Cheap Auto Insurance for 19-Year-Olds in 2025 (Find Savings With These 10 Companies)

For cheap auto insurance for 19-year-olds, State Farm, Geico, and Progressive are top choices. These providers offer competitive rates starts at $106 monthly with extensive coverage options. Insuring a 19-year-old is often costly, but safe driving and good student discounts can help lower the rates.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michael Vereecke

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Commercial Lines Coverage Specialist

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for 19-Year-Olds

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,283 reviews

13,283 reviewsCompany Facts

Min. Coverage for 19-Year-Olds

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsFinding cheap auto insurance for 19-year-olds might be challenging, but with options from State Farm, Geico, and Progressive, it doesn’t have to be. State Farm stands out with its exceptional rates starting at just $106 per month, offering both cost savings and comprehensive coverage.

This article delves into the best choices for young drivers, helping you navigate options to secure the best deal with auto insurance discounts for affordable coverage. Explore these top picks and discover how to maximize your savings today.

Our Top 10 Company Picks: Cheap Auto Insurance for 19-Year-Olds| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $106 | B | Good Student | State Farm | |

| #2 | $116 | A++ | Competitive Rates | Geico | |

| #3 | $122 | A+ | Snapshot Program | Progressive | |

| #4 | $124 | A+ | Vanishing Deductible | Nationwide |

| #5 | $125 | A++ | Young Discounts | Travelers | |

| #6 | $129 | A | Student Discounts | Farmers | |

| #7 | $131 | A | Safe Discounts | Liberty Mutual |

| #8 | $135 | A++ | Military Benefits | USAA | |

| #9 | $138 | A | Bundling Discounts | American Family | |

| #10 | $140 | A+ | Teen Program | Allstate |

If you are asking, “How much is car insurance for a 19-year-old?” you have come to the right place. 19-year-old drivers pay some of the highest rates for car insurance. With auto insurance for teenagers, you have a higher expected accident rate than virtually any other driver on the road.

- Discounts for good grades and safe driving can lower rates for young drivers

- Rates are high for 19-year-olds, but shopping around can save money

- Special programs and discounts are available for young drivers

#1 – State Farm: Top Overall Pick

Pros

- Low Starting Rates: Competitive starting rates around $106 per month make it one of the most affordable options for young drivers. This can significantly help in finding cheap auto insurance for 19-year-olds who are budget-conscious. Additionally, this affordability allows for better financial management.

- Exceptional Local Agents: Access to numerous local agents for personalized service and advice. This localized support is beneficial for navigating the specifics of cheap auto insurance for 19-year-olds and can assist in finding the best coverage. Delve more through our State Farm insurance review.

- Excellent Claims Handling: Known for efficient and fair claims processing, ensuring that any issues are resolved quickly. This reliability is crucial for those seeking cheap auto insurance for 19-year-olds with good service, reducing stress during the claims process.

Cons

- Potential for Rate Increases: Rates may increase if you add additional coverage or features, which could offset initial savings on cheap auto insurance for 19-year-olds. This might make it challenging to keep the costs low over time.

- Limited Online Discounts: Online-exclusive discounts might not be as extensive as those available through agents, potentially limiting savings on cheap auto insurance for 19-year-olds. This can affect the overall affordability of your policy.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#2 – Geico: Best for Competitive Rates

