Cheap North Carolina Auto Insurance for 2025 (10 Most Affordable Companies)

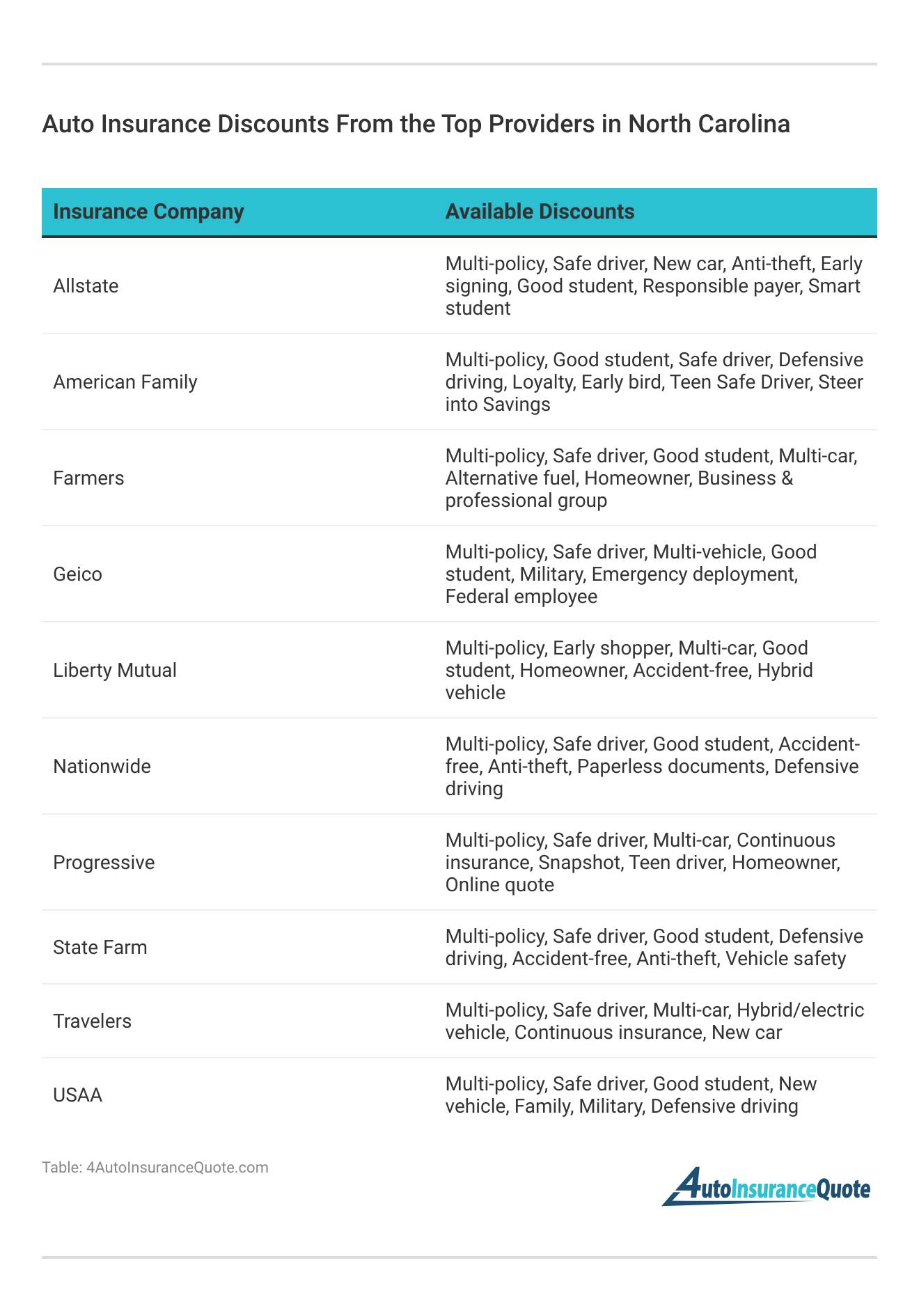

For cheap North Carolina auto insurance, Progressive, USAA, and Geico stand out as top choices, offering rates starting at $13 per month. These companies are renowned for their competitive premiums and coverage options, making them ideal for affordable auto insurance in North Carolina.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage in North Carolina

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage in North Carolina

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews

The top picks for cheap North Carolina auto insurance are Progressive, USAA, and Geico, with rates starting at $13 per month.  Progressive stands out as the best overall provider, offering comprehensive coverage that make it a top choice for many drivers. USAA excels in providing exceptional benefits for military families, making it a great option if you qualify for membership.

