Cheap Toyota Auto Insurance in 2025 (Earn Savings With These 10 Companies)

Geico, Progressive, and State Farm are top choices for cheap Toyota auto insurance offering rates starting at $45/mo. These providers are known for their competitive prices, making them great options for Toyota owners looking for reliable coverage. Compare quotes to find the best rate for Toyota auto insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

13,283 reviews

13,283 reviewsCompany Facts

Min. Coverage for Toyota

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage for Toyota

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsGeico, Progressive, and State Farm are top picks for cheap Toyota auto insurance, with Geico offering the lowest rates starting at $45 per month, delivering substantial cost reductions for drivers.

Before you buy a new or used Toyota, get Toyota auto insurance quotes online. You’ll get the cheapest rates possible if you compare Toyota auto insurance quotes by vehicle model.

Our Top 10 Company Picks: Cheap Toyota Auto Insurance| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $45 | A++ | Competitive Rates | Geico | |

| #2 | $50 | A+ | Snapshot Program | Progressive | |

| #3 | $55 | B | Reliable Service | State Farm | |

| #4 | $60 | A+ | Accident Forgiveness | Allstate | |

| #5 | $62 | A+ | Vanishing Deductible | Nationwide |

| #6 | $65 | A++ | Military Benefits | USAA | |

| #7 | $70 | A | RightTrack Program | Liberty Mutual |

| #8 | $72 | A | Eco-Friendly Discounts | Farmers | |

| #9 | $75 | A | Teen Discounts | American Family | |

| #10 | $78 | A++ | IntelliDrive Program | Travelers |

Insurance companies consider the make and model of your vehicle when determining premiums. New cars cost more to insure than used vehicles, but your rates will also go up if you drive a sport or luxury model.

- Affordable Toyota Auto Insurance Quotes

When selecting a Toyota vehicle, it is essential to review Toyota auto insurance options to compare rates and identify affordable coverage. To discover competitive auto insurance rates from leading providers, enter your ZIP code above.

- Geico has the lowest Toyota auto insurance rate at $45/month

- Progressive and State Farm offer competitive rates for Toyota drivers

- The Yaris is the cheapest Toyota to insure, starting at $129/month

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – Geico: Top Overall Pick

Pros

- Competitive Rates: Geico’s monthly rates start at $45, making it a leading choice for cheap Toyota auto insurance. This low-cost option helps budget-conscious drivers save significantly on their premiums.

- Excellent Financial Stability: With an A++ rating from A.M. Best, Geico offers reliable cheap Toyota auto insurance backed by solid financial health. This ensures confidence in their ability to cover claims.

- User-Friendly Digital Tools: Geico provides a streamlined online platform and mobile app for managing policies and claims, making it easy to access cheap Toyota auto insurance on the go. This convenience enhances the customer experience.

Cons

- Limited Coverage Options: Geico’s focus on affordability might mean fewer options for comprehensive coverage, which could be a drawback for those seeking extensive protection in their cheap Toyota auto insurance policy. Read more through our Geico auto insurance review.

- Customer Service Variability: Some customers report mixed experiences with Geico’s customer service, potentially affecting the value of their cheap Toyota auto insurance. Inconsistent service could be a concern for those needing reliable support.

#2 – Progressive: Best for Snapshot Program

Pros

- Snapshot Program: Progressive’s Snapshot program offers potential discounts for safe driving behavior, which can help reduce the cost of cheap Toyota auto insurance. This program rewards good driving habits with lower premiums. Learn more through our Progressive auto insurance review.

- Flexible Coverage Options: Progressive allows for extensive customization of coverage, which helps in finding cheap Toyota auto insurance that meets specific needs. This flexibility ensures a tailored approach to insurance.

- Strong Digital Presence: Progressive’s online tools and mobile app facilitate easy access to policy management and claims, enhancing the convenience of securing cheap Toyota auto insurance. This digital accessibility streamlines the process.

