Cheap Illinois Auto Insurance in 2025 (Big Savings With These 10 Companies!)

The most affordable and cheap Illinois auto insurance is led by Geico, USAA, and State Farm, offering rates as low as $18 per month. This article assesses and examines the pros and cons of each provider, aiding and helping Illinois drivers in making an informed choice for their peace of mind and reassurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active life and health insurance licenses in seven states and over 20 years of experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ...

Licensed Agent & Financial Advisor

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage in Illinois

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage in Illinois

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews

Geico, USAA, and State Farm are top choices for affordable and cheap Illinois auto insurance, providing competitive pricing and extensive coverage options.

Insuring a car in Illinois won’t cost you that much and will provide you with significant protection in case you happen to get in an accident.

Our Top 10 Company Picks: Cheap Illinois Auto Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $18 A++ Affordable Rates Geico

#2 $24 A+ Military Discounts USAA

#3 $25 B Local Agents State Farm

#4 $29 A Customizable Plans Liberty Mutual

#5 $33 A++ Safe Driver Travelers

#6 $34 A+ Snapshot Program Progressive

#7 $35 A+ Vanishing Deductible Nationwide

#8 $43 A Local Agents American Family

#9 $45 A Personalized Service Farmers

#10 $67 A++ Multiple Discounts Allstate

Let’s explore auto insurance in Illinois, including the best auto insurance companies and other important details.

If you’re prepared to purchase Illinois auto insurance, simply enter your ZIP code above to receive quick, free quotes.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – Geico: Top Overall Pick

Pros

- Affordable Monthly Rates: At just $18 per month, Geico offers some of the most affordable options for cheap Illinois auto insurance, making it an excellent choice for budget-conscious drivers. This affordability can be a significant advantage for those looking to minimize their insurance costs.

- High Financial Strength Rating: Geico’s A++ rating from A.M. Best underscores its strong financial stability, ensuring that it can reliably handle claims and provide peace of mind for those seeking cheap Illinois auto insurance.

