Cheap Ohio Auto Insurance in 2025 (Secure Low Rates With These 10 Companies)

Explore the best providers for cheap Ohio auto insurance from USAA, Geico, and American Family with rates starting at only $16 per month. These companies offer competitive pricing, the most excellent coverage, and superior customer service, making them the top choices for Ohio driver's insurance needs.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

UPDATED: Nov 4, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 4, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage in Ohio

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 2,235 reviews

2,235 reviewsCompany Facts

Min. Coverage in Ohio

A.M. Best Rating

Complaint Level

2,235 reviews

2,235 reviews

The top picks for cheap Ohio auto insurance are USAA, Geico, and American Family, renowned for their cost-effectiveness and extensive coverage.

Ohio auto insurance can be pricey, but knowing how to handle an auto insurance claim can help you save. We’ll highlight the best Ohio auto insurance options and key facts, making it easier to find the coverage you need.

Our Top 10 Company Picks: Cheap Ohio Auto Insurance

Company Rank Monthly Rates Good Driver Discount Best For Jump to Pros/Cons

#1 $16 20% Military Savings USAA

#2 $23 22% Cheap Rates Geico

#3 $24 13% Discount Availability American Family

#4 $25 10% Bundling Policies Travelers

#5 $27 15% Agency Network State Farm

#6 $33 10% Budgeting Tools Progressive

#7 $37 12% Safe Drivers Farmers

#8 $41 10% Coverage Options Liberty Mutual

#9 $44 12% Widespread Availability Nationwide

#10 $46 10% Drivewise Program Allstate

Before you buy Ohio auto insurance, make sure to shop around.

Enter your ZIP code above for free Ohio auto insurance quotes.

- Ohio auto insurance usually costs about $16 per month

- Coverage in Ohio is 25/50/25 for bodily injury and property damage

- Compare quotes to find the best rate on Ohio auto insurance

#1 – USAA: Top Overall Pick

Pros

- Outstanding Customer Service: Renowned for their exceptional service and claims support, especially for military families. Their top ranking in customer satisfaction and affordable monthly rates starting at $16 make them an ideal choice for those looking for inexpensive Ohio auto insurance.

- Affordable Rates: Known for offering some of the most competitive rates to eligible members, with average monthly premiums around $16. The 20% discount for good drivers further enhances their appeal, positioning them as a leading option for budget-friendly Ohio auto insurance.

- Comprehensive Coverage: Ideal for military savings, they provide customized policies that cater to specific needs, solidifying their status as a provider of affordable Ohio auto insurance.

Cons

- Limited Availability: Only available to military members, veterans, and their families, limiting access for the general population. This exclusivity can be a drawback if you’re not eligible for their affordable Ohio auto insurance. Compare rates and learn more through our Allstate vs. USAA insurance review.

- Less Flexible: Limited flexibility in customizing policies compared to some competitors. While the coverage is comprehensive, it may not offer as many options for customization as other providers, which might be a limitation for those seeking the best cheap Ohio auto insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#2 – Geico: Best for Cheap Rates

Pros

- Low Rates: Known for consistently low rates and competitive pricing, with monthly premiums averaging $23. Their rates are driven by a 22% discount for good drivers, making them a strong contender for cheap Ohio auto insurance.

- Convenient Online Tools: Offers robust online tools for managing policies and filing claims, making it easy to handle insurance needs digitally. This digital convenience is an added benefit for those looking for cheap Ohio auto insurance.

- Extensive Discounts: Provides a variety of discounts including for safe driving, bundling, and military service. The 22% discount for good drivers makes Geico an attractive option for affordable Ohio auto insurance. Read more through our Geico insurance review.

Cons

- Variable Service Quality: Customer service quality can vary depending on location and agent, which might affect the consistency of your experience with cheap Ohio auto insurance.

- Limited Personal Interaction: Online-focused approach may not appeal to those preferring face-to-face interactions, potentially leading to a less personalized experience, which could be a drawback for some seeking cheap Ohio auto insurance.

#3 – American Family: Best for Discount Availability

Pros

- Discount Availability: Offers a broad range of discounts, including for good students and bundling policies. Their 13% discount for good drivers helps in maintaining affordable rates, which makes them a viable option for cheap Ohio auto insurance.

- Flexible Coverage Options: Provides a variety of coverage options to suit different needs, making it easier to tailor a policy to individual requirements. This flexibility is beneficial for finding cheap Ohio auto insurance that fits your needs.