Cons

- Higher Premiums for New Drivers: New drivers might face higher premiums despite the Snapshot program, making it less ideal for those specifically seeking cheap Toyota auto insurance. This could be a disadvantage for younger or less experienced drivers.

- Claims Process Complexity: Some users find Progressive’s claims process to be complicated, which may detract from the value of their cheap Toyota auto insurance. A more straightforward process could improve overall satisfaction.

#3 – State Farm: Best for Reliable Service

Pros

- Reliable Service: State Farm is known for its dependable service and strong local presence, making it a solid choice for cheap Toyota auto insurance. Their reputation for reliability adds value to their coverage.

- Extensive Network of Agents: With a vast network of agents, State Farm offers personalized service for cheap Toyota auto insurance, providing easy access to expert advice and support. This network enhances customer service.

- Various Discounts: State Farm provides multiple discounts, including those for good driving and vehicle safety features, which can help reduce the cost of cheap Toyota auto insurance. These discounts contribute to lower premiums.

Cons

- Higher Rates for Some Models: State Farm’s rates might be higher for certain Toyota models, which could impact those specifically looking for cheap Toyota auto insurance. This variation can affect overall affordability.

- Limited Online Tools: State Farm’s digital tools may not be as advanced as those of other providers, potentially making it less convenient to manage cheap Toyota auto insurance online. This could be a drawback for tech-savvy users. Gain further insight into this through our State Farm auto insurance review.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#4 – Allstate: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Allstate’s accident forgiveness feature prevents premiums from increasing after your first accident, which is beneficial for maintaining affordable cheap Toyota auto insurance rates. This feature adds financial protection.

- Wide Range of Coverage Options: Allstate offers extensive coverage options, including those for roadside assistance and rental cars, which can enhance the value of cheap Toyota auto insurance. This variety helps meet diverse needs. Find out more by exploring our Allstate auto insurance review.

- Strong Customer Support: Allstate is known for good customer support, which adds value to its cheap Toyota auto insurance by ensuring effective assistance when needed. Reliable support can improve overall satisfaction.

Cons

- Higher Average Rates: Allstate’s rates may be higher compared to some competitors, which could be a downside for those specifically seeking cheap Toyota auto insurance. This might affect affordability for budget-conscious drivers.

- Mixed Claims Experiences: Some customers report mixed experiences with Allstate’s claims process, potentially affecting the overall value of their cheap Toyota auto insurance. A more consistent process could enhance satisfaction.

#5 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Nationwide’s vanishing deductible program reduces your deductible amount for each year of safe driving, which can make cheap Toyota auto insurance more affordable over time. This feature rewards safe driving habits.

- Flexible Coverage Options: Nationwide offers a range of coverage options and add-ons, allowing for the customization of cheap Toyota auto insurance to fit individual needs. This flexibility enhances the value of their policies.

- Strong Financial Stability: An A+ rating from A.M. Best indicates Nationwide’s financial strength, ensuring reliable cheap Toyota auto insurance coverage. This stability is important for peace of mind. Learn additional details through our Nationwide auto insurance review.

Cons

- Moderate Monthly Rates: With starting rates of $62, Nationwide might not be the cheapest option for Toyota auto insurance, which could be a drawback for those specifically seeking the lowest rates. This may affect budget-conscious drivers.

- Limited Local Agents: Fewer local agents compared to some competitors could reduce the availability of personalized service for cheap Toyota auto insurance. This might impact those who prefer face-to-face interactions.

#6 – USAA: Best for Military Benefits

Pros

- Military Benefits: USAA offers specialized benefits and discounts for military members and their families, making it a top choice for cheap Toyota auto insurance within this community. These benefits add significant value.

- Competitive Rates: With rates starting at $65, USAA provides affordable cheap Toyota auto insurance for eligible members, helping to keep costs manageable. Their pricing structure is beneficial for budget-conscious drivers.

- Excellent Customer Service: USAA is highly rated for customer service, ensuring high-quality support for cheap Toyota auto insurance. This excellent service enhances overall satisfaction and value.

