Cheap Michigan Auto Insurance in 2025 (Secure Low Rates With These 10 Companies)

Geico, Progressive, and Travelers offer the best rates for cheap Michigan auto insurance, starting at just $47 monthly. These providers stand out due to their affordable prices, comprehensive coverage, and excellent customer service, making them the top choices for budget-friendly Michigan auto insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

13,283 reviews

13,283 reviewsCompany Facts

Min. Coverage in Michigan

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 1,733 reviews

1,733 reviewsCompany Facts

Min. Coverage in Michigan

A.M. Best Rating

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviews

Geico, Progressive, and Travelers are leading choice for cheap Michigan auto insurance providing competitive rates.

Without drivers, there would be no market for cars, and drivers require insurance. Understanding auto insurance, including the process of filing an auto insurance claim, makes it easier to buy the coverage you need with confidence.

Our Top 10 Company Picks: Cheap Michigan Auto Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $47 A++ Good Drivers Geico

#2 $73 A+ Competitive Rates Progressive

#3 $88 A++ Coverage Options Travelers

#4 $96 A Roadside Assistance AAA

#5 $98 A Discount Availability American Family

#6 $100 B Student Savings State Farm

#7 $120 A++ Accident Forgiveness Auto-Owners

#8 $160 A Family Plans Farmers

#9 $195 A+ Customer Service Allstate

#10 $204 A Multi-Policy Discounts Liberty Mutual

Before you buy Michigan auto insurance, take the time to shop around.

Enter your ZIP code to compare free Michigan auto insurance quotes.

#1 – Geico: Top Overall Pick

Pros

- Budget-Friendly Prices: Geico provides competitive monthly premiums beginning at $47, making it an economical option for those looking to manage costs. This positions it as a top choice for affordable Michigan auto insurance, allowing you to save money while maintaining solid coverage.

- User-Friendly Online Tools: Their online platform is highly intuitive, allowing for easy policy management and claims filing. This convenience can enhance the overall experience when seeking cheap Michigan auto insurance, providing hassle-free service.