- Good Customer Service: Known for solid customer service and support, with a strong focus on personalized assistance. This reliable support adds value to their cheap Ohio auto insurance offerings. Learn more through our American Family auto insurance review.

Cons

- Higher Premiums: Rates may be higher compared to some competitors, especially if discounts aren’t applied. Their average monthly rate of $24 is higher than Geico and USAA, which may not be ideal for those strictly seeking cheap Ohio auto insurance.

- Mixed Claims Experience: Some users report slower claims processing times, which could affect overall satisfaction and make their cheap Ohio auto insurance less appealing.

#4 – Travelers: Best for Bundling Policies

Pros

- Bundling Benefits: Excellent for bundling policies with discounts for combining auto and home insurance, making it a good choice for those looking to save on multiple policies. This bundling can contribute to cheaper Ohio auto insurance.

- Wide Coverage Options: Offers extensive coverage choices and customizable policies, which can be tailored to individual needs. This variety helps in finding cheap Ohio auto insurance that fits different requirements.

- Strong Financial Stability: High financial stability ratings ensure reliability and assurance in claims payouts, adding value to their affordable Ohio auto insurance. Look for more details through our Travelers insurance review.

Cons

- Higher Premiums for Some Drivers: Rates can be higher depending on individual risk factors, potentially affecting affordability for some drivers, which might be a concern if you’re focused on finding cheap Ohio auto insurance.

- Inconsistent Customer Service: Some reports of varying customer service experiences, which might impact the overall experience with cheap Ohio auto insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#5 – State Farm: Best for Agency Network

Pros

- Extensive Agency Network: Wide network of local agents for personalized service, making it easy to access help and advice from nearby agents. This local presence can be beneficial for those seeking cheap Ohio auto insurance with a personal touch.

- Strong Local Presence: Reliable customer service through a large number of local offices, contributing to their high customer satisfaction and availability of cheap Ohio auto insurance.

- Variety of Discounts: Includes discounts for safe driving, student drivers, and more. Their 15% good driver discount is a notable benefit for those seeking affordable Ohio auto insurance. Delve more through our State Farm insurance review.

Cons

- Premium Costs: Can be more expensive for drivers with less-than-perfect driving records, with an average monthly rate of $27. This might be a disadvantage if you’re specifically looking for cheap Ohio auto insurance.

- Inconsistent Claims Experience: Customer experiences with claims handling can vary, potentially leading to mixed reviews and impacting the overall value of cheap Ohio auto insurance.

#6 – Progressive: Best for Budgeting Tools

Pros

- Innovative Budgeting Tools: Offers tools like the Name Your Price tool to help manage premiums, making it easier to find a policy that fits your budget. This feature is particularly useful for those seeking cheap Ohio auto insurance.

- Competitive Rates: Known for providing affordable rates and competitive pricing, with monthly premiums starting at $33. Their rates and tools make them a strong option for cheap Ohio auto insurance.

- Wide Range of Discounts: Discounts available for safe driving, multi-car policies, and more, helping to reduce overall costs and make their Ohio auto insurance affordable. Find out more through our Progressive insurance review.

Cons

- Service Inconsistencies: Customer service can vary, with some reports of slow response times and mixed experiences, which might affect satisfaction with cheap Ohio auto insurance.

- Rate Increases: Premiums may increase significantly after an initial period, potentially impacting long-term affordability for those seeking sustained cheap Ohio auto insurance.

#7 – Farmers: Best for Safe Drivers

Pros

- Safe Driver Discounts: Offers substantial discounts for drivers with clean records, including a 12% discount for good drivers. This helps in maintaining lower rates, contributing to cheap Ohio auto insurance.

- Comprehensive Coverage Options: Provides a range of coverage options and policy add-ons, allowing for customization based on individual needs. This flexibility is valuable for finding cheap Ohio auto insurance.

- Good Customer Support: Generally positive reviews for customer support and claims handling, contributing to overall satisfaction with their affordable Ohio auto insurance. Discover more information through our Farmers auto insurance review.

Cons

- Higher Premiums for Some: May be more expensive for drivers without qualifying discounts, with an average rate of $37. This can be a drawback for those specifically seeking cheap Ohio auto insurance.