Cons

- Eligibility Restrictions: USAA’s services are limited to military members and their families, which might exclude potential customers seeking cheap Toyota auto insurance. This restriction limits access to their offerings. Uncover more by reviewing our USAA auto insurance review.

- Higher Costs for Non-Military Members: Non-military drivers may find it difficult to access USAA’s competitive rates, impacting those specifically looking for cheap Toyota auto insurance outside the military community.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#7 – Liberty Mutual: Best for RightTrack Program

Pros

- RightTrack Program: Liberty Mutual’s RightTrack program offers discounts based on driving habits, which can help reduce the cost of cheap Toyota auto insurance. This program rewards safe driving with lower premiums. Delve deeper with our Liberty Mutual auto insurance review.

- Customizable Coverage Options: Liberty Mutual provides various coverage options and add-ons, allowing for a tailored cheap Toyota auto insurance policy. This customization ensures that coverage fits individual needs.

- Strong Financial Ratings: With an A rating from A.M. Best, Liberty Mutual demonstrates financial stability, providing reliable cheap Toyota auto insurance coverage. This stability is important for long-term confidence.

Cons

- Higher Monthly Rates: Starting rates of $70 might be higher compared to some competitors, potentially impacting those specifically seeking cheap Toyota auto insurance. This could be a drawback for budget-conscious drivers.

- Complex Policy Options: Liberty Mutual’s extensive range of coverage options may be overwhelming, which could complicate the process of finding cheap Toyota auto insurance. This complexity might deter some potential customers.

#8 – Farmers: Best for Eco-Friendly Discounts

Pros

- Eco-Friendly Discounts: Farmers offer discounts for hybrid or electric vehicles, making it easier to find cheap Toyota auto insurance for eco-conscious drivers. These discounts can help reduce overall insurance costs while supporting green initiatives.

- Innovative Coverage Options: Farmers provides unique coverage options such as rideshare insurance and customized equipment protection, which enhances the value of cheap Toyota auto insurance by catering to specific needs.

- Comprehensive Policy Customization: Extensive customization options allow drivers to tailor their cheap Toyota auto insurance policies to fit individual requirements. This ensures that drivers can secure affordable and suitable coverage.

Cons

- Higher Monthly Premiums: Starting rates of $72 might be higher compared to other providers, making it less appealing for those specifically seeking cheap Toyota auto insurance. This higher cost could be a disadvantage for budget-conscious drivers. Read more through our Farmers auto insurance review.

- Inconsistent Customer Service: Mixed reviews regarding customer service may impact the perceived value of cheap Toyota auto insurance with Farmers. Inconsistent experiences with support might affect overall satisfaction and the handling of claims.

#9 – American Family: Best for Teen Discount

Pros

- Teen Driver Discounts: American Family offers significant discounts for teen drivers, making cheap Toyota auto insurance more affordable for families with young drivers. These discounts can lead to considerable savings on premiums.

- Comprehensive Coverage Options: American Family provides a wide range of coverage options, allowing for a tailored cheap Toyota auto insurance policy that meets various needs. This ensures that customers receive appropriate protection. Expand your knowledge about this through our American Family auto insurance review.

- User-Friendly Digital Tools: American Family’s digital tools and mobile app offer easy management of policies and claims, enhancing the convenience of securing and maintaining cheap Toyota auto insurance. This accessibility improves the overall customer experience.

Cons

- Higher Rates for Some Drivers: American Family’s rates might be higher for certain drivers or vehicles, which could be a downside for those specifically seeking the most affordable cheap Toyota auto insurance. This could impact overall affordability.

- Limited Availability of Discounts: While American Family offers various discounts, some users may find the range less comprehensive compared to other providers, potentially affecting the affordability of cheap Toyota auto insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#10 – Travelers: Best for IntelliDrive Program

Pros

- IntelliDrive Program: Travelers’ IntelliDrive program uses telematics to offer discounts based on driving behavior, making cheap Toyota auto insurance more affordable for safe drivers. This program helps reduce premiums with responsible driving.