Pros

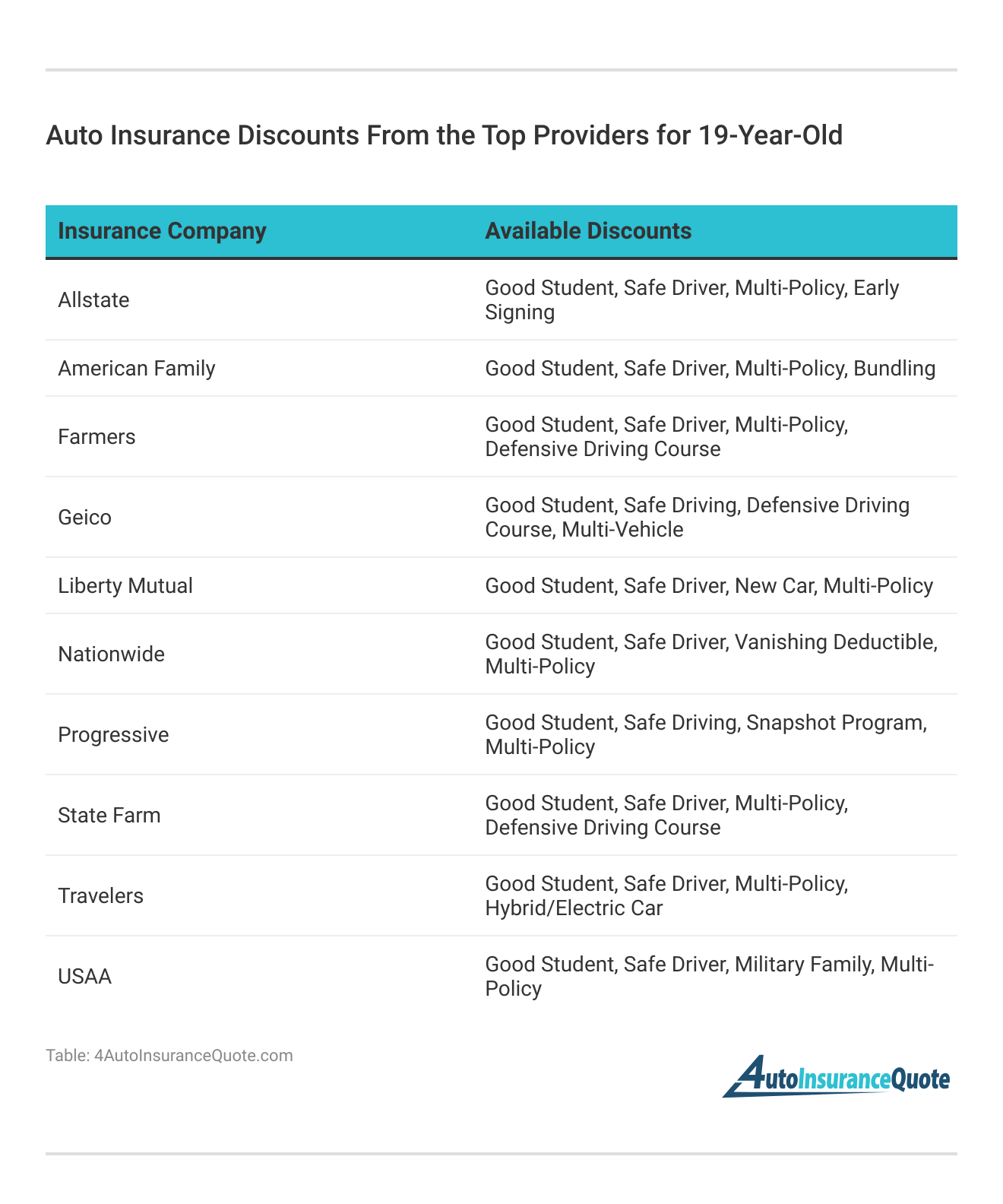

- Discounts for Safe Driving: Offers significant savings for safe driving habits through its usage-based program, helping reduce the cost of cheap auto insurance for 19-year-olds. This program incentivizes good driving and can lead to substantial long-term savings.

- Low Rates for Good Students: Discounts for students with good grades help reduce premiums, making it easier to find cheap auto insurance for 19-year-olds who excel academically. This can make a big difference in overall costs. More info on our Geico insurance review.

- Efficient Mobile App: The user-friendly app facilitates easy policy management and claims filing, streamlining the process of maintaining cheap auto insurance for 19-year-olds. It provides convenient access to your insurance details on the go.

Cons

- Customer Service Variability: Mixed reviews regarding customer service experiences might affect satisfaction with cheap auto insurance for 19-year-olds. This variability could impact your overall experience with the insurer.

- High Rates for Certain Vehicles: Insurance costs can be higher for certain high-risk or luxury vehicles, impacting the affordability of cheap auto insurance for 19-year-olds. This could limit options if you drive a higher-risk car.

#3 – Progressive: Best for Snapshot Program

Pros

- Snapshot Program Savings: Potential for lower rates through the Snapshot program, which tracks driving behavior. This program can help secure cheaper auto insurance for 19-year-olds by rewarding good driving habits and encouraging safer driving.