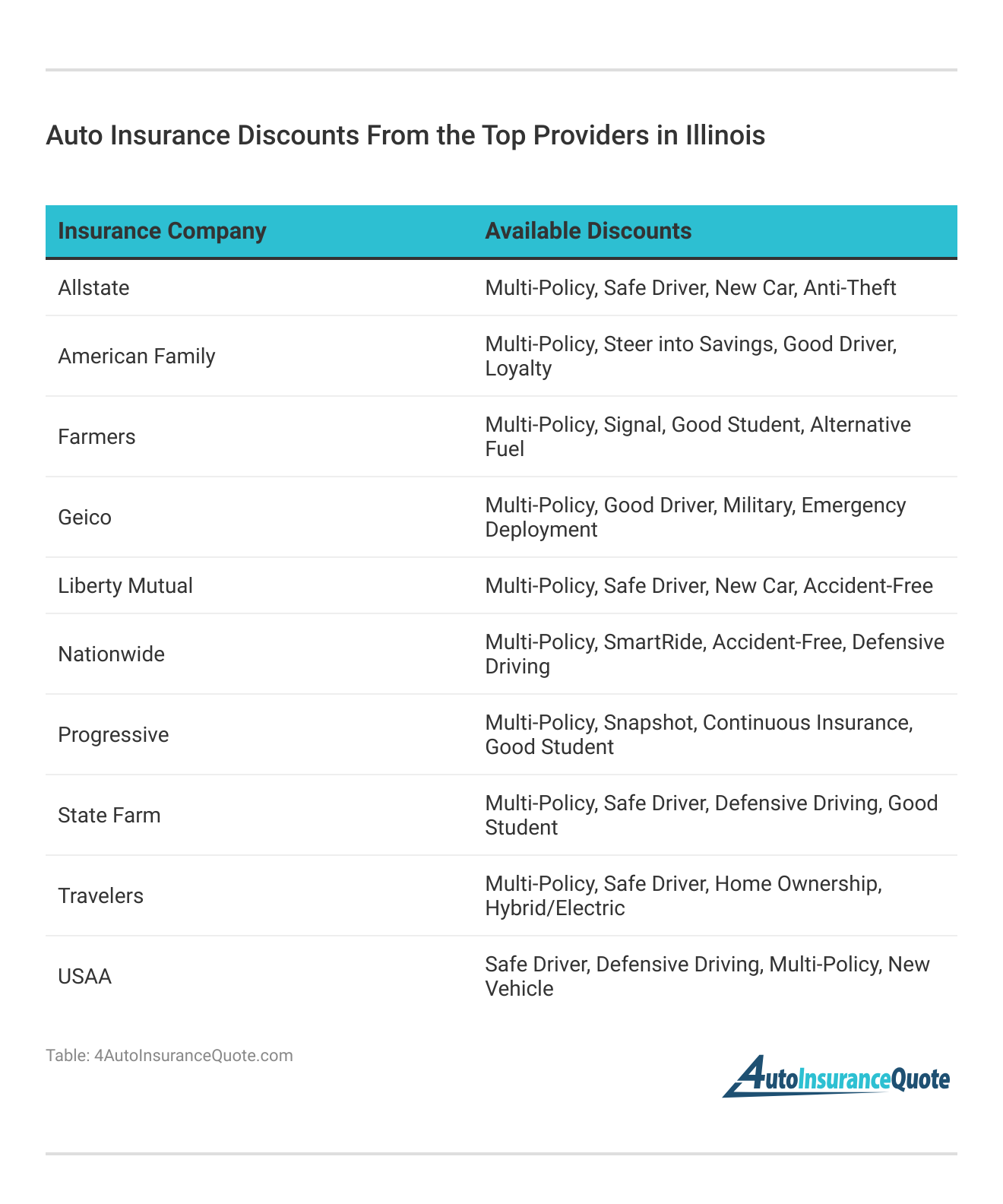

- Extensive Discounts: Geico provides a variety of discounts, including those for safe driving and good grades, which can help reduce premiums and make cheap Illinois auto insurance even more affordable. Read more through our Geico insurance review.

Cons

- Limited Local Agent Support: Geico operates primarily online, which means personalized, face-to-face support for cheap Illinois auto insurance is limited. This could be a drawback for those who prefer in-person assistance and advice.

- Mixed Customer Service Reviews: Some customers have reported issues with claims processing and customer support, which may affect the overall experience for those seeking reliable cheap Illinois auto insurance.

#2 – USAA: Best for Military Discounts

Pros

- Exceptional Military Discounts: USAA offers significant discounts and benefits for military members and their families, making it an excellent choice for affordable cheap Illinois auto insurance for those who qualify.

- High Customer Satisfaction: Known for its excellent customer service, USAA consistently ranks highly in customer satisfaction surveys, reflecting its commitment to providing top-notch cheap Illinois auto insurance. Find our more through our Allstate vs. USAA insurance review.

- Comprehensive Coverage Options: USAA provides a range of coverage options tailored to the needs of military families, enhancing the overall value and protection of its cheap Illinois auto insurance.

Cons

- Limited Eligibility: USAA’s services are only available to military members, veterans, and their families, excluding many potential customers who might otherwise benefit from its cheap Illinois auto insurance.

- Higher Premiums for Some: While generally competitive, premiums for certain high-risk drivers or non-standard situations may be higher, potentially impacting the affordability of cheap Illinois auto insurance.

#3 – State Farm: Best for Local Agents

Pros

- Local Agent Network: With a large network of local agents, State Farm offers personalized service for cheap Illinois auto insurance, ensuring customers receive tailored advice and support specific to their needs.

- Customizable Policies: State Farm provides a variety of coverage options and add-ons, allowing customers to tailor their cheap Illinois auto insurance policies to fit their individual requirements.

- Good Customer Service: State Farm generally receives positive reviews for customer service, reflecting its commitment to providing quality support for cheap Illinois auto insurance. Delve more through our State Farm insurance review.

Cons

- Higher Premiums for Some Drivers: For certain demographics or high-risk drivers, State Farm’s premiums can be higher, which may affect the overall affordability of cheap Illinois auto insurance.