- Customizable Coverage Options: Travelers provide extensive customization options for their policies, allowing for a tailored cheap Toyota auto insurance plan that fits individual needs. This flexibility enhances the value of their coverage.

- Innovative Technology: Travelers offers advanced digital tools and a mobile app for easy management of policies and claims, improving the accessibility and convenience of cheap Toyota auto insurance. This tech-driven approach enhances user experience. Get more information from our Travelers auto insurance review.

Cons

- Higher Starting Rates: With starting rates of $78, Travelers may not be the most cost-effective option for cheap Toyota auto insurance. This higher cost might be a concern for those seeking the lowest premiums.

- Complex Claims Process: Some users find Travelers’ claims process to be complicated, which could detract from the overall value of their cheap Toyota auto insurance. A more streamlined process could improve customer satisfaction.

Understanding the Different Types of Toyota Auto Insurance

Before you get Toyota auto insurance quotes, determine how much coverage you need. Check your state insurance laws to make sure you are meeting the legal requirements.

Toyota Auto Insurance Monthly Rates by Coverage Level & Provider| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $60 | $145 |

| American Family | $75 | $170 |

| Farmers | $72 | $165 |

| Geico | $45 | $120 |

| Liberty Mutual | $70 | $160 |

| Nationwide | $62 | $150 |

| Progressive | $50 | $135 |

| State Farm | $55 | $140 |

| Travelers | $78 | $175 |

| USAA | $65 | $155 |

Most states require the following types of auto insurance for Toyota drivers:

- Auto Liability Insurance: Pays for damages and injuries you cause in an at-fault accident.

- Uninsured/Underinsured Motorist (UM/UIM) Protection: This covers your damages if you’re hit or injured by an uninsured or underinsured driver.

- Medical Payments Coverage (MedPay): Covers hospital and medical costs for injuries after an accident or collision no matter who is at fault.

- Personal Injury Protection Insurance: This covers hospitalization, medical costs, lost wages, child care, and more household services if you’re injured and unable to work after an accident.

- SR-22 Insurance: Drivers with revoked licenses are required to file an SR-22 insurance form with the local DMV to reinstate their driving privileges.

If you are leasing or financing a new Toyota, you may want to buy full coverage insurance. This kind of policy combines liability with comprehensive and collision auto insurance for coverage that applies to accidents, weather-related events, and theft.

There are differences between collision and comprehensive coverage, so it’s important to know what type of coverage you want.

Toyota Auto Insurance Quotes by Model

The model and year of your Toyota will have an impact on your insurance quotes. Brand new cars cost more to insure than used vehicles. However, according to the Insurance Institute for Highway Safety (IIHS), models that earn higher safety ratings will have lower rates.

The Toyota Land Cruiser has the most expensive rates, while the Yaris is the cheapest model to insure. Use our rate data on other popular models below to compare Toyota auto insurance quotes.

Toyota 4Runner Auto Insurance

Toyota 4Runner insurance rates are more expensive when compared to other midsize SUVs. Drivers pay $32 per month for liability insurance and $133 for full coverage.

You’ll pay less for insurance on a Ford Escape or Honda CR-V, so shop around and compare auto insurance quotes before you buy a new Toyota.

Read more: Affordable Ford Auto Insurance Quotes

Toyota Avalon Auto Insurance

Toyota Avalon auto insurance costs are very affordable at only $132 per month for full coverage.

Liability-only costs around $35 monthly, depending on where you live, but you’ll want to compare Avalon insurance quotes online to get the lowest rates possible.

Toyota Camry Auto Insurance

The Toyota Camry is one of the cheapest used cars to insure. Monthly auto insurance rates average around $143 for full coverage and $37 for liability insurance.