Progressive stands out as the best overall provider, offering comprehensive coverage that make it a top choice for many drivers. USAA excels in providing exceptional benefits for military families, making it a great option if you qualify for membership.

Our Top 10 Company Picks: Cheap North Carolina Auto Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $13 A+ Competitive Rates Progressive

#2 $18 A+ Military Discounts USAA

#3 $29 A++ Affordable Premiums Geico

#4 $32 B Reliable Pricing State Farm

#5 $35 A Budget-Friendly American Family

#6 $36 A Customizable Coverage Liberty Mutual

#7 $41 A Discounts Available Farmers

#8 $42 A++ Price Matching Travelers

#9 $47 A+ Economical Options Nationwide

#10 $72 A++ Savings Programs Allstate

Geico is known for its competitive premiums and ease of use, making it a strong contender for those seeking affordability. Explore further with our article entitled, “Affordable Instant Auto Insurance.” Just enter your ZIP code above for free North Carolina auto insurance quotes.

- Cheap North Carolina auto insurance starts at $13/month

- Compare top providers: Progressive, USAA, and Geico

- Progressive offers the best value and coverage options

#1 – Progressive: Top Overall Pick

Pros

Pros

- Competitive Rates: Progressive offers some of the most competitive rates in North Carolina, starting at just $13 per month, making it a top choice for budget-conscious drivers.

- Wide Range of Discounts: North Carolina policyholders can take advantage of various discounts, including multi-policy and safe driver discounts.

- Strong Financial Stability: Rated A+ by A.M. Best, Progressive provides North Carolina drivers with confidence in their financial reliability.

- User-Friendly Online Tools: The company provides excellent online tools for managing policies and getting quotes, making it convenient for North Carolina owners.

Cons

- Customer Service Issues: Some North Carolina policyholders report mixed experiences with customer service. Obtain a more nuanced perspective with our “Progressive Auto Insurance Review.”

- High Rates for High-Risk Drivers: North Carolina drivers with poor driving records might face higher premiums.

- Complex Claim Process: The claims process can sometimes be complicated and lengthy for North Carolina drivers.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Discounts

Pros

Pros

- Exclusive Military Discounts: USAA offers special discounts for military members and their families in North Carolina, with rates starting at $18 per month.

- Highly Rated Customer Service: Known for exceptional customer service and support for North Carolina policyholders.

- Financial Strength: A+ rating from A.M. Best ensures strong financial stability for North Carolina enthusiasts.

- Comprehensive Coverage Options: Wide range of coverage options tailored to military personnel in North Carolina.

Cons

- Restricted Eligibility: Only available to military members and their families in North Carolina. Gain a deeper understanding through our “USAA Auto Insurance Review.”

- Limited Local Offices: Fewer physical locations in North Carolina compared to other insurers.

- Potential Higher Rates for Non-Military: Non-military associated North Carolina drivers might find better rates elsewhere.

#3 – Geico: Best for Affordable Premiums

Pros

Pros

- Affordable Premiums: Geico is known for offering some of the most affordable premiums in North Carolina, with rates starting at $29 per month.

- Strong Financial Ratings: Holds an A++ rating from A.M. Best, indicating superior financial stability for North Carolina drivers.

- Wide Range of Discounts: Offers numerous discounts to North Carolina policyholders, such as for good drivers, good students, and federal employees.

- User-Friendly Digital Experience: Highly rated mobile app and website for easy policy management for North Carolina owners.

Cons

- Mixed Customer Service Reviews: Some North Carolina policyholders report less satisfactory experiences with customer service.

- Limited Local Agents: Fewer local agents in North Carolina compared to other major insurers, which might impact personalized service.

- High Premiums for High-Risk Drivers: Higher rates for North Carolina drivers with a less-than-perfect driving record. Discover what lies beyond with our “Geico Auto Insurance Review.”

#4 – State Farm: Best for Reliable Pricing

Pros

Pros

- Reliable Pricing: State Farm is known for its reliable and consistent pricing structure for North Carolina drivers, with rates starting at $32 per month.

- Strong Local Presence: Extensive network of local agents in North Carolina providing personalized service.

- Excellent Coverage Options: Wide range of coverage options and customizable policies for North Carolina policyholders.

- Customer Loyalty Programs: Offers programs to reward long-term North Carolina policyholders. Access the complete picture in our “State Farm Auto Insurance Review.”