- Limited Digital Features: Compared to some other providers, State Farm’s online tools and mobile app may not be as advanced, potentially limiting convenience for those managing their cheap Illinois auto insurance online.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#4 – Liberty Mutual: Best for Customizable Plans

Pros

- Customizable Plans: Liberty Mutual offers a range of customizable coverage options, allowing customers to create a cheap Illinois auto insurance policy that best fits their individual needs.

- Accident Forgiveness: Liberty Mutual provides accident forgiveness for certain policies, which can help keep premiums stable and affordable for cheap Illinois auto insurance after a first accident.

- High Financial Rating: With an A rating from A.M. Best, Liberty Mutual shows strong financial stability, ensuring reliability in meeting claims for those seeking cheap Illinois auto insurance. Read more through our Liberty Mutual auto insurance review.

Cons

- Higher Premiums for Some Drivers: Premiums with Liberty Mutual can be more expensive compared to other providers, particularly for high-risk drivers, which could affect the affordability of cheap Illinois auto insurance.

- Mixed Customer Reviews: Some customers have reported issues with claims processing and customer service, which might impact the overall satisfaction with cheap Illinois auto insurance.

#5 – Travelers: Best for Safe Driver

Pros

- Safe Driver Discounts: Travelers offers discounts for safe driving behaviors, which can significantly reduce premiums and provide affordable cheap Illinois auto insurance for responsible drivers.

- Unique Coverage Options: Provides special coverages like mechanical breakdown and gap insurance, adding extra protection and value to cheap Illinois auto insurance policies. Look for more details through our Travelers insurance review.

- Vanishing Deductible: The vanishing deductible feature decreases your deductible with each claim-free year, offering a financial benefit for maintaining a clean driving record and contributing to cheap Illinois auto insurance.

Cons

- Higher Rates in Some Areas: Travelers’ rates can be higher in certain regions compared to other providers, potentially impacting the affordability of cheap Illinois auto insurance depending on your location.

- Customer Service Issues: Some customers report difficulties with claim disputes and service, which might affect overall satisfaction with cheap Illinois auto insurance.

#6 – Progressive: Best for Snapshot Program

Pros

- Snapshot Program: The Snapshot program monitors driving habits to offer discounts, which can lower premiums and provide affordable cheap Illinois auto insurance for safe drivers.

- Competitive Rates: At $34 per month, Progressive offers competitive rates, especially for those who qualify for various discounts and maintain good driving records, ensuring access to cheap Illinois auto insurance.

- Broad Coverage Options: Provides a wide range of coverage options and discounts, including bundling policies, enhancing the overall value of cheap Illinois auto insurance. Find out more through our Progressive insurance review.

Cons

- Higher Premiums for Some: Drivers with less-than-ideal driving habits or high-risk profiles may face higher premiums, which can affect the affordability of cheap Illinois auto insurance.

- Complex Policy Details: The range of discounts and coverage options can be confusing, making it challenging for some customers to fully understand their cheap Illinois auto insurance policy.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Nationwide’s vanishing deductible program reduces your deductible over time with each claim-free year, providing a financial incentive for safe driving and contributing to cheap Illinois auto insurance.

- Wide Range of Coverage Options: Offers various coverage options and add-ons, allowing customization of cheap Illinois auto insurance policies to meet individual needs.

- Strong Financial Stability: With an A+ rating from A.M. Best, Nationwide demonstrates robust financial health, ensuring reliability in providing cheap Illinois auto insurance. Find out more through our Nationwide insurance review.

Cons

- Higher Rates for High-Risk Drivers: Premiums can be higher for drivers with high-risk profiles, potentially impacting the affordability of cheap Illinois auto insurance.

- Customer Service Variability: The quality of service can vary by location and agent, which might lead to inconsistent experiences with cheap Illinois auto insurance.

#8 – American Family: Best for Local Agents

Pros

- Local Agent Support: American Family’s extensive network of local agents offers personalized service for cheap Illinois auto insurance, providing tailored advice and support.

