | USAA | |

| #2 | $22 | A++ | Online Discounts | Geico | |

| #3 | $23 | A+ | Snapshot Program | Progressive | |

| #4 | $24 | A++ | Bundling Savings | Travelers | |

| #5 | $25 | B | Drive Safe | State Farm | |

| #6 | $27 | A | Affinity Groups | Farmers | |

| #7 | $33 | A+ | SmartRide Program | Nationwide |

| #8 | $37 | A | Loyalty Rewards | American Family | |

| #9 | $48 | A++ | Safe Driving | Allstate | |

| #10 | $63 | A | Accident Forgiveness | Liberty Mutual |

Get started by comparing Indiana auto insurance quotes today.

- Cheap Indiana Auto Insurance

- Get Affordable Wabash, IN Auto Insurance Quotes (2025)

- Get Affordable Speedway, IN Auto Insurance Quotes (2025)

- Get Affordable Hartford City, IN Auto Insurance Quotes (2025)

- Get Affordable Granger, IN Auto Insurance Quotes (2025)

- Get Affordable Gary, IN Auto Insurance Quotes (2025)

- Get Affordable Fairland, IN Auto Insurance Quotes (2025)

Just enter your ZIP code to find the best rates and ensure you have sufficient auto liability coverage.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – USAA: Top Overall Pick

Pros

- Competitive Rates: USAA offers some of the most affordable rates for cheap Indiana auto insurance, with monthly premiums as low as $15. This makes it a top choice for those seeking substantial savings on their auto insurance.

- Excellent Customer Service: Known for high levels of customer satisfaction and efficient claim processing, USAA provides top-notch service that enhances the experience of managing cheap Indiana auto insurance.

- Comprehensive Coverage: USAA’s policies are well-suited for military families, offering extensive protection and benefits that cater to their unique needs. This ensures robust coverage for cheap Indiana auto insurance. Find out more through our Allstate vs. USAA insurance review.

Cons

- Limited Eligibility: USAA’s cheap Indiana auto insurance is only available to military members, veterans, and their families, which restricts access for others seeking similar benefits.

- Fewer Local Agents: The limited network of local agents might be less convenient for those who prefer in-person service for their cheap Indiana auto insurance. This can affect the overall experience.

#2 – Geico: Best for Online Discounts

Pros

- Great Online Discounts: Geico provides significant savings through its online platform, making it an excellent option for those looking for cheap Indiana auto insurance. Their digital approach includes various discounts for online management.

- User-Friendly Website: Geico’s website is designed for ease of use, allowing customers to efficiently manage their cheap Indiana auto insurance policies and file claims online. This user-friendly interface enhances convenience.

- Wide Availability: With operations in all states, Geico ensures that its cheap Indiana auto insurance is accessible across the country, offering consistent service regardless of location. Read more through our Geico insurance review.

Cons

- Inconsistent Customer Service: Some users report mixed experiences with Geico’s customer service, which can affect satisfaction with their cheap Indiana auto insurance. This inconsistency may impact overall reliability.

- Potential for Higher Premiums: For high-risk drivers, Geico’s rates might not be as competitive, making it less ideal for those seeking cheap Indiana auto insurance if they have a history of claims or violations.

#3 – Progressive: Best for Snapshot Program

Pros

- Innovative Snapshot Program: Progressive’s Snapshot Program, starting at $23 per month, offers personalized rates based on driving behavior. This program can result in significant discounts for safe drivers looking for cheap Indiana auto insurance.

- Flexible Coverage Options: Progressive provides a variety of coverage types and add-ons, allowing for customization to meet individual needs. This flexibility helps in obtaining cheap Indiana auto insurance that fits specific requirements.

- High-Risk Friendly: Progressive is known for accommodating drivers with less-than-perfect records, making it a viable option for those who might struggle to find affordable cheap Indiana auto insurance elsewhere. Find out more through our Progressive insurance review.

Cons

- Premium Variability: Rates can vary widely based on individual factors and driving history, which might result in higher premiums for some. This variability can affect the affordability of cheap Indiana auto insurance.

