10 Best Auto Insurance Companies in 2025

Erie, Geico, and Travelers emerge as the top overall picks for the best auto insurance companies, with starting rates as low as $41 per month. These companies offer customized plans and competitive pricing, ensuring drivers receive dependable and comprehensive auto insurance coverage.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: Jan 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for Best Insurance Companies

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Best Insurance Companies

A.M. Best Rating

Complaint Level

Pros & Cons

Erie, Geico, and Travelers are the premier choices for the best auto insurance companies, offering tailored policies and exceptional customer service. Delve into their unique features, available discounts, and comprehensive auto insurance coverage options to find the perfect fit for your needs.

These providers excel in financial stability, efficient claims handling, and high customer satisfaction ratings. Discover how choosing the right auto insurance company can ensure your peace of mind by prioritizing your protection and financial security.

Our Top 10 Picks: Best Auto Insurance Companies

Company Rank Safe Driving Discount A.M. Best Best For Jump to Pros/Cons

#1 20% A+ Customer Service Erie

#2 25% A++ Low Rates Geico

#3 15% A++ Bundling Policies Travelers

#4 20% A++ Comprehensive Coverage Auto Owners

#5 15% A+ Digital Tools Nationwide

#6 10% A Young Drivers AAA

#7 20% A++ Reliable Agents State Farm

#8 20% A+ Usage-Based Progressive

#9 15% A High-Risk Drivers American Family

#10 10% A+ Claims Handling Amica

Compare quotes from these top providers to secure the best auto insurance tailored to your specific requirements. Understanding auto insurance is the best way to save money.

Find the best auto insurance company near you by entering your ZIP code into our free quote tool above.

- Erie stands out as the best pick for comprehensive auto insurance coverage

- Compare rates from top auto insurance companies, starting at $41/month

- Tailored policies and unique discounts from leading auto insurance providers

#1 – Erie: Top Overall Pick

Pros

- Highly Rated for Young Drivers: Offers tailored solutions specifically for younger drivers, which can lead to better rates and coverage options.

- Personalized Service: Known for strong customer satisfaction due to the personalized service provided by local agents.

- Competitive Rates: Provides competitive pricing, especially for full coverage policies. Read more in our Erie auto insurance review.

Cons

- Limited Availability: Only operates in a limited number of states, restricting access for many potential customers.

- Fewer Online Services: May lack extensive online tools and services, requiring more in-person agent interaction.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#2 – Geico: Best for Low Rates

Pros

- Low Rates: Geico is renowned for offering some of the most affordable rates in the industry, making it a budget-friendly option. Learn more in our Geico auto insurance review.

- Extensive Online Tools: Provides a wide range of online resources and tools for easy policy management.

- Strong Financial Stability: Highly rated for financial strength, ensuring the ability to pay out claims efficiently.

Cons

- Mixed Customer Service Reviews: While many are satisfied, some customers report issues with claims handling and customer service.

- Higher Rates for Poor Credit: Can charge higher premiums for drivers with poor credit or driving records.

#3 – Travelers: Best for Discounts

Pros

- Variety of Discounts: Offers numerous discounts, which can help lower the overall cost of insurance.

- Well-Rated Claims Process: Travelers has an efficient and well-regarded claims handling process. To understand more, read our guide on How do auto insurance claims work.

- Customizable Coverage Options: Provides a range of customizable coverage options to suit different needs.

Cons

- Higher Premium Rates: Can be more expensive than some competitors for similar coverage levels.

- Limited Local Agents: Fewer local agents available in some areas, which can affect personalized service.

#4 – Auto-Owners: Best for Personalized Service

Pros

- Affordable Rates: Our Auto-Owners auto insurance review shows that the company offers competitive rates for both minimum and full coverage policies.

- Personalized Agent Service: High customer satisfaction due to the personalized service from local agents.

- Financial Stability: Strong financial health, ensuring the ability to handle expensive claims.

Cons

- Limited Online Presence: Less focus on online tools and services, which can be less convenient for tech-savvy customers.

- Regional Availability: Not available nationwide, limiting accessibility for some customers.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Unique Features

Pros

- Competitive Pricing: Offers competitive rates and various discounts.

- Unique Features: Provides unique features like AutoWatch for tracking vehicle repairs.

- Financial Strength: Strong financial stability and positive customer service ratings.

Cons

- Higher Premiums for High-Risk Drivers: Premiums can be higher for those with poor credit or a history of accidents. For more information, visit our Auto Accident & insurance claim resources.

- Limited Online Tools: Online resources and tools may not be as comprehensive as some competitors.