The Camry also earned the highest IIHS rating of Top Safety Pick+ for its superior front and side crash prevention systems. These features prompt cheaper auto insurance rates, but you can pay even less if you install additional safety and anti-theft recovery systems.

Toyota Celica Auto Insurance

Is a Toyota Celica a sports car for insurance? Yes, most companies will charge sports auto insurance rates because the Celica is a two-door compact vehicle.

However, it lacks the torque and aerodynamic features that other sports models have, so your rates could be slightly less than someone who drives a Mitsubishi Eclipse or Nissan 370z.

Read our guide for more tips on how to find cheap auto insurance for sports car drivers.

Read more: Affordable Mitsubishi Auto Insurance Quotes

Toyota Corolla Auto Insurance

The average auto insurance price for a Toyota Corolla averages around $140 per month for full coverage and $37 for liability-only.

Corollas are very easy to repair or replace, so it’s easy to find affordable Toyota auto insurance quotes. Your rates will also be cheaper if you buy an older or used Corolla.

Toyota Highlander Auto Insurance

Toyota Highlander insurance costs around $141 per month for full coverage and $37 for liability.

Highlander auto insurance rates are low due to their high safety ratings. It performed better than other midsize SUVs in the IIHS safety tests, with superior front-end crash and higher headlight ratings.

The best auto insurance for Toyota Highlanders will offer further discounts for safety features, so shop around with multiple companies to see where you can save the most money.

Toyota Land Cruiser Auto Insurance

The Toyota Land Cruiser is one of the most expensive models to insure, with monthly full coverage rates close to $174. Liability costs are also higher than average at $42 per month.

The Land Cruiser is Toyota’s largest SUV, with an MSRP starting at $89,000. Luxury models can cost upwards of $137,000. You can lower Toyota auto insurance rates if you buy an older model year, but you’ll still be paying more than other Toyota drivers.

Toyota MR2 Spyder Auto Insurance

The Toyota MR2 Spyder was a two-seater sports car with three models released between 1984-2007. Some insurance companies require vehicles to be at least 25 years old, so you may want to consider classic auto insurance depending on the model year you have.

Otherwise, Toyota MR2 Spyder auto insurance rates might be expensive, especially for the convertible. Insurance companies consider these types of vehicles high risk for accidents and rollovers and therefore charge drivers higher rates.

Toyota Prius Auto Insurance

When it comes to hybrid and electric vehicles (EVs), Toyota Prius auto insurance rates are very affordable.

Good drivers pay $131 for full coverage and $32 for liability insurance. Teen drivers will also save money by driving a Toyota Prius, with monthly rates around $477 — almost $50 less per month than average.

Toyota Rav4 Auto Insurance

Insurance companies consider the Toyota Rav4 a compact SUV, which is one of the safest vehicles, according to the IIHS.

Most drivers pay $132 for full coverage and $37 for liability Rav4 insurance. Rav4 Prime insurance costs might be higher since it’s a hybrid vehicle, but you can compare companies with alternative fuel and hybrid vehicle insurance discounts to lower rates.

Toyota Sequoia Auto Insurance

Toyota Sequoia insurance costs around $145 for full coverage and $42 for liability. This is less than average but $10-$15 more per month than similar models, like the Ford Expedition ($132/month) or Nissan Armada ($131/month). However, Sequoias still cost less to insure than a GMC Yukon or Lincoln Navigator.

Read more: Affordable Nissan Auto Insurance Quotes

Toyota Sienna Auto Insurance

The Toyota Sienna earned the IIHS Top Safety Pick+ among minivans, which led to lower insurance rates. You can expect to pay around $145 for full coverage and $42 for liability insurance.

Although quotes are often lower than average, similar models, like the Chrysler Pacifica and Kia Sedona, cost less to insure.

Read more: Affordable Chrysler Auto Insurance Quotes

Toyota Tacoma Auto Insurance

Tacoma truck insurance rates average $134 for full coverage and $37 for liability-only, which is less than average but still more expensive than comparable models.