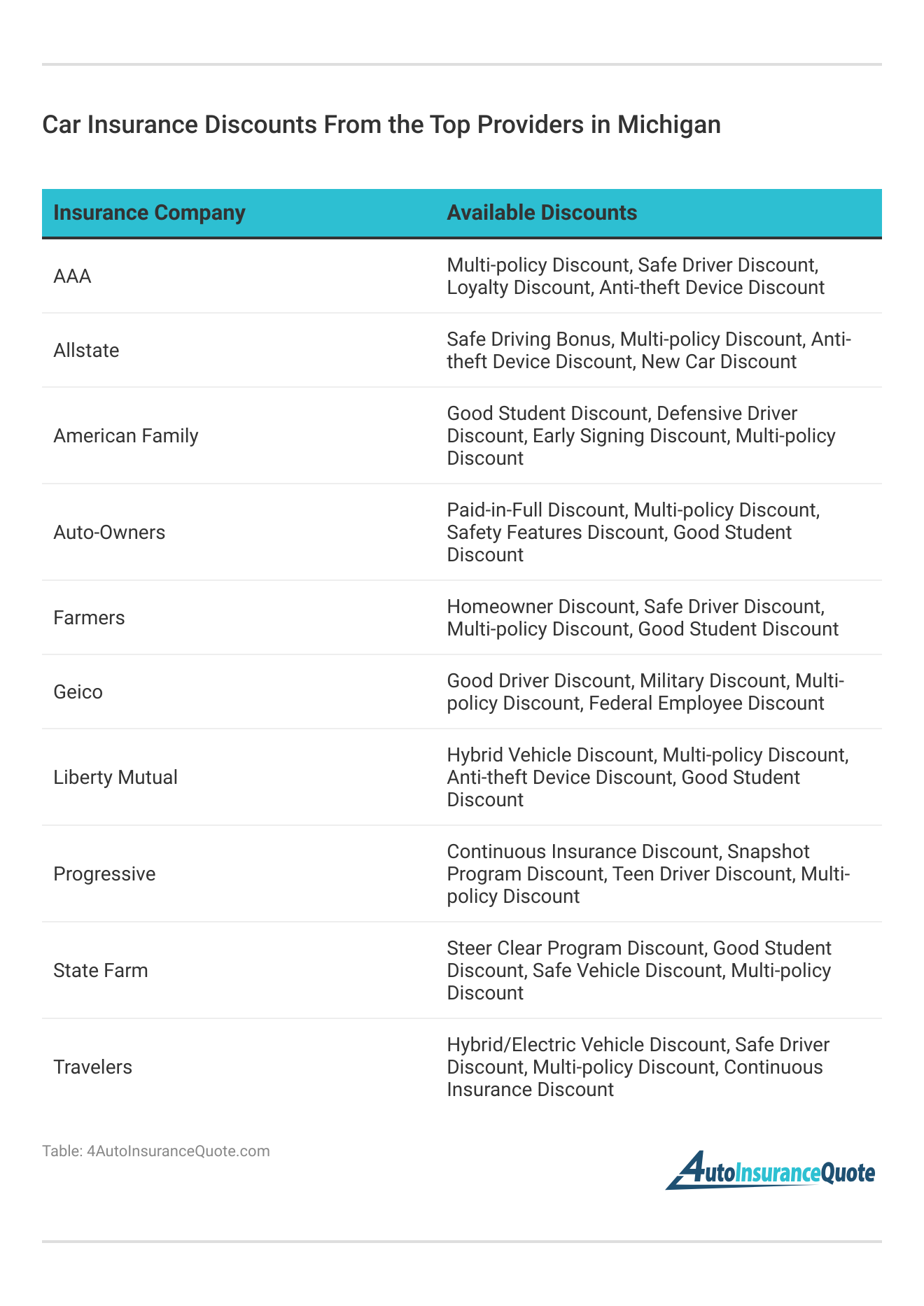

- Wide Range of Discounts: Geico provides numerous discounts, including multi-policy, good driver, and military discounts. These discounts contribute to making Geico a viable option for cheap Michigan auto insurance by reducing your overall premiums.

Cons

- Limited Local Agents: Geico relies heavily on its online presence, which may not be ideal for those who prefer in-person service. This can be a drawback for those looking for cheap Michigan auto insurance with personalized local support. Discover more through our Geico insurance review.

- Mixed Reviews on Claims Handling: While many customers report positive experiences, there are some complaints about the claims process being slow or complicated. This inconsistency can affect your perception of cheap Michigan auto insurance if the claims process is not smooth.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#2 – Progressive: Best for Competitive Rates

Pros

- Snapshot Program: Progressive’s usage-based insurance program can offer significant savings based on your driving habits. This program makes cheap Michigan auto insurance even more affordable by rewarding safe driving.

- Comprehensive Coverage Options: They provide a wide array of coverage options, including gap insurance and custom parts coverage. This flexibility ensures that cheap Michigan auto insurance can still offer extensive protection.

- Competitive Rates: Progressive is known for offering affordable rates, especially for high-risk drivers. With monthly rates starting at $73, it remains a strong option for cheap Michigan auto insurance. Find out more through our Progressive insurance review.

Cons

- Rate Increases After Claims: Some customers have reported substantial rate hikes following a claim. This can make cheap Michigan auto insurance more expensive over time if your rates increase significantly after a claim.

- Average Customer Satisfaction: While generally positive, Progressive’s customer service ratings are not as high as some competitors. This might lead to less satisfaction with cheap Michigan auto insurance if the service quality is inconsistent.

#3 – Travelers: Best for Coverage Options

Pros

- Broad Coverage Options: Travelers provides an array of policies, such as accident forgiveness and new car replacement, ensuring that affordable Michigan auto insurance can still offer extensive protection.

- Robust Financial Stability: Highly rated by A.M. Best, reflecting strong financial health and dependability. Their financial stability guarantees that your affordable Michigan auto insurance will be dependable and trustworthy.

- Discounts for Hybrid/Electric Cars: Special discounts are available for eco-friendly vehicles, promoting environmentally conscious choices. These discounts can contribute to securing cheap Michigan auto insurance.

Cons

- Higher Rates for Younger Drivers: Travelers tends to be more expensive for drivers under 25. This can impact the availability of cheap Michigan auto insurance for younger individuals. See more through our Travelers insurance review.

- Limited Availability of Local Agents: Fewer local agents compared to other major insurers, which might be a drawback for those preferring in-person service. This can limit access to cheap Michigan auto insurance with personalized assistance.

#4 – AAA: Best for Roadside Assistance

Pros

- Roadside Assistance: AAA is renowned for its comprehensive roadside assistance services, providing peace of mind for drivers. This additional service adds value to cheap Michigan auto insurance by offering more than just basic coverage.

- Wide Range of Discounts: AAA offers discounts for good students, multi-vehicle policies, and more. These discounts can help lower your costs, making AAA a good option for cheap Michigan auto insurance.