#6 – AAA: Best for Additional Services

Pros

- Reliable Reputation: AAA has a long-standing reputation for reliable insurance services. For a detailed assessment, check out our AAA auto insurance review.

- Additional Services: Offers a wide range of additional services, such as roadside assistance.

- Competitive Rates: Provides competitive rates for both minimum and full coverage policies.

Cons

- Membership Requirement: Requires AAA membership to access insurance services.

- Variable Customer Service: Customer service experiences can vary significantly by region.

#7 – State Farm: Best for Financial Stability

Pros

- Financial Stability: State Farm is known for its strong financial health, ensuring efficient claims handling. For a comprehensive evaluation, read our State Farm auto insurance review.

- Extensive Agent Network: Wide network of local agents for personalized service.

- Competitive Discounts: Offers various discounts to help reduce premium costs.

Cons

- Higher Rates for Young Drivers: Premiums can be higher for young or high-risk drivers.

- Mixed Claims Handling Reviews: Some customers report issues with the efficiency of claims handling.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#8 – Progressive: Best for Customizable Coverage

Pros

- Customizable Coverage: Offers a wide range of coverage options that can be tailored to individual needs.

- Competitive Rates: Known for competitive pricing, especially for drivers with clean records.

- User-Friendly Online Tools: Our Progressive auto insurance review highlights the company’s extensive online resources and a user-friendly website.

Cons

- Inconsistent Customer Service: Customer service experiences can be mixed, with some negative reviews.

- Significant Rate Increases: Rates may increase significantly after an accident or claim.

#9 – American Family: Best for Prompt Claims Handling

Pros

- Prompt Claims Handling: Known for quick and efficient claims processing.

- Competitive Rates: Offers competitive pricing with various discounts available.

- Financial Health: Our American Family insurance auto insurance review shows the company’s strong financial stability and ability to pay out claims.

Cons

- Limited State Availability: Only available in 19 states, limiting access for many potential customers.

- Less Comprehensive Online Tools: Online resources and tools may not be as robust as those of larger insurers.

#10 – Amica: Best for Customer Satisfaction

Pros

- High Customer Satisfaction: Consistently receives high ratings for customer service and claims handling.

- Customizable Policies: Offers a variety of customizable policy options to meet diverse needs.

- Competitive Pricing: Provides competitive rates, especially for full coverage auto insurance.

Cons

- Limited Availability: Not available in all states, restricting access for some customers.

- Higher Premiums for High-Risk Drivers: Tends to charge higher premiums for drivers with poor credit or a history of accidents.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Consumer Reports Auto Insurance Company Survey

When searching for the best auto insurance company, consider factors beyond price. A Consumer Reports survey of 28,241 customers ranked 22 insurers on claims payment speed and issues, with all scoring over 80 out of 100. Smaller insurers often received the highest ratings.

However, 10 to 26 percent of respondents reported issues with claims payments, sometimes waiting over two weeks. This underscores the importance of choosing reputable companies, not just focusing on price.

Erie is the best choice for auto insurance, combining tailored policies with outstanding customer service and competitive rates.Dani Best Licensed Insurance Producer

Many seek the cheapest options, but a low price doesn’t always mean excellent coverage or customer service. Comparing auto insurance quotes for state employees are essential steps. For those prioritizing customer service, exploring auto insurance companies with great customer service is crucial.

Auto Insurance Best Companies: Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $55 $130

American Family $50 $115

Amica $60 $125

Auto-Owners $35 $85

Erie $41 $106

Geico $30 $92

Nationwide $52 $118

Progressive $48 $120

State Farm $47 $110

Travelers $45 $105

The table compares monthly rates for minimum and full coverage across different insurers. AAA offers $55 for minimum and $130 for full coverage. American Family charges $50 for minimum and $115 for full coverage. Amica’s rates are $60 for minimum and $125 for full coverage. Auto-Owners provides $35 for minimum and $85 for full coverage.

Erie offers $41 for minimum and $106 for full coverage. Geico charges $30 for minimum and $92 for full coverage. Nationwide’s rates are $52 for minimum and $118 for full coverage. Progressive offers $48 for minimum and $120 for full coverage. State Farm charges $47 for minimum and $110 for full coverage. Travelers provides $45 for minimum and $105 for full coverage.

List of Auto Insurance Companies With the Cheapest Rates

Finding the best deal on auto insurance involves evaluating various top service providers. High or full coverage auto insurance costs around $345 per month, while low or liability-only coverage averages $312 per month.

Beware of significantly lower quotes, as they might compromise quality. Consumer Reports warns that low premiums can lead to higher overall costs due to low-ball loss estimates and repair hassles. Research reputable insurers with high ratings from Consumer Reports, J.D. Power, and A.M. Best.