Cons

- Higher Rates for Some Drivers: Premiums can be higher for younger North Carolina drivers and those with traffic violations.

- Average Customer Service: Mixed reviews regarding customer service experiences among North Carolina policyholders.

- Limited Online Tools: Not as advanced as digital tools compared to competitors, which may impact North Carolina owners looking for online convenience.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#5 – American Family: Best for Budget-Friendly

Pros

Pros

- Budget-Friendly: Offers affordable rates, making it a good option for North Carolina policyholders on a tight budget, with rates starting at $35 per month.

- Strong Financial Rating: A rating from A.M. Best indicates good financial stability for North Carolina drivers.

- Wide Range of Discounts: Available discounts include multi-policy and safe driver discounts for North Carolina enthusiasts.

- Good Customer Service: Generally positive customer service reviews from North Carolina policyholders.

Cons

- Limited Availability: Not available in all states, which can be restrictive for some North Carolina policyholders.

- Higher Rates in Some Areas: Premiums can be higher in certain regions of North Carolina. Obtain further insights from our “American Family Insurance Auto Insurance Review.”

- Average Digital Experience: Online tools and mobile apps are functional but not exceptional for North Carolina drivers.

#6 – Liberty Mutual: Best for Customizable Coverage

Pros

Pros

- Customizable Coverage: Offers highly customizable policies to fit the individual needs of North Carolina policyholders, with rates starting at $36 per month.

- Good Financial Strength: Rated A by A.M. Best, providing financial reliability for North Carolina drivers.

- Variety of Discounts: Discounts for bundling, safe driving, and more are available for North Carolina enthusiasts.

- Positive Customer Service: Generally good reviews for customer service interactions from North Carolina policyholders.

Cons

- Higher Base Rates: Base rates can be higher than some competitors for North Carolina drivers.

- Mixed Claims Experiences: Some North Carolina policyholders report less satisfactory claims processing.

- Limited Availability: Not all coverage options are available in every part of North Carolina. Enhance your comprehension with our “Liberty Mutual Auto Insurance Review.”

#7 – Farmers: Best for Discounts Available

Pros

Pros

- Discounts Available: Offers numerous discounts that can help lower premiums for North Carolina policyholders, with rates starting at $41 per month.

- Good Financial Rating: Holds an A rating from A.M. Best, providing confidence for North Carolina drivers.

- Wide Range of Coverage Options: Comprehensive and customizable policies available for North Carolina enthusiasts.

- Local Agents: Strong network of local agents providing personalized service to North Carolina policyholders.

Cons

- Higher Premiums: This can be more expensive than some competitors for North Carolina drivers. Access supplementary details in our “Farmers Auto Insurance Review.”

- Mixed Customer Service Reviews: Customer service experiences vary among North Carolina policyholders.

- Complex Discounts: Understanding and applying discounts can be complicated for North Carolina policyholders.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#8 – Travelers: Best for Price Matching

Pros

Pros

- Price Matching: Travelers offers price matching to help North Carolina policyholders get competitive rates, with rates starting at $42 per month.

- Excellent Financial Stability: Holds an A++ rating from A.M. Best, ensuring strong financial stability for North Carolina drivers.

- Comprehensive Coverage: A wide range of coverage options and add-ons are available for North Carolina enthusiasts.

- Positive Customer Reviews: Generally positive feedback from North Carolina policyholders. Unlock additional information in our “Travelers Auto Insurance Review.”

Cons

- Higher Rates in Some Areas: Premiums can be higher in metropolitan areas of North Carolina.

- Complex Policy Options: Some North Carolina policyholders find policy options and terms confusing.

- Limited Local Presence: Fewer local agents compared to some other major insurers, affecting North Carolina drivers seeking personalized service.

#9 – Nationwide: Best for Economical Options

Pros

Pros

- Economical Options: Offers affordable and economical insurance options for North Carolina policyholders, with rates starting at $47 per month.

- Good Financial Stability: A+ rating from A.M. Best, providing confidence for North Carolina drivers.

- Variety of Discounts: Multiple discount options are available for North Carolina enthusiasts.

- Strong Digital Tools: Easy-to-use online tools and mobile app for North Carolina owners. Find out more by reading our “Nationwide Auto Insurance Review.”

Cons

- Mixed Customer Service: Customer service experiences are varied among North Carolina policyholders.

- Higher Rates for Certain Drivers: Premiums can be higher for young North Carolina drivers and those with poor driving records.

- Limited Availability of Some Coverage: Not all coverage options available in every part of North Carolina.