- Inconsistent Claims Processing: Some customers report varying experiences with claims processing, which might affect satisfaction with their cheap Ohio auto insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Coverage Options

Pros

- Extensive Coverage Options: Offers a wide range of coverage options and policy features, including various add-ons. This variety helps in tailoring coverage to meet individual needs and achieve cheap Ohio auto insurance.

- Various Discounts: Discounts available for bundling, safe driving, and more, contributing to their overall affordability and making them a contender for cheap Ohio auto insurance.

- Strong Financial Stability: High financial stability ratings provide reassurance of their ability to handle claims effectively, which supports their credibility in offering cheap Ohio auto insurance. Read more through our Liberty Mutual auto insurance review.

Cons

- Higher Rates for Some: Premiums can be higher compared to competitors, especially for drivers with less-than-ideal records, which could be a concern for those focused on cheap Ohio auto insurance.

- Mixed Customer Feedback: Customer reviews can be inconsistent, with some reports of less satisfactory experiences, impacting their appeal for those seeking cheap Ohio auto insurance.

#9 – Nationwide: Best for Widespread Availability

Pros

- Competitive Rates: Provides competitive rates with various discounts available, including a 10% discount for safe drivers. Their pricing helps in offering affordable Ohio auto insurance.

- Flexible Coverage: A variety of coverage options and add-ons available to meet different needs, allowing for customization and achieving cheap Ohio auto insurance.

- Good Customer Service: Positive reviews for customer service and support, contributing to overall satisfaction with their affordable Ohio auto insurance. Delve deeper through our Nationwide insurance review.

Cons

- Higher Costs for Certain Drivers: Premiums may be steeper for those who don’t qualify for specific discounts, averaging around $37. This could be a disadvantage for those focused on finding affordable auto insurance in Ohio.

- Variable Claims Experiences: Some customers have reported inconsistent experiences with claims processing, which could impact overall satisfaction with their budget-friendly Ohio auto insurance.

#10 – Allstate: Best for Drivewise Program

Pros

- Drivewise Program: Offers the Drivewise program that tracks driving habits and rewards safe driving with discounts. This program supports affordable Ohio auto insurance by reducing premiums for good drivers.

- Wide Range of Coverage Options: Provides extensive coverage options including accident forgiveness and new car replacement. Their comprehensive coverage can help in finding cheap Ohio auto insurance tailored to your needs.

- Strong Local Network: Large network of local agents for personalized service, which can assist in finding the best coverage and deals for cheap Ohio auto insurance. Read more through our Allstate insurance review.

Cons

- Higher Premiums: Premiums can be higher compared to some competitors, with average rates starting at $46, which might be a concern for those specifically seeking cheap Ohio auto insurance.

- Mixed Customer Service Reviews: Some users report inconsistent experiences with customer service, which could impact satisfaction with their cheap Ohio auto insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Requirements for Ohio Auto Insurance

According to the Ohio Department of Insurance, drivers in the state enjoy the thirteenth lowest auto insurance rates in the nation. The state does require that drivers provide proof of financial responsibility – which nearly everyone does in the form of purchasing Ohio auto insurance.

Like virtually all other mandatory insurance states in the country, Ohio has two main areas where drivers are required to cover their financial liability.

Ohio Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $46 $120

American Family $24 $62

Farmers $37 $96

Geico $23 $59

Liberty Mutual $41 $106

Nationwide $44 $114

Progressive $33 $85

State Farm $27 $70

Travelers $25 $63

USAA $16 $41

Bodily injury liability covers injuries to another driver, passengers, or pedestrian in an accident where you are at fault. Ohio state law requires that drivers carry $25,000 in BIL coverage per person in any one accident and $50,000 in BIL coverage for all parties in any one accident.

While these minimums are higher than in some states, they are still quite low when compared to today’s average medical treatment costs. Any driver with the means to purchase additional BIL insurance coverage should do so.

Property damage liability policy covers the driver for any claims resulting from property damage they cause in an accident. For instance, any accident involving another car will result in a property damage claim.

The minimum coverage required by Ohio law is $25,000, but again, it’s critical to get as much PDL as you believe is necessary and fits within your budget. Any accident at freeway speeds is likely to cause much more than $25,000 in damage.

Driving Stats (Accidents And Theft) for Ohio

The news isn’t great for Ohio drivers when it comes to auto crashes, unfortunately. Ohio suffered almost 300,000 auto crashes in 2010, with 910 fatalities reported. This number is actually up slightly from 2009, when 298,663 crashes were reported.