For example, you can save a few dollars every month on auto insurance if you choose to drive a Chevy Colorado or GMC Canyon instead.

Read more: Affordable GMC Auto Insurance Quotes

Toyota Tundra Auto Insurance

When it comes to safety, the Toyota Tundra outperforms other pickup trucks. It earned Top Safety Pick+ from IIHS when compared to other models, and drivers pay rates as low as $147 per month. That’s only slightly higher than rates for the Camry and Corolla.

You can save money on Toyota Tundra auto insurance quotes when buying minimum coverage, which costs $42 per month, but none of your vehicle repairs will be covered after an accident.

Toyota Yaris Auto Insurance

The Yaris is the smaller alternative to the Prius. Smaller vehicles cost less to insure, which is why Toyota Yaris auto insurance rates were the cheapest we found at only $129 per month for full coverage.

However, some companies will charge more for hybrids and EVs, so shop around and compare at least three insurers to get the cheapest Toyota auto insurance quotes.

Enter your ZIP code to find affordable Toyota insurance from local companies.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Comparing Rates and Coverage Options for Toyotas

The best way to find cheap Toyota vehicle insurance is to compare rates across different models and companies. Sportier models will typically have higher insurance rates, but adding safety features and avoiding speeding tickets will help lower your Toyota insurance costs.

Toyota drivers will also want to compare insurance discounts and coverage options. For example, some companies offer free accident forgiveness if you avoid filing a collision claim for at least three to five years. This type of coverage prevents your rates from going up after your first auto accident.

Where you live also affects your Toyota auto insurance rates, big-city drivers often pay the most. Our free comparison tool below compares location-based car insurance quotes.

Read more: Affordable Convertible Vehicle Auto Insurance Quotes

Toyota Auto Insurance Quotes Explained

The Yaris and Prius get the most affordable Toyota auto insurance quotes, while the Land Cruiser, a luxury model, has the highest. (Acquire greater detail about how vehicle makes and models affect auto insurance rates.)

Tim Bain Licensed Insurance Agent

You can get lower quotes by comparing policies online. Start with our comparison tool below. Just enter your ZIP code and vehicle information to get cheap Toyota auto insurance quotes near you.

Frequently Asked Questions

Will a Toyota be expensive to insure?

Toyota auto insurance quotes are affordable because most models are easy to repair or replace after an accident. Toyota insurance costs are comparable to Honda and Nissan.

Which Toyota will be the cheapest to insure?

According to our rate data, the Toyota Yaris is the cheapest to insure, with monthly rates at $129. The Yaris is also the cheapest Toyota to insure for teen drivers, costing around $471 per month.

Get fast and cheap auto insurance coverage today with our quote comparison tool below.

How much is auto insurance for a 2020 Toyota Camry?

Full coverage auto insurance for a 2020 Toyota Camry costs around $143 per month, but you should compare quotes from at least three different companies to see which can offer you the lowest rates.

Understanding how auto insurance works can help you identify the best rates and coverage options available.

What insurance is best for Toyotas?

We usually recommend carrying a full coverage auto insurance policy on your Toyota, no matter what model you own. Full coverage auto insurance offers the most protection on your Toyota.

How much is auto insurance for a 1999 Toyota Camry?

On average, auto insurance for a 1999 Toyota Camry costs less than $1,000 per year. You could pay between $80 and $100 monthly, depending on how much coverage you need.

Get fast and cheap auto insurance coverage today with our quote comparison tool below.

