Cheap Delaware Auto Insurance in 2025 (Save Money With These 10 Companies)

Progressive, Erie, and Travelers have the best cheap auto insurance in Delaware, with rates beginning at just $43 per month. By comparing quotes from the top Delaware auto insurance providers, customers hoping to reduce their auto insurance costs can find cheap Delaware auto insurance rates.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

1,883 reviews

1,883 reviewsCompany Facts

Min. Coverage in Delaware

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews 13,283 reviews

13,283 reviewsCompany Facts

Min. Coverage in Delaware

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsWith monthly rates as low as $43, Progressive, Erie, and Travelers make excellent choices for cheap Delaware auto insurance.

It is a requirement for all drivers to have Delaware auto insurance and understanding the components of auto insurance, including auto liability coverage, before you buy is key to getting the best Delaware auto insurance rates.

Our Top 10 Company Picks: Cheap Delaware Auto Insurance| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $43 | A++ | Bundling Policies | Travelers | |

| #2 | $45 | A+ | Customer Service | Erie |

| #3 | $47 | A+ | Qualifying Coverage | Progressive | |

| #4 | $50 | A | Roadside Assistance | AAA |

| #5 | $53 | A++ | Cheap Rates | Geico | |

| #6 | $61 | B | Many Discounts | State Farm | |

| #7 | $75 | A+ | Vanishing Deductible | Nationwide |

| #8 | $83 | A | Policy Options | Farmers | |

| #9 | $108 | A+ | Infrequent Drivers | Allstate | |

| #10 | $259 | A | 24/7 Support | Liberty Mutual |

We can assist you in locating reasonably priced Delaware auto insurance.

- Cheap Delaware Auto Insurance

To obtain cheap Delaware auto insurance rates right now, enter your ZIP code above.

- Delaware auto insurance averages $43 per month for most drivers

- Travelers and Erie offer some of the lowest rates in Delaware

- Drivers should compare quotes to find affordable auto insurance

#1 – Travelers: Top Overall Pick

Pros

- Comprehensive Coverage Options: Travelers offers a range of coverage options, including accident forgiveness and new car replacement, making it a strong choice for cheap Delaware auto insurance. This flexibility ensures you can tailor your policy to meet specific needs and save money. Look for more details through our Travelers insurance review.

- Competitive Rates: Known for providing affordable rates starting as low as $43 per month, Travelers offers some of the cheapest Delaware auto insurance options, especially if you bundle policies. This makes it a cost-effective choice for many drivers looking to save.

- Strong Financial Stability: With an A++ rating from A.M. Best, Travelers demonstrates exceptional financial stability and reliability, ensuring they can meet their claims obligations. This financial strength supports their ability to offer cheap Delaware auto insurance with confidence.

Cons

- Customer Service: Some customers report slower response times for claims compared to other top providers, which can be frustrating when dealing with issues related to cheap Delaware auto insurance.

- Limited Local Availability: Travelers may not have as extensive a local presence in certain rural areas, making it harder to access in-person support for your cheap Delaware auto insurance needs.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#2 – Erie: Best for Customer Service

Pros

- Excellent Customer Service: Erie is highly rated for customer service, with a focus on providing personalized attention and support, making it an excellent choice for cheap Delaware auto insurance. Their A+ rating from A.M. Best reflects their strong customer satisfaction.

- Affordable Rates: With monthly rates starting at $45, Erie offers competitive pricing, especially beneficial for those seeking cheap Delaware auto insurance. Their value-for-money is ideal for drivers looking to save without compromising on service.

- Unique Coverage Options: Erie provides distinctive features like guaranteed replacement cost for vehicles, which adds extra value to their cheap Delaware auto insurance offerings. This ensures comprehensive protection at an affordable rate.

Cons

- Limited Availability: Erie’s coverage is not available in all states, which can restrict access to their cheap Delaware auto insurance for potential customers outside their operational areas. Discover more through this Erie auto insurance review.

- Fewer Discounts: Compared to some competitors, Erie offers fewer discount opportunities, potentially limiting the savings available on cheap Delaware auto insurance for some drivers.

#3 – Progressive: Best for Qualifying Coverage

Pros

- Broad Coverage Options: With coverage options including rental reimbursement and roadside assistance, Progressive caters to a variety of needs, providing valuable cheap Delaware auto insurance. These features enhance overall coverage while keeping costs low.