On the plus side, the number of fatalities dropped in 2010 from 2009, when 945 fatalities were caused by automobile accidents. As being in an accident can significantly impact your insurance costs, it’s important to drive as safely as possible when out cruising the roads.

It should go without saying, but wearing seatbelts and driving defensively are critical and could end up saving your life if you should get into a crash.

The news is much better for Ohio citizens when we look at instances of vehicle theft. Ohioans reported just 22,900 vehicle thefts in 2009, down from almost 29,000 in 2008—a significant decrease. This trend highlights the importance of understanding the differences between comprehensive vs. collision coverage in car insurance.

Tim Bain

Licensed Insurance Agent

Ohio’s statewide rate of vehicle theft is down 50% since 2001, which can be directly attributed to the enforcement efforts of state and local police, and much greater use of anti-theft devices such as car alarms and “Lojack” systems.

Fewer stolen vehicles mean less reason for insurance rates to go up, so this is one area that is cause for celebration. Enter your ZIP code now to begin comparing.

Rates for Ohio Auto Insurance

As mentioned previously, Ohio enjoys relatively inexpensive auto insurance when compared to the rest of the nation.

In 2010, the average Ohio auto insurance premium was $100 per month, which is quite a bit lower than the national average of $146 per month recorded at the same time.

While many of these factors are simply based on your own driving record, two things that affect even the safest drivers are age and gender. As with most states, (such as Pennsylvania auto insurance), males typically pay higher auto insurance rates than females.

Bear in mind that every person is going to be quoted different monthly and annual Ohio auto insurance rates due to variables such as driving record, make and model of the automobile being insured, credit rating, and more.

It’s best to research online or check with an auto insurance agent if you’re unsure about what you should be paying for Ohio auto insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Understanding Rates by Company for Ohio Auto Insurance

But which companies are the largest, holding the most market share percentage in the region?

There are quite a few insurance companies in the Ohio marketplace that can offer you any number of insurance packages and plans, so make sure you spend some time to figure out which plans are best for you and what fits into your budget. Enter your ZIP code now to begin comparing.