- Complex Policies: The range of coverage options and discounts can be overwhelming, leading to confusion about how to get the best deal on cheap Indiana auto insurance. This complexity might detract from the overall experience.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#4 – Travelers: Best for Bundling Savings

Pros

- Bundling Discounts: Travelers offers substantial savings when bundling auto insurance with other policies, starting at $24 per month. This can provide cheap Indiana auto insurance if you also have other types of coverage with them.

- Comprehensive Coverage: Travelers provides extensive coverage options and additional benefits, ensuring broad protection. This variety helps in finding affordable cheap Indiana auto insurance that meets diverse needs.

- Strong Financial Stability: With high ratings for financial stability, Travelers can reliably handle claims, giving customers peace of mind about their cheap Indiana auto insurance. Look for more details through our Travelers insurance review.

Cons

- Higher Premiums Without Bundling: Without bundling multiple policies, Travelers’ rates may be higher, which could impact the affordability of cheap Indiana auto insurance. Bundling is crucial for maximizing savings.

- Limited Discounts for Safe Drivers: Travelers might not offer as many discounts specifically for safe driving compared to competitors. This could mean fewer savings for those with a clean driving record seeking cheap Indiana auto insurance.

#5 – State Farm: Best for Drive Safe

Pros

- Drive Safe & Save Program: State Farm’s Drive Safe & Save Program provides discounts based on driving behavior, starting at $25 per month. This program offers opportunities to lower cheap Indiana auto insurance premiums for safe drivers.

- Extensive Agent Network: State Farm’s large network of local agents provides personalized service and support, making it easier to manage your cheap Indiana auto insurance with in-person assistance.

- Strong Reputation: With a solid industry reputation, State Farm offers reliability and trustworthiness in their cheap Indiana auto insurance policies, contributing to overall customer confidence. Delve more through our State Farm insurance review.

Cons

- Higher Rates in Some Areas: Premiums can be higher in specific regions, which might affect the overall affordability of cheap Indiana auto insurance. Rates are not uniform and can vary based on location.

- Limited Online Features: State Farm’s online management tools are less advanced compared to some competitors, which might impact the convenience of handling cheap Indiana auto insurance online.

#6 – Farmers: Best for Affinity Groups

Pros

- Affinity Group Discounts: Farmers offers savings for members of certain professional and organizational affiliations, with rates starting at $27 per month. This can result in cheap Indiana auto insurance for those who qualify for these discounts.

- Broad Coverage Options: Provides a wide range of coverage types and add-ons, ensuring comprehensive protection. This helps in obtaining cheap Indiana auto insurance that meets various insurance needs.

- Customizable Policies: Farmers offers significant flexibility in policy customization, allowing for tailored coverage solutions. This adaptability helps in finding the most affordable cheap Indiana auto insurance. Read more through our Farmers auto insurance review.

Cons

- Potentially Higher Rates: Farmers’ premiums may be higher compared to some competitors, which could impact the overall affordability of cheap Indiana auto insurance for some drivers.

- Inconsistent Discounts: The availability and value of discounts can vary widely, which might affect potential savings. This inconsistency can make it challenging to find the best cheap Indiana auto insurance rates.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#7 – Nationwide: Best for SmartRide Program

Pros

- SmartRide Program: Nationwide’s SmartRide Program offers discounts based on driving behavior, starting at $33 per month. This program can help achieve cheap Indiana auto insurance rates for safe drivers.

- Comprehensive Coverage Options: Nationwide provides a broad range of coverage types and additional benefits, ensuring extensive protection. This variety helps in securing cheap Indiana auto insurance that meets diverse needs.

- Financial Strength: High ratings for financial stability offer confidence in Nationwide’s ability to handle claims. This reliability is crucial for securing cheap Indiana auto insurance with peace of mind. Find out more through our Nationwide insurance review.

Cons

- Higher Premiums for Some: Rates can be less competitive for certain drivers, which may affect the affordability of cheap Indiana auto insurance. Premiums are not always the lowest option available.

- Complex Discounts: Navigating the discount options can be complicated, which might affect the overall ease of finding cheap Indiana auto insurance. The complexity can make it harder to optimize savings.

#8 – American Family: Best for Loyalty Rewards

Pros

- Loyalty Rewards: American Family offers benefits for long-term customers, starting at $37 per month. This can result in cheap Indiana auto insurance for those who maintain their policies over time.