- Variety of Discounts: Provides a range of discounts, including for bundling and safe driving, which can help reduce premiums and make cheap Illinois auto insurance more affordable.

- Good Financial Rating: With an A rating from A.M. Best, American Family shows strong financial stability, ensuring reliable claims handling for those seeking cheap Illinois auto insurance.

Cons

- Higher Premiums for Some: Premiums can be higher compared to competitors, especially for high-risk drivers, which may affect the overall affordability of cheap Illinois auto insurance.

- Limited Digital Tools: The online features and mobile app may not be as advanced as those of other providers, potentially limiting convenience for managing cheap Illinois auto insurance. Read more through our American Family insurance review.

#9 – Farmers: Best for Personalized Service

Pros

- Personalized Service: Farmers emphasizes personalized service with a focus on tailoring cheap Illinois auto insurance solutions to individual needs, enhancing customer satisfaction.

- Broad Coverage Options: Provides a wide array of coverage options and add-ons, allowing customization of cheap Illinois auto insurance policies to meet various requirements.

- Multiple Discounts: Offers various discounts, such as for bundling and safe driving, which can help lower premiums and provide affordable cheap Illinois auto insurance. Read more through our Farmers auto insurance review.

Cons

- Higher Premiums in Some Areas: Rates can be higher in certain regions compared to other providers, potentially impacting the affordability of cheap Illinois auto insurance depending on your location.

- Mixed Customer Service Feedback: Some customers report issues with claims processing and customer service, which might affect the overall satisfaction with cheap Illinois auto insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#10 – Allstate: Best for Multiple Discounts

Pros

- Wide Range of Discounts: Allstate offers numerous discounts, including for safe driving and bundling, helping to reduce premiums and making cheap Illinois auto insurance more affordable.

- Local Agents Available: With a large network of local agents, Allstate provides personalized service for managing cheap Illinois auto insurance, ensuring tailored support and advice.

- Strong Financial Stability: An A+ rating from A.M. Best indicates strong financial health, ensuring reliable claims handling and peace of mind for those seeking cheap Illinois auto insurance. Read more through our Allstate insurance review.

Cons

- Higher Premiums for High-Risk Drivers: Premiums can be higher for drivers with higher risk profiles, potentially impacting the overall affordability of cheap Illinois auto insurance.

- Complex Policy Details: The range of coverage options and discounts may be confusing, making it challenging for some customers to fully understand their cheap Illinois auto insurance policy.

Illinois Auto Insurance Requirements

Like many other states, Illinois has mandatory automobile liability insurance laws that every driver on the road must comply with. There are three main auto insurance coverage types that are required to be in full compliance with Illinois state laws.

Illinois Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $67 $176

American Family $43 $114

Farmers $45 $117

Geico $18 $47

Liberty Mutual $29 $76

Nationwide $35 $93

Progressive $34 $89

State Farm $25 $64

Travelers $33 $87

USAA $24 $62

The first is to have a minimum of $20,000 in coverage for injury or death of a single person in an accident. Next, you’ll require a minimum of $40,000 in liability coverage for injury or death of multiple victims in an accident – this is the total claim amount from all injured parties. Finally, you’ll be required to carry a minimum of $15,000 in property damage liability insurance.

While these amounts may seem like they are significant – they’re not. With today’s very high medical costs, a small amount such as $20,000 can get eaten up very quickly after an accident, leaving you paying the rest of the victim’s medical bills out of pocket.

The same goes for the $15,000 in property damage – if you’re in an accident that does significant damage to someone else’s luxury or expensive sports car, you’ll well exceed this amount. It’s critical that any Illinois driver get as much insurance coverage as they can afford.

Insurance may seem like something you just never need, but if you do end up needing it you will be very thankful you have it. Enter your ZIP code now to begin comparing.

Illinois Auto Insurance Rates

Average auto insurance premiums in Illinois are quite reasonable, ranking 21st overall in the nation according to the National Association of Insurance Commissioners. Insurance customers will pay an average of $67 per month when insuring a car in the state of Illinois.