- Travel Benefits: AAA members receive various travel-related perks and discounts, adding value beyond just auto insurance. These benefits enhance the appeal of cheap Michigan auto insurance by providing additional services. Read more through our AAA insurance review.

Cons

- Higher Premiums: AAA’s monthly rates are $96, which is higher than some competitors. This might not be ideal for those specifically looking for cheap Michigan auto insurance.

- Membership Requirement: AAA requires a membership, which adds an extra cost on top of insurance premiums. This requirement can make cheap Michigan auto insurance less affordable due to the added membership fee.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#5 – American Family: Best for Discount Availability

Pros

- Comprehensive Coverage Options: American Family offers a variety of policies, including rideshare insurance and gap coverage. These options ensure that cheap Michigan auto insurance can still provide extensive protection.

- Teen Safe Driver Program: This program helps reduce premiums for families with young drivers by promoting safe driving habits. Such initiatives make American Family a good option for cheap Michigan auto insurance for families.

- Strong Financial Stability: With high ratings from A.M. Best, American Family is financially stable, ensuring reliability. Financial stability guarantees that cheap Michigan auto insurance will be backed by a dependable provider. Learn more through our American Family auto insurance review.

Cons

- Higher Rates for Certain Policies: American Family’s premiums can be higher for specific coverage options or drivers with less-than-perfect records. This can impact the affordability of cheap Michigan auto insurance for these individuals.

- Mixed Customer Satisfaction: While generally positive, American Family’s customer service ratings vary, which might lead to less satisfaction with cheap Michigan auto insurance if service quality is inconsistent.

#6 – State Farm: Best for Student Savings

Pros

- Extensive Agent Network: State Farm has a large network of local agents, providing personalized service. This extensive network makes it easier to find cheap Michigan auto insurance with local support.

- Discounts for Safe Driving: State Farm offers discounts for safe driving, including the Steer Clear program for young drivers. These discounts help lower premiums, contributing to cheap Michigan auto insurance. Delve more through our State Farm insurance review.

- Comprehensive Coverage Options: State Farm provides a variety of coverage options, including rideshare insurance. This flexibility ensures that cheap Michigan auto insurance can still offer extensive protection.

Cons

- Higher Rates for Some Drivers: State Farm’s rates can be higher for certain demographics, such as young drivers. This can impact the availability of cheap Michigan auto insurance for these groups.

- Mixed Reviews on Claims Handling: While generally positive, some customers report issues with the claims process. This can affect your experience with cheap Michigan auto insurance if claims handling is not efficient.

#7 – Auto-Owners: Best for Accident Forgiveness

Pros

- Local Agent Network: Auto-Owners Insurance operates through a network of local agents, providing personalized service and support. This local presence makes it easier to access cheap Michigan auto insurance with tailored assistance.

- Strong Financial Stability: With high ratings from A.M. Best, Auto-Owners is financially stable, ensuring reliability. Financial stability is crucial for cheap Michigan auto insurance, as it guarantees the company can cover claims.

- Comprehensive Coverage Options: They offer a wide range of coverage options, including umbrella policies and additional endorsements. These options ensure that cheap Michigan auto insurance can still provide extensive protection. Learn more through our Auto-Owners insurance review.

Cons

- Limited Online Tools: Their online presence is not as robust as some competitors, which may inconvenience tech-savvy customers. This limitation can be a drawback for those seeking cheap Michigan auto insurance with easy online management.

- Higher Premiums for Some Drivers: Auto-Owners’ rates can be higher for certain demographics, such as young drivers. This can impact the availability of cheap Michigan auto insurance for these groups.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#8 – Farmers: Best for Family Plans

Pros

- Comprehensive Coverage Options: Farmers offers a variety of policies, including rideshare insurance. This flexibility ensures that cheap Michigan auto insurance can still provide extensive protection.

- Signal Program: Farmers’ usage-based insurance program rewards safe driving with discounts. This program enhances the value of cheap Michigan auto insurance by offering savings based on your driving habits.

- Strong Financial Rating: Farmers is rated highly for its financial health, ensuring reliability. Financial stability ensures that your cheap Michigan auto insurance is backed by a trustworthy provider. Read more through our Farmers auto insurance review.

Cons

- Higher Rates for Some Policies: Farmers’ premiums can be higher for certain coverage options. This can impact the affordability of cheap Michigan auto insurance for specific policies.

- Average Customer Satisfaction: While generally positive, Farmers’ customer service ratings are not the highest. This might lead to less satisfaction with cheap Michigan auto insurance if service quality is inconsistent.

#9 – Allstate: Best for Customer Service

Pros

- Comprehensive Coverage Options: Allstate offers a wide range of coverage options, including accident forgiveness. These options ensure that cheap Michigan auto insurance can still provide extensive protection.

- Drivewise Program: Allstate’s usage-based insurance program rewards safe driving with discounts. This program enhances the value of cheap Michigan auto insurance by offering savings based on your driving habits.

- Strong Financial Stability: Allstate is rated highly for its financial health, ensuring reliability. Financial stability ensures that your cheap Michigan auto insurance is backed by a trustworthy provider. Read more through our Allstate insurance review.

Cons

- Higher Premiums: Allstate’s rates can be higher than some competitors. This might not be ideal for those specifically looking for cheap Michigan auto insurance.

- Mixed Reviews on Claims Handling: Some customers report issues with the claims process. This can affect your experience with cheap Michigan auto insurance if claims handling is not efficient.

#10 – Liberty Mutual: Best for Multi-Policy Discounts

Pros

- Customizable Policies: Liberty Mutual allows you to tailor your coverage to your specific needs. This customization ensures that cheap Michigan auto insurance can still offer the protection you need.

- Accident Forgiveness: Liberty Mutual offers accident forgiveness, preventing your rates from increasing after your first accident. This feature enhances the value of cheap Michigan auto insurance by maintaining low rates.

- Wide Range of Discounts: Liberty Mutual provides various discounts, including multi-policy and good student discounts. These discounts help lower premiums, contributing to cheap Michigan auto insurance. Read more through our Liberty Mutual auto insurance review.

Cons

- Higher Rates for Some Drivers: Liberty Mutual’s premiums can be higher for certain demographics. This can impact the availability of cheap Michigan auto insurance for these groups.

- Mixed Customer Satisfaction: While generally positive, Liberty Mutual’s customer service ratings vary. This inconsistency can affect your experience with cheap Michigan auto insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Michigan Auto Insurance Laws and Requirements

Michigan has unusual no-fault insurance laws. Personal injury protection coverage is required by law and there is no limit to how much coverage is available. Your PIP will pay for all reasonable medical costs for you and your passengers regardless of fault.

The first and most important fact about Michigan’s auto insurance that drivers need to be well aware of is that Michigan is a no-fault state. This means that no matter who causes the accident, all parties will be covered by their own insurance.

Michigan Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $96 $156

Allstate $195 $406

American Family $98 $204

Auto-Owners $120 $223

Farmers $160 $335

Geico $47 $99

Liberty Mutual $204 $424

Progressive $73 $152

State Farm $100 $209

Travelers $88 $183

No-fault insurance does not mean that no one is found to be at fault in the accident, only that your own insurance pays out regardless of who is at fault.

If you are at fault in the accident, your company pays your damages, but you will still see an increase in rates as a result of the accident.

Michigan has mandatory minimum amounts of coverage, like almost every other state. Drivers are required to carry $20,000 in bodily injury liability per person per accident, $40,000 in bodily injury liability total per accident, and $10,000 in property damage liability coverage per accident.

This liability coverage will kick in if you are responsible for an accident and there are costs outside of what is covered by no-fault insurance. It also protects you if you’re involved in an accident outside of Michigan where laws differ.

Personal injury protection or PIP coverage is also required; this type of coverage pays your medical expenses for any injuries you sustain in an accident as well as your passengers.

Michigan Auto Insurance Rates

Michigan has some of the highest auto insurance rates in the nation. The average annual premium is about $2100, which comes out to about $175 per month – and that’s the average.

Many individuals are paying much higher rates for their car insurance, thanks to insurance companies pricing coverage based on variables like credit rating, past driving history, area of residence, and many other factors.

With rates being as high as they are, it’s good to see a reprieve in rates when it comes to gender. Unlike most states, Michigan has outlawed insurance companies charging different rates based on gender.

While the price has trended downward since reform to the no-fault laws, it’s still going to pay off for Michigan drivers to do some research and talk with a few auto insurance agents before committing to any Michigan auto insurance company. Enter your ZIP code now to begin comparing.

Michigan Driving Statistics

The situation is much improved for Michigan drivers when we take a look at the most recent auto crash statistics. 2009 saw a total of 291,000 accidents on Michigan roads and highways, which was a decrease of almost eight percent over the 2008 numbers.

As these statistics show a positive trend in reducing accidents, it highlights the importance of securing affordable full coverage auto insurance. A comprehensive policy can help protect drivers from financial hardship in the event of an accident, ensuring that they are covered for a range of potential damages and liabilities.

There were 871 total fatalities and about 71,000 injuries caused by automobile accidents in 2009, which again were down eleven and five percent respectively. As more than fourteen percent of these accidents were due to excessive speed, it should come as no surprise that law enforcement and state officials are pleading with Michigan’s drivers to slow down, for the safety of everyone.

Things are looking up for Michigan residents in the auto theft department – although some of the decline is likely attributed to the population drop the state has experienced over the past couple of years. 2009 saw 29,383 auto thefts in the state – a rate of 339 per 100,000 citizens.

This ranks Michigan at number 6 in the nation, a rather terrible ranking overall but at least the situation is improving.

2009’s numbers saw a drop of over 6,000 auto thefts compared to 2008, so while the situation is somewhat dire it is at least improving. Michigan drivers would do well to purchase an anti-theft device for their automobiles, which can help deter thieves from making your car their next target.

There’s no doubt that the state of Michigan is going through some tough times thanks to the national economic downturn and the troubles of the automobile manufacturers. These troubles are even reflected on Michigan roads, which saw a vehicle mileage decrease of over five percent from 2008 to 2009 as fewer drivers are getting behind the wheel and driving less when they do.

Regardless of how much you drive, you’ll still need insurance – and to get the best deal you’ll need to do some digging. As long as you take the time to do your research, you should come out on top.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Michigan Auto Insurance Agents

Additionally, understanding factors like coverage limits, deductibles, and discounts available for safe driving or combining insurance policies can further optimize your insurance selection.

Ty Stewart

Licensed Insurance Agent

Ready to find affordable Michigan auto insurance? Shopping around is crucial to securing the best deal. This comparison allows you to evaluate different coverage options and premium costs, helping you make an informed decision.

Comparing rates ensures you find the most cost-effective policy that meets your needs. By entering your ZIP code, you can compare Michigan auto insurance rates from various providers.

Frequently Asked Questions

What are the auto insurance requirements in Michigan?

Michigan auto insurance requirements include 20/40/10 for bodily injury and property damage coverage, as well as mandatory no-fault insurance coverage.

What are the average auto insurance rates in Michigan?

The average auto insurance rates in Michigan are around $175 per month or $2,100 per year. Enter your ZIP code now to begin comparing.

How can I save on Michigan auto insurance?

To save on Michigan auto insurance, it is recommended to compare auto insurance quotes from multiple insurance companies. By comparing rates, you can find the best deal and potentially save money.

What is the no-fault insurance system in Michigan?

Michigan operates under a no-fault insurance system, which means that regardless of who is at fault in an accident, each party’s insurance company pays for their own damages and injuries.

What are the mandatory minimum coverage amounts in Michigan?

Michigan requires drivers to carry a minimum of $20,000 in bodily injury liability per person, $40,000 in bodily injury liability per accident, and $10,000 in property damage liability per accident. Enter your ZIP code now to begin comparing.

What are the main benefits of choosing Auto-Owners Insurance for cheap Michigan auto insurance?

Auto-Owners Insurance offers competitive rates, excellent customer service through a network of local agents, and a robust range of coverage options.

Their accident forgiveness and diminishing auto insurance deductible programs are also significant benefits for policyholders.

How does Auto-Owners Insurance’s local agent network impact customer service for policyholders?

Auto-Owners Insurance’s local agent network ensures personalized service and expert guidance, enhancing the overall customer experience. This local presence allows for tailored solutions and quicker responses to claims and inquiries.

What unique program does American Family Insurance offer to help reduce premiums for families with young drivers?

American Family Insurance offers the Teen Safe Driver program, which provides feedback on young drivers’ habits and can lead to premium reductions.

This program, combined with their numerous discount options, helps families save on their auto insurance. Enter your ZIP code now to begin comparing.

How does the financial stability of Auto-Owners Insurance and American Family Insurance influence their reliability in providing cheap Michigan auto insurance?

The financial stability of Auto-Owners Insurance and American Family Insurance, indicated by strong ratings from A.M. Best, ensures they can reliably pay out claims and provide consistent service.

This reliability is crucial for customers seeking dependable coverage, especially when considering the various types of auto insurance coverage such as liability, comprehensive, and collision that they may need.

What are the primary drawbacks of Auto-Owners Insurance and American Family Insurance regarding their online tools and premium rates for certain demographics?

One primary drawback of Auto-Owners Insurance is their limited online tools and resources compared to other major providers. For American Family Insurance, their premiums can be higher for certain demographics, particularly those with lower credit scores.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.