- Good Customer Service: Positive feedback highlights American Family’s customer support, enhancing the experience of managing cheap Indiana auto insurance. Their service is noted for being helpful and responsive.

- Flexible Coverage Options: Offers a variety of coverage types and add-ons, allowing for a customizable insurance experience. This flexibility helps in finding cheap Indiana auto insurance that fits specific needs. Discover more through our American Family insurance review.

Cons

- Higher Costs for Some Drivers: Premiums might be higher for certain demographics, which could affect the affordability of cheap Indiana auto insurance for some individuals.

- Limited National Presence: American Family is less available in some regions, which might restrict access to their cheap Indiana auto insurance for those outside their primary service areas.

#9 – Allstate: Best for Safe Driving

Pros

- Safe Driving Discounts: Allstate provides discounts for safe driving behaviors, with rates starting at $29 per month. This can help achieve cheap Indiana auto insurance for drivers with a clean record.

- Wide Range of Coverage: Offers various coverage options and add-ons to suit different needs, ensuring comprehensive protection. This variety helps in finding affordable cheap Indiana auto insurance.

- Strong Financial Stability: Allstate’s high financial strength ratings offer assurance in their ability to manage claims effectively, contributing to reliable cheap Indiana auto insurance.

Cons

- Higher Premiums for Some Drivers: Premiums can be higher for high-risk drivers or those with poor credit scores, which may impact the affordability of cheap Indiana auto insurance. Read more through our Allstate insurance review.

- Complex Policy Options: The variety of coverage options and add-ons can be overwhelming, making it challenging to find the best deal on cheap Indiana auto insurance. This complexity might affect the overall experience.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for Accident Forgiveness

Pros

- Customizable Coverage Options: Liberty Mutual offers a wide range of coverage types and add-ons, allowing for tailored insurance solutions. This flexibility helps in obtaining cheap Indiana auto insurance that meets individual needs.

- Discounts for Bundling: Offers significant savings when bundling auto insurance with other policies, starting at $30 per month. This can result in affordable cheap Indiana auto insurance for those who combine multiple policies.

- Good for High-Risk Drivers: Liberty Mutual provides options for drivers with challenging records, ensuring that cheap Indiana auto insurance is available for a broader range of individuals. Read more through our Liberty Mutual auto insurance review.

Cons

- Potentially Higher Rates: Premiums can be higher compared to some competitors, which might affect the overall affordability of cheap Indiana auto insurance for some drivers.

- Less Personalized Service: The large size of Liberty Mutual may result in less personalized customer service compared to smaller providers, which could impact the experience of managing cheap Indiana auto insurance.

Indiana Auto Insurance Laws and Requirements

Finding the right auto insurance plan is like buying a house. Everything has to be exactly the way you want it or it just won’t seem “right.” When purchasing insurance in Indiana, or in any state for that matter, it’s always important to do some research on the insurance providers and understanding how auto insurance works.

Indiana Auto Insurance Monthly Rates by Coverage Level & Provider| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $48 | $140 |

| American Family | $37 | $107 |

| Farmers | $27 | $79 |

| Geico | $22 | $63 |

| Liberty Mutual | $63 | $183 |

| Nationwide | $33 | $97 |

| Progressive | $23 | $69 |

| State Farm | $25 | $71 |

| Travelers | $24 | $69 |

| USAA | $15 | $43 |

Though all providers have to go through the state Department of Insurance before they can sell their services, there is still a chance that you’re not getting exactly what you want. Below are some guidelines to help you with your purchase of auto insurance in the state of Indiana.

For every state, it’s required that there be a minimum insurance requirement for certain coverage in your insurance policy, and Indiana is no exception. Usually, there are two to three areas of liability in which all states require minimum coverage. The state of Indiana requires all motorists to have minimum coverage auto insurance for bodily injury and property damage.

The first type of liability coverage, bodily injury liability, covers medical expenses for the other driver and passengers as result of the accident where you are at fault. In the state of Indiana, the minimum requirement per person is $25,000 and a total of $50,000 per incident for all people injured in the accident.

Secondly, there is property damage liability. Property damage covers damage to the other person’s vehicle and any other property you are responsible for damaging. In Indiana, the minimum requirement for this liability is $10,000.