While many of these factors are simply based on your own driving record, two things that affect even the safest of drivers are age and gender. As with most states, males typically pay higher auto insurance rates than females.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Illinois Driving Statistics

Illinois drivers have much to be proud of when it comes to driver safety. After seeing virtually no decline in automobile crashes from 2007 to 2008, there was a drop of over 100,000 crashes in 2009 – one of the largest drops in annual traffic crashes in history at about thirty percent (408,258 in 2008 compared to 292,106 in 2009).

Fatalities in automobile accidents also declined from 1043 to 911 in 2009, proving that Illinois drivers are taking road safety very seriously. Illinois Governor Pat Quinn commended Illinois drivers, noting that “In 2009, the state of Illinois became a safer place to travel in an automobile as a result of our successful efforts to improve traffic safety.

Overall, the picture is a bit worse for Illinois when it comes to auto theft. The state ranked eighth overall in the nation for incidences of grand theft auto in 2009, with nearly 38,000 vehicles stolen. This gives Illinois a rate of around 340 vehicle thefts per 100,000 citizens.

To protect against such risks, understanding different auto insurance coverage types, such as comprehensive coverage, is crucial. While Illinois’s theft rate isn’t too bleak, having the right coverage can significantly reduce the impact of vehicle theft.

The good news is that the overall auto theft rate has been trending downwards in Illinois over the past decade, making the risk of having your vehicle stolen that much less likely. Look for state initiatives such as the “Northern Illinois Auto Theft Task Force” and other local law enforcement initiatives to bring this number down even further.

Consider yourself well-armed in regards to how auto insurance works in the state of Illinois. Before you purchase or renew your insurance plan, be sure to do your research as there are dozens of different companies and thousands of plans and combinations on the market today.

As long as you put some care into it, you’ll come out with a decent insurance package at a great monthly rate. Enter your ZIP code now to begin comparing.

Frequently Asked Questions

What are the monthly rates for Geico’s auto insurance in Illinois?

Geico’s monthly rates for auto insurance in Illinois start at $18. This makes it one of the most affordable options among the top providers.

Which insurance provider offers the lowest monthly rates among the top 10 for Illinois?

Geico offers the lowest monthly rates at $18. This positions them as the top choice for cheap Illinois auto insurance. Enter your ZIP code now to begin comparing.

What A.M. Best rating does USAA hold?

Which insurance company is ranked #3 for cheap Illinois auto insurance?

State Farm is ranked #3 for cheap Illinois auto insurance. Known for its local agent network, State Farm offers personalized service.

What unique feature does Progressive offer that can affect your auto insurance premiums?

Progressive offers the Snapshot program, which provides discounts based on your driving habits. This can lead to significant savings on your cheap Illinois auto insurance. Enter your ZIP code now to begin comparing.

Which provider is known for its customizable plans?

Liberty Mutual is known for its customizable plans, offering the flexibility to tailor your affordable full coverage auto insurance to fit your specific needs.

This means you can design a policy that provides comprehensive protection while remaining cost-effective, making it easier to balance comprehensive coverage with budget constraints.

What is the monthly rate for Liberty Mutual’s auto insurance coverage?

Liberty Mutual’s monthly rates start at $29. This rate provides access to their range of customizable insurance options.

Which provider offers accident forgiveness as a feature?

Nationwide offers accident forgiveness as part of their coverage options. This feature helps prevent premium increases after your first accident. Enter your ZIP code now to begin comparing.

How does Nationwide’s vanishing deductible benefit affect premiums?

Nationwide’s vanishing deductible feature is a great tool for budgeting for auto insurance, as it reduces your deductible for each claim-free year.

This can lead to lower out-of-pocket costs and contribute to more affordable cheap Illinois auto insurance. By incorporating this feature into how you budget auto insurance, you can potentially save money on insurance premiums over time.

What type of discounts does Allstate provide for cheap Illinois auto insurance?

Allstate offers a variety of discounts, including for safe driving and bundling multiple policies. These discounts can help reduce the cost of your cheap Illinois auto insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active life and health insurance licenses in seven states and over 20 years of experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ...

Licensed Agent & Financial Advisor

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.