Frequently Asked Questions

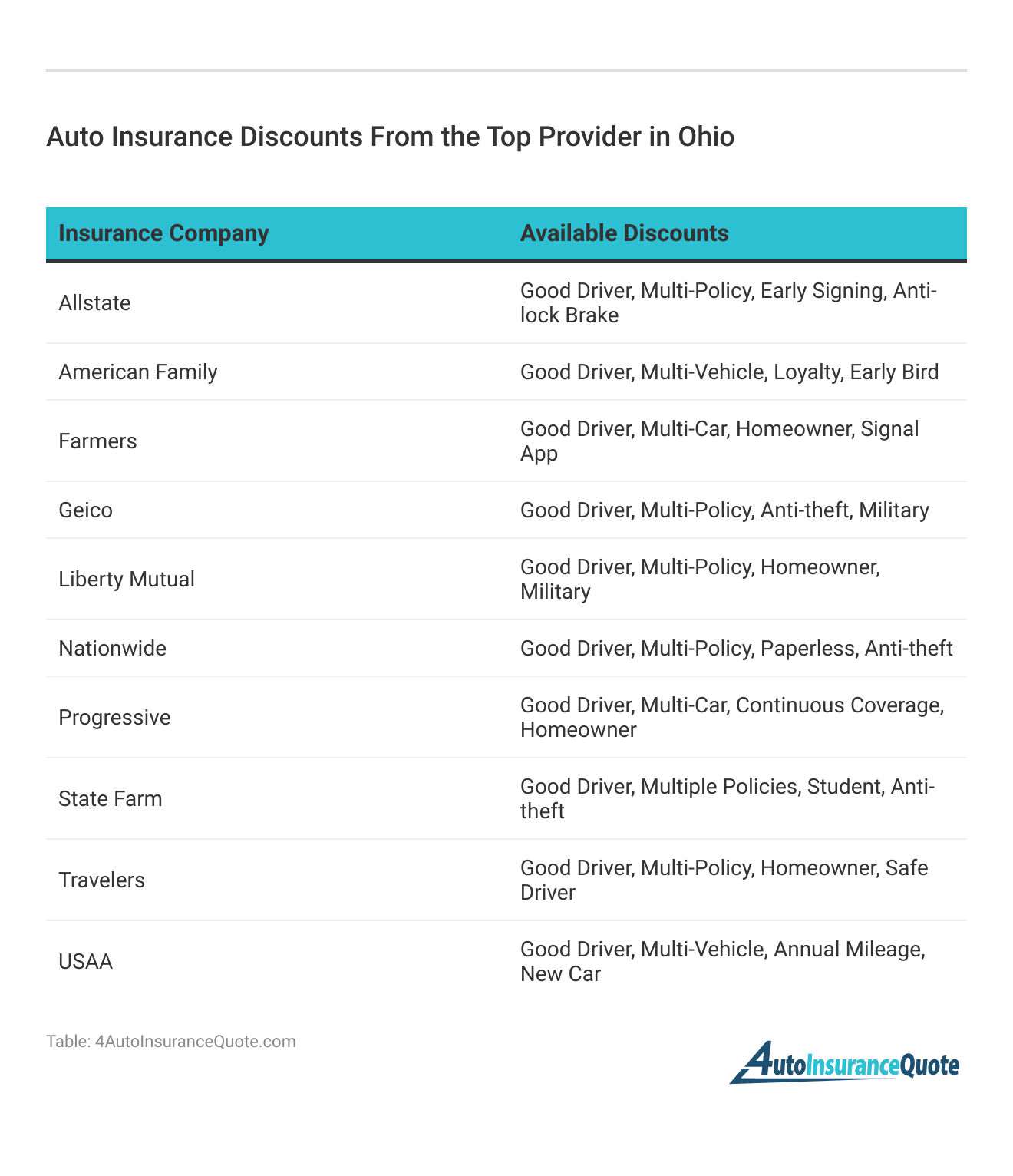

Are there any discounts available to help lower my Ohio auto insurance rates?

Yes, many insurance companies offer discounts for various reasons, such as safe driving records, multiple policies with the same company, anti-theft devices, and good student discounts. It’s worth asking your insurance provider about available discounts.

Does my credit score impact my Ohio auto insurance rates?

Yes, in most cases, insurance companies consider credit scores when determining rates. A good credit score can potentially help you secure lower insurance premiums. Enter your ZIP code now to begin comparing.

Can I get Ohio auto insurance with a suspended license?

It is generally more challenging to obtain auto insurance with a suspended license. However, you may still be able to find specialized insurance providers who offer coverage under certain circumstances.

Additionally, if you’re considering protecting your vehicle further, it’s worth exploring options for affordable guaranteed auto protection (gap) insurance.

This coverage can help cover the difference between what you owe on your vehicle and its current market value if it’s totaled, which is especially important if you’re financing or leasing the car.

What happens if I drive without insurance in Ohio?

Driving without insurance in Ohio can result in penalties, including fines, suspension of your license, and the requirement to provide an SR-22 form (proof of financial responsibility) for future insurance coverage.

Does Ohio auto insurance cover rental cars?

It depends on your policy. Some auto insurance policies may include rental car coverage, but it’s essential to review your policy or contact your insurance provider to confirm whether rental cars are covered. Enter your ZIP code now to begin comparing.

Can I add additional drivers to my Ohio auto insurance policy?

Yes, most insurance policies allow you to add additional drivers to your policy. However, it’s crucial to disclose all drivers who regularly use your vehicle to ensure proper coverage.

Remember that adding drivers can affect your auto insurance deductibles. If these drivers are involved in a claim, your deductible might come into play, impacting your out-of-pocket costs.

Which insurance provider offers the lowest monthly rates for Ohio auto insurance according to the article?

USAA offers the lowest monthly rates for Ohio auto insurance at $16. This rate is specifically available to eligible military members and their families.

What discount percentage does Geico provide for good drivers?

Geico provides a 22% discount for good drivers. This substantial discount contributes to Geico being one of the top choices for cheap Ohio auto insurance. Enter your ZIP code now to begin comparing.

Which company is noted for its strong local agent network and personalized service?

State Farm is noted for its extensive agency network and personalized service. This allows for more localized support and customized insurance solutions for Ohio drivers.

Additionally, combining insurance policies with State Farm, such as bundling home and auto insurance, can offer significant discounts and streamlined management, enhancing overall convenience and potential savings.

How does Allstate’s Drivewise program benefit policyholders seeking affordable auto insurance?

Allstate’s Drivewise program offers discounts based on driving habits, which can help reduce premiums.

This program rewards safe driving and can make Allstate a competitive option for cheap Ohio auto insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.