Once again, it is not recommended that you only get enough to meet the minimum requirement. In the event of an accident with serious damage, that amount will be quickly exceeded.

High-Risk Auto Insurance in Indiana

If you are deemed to be a high-risk driver by the Indiana BMV, you might be required to file either an SR-50 form or an SR-22 form. Both of these documents are used to verify that you have adequate insurance coverage.

These documents, which need to be signed or stamped by your insurer and submitted to the BMV, validate that you are financially responsible enough to be driving on Indiana’s roads. Incidents that could lead to you needing to prove financial responsibility include driving without insurance or driving under the influence (DUI). Enter your ZIP code now.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Indiana Auto Insurance Premiums

Throughout the United States, the premiums for auto insurance varies greatly, and states often times have insurance rates that cost more or less than the national average rate. Fortunately, Indiana’s average auto insurance rate is $15 compared to the national average of $63.

This rate changes drastically when you go from the outskirts of rural Indiana to the inner city area, however. In the main city and capital of Indianapolis, the average insurance premium is $15, which is still less than the national average.

Obviously, this rate is much more than the rural rate to account for the higher possibility of auto accidents due to the higher density of people and vehicles. Urban areas typically have higher property damage liability coverage requirements, which contribute to the increased insurance rates compared to rural areas.

While many of these factors are simply based on your own driving record, two things that affect even the safest of drivers are age and gender. As with most states, males typically pay higher auto insurance rates than females.

Driving Statistics in Indiana

Luckily, the numbers of accidents that occur in Indiana have decreased since 2008. Since 2008, there has been a 7.7% decrease in auto accidents, with 189,676 in 2009. The number of fatal accidents has also decreased substantially, with 631 in 2009.

Interestingly enough, more fatal accidents occurred in the rural areas of Indiana, even though it would be more likely that they occur in the metropolitan city of Indianapolis. A total of 68.1% of the fatal accidents in the state of Indiana happened in rural areas, probably as a result of reckless driving on small interstate roads.

Ty Stewart

Licensed Insurance Agent

To learn which highways to be cautious of in Indiana, take a look at our page, Most Dangerous Highways by State, for more information.

Whether you live in a busy city or on a small farm, it is important that you are insured. Here at 4AutoInsuranceQuote.com, we greatly value your privacy. This is why, compared to many other companies, we would never ask for your social security number when calculating an insurance quote.

To easily begin your quest to find the best deal on auto insurance and the “Best Auto Insurance Companies”, simply enter your ZIP code at the top of this page to start a quick and easy quoting process.

Frequently Asked Questions

What are the minimum auto insurance requirements in Indiana?

Indiana requires 25/50/25 coverage (bodily injury per person/bodily injury per accident/property damage).

How can I find cheap Indiana auto insurance?

Compare rates from multiple companies before buying. Enter your ZIP code now to begin comparing.