Auto Insurance Monthly Rates by Coverage Level & Provider| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $386 | $429 | |

| $281 | $295 | |

| $327 | $375 | |

| $250 | $286 | |

| $484 | $530 |

| $283 | $292 |

| $311 | $363 | |

| $255 | $288 | |

| $352 | $385 | |

| $200 | $222 |

J.D. Power ranks companies on customer satisfaction, pricing, coverage, and service, while A.M. Best assesses financial stability. Your driving record significantly affects rates. According to a Consumer Reports survey, 86 percent of respondents were highly satisfied with claim handling.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Top-rated companies included New Jersey Manufacturers Insurance, Arbella, and Auto-Owners Insurance, though availability may vary. The internet facilitates obtaining quotes from reputable sources. Unlike other sites, 4AutoInsuranceQuote.com recommends only the best companies and provides the best auto insurance quotes from highly-rated insurers.

Our Top 25 Best Auto Insurance Companies List

The following list highlights 25 of the best car insurance companies, known for top-notch customer service, low rates, and high satisfaction. For affordable car insurance, consider Geico, Allstate, or State Farm, all offering excellent coverage and competitive prices. Esurance provides 24/7 support and competitive rates. Arbella is known for hassle-free claims.

American Family is praised for prompt claims but is available in only 19 states. Liberty Mutual offers quick claims and competitive pricing. Progressive offers customizable coverage. AAA provides reliable insurance. Farmers offers customizable auto and home policies. USAA ranks high in price and satisfaction for military families.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Amica offers customizable policies and top customer satisfaction. Erie is highly rated for young drivers and personalized service. NJM serves New Jersey and Pennsylvania with strong satisfaction. The Hartford caters to drivers over 50 with unique features. Auto-Owners Insurance provides affordable rates and personalized agent service. The Hanover offers premium services.

Nationwide offers competitive prices and AutoWatch. Travelers provides discounts and a well-rated claims process. 21st Century offers good-value policies. MetLife offers organizational discounts. Mercury Insurance provides low-cost policies. Safeco offers discounts and driver tracking. MAPFRE offers competitive rates. The General specializes in high-risk driver insurance.

The Best Auto Insurance Companies’ Features

When looking for car insurance, the lowest-priced policy is not always the best. Carefully research multiple companies and check public records on claims handling and rate setting.

Independent agents, representing several insurers, can help find good coverage for unique needs. While the list above includes top choices, other companies also deserve recognition when searching for affordable auto insurance.

The table summarizes the various discounts offered by top auto insurance providers, helping you identify potential savings on your policy. By exploring the discounts available from these top providers, you can find ways to reduce your auto insurance costs while maintaining quality coverage.

Auto Insurance Company Ratings

When buying auto insurance, many people focus only on cost, but it’s important to consider other factors and check company ratings. Two companies may offer similar quotes, but coverage can differ significantly.

Americans have many options for auto insurance, whether you need Arizona auto insurance, California auto insurance, Connecticut auto insurance, or Alaska auto insurance. Checking ratings online can help you find the best provider, as low prices often come with minimal coverage. Evaluating company ratings ensures adequate protection.

The Top Car Insurance Companies in the United States

There are hundreds of car insurance providers in the United States, some available nationwide and others only in specific states or regions. The top companies by market share are State Farm, Geico, Allstate, Progressive, Farmers auto insurance, USAA, Liberty Mutual auto insurance, Nationwide, American Family, and Travelers.

These companies are among the largest and serve customers across the country. USAA ranks high in price and customer satisfaction but is only available to retired and active-duty military personnel and their families. Some customers may prefer the personalized service of smaller, regional providers.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

The Best Car Insurance Comes From Smaller, Regional Providers

The companies listed above have name-brand recognition. However, if you’re looking for the best auto insurance company ratings in the United States, then consider choosing a smaller, regional provider. Smaller providers may serve a particular region – like the Midwest or the Northeast. Or, they might serve a specific state.

There’s nothing wrong with choosing a regional insurance company. Many customers report higher satisfaction with smaller companies. Sometimes, you might even pay lower rates. It highlights the importance of comparing as many car insurance quotes as possible when shopping around for insurance.

Some popular regional car insurance providers include Automobile Club Group, Amica Mutual, Erie Insurance, Auto Club of SoCal, The Hartford, The Hanover, CSAA insurance group auto insurance, Safeco, MetLife, and NJM insurance group auto insurance.

Comparing Auto Insurance Ratings Online

Choosing between good insurance companies can be overwhelming, but the internet makes it easier to compare auto insurance ratings online. Shopping for car insurance requires careful research to find the right company at a better price.