- Discounts for Multi-Car Policies: Savings available for insuring multiple vehicles, which can help reduce the cost of cheap auto insurance for 19-year-olds with multiple cars. This can be particularly useful for families or those with more than one vehicle.

- User-Friendly Website: Easy-to-navigate website for quick policy management and quote comparisons, simplifying the search for cheap auto insurance for 19-year-olds. This ease of use enhances the overall customer experience. Sight more info through our Progressive insurance review.

Cons

- Higher Base Rates: Initial premiums may be higher compared to some competitors, potentially making it harder to find cheap auto insurance for 19-year-olds. This could affect your budget if initial costs are a concern.

- Complex Discount Structure: Understanding and applying all available discounts can be complicated, which may affect the overall affordability of cheap auto insurance for 19-year-olds. This complexity can make it difficult to maximize savings.

#4 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible Feature: Reduces your deductible over time, offering potential savings on out-of-pocket expenses. This feature helps make cheap auto insurance for 19-year-olds more affordable in the long run by lowering future costs.

- Diverse Payment Plans: Various payment plans available to accommodate different budgets, making it easier to manage cheap auto insurance for 19-year-olds. This flexibility can help with budgeting and financial planning. Find more insights through our Nationwide insurance review.

- Multi-Vehicle Discounts: Additional savings for bundling multiple vehicles under one policy, which can be particularly beneficial for families or individuals seeking cheap auto insurance for 19-year-olds. This can significantly lower costs if you insure more than one vehicle.

Cons

- Higher Initial Premiums: Premiums may be higher at the start compared to some other providers, potentially affecting the search for cheap auto insurance for 19-year-olds. This might require a higher initial investment.

- Limited Availability of Some Discounts: Certain discounts might not be available in all states, which could limit opportunities for cheap auto insurance for 19-year-olds in some regions. This variability can impact overall savings.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#5 – Travelers: Best for Young Discounts

Pros

- Young Driver Discounts: Special discounts tailored for young drivers to reduce overall premiums, making it easier to find cheap auto insurance for 19-year-olds. This can lead to significant savings for younger drivers. Review further information in our Travelers insurance review.

- Good Student Discounts: Additional savings for students maintaining good academic performance, which helps lower the cost of cheap auto insurance for 19-year-olds who excel academically. This can be a valuable benefit for high-achieving students.

- Strong Financial Ratings: High A.M. Best ratings indicate financial stability and reliability, ensuring that you get reliable cheap auto insurance for 19-year-olds. This provides peace of mind knowing the insurer is financially sound.

Cons

- Higher Rates for New Drivers: Initial rates might be elevated for new drivers until discounts are applied, impacting the search for cheap auto insurance for 19-year-olds. This can be a challenge for those just starting out.

- Complex Policy Options: The range of coverage options can be overwhelming to navigate, which may complicate finding cheap auto insurance for 19-year-olds. This complexity can make it harder to select the best policy.

#6 – Farmers: Best for Student Discounts

Pros

- Discounts for Academic Achievement: Offers discounts for students with good grades or who are involved in extracurricular activities, helping reduce the cost of cheap auto insurance for 19-year-olds. This can lead to lower premiums for those who excel academically.

- Accident Forgiveness: Provides forgiveness for your first accident, potentially keeping premiums from increasing and aiding in maintaining affordable cheap auto insurance for 19-year-olds. This feature helps mitigate the financial impact of an accident.

- Local Agent Support: Access to local agents for personalized service and support, which can be beneficial when finding the best cheap auto insurance for 19-year-olds. Personalized service can help you understand and manage your policy better. Check out more specifics through our Nationwide insurance review.

Cons

- Higher Premiums for Young Drivers: Premiums can be higher compared to some competitors for young drivers, making it more challenging to find cheap auto insurance for 19-year-olds. This can affect affordability for younger drivers.

- Complex Discount Structure: Understanding and applying all available discounts can be complicated, potentially affecting the affordability of cheap auto insurance for 19-year-olds. This complexity might limit the savings you can achieve.

#7 – Liberty Mutual: Best for Safe Discounts

Pros

- Safe Driver Discounts: Provides discounts for maintaining a clean driving record, which can help lower the cost of cheap auto insurance for 19-year-olds. This encourages safe driving and rewards responsible behavior.