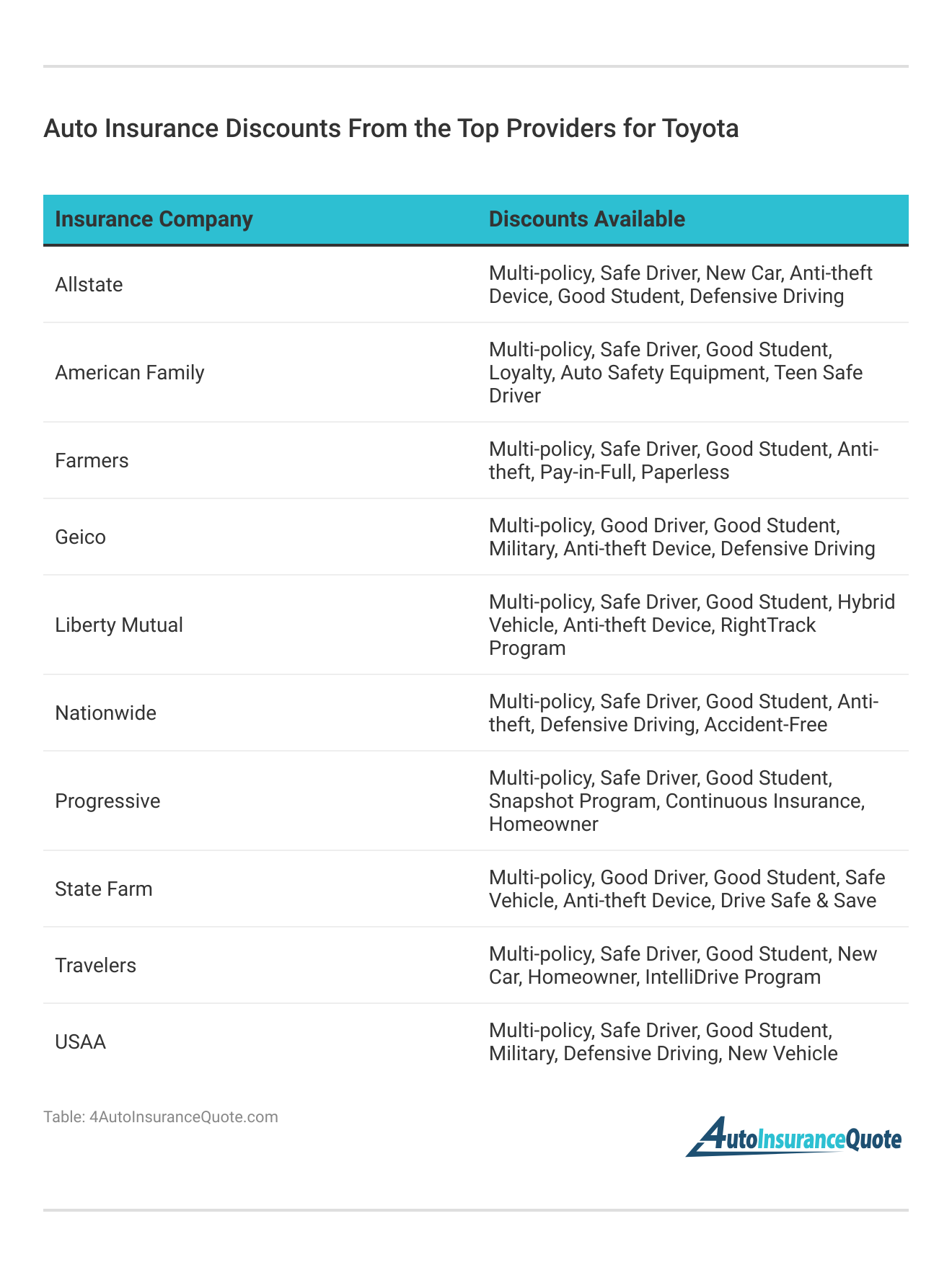

Can I get discounts on Toyota auto insurance?

Yes, many insurance companies offer various auto insurance discounts for Toyota drivers. Some common discounts include multi-policy discounts, good driver discounts, low mileage discounts, safety feature discounts, and discounts for completing defensive driving courses.

Utilizing these auto insurance discounts can significantly reduce the cost of your Toyota coverage.

How much is auto insurance for a 2022 Toyota Corolla?

Auto insurance rates for a 2022 Toyota Corolla average around $140 per month, but your rates will vary based on your driving record and where you live.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.