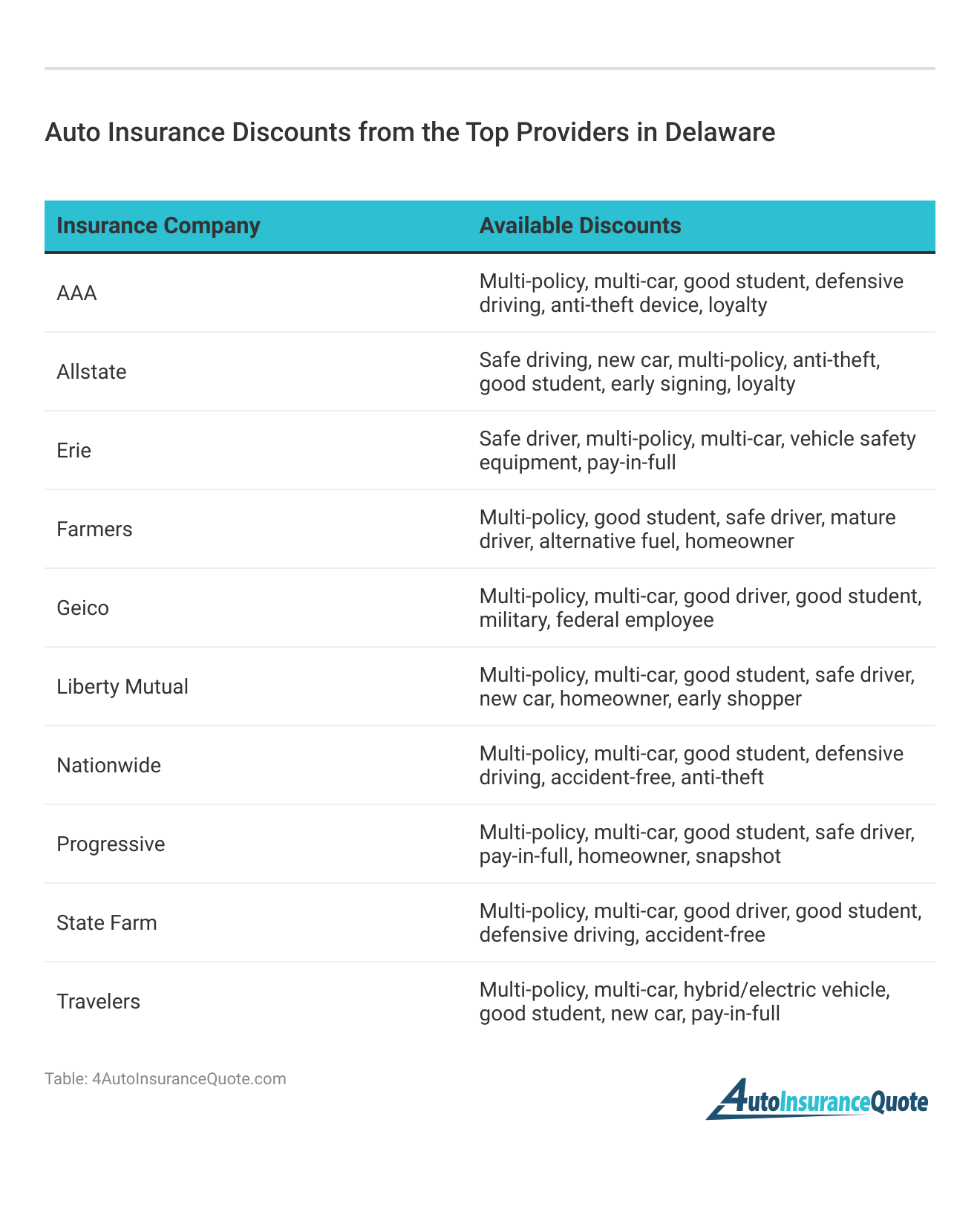

- Variety of Discounts: Progressive offers a wide range of discounts, such as for safe driving and bundling policies, which can significantly reduce your cheap Delaware auto insurance premiums. This makes their policies more affordable. Find out more through our Progressive insurance review.