- Package Deals: Savings available when bundling auto insurance with home or renters insurance, making it easier to find cheap auto insurance for 19-year-olds. Bundling can lead to significant overall savings. Discover more about this in our Liberty Mutual auto insurance review.

- Roadside Assistance Included: Many policies include roadside assistance for added convenience, enhancing the value of cheap auto insurance for 19-year-olds. This can provide peace of mind knowing help is available if needed.

Cons

- Higher Premiums for Younger Drivers: Initial premiums might be higher, especially for younger drivers, potentially impacting the search for cheap auto insurance for 19-year-olds. This could be a concern if initial costs are a significant factor.

- Discount Availability: Some discounts might not be available in all regions, which could limit savings on cheap auto insurance for 19-year-olds. This can affect the overall affordability of your policy.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#8 – USAA: Best for Military Benefits

Pros

- Exclusive Military Discounts: Special benefits and discounts for military members and their families, making it an excellent option for finding cheap auto insurance for 19-year-olds in the military. This can lead to substantial savings for eligible members.

- Exceptional Service Quality: Highly rated for customer support and claims handling, ensuring a positive experience with cheap auto insurance for 19-year-olds. The high level of service can enhance your overall satisfaction with the insurer.

- Economical Pricing: Generally lower rates compared to many other providers for eligible members, making it easier to secure cheap auto insurance for 19-year-olds. This can help manage costs effectively. Get more insights from our Allstate vs. USAA insurance review.

Cons

- Eligibility Restrictions: Only available to military members and their families, which may limit access for those seeking cheap auto insurance for 19-year-olds outside this group. This could restrict options for non-military individuals.

- Limited Physical Locations: Fewer physical offices for in-person support compared to other providers, potentially affecting the convenience of managing cheap auto insurance for 19-year-olds. This could be a disadvantage if you prefer face-to-face interactions.

#9 – American Family: Best for Bundling Discounts

Pros

- Bundling Discounts: Offers savings when bundling auto insurance with other policies such as home or life insurance, which can help reduce the cost of cheap auto insurance for 19-year-olds. Bundling policies can lead to significant discounts and overall savings.

- Good Student Discounts: Additional savings for students with good grades, making it easier to find cheap auto insurance for 19-year-olds who excel academically. This benefit can provide substantial savings for high-achieving students. Explore further details in our American Family auto insurance review.

- 24/7 Customer Support: Round-the-clock customer service for assistance with policy management and claims, ensuring reliable support for cheap auto insurance for 19-year-olds. This constant availability helps address any issues promptly.

Cons

- Higher Premiums Initially: Premiums might be higher before applying available discounts, which could affect the affordability of cheap auto insurance for 19-year-olds. Initial costs may be a concern before discounts take effect.

- Complex Policy Options: The range of coverage options can be overwhelming, which may complicate finding cheap auto insurance for 19-year-olds. This complexity might make it challenging to select the best policy.

#10 – Allstate: Best for Teen Program

Pros

- Safe Driving Bonuses: Provides bonuses for maintaining a clean driving record, which can lower the cost of cheap auto insurance for 19-year-olds. This encourages responsible driving and rewards good behavior. Read more through our Allstate insurance review.

- Good Student Discounts: Offers discounts for students with good grades, making it easier to find cheap auto insurance for 19-year-olds who excel academically. This can help reduce premiums for high-achieving students.

- User-Friendly Mobile App: The app simplifies managing your policy and filing claims, making it easier to handle cheap auto insurance for 19-year-olds. This convenience can improve the overall experience with the insurer.

Cons

- Higher Rates for New Drivers: Initial premiums may be higher, especially for new drivers, which could impact the affordability of cheap auto insurance for 19-year-olds. This can be a concern if you’re just starting out.

- Discount Complexity: The structure for discounts can be complex, potentially affecting the overall affordability of cheap auto insurance for 19-year-olds. Understanding and applying all available discounts might be challenging.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

19-Year-Old Drivers Pay Some of the Most Expensive Car Insurance Premiums

As a 19-year-old, you may have been driving successfully since age 14 or 16 without making a claim. While it is great to have a what is considered clean driving record and good driving habits, any teen driver will still have a higher rate.