#10 – Allstate: Best for Savings Programs

Pros

Pros

- Savings Programs: Allstate offers various programs to help North Carolina policyholders save on premiums, with rates starting at $72 per month.

- Strong Financial Rating: A++ rating from A.M. Best indicates excellent financial stability for North Carolina drivers.

- Comprehensive Coverage Options: A wide range of coverage options and add-ons are available for North Carolina enthusiasts.

- Good Customer Service: Generally positive reviews for customer service from North Carolina policyholders.

Cons

- Higher Premiums: More expensive than some competitors for North Carolina drivers. Get the full story by checking out our “Allstate Auto Insurance Review.”

- Mixed Claims Experiences: Some North Carolina policyholders report dissatisfaction with the claims process.

- Limited Discount Options: Fewer discount options compared to other insurers, which may impact North Carolina policyholders.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

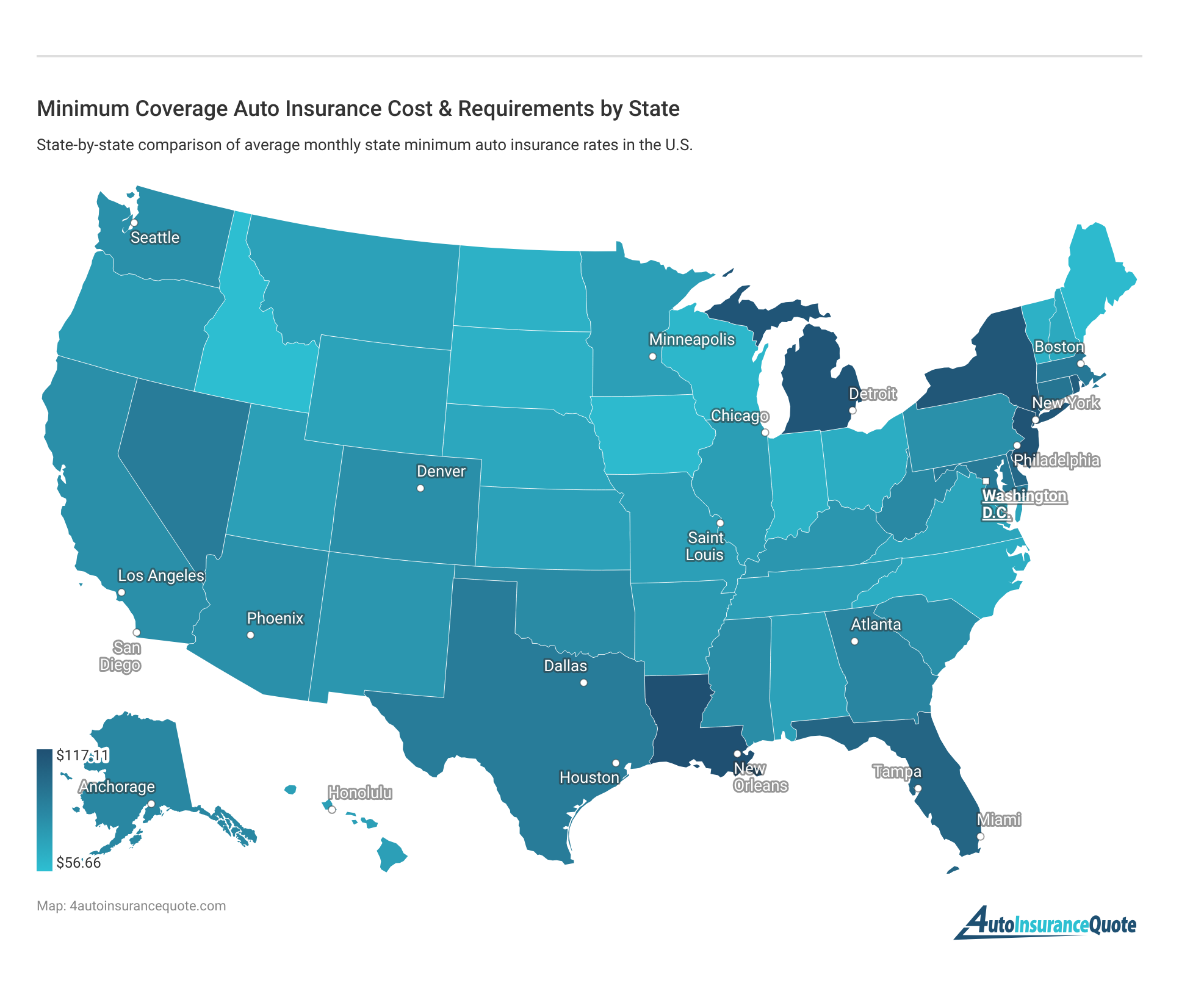

North Carolina Auto Insurance Rates

In North Carolina, drivers generally benefit from lower insurance premiums compared to the national average. The average monthly cost for auto insurance in the state is about $100, making it affordable for many residents.