- Flexible Payment Options: Multiple payment plans are available, allowing you to choose one that fits your financial situation and makes managing your cheap Delaware auto insurance easier.

Cons

- Rate Increases: Rates may increase after the first year based on claims history, which can be a drawback if you’re seeking stable cheap Delaware auto insurance rates over time.

- Complex Policies: The range of options and discounts can be complex, making it challenging to navigate and find the best cheap Delaware auto insurance coverage for your needs.

#4 – AAA: Best for Roadside Assistance

Pros

- Exceptional Roadside Assistance: AAA is renowned for its top-notch roadside assistance services, providing added security for drivers and enhancing the value of your cheap Delaware auto insurance policy. This service is particularly beneficial for frequent travelers.

- Discounts for Members: AAA members receive additional discounts on auto insurance, making it a cost-effective option for those seeking cheap Delaware auto insurance and already subscribed to AAA services.

- Good Customer Service: AAA generally receives high ratings for customer service, reflecting their commitment to providing excellent support, which adds value to their cheap Delaware auto insurance offerings.

Cons

- Higher Premiums: Starting at $50 per month, AAA’s premiums can be higher compared to some other providers, which may not be ideal if you’re strictly searching for cheap Delaware auto insurance options.

- Limited Online Tools: The digital tools and resources available through AAA may not be as advanced as those offered by some competitors, potentially limiting the convenience of managing your cheap Delaware auto insurance. Gain further insights with this AAA auto insurance review.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#5 – Geico: Best for Cheap Rates

Pros

- Competitive Rates: Geico offers some of the lowest rates in the industry, starting at $53 per month, making it a leading option for cheap Delaware auto insurance. This affordability helps drivers save significantly on their premiums.

- User-Friendly Online Access: Geico’s website and mobile app provide a seamless experience for managing policies, filing claims, and accessing information, which is ideal for those seeking cheap Delaware auto insurance with easy online management.

- Extensive Discounts: Geico provides a broad array of discounts, including for military personnel and federal employees, which can lead to significant savings on cheap Delaware auto insurance. Read more through our Geico insurance review.

Cons

- Customer Service: Some customers have reported less personalized service and slower claims processing compared to other top providers, which may impact your experience with cheap Delaware auto insurance.

- Limited Local Agents: Fewer opportunities for in-person interactions with agents can be a drawback for those who prefer face-to-face communication for their cheap Delaware auto insurance needs.

#6 – State Farm: Best for Many Discounts

Pros

- Numerous Discounts: State Farm offers a wide range of discounts, including for good students and multiple policies, starting at $61 per month. This makes it a good choice for finding cheap Delaware auto insurance with significant savings. Delve deeper with this State Farm insurance review.

- Strong Local Presence: With an extensive network of local agents, State Farm provides personalized service and support tailored to local needs, which can help you find affordable cheap Delaware auto insurance.

- High Claims Satisfaction: State Farm generally receives high ratings for claims handling, ensuring a reliable process when you need to file a claim and maintain your cheap Delaware auto insurance.

Cons

- Higher Rates for Some: Depending on the driver’s profile, finding the cheapest Delaware auto insurance rates may be challenging with State Farm, as their premiums can be higher compared to some competitors.

- Complex Policies: The variety of policy options and discounts can be overwhelming, making it difficult to navigate and find the best cheap Delaware auto insurance for your needs.

#7 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Nationwide offers a unique vanishing deductible feature that reduces your deductible for each claim-free year, starting at $75 per month. This can lower out-of-pocket costs and enhance your cheap Delaware auto insurance value over time.

- Extensive Coverage Options: Nationwide provides a broad range of coverage options, including accident forgiveness and rental car coverage, which contributes to their competitive cheap Delaware auto insurance offerings.

- Good Customer Service: Generally receives high marks for customer service and support, ensuring a positive experience for policyholders seeking cheap Delaware auto insurance.

Cons

- Higher Rates: Nationwide’s premiums can be on the higher side compared to some other providers, which may not align with those searching for the cheapest Delaware auto insurance. Uncover more by reviewing this Nationwide auto insurance review.

- Regional Variations: Coverage and pricing can vary significantly by region, potentially leading to inconsistencies in service and rates for cheap Delaware auto insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#8 – Farmers: Best for Policy Options

Pros

- Varied Policy Options: Farmers offers a wide range of coverage options and policy add-ons, starting at $83 per month, allowing for extensive customization of your cheap Delaware auto insurance.