Most car insurance companies still treat you as an inexperienced teenager, and that means you can expect to pay similar insurance premiums as auto insurance for 16-year-olds, auto insurance for 17-year-olds (read our “What’s the Cheapest Auto Insurance Quotes for 17-Year-Olds” for more information), or cheap auto insurance for 18-year-olds.

19-Year-Old Auto Insurance Monthly Rates by Coverage Level & Provider| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $140 | $300 |

| American Family | $138 | $285 |

| Farmers | $129 | $270 |

| Geico | $116 | $248 |

| Liberty Mutual | $131 | $278 |

| Nationwide | $124 | $255 |

| Progressive | $122 | $263 |

| State Farm | $106 | $235 |

| Travelers | $125 | $250 |

| USAA | $135 | $290 |

As a 19-year-old driver, you’re not going to find cheap car insurance anywhere. How much can you really expect to pay for car insurance as a 19-year-old? Keep reading to find out how age affects auto insurance rates.

However, you can still find good car insurance for a 19-year-old by shopping around. You’re always going to be paying a higher auto insurance rate than older drivers, but smart 19-year-old drivers can compare car insurance quotes online today to ensure they get the best deal.

Average Car Insurance Premiums for a 19-Year-Old Driver

Car insurance premiums can rise to an average of $2,600 to $4,000 per year for car insurance if you want more than the bare legal minimum amount of coverage required. A 19-year-old driver who wants a 100/300/100 car insurance policy will pay an average of around $3,500.

A 19-year-old female driver in Hawaii, for example, may pay less than $1,500 for car insurance, while a 19-year-old male driver in Connecticut may pay over $5,500.

Generally, however, an average 19-year-old driver in the United States can be expected to pay around $2,600 per year for car insurance. The average for a young driver is slightly less for females and slightly more for males. Enter your ZIP code in our free tool to start your quote.

Read more:

- Affordable Auto Insurance Quotes for High School Students

- Affordable Auto Insurance Quotes for Women

- Affordable Auto Insurance Quotes for 18-Year-Olds

Saving Money on Car Insurance as a 19-Year-Old Driver

Fortunately for 19-year-old drivers, there are a number of ways to save a significant amount on car insurance. With a little bit of work, you can lower your auto insurance rates and save hundreds of dollars per year on your premiums.

By adding yourself to your parent’s policy, you may be able to save thousands of dollars per year.

Some of the best cost-saving strategies for 19-year-old drivers include:

Add Yourself Under Your Parents’ Policy

Many 19-year-olds are either living at home or away at college. Should college students use a home address or college address for auto insurance? If you’re away at college, then you may still be considered a resident of your parent’s house for insurance purposes.

A 19-year-old male driver in Texas, for example, can pay up to $5,000 for his own car insurance policy. When adding himself under his parents’ policy, however, that same driver can reduce car insurance premiums to around $250 per month while maintaining 100/300/100 coverage for better protection.

>It’s perfectly legal to add yourself under your parents’ policy as long as you abide by your insurance rules. You can’t list your mom as a primary driver on your own vehicle, for example, if you’re the one who drives it every day.

Good Student Discounts

Many of the best auto insurance companies now offer good student discounts or good grade discounts. If you’re a high school or college student with a B+ or higher average, then you may be able to save money on car insurance premiums.

Studies have shown that good students make fewer claims than bad students, so insurance companies have a reason to give discounts to good students. Ask your car insurance company about a good grades discount.

Drop Collision and Comprehensive Coverage on Older Vehicles

Many students drive cheaper, older vehicles. These vehicles might not be worth repairing after an accident. In this case, you may want to drop comprehensive and collision coverage from the older vehicle.

This can cut the cost of car insurance by up to 50%, saving you hundreds – even thousands – per year on car insurance as a 19-year-old driver.

Collision coverage covers damage to your own vehicle after a collision with another driver, while comprehensive coverage covers things like hail damage, theft, and vandalism.

Attend Driver Training

Many younger drivers choose to go through driver training. Or, some did driver training before taking their license test. Many insurance companies give 19-year-old drivers a discount of 10% to 15% for attending a defensive driving class or something similar.