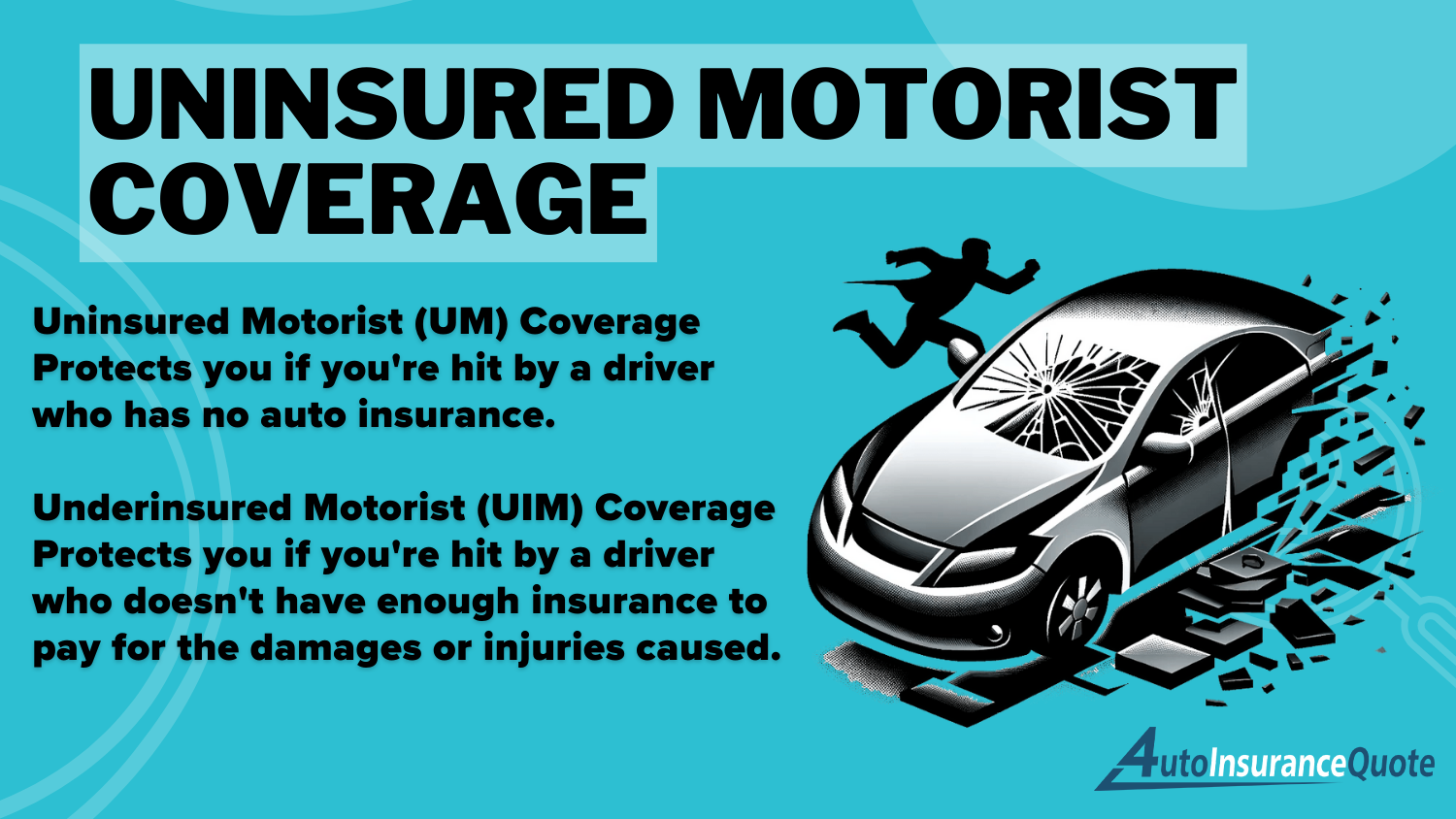

What optional coverage options are available in Indiana?

Additional coverage options include collision, comprehensive, uninsured/underinsured motorist, and medical payments coverage.

What is high-risk auto insurance in Indiana?

High-risk drivers may need to file an SR-50 or SR-22 form to prove insurance coverage.

What are the average auto insurance rates in Indiana?

Indiana’s average auto insurance rate is $942.39, lower than the national average. Enter your ZIP code now to begin comparing.

Which insurance company offers the lowest monthly rates for cheap Indiana auto insurance?

USAA offers the lowest monthly rates for cheap Indiana auto insurance, starting at $15 per month. This makes it an excellent choice for budget-conscious drivers looking for effective budgeting strategies in managing their insurance costs.

What program does Progressive offer to help reduce premiums based on driving behavior?

Progressive’s Snapshot Program offers discounts based on your driving habits. Safe driving can lead to lower premiums, making it a good option for those seeking cheap Indiana auto insurance.

How does the Drive Safe & Save program benefit State Farm customers seeking cheap Indiana auto insurance?

State Farm’s Drive Safe & Save program rewards drivers for safe driving habits, potentially lowering their insurance premiums. This program helps in obtaining affordable cheap Indiana auto insurance. Enter your ZIP code now to begin comparing.

What type of discounts does Geico provide through its online platform for cheap Indiana auto insurance?

Geico offers various online discounts, including savings for bundling multiple policies and for maintaining a clean driving record.

To find the best rates, it’s helpful to compare auto insurance quotes, as these discounts can contribute to achieving cheap Indiana auto insurance.

Which insurance provider is noted for its extensive local agent network and personalized service?

Allstate is recognized for its extensive network of local agents who provide personalized service. This local support helps customers manage and obtain cheap Indiana auto insurance more effectively.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.