- Customizable Coverage: Policies can be tailored to meet individual needs, providing flexibility in coverage levels and features for cheap Delaware auto insurance. Read more through our Farmers auto insurance review.

- Strong Customer Service: High ratings for customer service and support ensure a positive experience when interacting with Farmers, enhancing their cheap Delaware auto insurance value.

Cons

- Higher Premiums: Farmers’ rates can be higher, particularly for younger or high-risk drivers, which may not be ideal for those specifically seeking cheap Delaware auto insurance.

- Policy Complexity: The variety of options and add-ons available can be overwhelming, making it difficult to navigate and find the best cheap Delaware auto insurance coverage.

#9 – Allstate: Best for Infrequent Drivers

Pros

- Specialized Coverage for Infrequent Drivers: Allstate offers specialized coverage options for infrequent drivers, starting at $108 per month, which can be beneficial for those looking for cheap Delaware auto insurance tailored to low-mileage usage. This ensures you’re not overpaying for coverage you don’t need.

- Personalized Support: With a strong focus on personalized service and local agents, Allstate provides tailored support for your cheap Delaware auto insurance needs, ensuring you get the most relevant advice and assistance.

- Strong Financial Stability: With an A+ rating from A.M. Best, Allstate’s financial strength supports its ability to offer reliable and secure cheap Delaware auto insurance, ensuring that claims are paid promptly.

Cons

- Higher Premiums: For drivers on a limited budget looking for the lowest auto insurance rates in Delaware, Allstate’s pricing may be higher than others in the area. As a result, it may not be the most cost-effective option for individuals seeking to lower their insurance costs.

- Complex Policy Options: The variety of policy options and add-ons can be confusing, making it challenging to determine the best cheap Delaware auto insurance coverage for your needs. Get more information from this Allstate insurance review.

#10 – Liberty Mutual: Best for 24/7 Support

Pros

- 24/7 Customer Support: Liberty Mutual offers round-the-clock customer support, ensuring assistance is available whenever needed, which adds value to their cheap Delaware auto insurance coverage. This constant support can be crucial in managing and addressing any insurance issues promptly.

- Comprehensive Coverage Options: Provides a wide range of coverage options, including new car replacement and accident forgiveness, starting at $259 per month. This variety allows for tailored cheap Delaware auto insurance that meets diverse needs.

- Customizable Policies: Liberty Mutual offers various add-ons and customization options, allowing you to adjust your coverage to fit your needs and budget for cheap Delaware auto insurance. Learn more through our Liberty Mutual auto insurance review.

Cons

- Higher Monthly Rates: With rates starting at $259 per month, Liberty Mutual may not be the best choice for those seeking the most affordable cheap Delaware auto insurance options.

- Mixed Customer Reviews: Some customers report mixed experiences with Liberty Mutual, particularly regarding claims processing and customer service, which may affect your overall satisfaction with their cheap Delaware auto insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Delaware Auto Insurance Requirements

Delaware follows most states in the country by using a tort auto insurance system. This means that when an accident occurs, one of the drivers will be determined to have caused the accident (the “at fault” party) and this driver and their insurance will be subject to claims and lawsuits.

Delaware Auto Insurance Monthly Rates by Coverage Level & Provider| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $50 | $135 |

| Allstate | $108 | $207 |

| Erie | $45 | $120 |

| Farmers | $83 | $157 |

| Geico | $53 | $101 |

| Liberty Mutual | $259 | $494 |

| Nationwide | $75 | $144 |

| Progressive | $47 | $90 |

| State Farm | $61 | $116 |

| Travelers | $43 | $82 |

Drivers in the state must also purchase a minimum amount of insurance coverage in several different areas to be considered “fully covered” and legally allowed to drive. Bodily injury liability coverage helps cover medical treatment costs, lost wages, rehabilitation, and other claims.

Note that BIL doesn’t cover the insurance policyholder – it only covers other parties in the accident and only if you were at fault. The minimum amount of BIL coverage in Delaware is $25,000 per person, per accident, and $50,000 for all parties in a single accident.