Compare Quotes Online

The more quotes you compare, the better your car insurance premiums will be. Compare as many quotes as possible online today. Some car insurance companies heavily discourage 19-year-old drivers by charging higher premiums.

Other insurance companies like having 19-year-old drivers in their insurance pool and will charge lower rates than competitors.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Conclusion: Wait a Few Years to Enjoy Lower Car Insurance Prices

Ultimately, 19-year-old drivers pay some of the highest rates in the United States for car insurance. Rates may be slightly lower than the average premiums paid by a 16, 17, or 18-year-old driver.

As a teenage driver, expect to pay more for car insurance than average adult rates.Tracey L. Wells Licensed Insurance Agent & Agency Owner

Wait a few years, maintain a clean driving record, and eventually, auto insurance will go down at age 25. You won’t be stuck paying high 19-year-old driver insurance prices forever.

Enter your ZIP code in our free tool to compare annual rates from multiple insurers for cheap car insurance for 19-year-olds.

Frequently Asked Questions

Why is auto insurance expensive for 19-year-olds?

Auto insurance for 19-year-olds is expensive because they are considered high-risk drivers due to their age and limited driving experience. However, there are options for affordable high-risk auto insurance that can help manage these costs.

How much does car insurance cost for a 19-year-old?

On average, a 19-year-old driver can expect to pay around $1,800 to $3,000 per year for car insurance, depending on various factors such as location, gender, and coverage needs. Enter your ZIP code to start your free quote today.

Are there any ways to save money on car insurance as a 19-year-old driver?

Yes, there are several ways to save money on car insurance as a 19-year-old driver.

These include adding yourself under your parents’ policy, taking advantage of good student discounts, including the student auto insurance discount, considering dropping collision and comprehensive coverage on older vehicles, attending driver training courses, and comparing quotes online.

Can I be added to my parents’ car insurance policy as a 19-year-old?

Yes, if you are living at home or away at college and meet certain criteria, you can be added to your parents’ car insurance policy, which can often result in significant cost savings.

Will car insurance prices go down as I get older?

Yes, car insurance prices generally decrease as you get older and gain more driving experience. By maintaining a clean driving record and reaching age 25, you can expect to see a decrease in your car insurance premiums. Comparing is easy by entering your ZIP code below.

What factors contribute to the high cost of auto insurance for 19-year-olds compared to older drivers?

The high cost for 19-year-olds is primarily due to their inexperience and higher likelihood of accidents. Insurance companies view younger drivers as higher risk, leading to increased premiums, although a distant student auto insurance discount might help mitigate some of these costs.

Additionally, the statistical data on young drivers supports higher rates due to their frequent involvement in collisions.

How do the insurance needs of 19-year-olds differ from those of younger teenagers or older drivers?

At 19, drivers often need affordable comprehensive auto insurance coverage due to increased independence and driving responsibility. Older drivers typically have lower rates due to their accumulated driving experience and fewer accidents.

The insurance needs for 19-year-olds also include considerations for academic discounts and driver training benefits.

What are the most effective strategies for a 19-year-old to improve their insurance rates over time?

Maintaining a clean driving record and taking defensive driving courses can help lower premiums. Good student discounts and bundling insurance policies with other types can also reduce costs.

Gradually, as the driver gains experience and reaches a more mature age, insurance rates will typically decrease. Start comparing quote by entering your ZIP code in our tool below.

How do geographic locations impact auto insurance rates for 19-year-olds?

Geographic locations can significantly affect rates due to varying traffic patterns, accident rates, and local insurance regulations. Areas with higher traffic congestion or accident rates typically see higher premiums.

Additionally, how age affects your auto insurance rates can further influence costs, as younger drivers often face higher premiums due to their higher risk profile. Conversely, locations with fewer accidents or lower crime rates may offer more affordable coverage.

What role does vehicle type and age play in determining the cost of auto insurance for 19-year-olds?

Newer or more expensive vehicles generally have higher insurance premiums due to their higher repair costs and replacement value.

Older vehicles or those with lower market value may qualify for cheaper coverage, especially if comprehensive and collision coverage is dropped. The type of vehicle can also impact rates based on its safety features and risk profile.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Michael Vereecke

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Commercial Lines Coverage Specialist

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.