North Carolina Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $72 | $169 |

| American Family | $35 | $81 |

| Farmers | $41 | $98 |

| Geico | $29 | $69 |

| Liberty Mutual | $36 | $82 |

| Nationwide | $47 | $111 |

| Progressive | $13 | $32 |

| State Farm | $32 | $77 |

| Travelers | $42 | $99 |

| USAA | $18 | $44 |

However, premiums can be higher in major cities. For instance, drivers in Raleigh usually pay around $105 per month, while those in Charlotte face premiums exceeding $118 per month. This increase is due to higher risks associated with accidents and vehicle theft in urban areas. Insurance costs also vary by ZIP code.

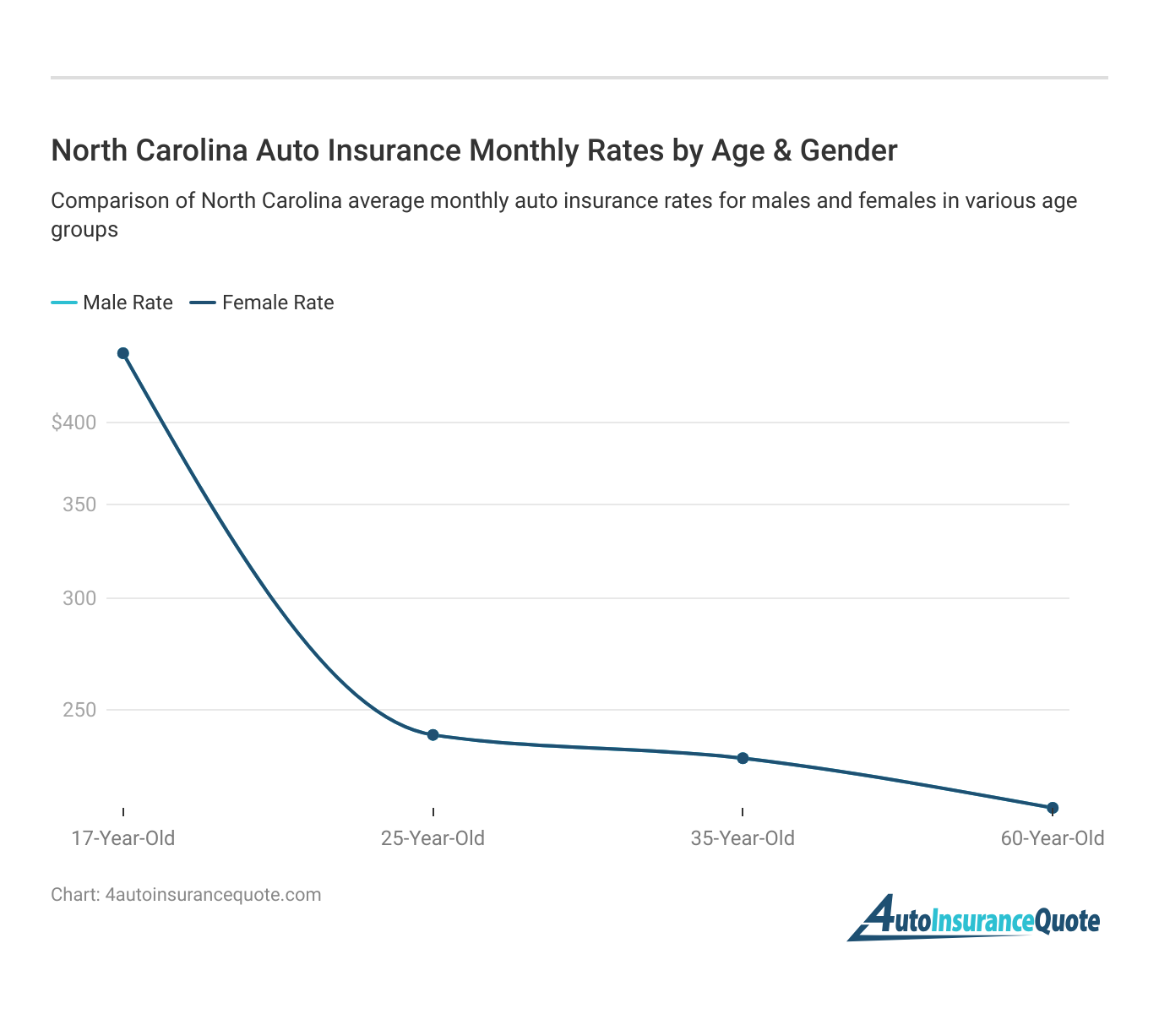

Regional differences in risk levels can impact insurance rates. Several factors influence auto insurance premiums, with your driving record being a key consideration. Age significantly affects rates, as younger drivers often face higher premiums due to perceived risk.

Gender no longer influences rates, as insurance companies are prohibited from charging different rates based on gender. Understanding how age affects your auto insurance rates and other factors can help you manage your insurance costs more effectively. Expand your understanding with our “Auto Insurance by Age.” Enter your ZIP code below to start seeing quotes today.

North Carolina Auto Insurance Laws and Requirements

In North Carolina, the state minimum coverage requirements for auto insurance are $30,000 per person and $60,000 per accident for bodily injury liability, with $25,000 per accident for property damage liability. For uninsured/underinsured motorist coverage, the minimums are the same as those for bodily injury liability and property damage.

Drivers also have the option to purchase additional coverages, including comprehensive auto insurance, collision coverage, medical payments coverage, rental car reimbursement, and roadside assistance.

North Carolina enforces stringent auto insurance laws and operates under a tort system, meaning that the driver deemed at fault in an accident is responsible for covering the costs of injuries and damages sustained by the other party.

View this post on Instagram

This system ensures that those responsible for accidents bear the financial burden, reinforcing the importance of maintaining adequate insurance coverage. For additional insights, refer to our “What is an auto insurance claim?” Instantly compare quotes by entering your ZIP code below.

North Carolina Driving Statistics

North Carolina drivers have made significant progress in road safety, with auto crash rates showing a consistent decline. Enhanced driver vigilance and more rigorous enforcement have played key roles in this positive trend. The number of crashes and fatalities has decreased notably over recent years.