Auto Insurance Rates In Delaware

It is unfortunate that those who live in Delaware end up paying much more than the nationwide average for their auto insurance, making it harder to find affordable auto insurance. The statewide median insurance rate is $175 per month, which is considerably more than the national average of $120.

Those who live in Delaware’s major cities do not fare much better, with residents of Dover paying about $162 per month and those in Wilmington paying a whopping $195 per month. There are a lot of factors that auto insurance companies take into consideration when determining your rates.

As with most states, males typically pay higher auto insurance rates than females.Ty Stewart Licensed Insurance Agent

With rates this high, drivers must shop around through the dozens of different auto insurance companies that provide insurance to Delaware residents. Enter your ZIP code now to compare rates.

Delaware Auto Insurance Rates by Company

The rates of Delaware auto insurance are generally quite affordable, but they can vary significantly between different insurance providers. To understand these differences, it’s helpful to look at how rates compare among some of the largest companies operating in the region.

The largest insurers in Delaware, those with the highest market share percentages, often offer a range of rates and coverage options. Additionally, the inclusion of personal injury protection (PIP) coverage can influence your overall rates.

By examining the offerings from these major companies, drivers can gain insight into which insurer provides the best value for their needs and potentially find even more cost-effective solutions.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Delaware Auto Theft And Crash Statistics

In 2009, auto thefts in Delaware dropped significantly by over 25%, from 2,557 to 1,907, showcasing the successful efforts of drivers and law enforcement.

However, 2010 saw a 9% increase in vehicle crashes, climbing from 18,927 to 20,697. While this spike is considered an anomaly, crash rates are expected to improve in the future.

On a positive note, fatalities decreased by 13% in 2010, from 118 to 103. To address rising crash rates and keep insurance costs manageable, finding affordable full-coverage car insurance will be crucial for Delaware drivers.

Enter your ZIP code to receive free Delaware auto insurance quotes from leading companies today.

Frequently Asked Questions

What are the auto insurance requirements in Delaware?

Delaware requires a minimum of 25/50/10 for bodily injury and property damage coverage, and 15/30 for personal injury protection (PIP).

How can I find the best rates for auto insurance in Delaware?

To find the best rates, it’s recommended to compare quotes from multiple auto insurance companies. Use our free quote tool to compare quotes and find the most affordable coverage options. Enter your ZIP code now.

How much are the auto insurance rates in Delaware?

The average auto insurance rate in Delaware is $175 per month, but rates can vary depending on several factors such as location, driving record, and the coverage options chosen.

To effectively understand auto insurance, it’s important to consider how these variables impact your premiums and to compare different policies.

What additional coverage options can I add to my Delaware auto insurance policy?

In addition to the minimum required coverage, you can consider adding optional coverage options such as comprehensive coverage, collision coverage, uninsured/underinsured motorist coverage, and roadside assistance.

Does Delaware follow a no-fault insurance system?

Yes, Delaware follows a no-fault insurance system. This means that your insurance policy will cover your medical expenses regardless of who is at fault in an accident. Enter your ZIP code now.

What is Delaware’s minimum auto insurance required?

In Delaware, drivers must meet specific state liability coverage minimums to legally operate a vehicle.

The required bodily injury coverage includes $25,000 per person and $50,000 per accident. This means that if you are at fault in an accident, your insurance will cover up to $25,000 for each individual injured and a maximum of $50,000 for all injuries resulting from a single accident.

Do drivers need insurance to drive in Delaware?

Yes, drivers need Delaware’s minimum auto insurance to drive legally.

Which auto insurance provider offers the lowest monthly rates in Delaware according to the article?

Travelers offer the lowest monthly rates in Delaware, starting at $43. This makes it a cost-effective option for those seeking cheap Delaware auto insurance. Enter your ZIP code now.

What unique feature does Nationwide offer that reduces your deductible over time?

Nationwide provides a vanishing deductible program, which reduces your deductible amount for each year of accident-free driving.

This benefit can lower out-of-pocket costs significantly in the event of an auto insurance claim, making it a valuable feature for those who maintain a clean driving record.

How does Erie’s customer service rating compare to other auto insurance providers in Delaware?

Erie is recognized for its exceptional customer service, which is one of the highest-rated among Delaware auto insurance providers. Their focus on customer satisfaction sets them apart from many competitors.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.