Consider each state’s minimum legal limits, as laws vary and affect how you file an insurance claim and the price of car insurance. For example, Idaho auto insurance is among the cheapest. Look for claims satisfaction, as smooth claims processes are essential. Price satisfaction is also important; sometimes higher premiums are worth better coverage.

Companies with easy online shopping experiences, stable financial situations, and strong J.D. Power rankings are preferable. Be aware of repair facility restrictions and range of coverage options, as poor companies may limit coverage and increase long-term costs.

Real-Life Case Studies: Tailored Auto Insurance Solutions for Diverse Needs

Explore how auto insurance for diverse customer needs can provide essential coverage, offering peace of mind and financial security. Through real-life case studies, discover how top insurance providers like Erie, Geico, and Travelers offer specialized solutions tailored to meet unique requirements.

- Case Study #1 – Personalized Service: Anna, 30, chose Erie Insurance for reliable auto coverage. Understanding how auto insurance works, Erie offered a comprehensive policy with discounts and tailored support. Anna was pleased with the service and rates, making Erie ideal for her.

- Case Study #2 – Affordable Rates: Mark, 25, chose Geico for affordable auto insurance. Geico offered competitive rates and discounts for students, multi-policy, and military service. Their financial stability and customer satisfaction provided Mark with economical, comprehensive coverage.

- Case Study #3 – Comprehensive Coverage: Lisa, 40, chose Travelers for comprehensive auto insurance. Travelers offered a robust policy with multi-policy, hybrid/electric car, and new car discounts. The well-rated claims process and wide range of discounts ensured Lisa had the protection she needed, making Travelers an excellent choice.

These case studies illustrate how individuals can secure auto insurance by leveraging discounts and comparing quotes from top providers ensuring they make informed decisions to protect their vehicles and financial future.

Erie excels in auto insurance with 86% customer satisfaction, offering tailored policies and top-notch service.Travis Thompson Licensed Insurance Agent

By doing so, they can make informed decisions to protect their vehicles and financial future.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Secure Reliable Auto Insurance: Tips for Informed Decision-Making

Selecting a top-rated auto insurance company is essential for securing reliable coverage and support. Evaluating ratings, financial stability, and coverage options helps ensure you get the best value.

By comparing quotes and exploring auto insurance discounts for affordable coverage, you can find a policy that meets your needs and budget. Use this information to make an informed decision and protect your vehicle and financial future.

Stop overpaying for auto insurance. Enter your ZIP code below to find out if you can get a better deal.

Frequently Asked Questions

How can I get an affordable insurance quote?

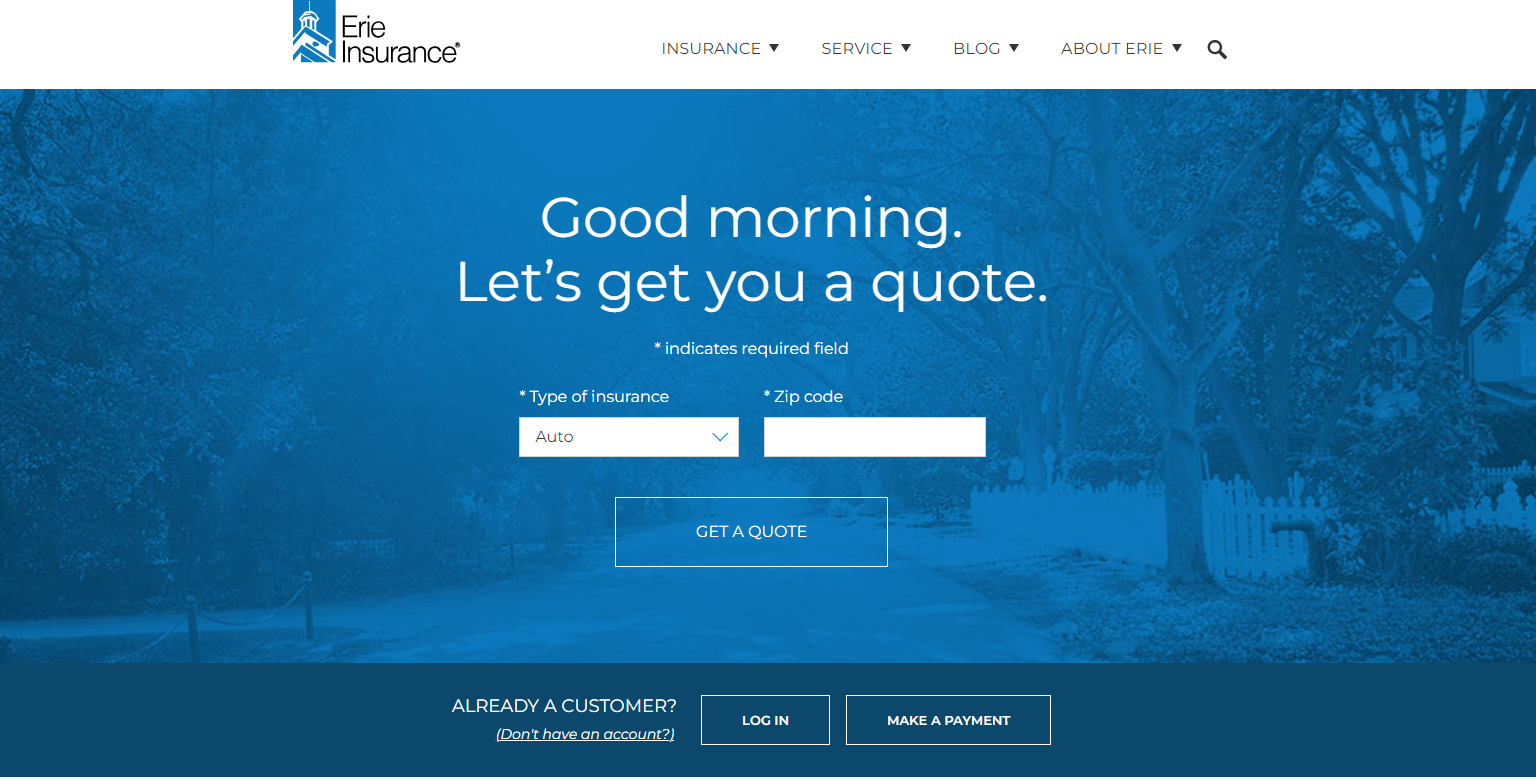

You can obtain an affordable insurance quote by visiting various auto insurance company websites and using their online tools. These tools allow you to input your information and receive quotes tailored to your needs.

To broaden your understanding, explore our comprehensive resource on insurance coverage titled “Affordable Instant Auto Insurance Quotes,” and gain valuable insights.

What are some reputable auto insurance company names?

Some reputable auto insurance company names include Erie, State Farm, Geico, Progressive, Allstate, and USAA. These companies are known for their reliable services and customer satisfaction.

Explore your auto insurance options by entering your ZIP code into our free comparison tool below today.

Where can I find auto insurance rankings?

Auto insurance rankings can be found on websites like J.D. Power and Consumer Reports. These rankings evaluate companies based on customer satisfaction, claims handling, and pricing.

For detailed information, refer to our comprehensive report titled “How to File an Auto Insurance Claim” to get started.

How can I compare auto quotes from different insurers?

You can compare auto quotes by visiting comparison websites such as NerdWallet or The Zebra. These sites allow you to compare quotes from multiple insurers side by side.

How do I choose the right insurance company for my needs?

To choose the right insurance company, consider factors like customer reviews, coverage options, pricing, and the company’s financial stability. Comparing multiple quotes can also help you make an informed decision.

To gain profound insights, consult our comprehensive guide titled “Finding Auto Insurance Quotes Online,” and make an informed decision today.

What are the benefits of using the biggest auto insurance company in USA?

Using the biggest auto insurance company in USA can offer benefits such as a wide range of coverage options, extensive resources for claims processing, and reliable customer service.

To enhance your understanding, you can refer to our extensive handbook titled “Compare Auto Insurance Coverage Types” for more details.

How can I find affordable auto insurance reviews?

Affordable auto insurance reviews can be found on websites like Yelp, Google Reviews, and the Better Business Bureau. These reviews provide insights from other customers about their experiences with different insurers.

Can I get car insurance online?

Yes, you can get car insurance online by visiting the websites of various auto insurers and using their online quote tools. This allows you to compare different policies and purchase coverage without leaving your home.

Enter your ZIP code into our free quote tool below to find the best auto insurance providers for your needs and budget.

Which are the 10 best auto insurance companies in America?

The 10 best auto insurance companies in America typically include Erie, Geico, Travelers, Auto-Owners, Nationwide, AAA, State Farm, Progressive, American Family, and Amica. These companies are known for their excellent coverage and customer service.

To gain a comprehensive insight, check out our in-depth review titled “Auto Insurance Discounts for Affordable Coverage” and ensure you get the best rates.

What should I consider when choosing from the biggest car insurance companies?

When choosing from the biggest car insurance companies, consider factors such as customer service, claim processing speed, coverage options, and pricing. It’s also beneficial to read reviews and compare quotes.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.