The rate of auto theft per capita has decreased substantially, and despite the state’s growing population, the trend remains downward. This is promising news for those purchasing auto insurance in North Carolina. Explore further details in our “Finding Auto Insurance Quotes Online.“

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

North Carolina Auto Insurance Quotes

Frequently Asked Questions

What are the minimum coverage requirements for cheap auto insurance in North Carolina?

Minimum coverage includes $30,000 per person and $60,000 per accident for bodily injury, and $25,000 for property damage. For additional insights, refer to our “How does the auto insurance company determine my premium?“

Which companies offer the cheapest auto insurance in North Carolina?

Progressive, USAA, and Geico offer some of the cheapest auto insurance options in North Carolina, starting at $13 per month. Get fast and cheap auto insurance coverage today with our quote comparison tool below.

Can you drive a car in North Carolina without cheap auto insurance?

No, cheap auto insurance is mandatory in North Carolina.

How can I prove that I have cheap auto insurance in North Carolina?

Carry an insurance card provided by your insurer to prove you have coverage. Find out more by reading our article titled, “Is auto insurance paid in advance?“

Can I use my out-of-state auto insurance for cheap North Carolina auto insurance?

No, you need to switch to a policy that meets North Carolina’s minimum requirements for cheap insurance.

Do I need uninsured motorist coverage for cheap auto insurance in North Carolina?

not required, uninsured motorist coverage is highly recommended even for cheap auto insurance.

Can I cancel my cheap North Carolina auto insurance policy at any time?

Yes, but ensure you have another cheap policy in place to avoid driving uninsured. Explore further with our article entitled, “What is the difference between primary and secondary auto insurance coverage?“

Can I get rental car coverage with my cheap North Carolina auto insurance?

Yes, rental car reimbursement can be added to your cheap auto insurance policy.

What is the average monthly cost for cheap auto insurance in North Carolina?

The average monthly cost for cheap auto insurance in North Carolina is about $100. Start saving on your auto insurance by entering your ZIP code below and comparing quotes.

Why might cheap auto insurance rates be higher in cities like Charlotte?

Rates may be higher due to increased risks of accidents and theft in major cities. Gain insights by reading our article titled, “What information do I need to file an auto insurance claim with Progressive?“

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros