Cheap Nissan Auto Insurance in 2025 (Lower Your Rates With These 10 Companies!)

Cheap Nissan auto insurance starts at $85 a month, with USAA, Geico, and State Farm as the top providers. These companies offer the best value through competitive pricing and excellent service, providing comprehensive coverage options and discounts that make them ideal for Nissan owners.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Nov 4, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 4, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for Nissan

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage for Nissan

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsUSAA, Geico, and State Farm are the top choices for cheap Nissan auto insurance, with rates starting as low as $85 per month.

USAA leads the pack, offering the best overall value due to its competitive pricing and comprehensive coverage options. Geico provides affordable rates and a user-friendly experience, making it a strong contender for those seeking budget-friendly insurance. State Farm also delivers excellent service and competitive pricing, ensuring you get substantial coverage for your Nissan.

Our Top 10 Company Picks: Cheap Nissan Auto Insurance| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $85 | A++ | Military Discounts | USAA | |

| #2 | $95 | A++ | Affordable Rates | Geico | |

| #3 | $110 | B | Local Agents | State Farm | |

| #4 | $115 | A+ | Strong Reputation | Nationwide |

| #5 | $120 | A | Customizable Plans | American Family | |

| #6 | $121 | A+ | Online Tools | Progressive | |

| #7 | $125 | A++ | Broad Coverage | Travelers | |

| #8 | $126 | A | Various Discounts | Liberty Mutual |

| #9 | $130 | A+ | Extensive Network | Allstate | |

| #10 | $135 | A | Comprehensive Options | Farmers |

For a comprehensive understanding, consult our article titled, “Good Driver Auto Insurance Discount.” See which companies have the cheapest minimum auto insurance rates by entering your ZIP code into our free comparison tool above.

- Compare quotes for the best cheap Nissan auto insurance

- USAA offers top value for Nissan insurance at $85/month

- Tailor coverage to fit your Nissan’s needs and budget

#1 – USAA: Top Overall Pick

Pros

Pros

- Exclusive Discounts: Offers significant discounts for military personnel and their families, making it an excellent option for Nissan owners who qualify at just $85 per month, ensuring that they receive affordable coverage without compromising on quality.

- Superior Customer Service: Known for exceptional customer satisfaction and support, which is a great advantage for Nissan drivers seeking reliable service and peace of mind throughout their policy term.

- Low Rates: Provides some of the most competitive rates in the industry, especially appealing to Nissan policyholders looking to save on insurance while still receiving comprehensive coverage.

- Top-Rated Financial Strength: Rated A++ by A.M. Best, ensuring that Nissan enthusiasts can rely on the company’s financial stability and long-term commitment to meeting their insurance needs.

Cons

- Eligibility Restrictions: Limited to military members, veterans, and their families, so not all Nissan drivers can qualify, potentially excluding some from accessing USAA’s benefits. Access supplementary details in our article called, “USAA Auto Insurance Review.”

- Limited Local Offices: While customer service is excellent, in-person service options for Nissan insurance are less available compared to some other insurers, which may be a drawback for those who prefer face-to-face interactions.

- Specialized Coverage Options: May not offer as many specialized coverage options tailored specifically for Nissan policyholders as some other companies, which could be a limitation for those with unique insurance needs.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#2 – Geico: Best for Affordable Rates

Pros

Pros

- Affordable Rates: Geico is known for offering consistently low rates at $95 per month, making it a popular choice for budget-conscious Nissan drivers who want to keep their insurance costs manageable without sacrificing coverage quality.

- Strong Online Tools: Excellent online tools and mobile app, making it easy for Nissan policyholders to manage their policies and claims efficiently, offering convenience and control at their fingertips.

- Multiple Discounts: Offers a variety of discounts, including those that Nissan owners can benefit from, like good driving and vehicle safety features, helping them to further reduce their premiums.

- High Financial Strength: A++ rating from A.M. Best, ensuring that Nissan enthusiasts are backed by a financially strong company that is capable of meeting its obligations, even in challenging times.

Cons

- Average Customer Service: While affordable, Geico’s customer service may not meet the expectations of some Nissan owners who prioritize personalized support, potentially leading to a less satisfactory experience.

- Limited Local Agent Support: Primarily an online and phone-based service, which may not appeal to Nissan drivers who prefer in-person interactions and the personalized attention that comes with a local agent.

- Rates May Vary: Nissan policyholders might see significant rate increases after the initial policy period, which could make Geico less appealing in the long term if costs rise unexpectedly. Unlock additional information in our article entitled, “Geico Auto Insurance Review.“

#3 – State Farm: Best for Local Agents

Pros

Pros

- Strong Local Agent Network: Offers a vast network of local agents, providing personalized service that Nissan drivers can appreciate at a monthly rate of $110, ensuring they receive guidance and support tailored to their specific needs.

- Comprehensive Coverage Options: Extensive policy options that can be tailored to meet the specific needs of Nissan owners, giving them the flexibility to create a policy that aligns with their driving habits and preferences.

- Reputation for Reliability: State Farm is known for its reliable claims process, giving Nissan policyholders peace of mind knowing that their claims will be handled promptly and fairly in the event of an accident.

- Discounts for Safe Drivers: Nissan enthusiasts can benefit from discounts tailored for those with clean driving records, helping them to lower their insurance costs while rewarding safe driving behaviors. Enhance your comprehension with our article titled, “State Farm Auto Insurance Review.“

Cons

- Higher Rates: At $110 per month, State Farm’s rates might be higher than some competitors, which could be a drawback for budget-conscious Nissan owners who are looking to minimize their insurance expenses.

- Varying Customer Service: Customer service quality may vary depending on the local agent, potentially leading to inconsistent experiences for Nissan policyholders, which could affect their overall satisfaction.

- Limited Online Tools: The online tools and mobile app may not be as robust as those offered by other insurers, which could be a disadvantage for tech-savvy Nissan drivers who prefer managing their policies digitally.

#4 – Nationwide: Best for Strong Reputation

Pros

Pros

- Strong Reputation: Nationwide is known for its solid reputation and customer satisfaction, offering Nissan drivers peace of mind at $115 per month, ensuring they are covered by a company with a proven track record of reliability and trustworthiness.

- Comprehensive Coverage Options: Provides a wide range of coverage options that can be customized to fit the unique needs of Nissan policyholders, allowing them to create a policy that aligns perfectly with their requirements.

- Discounts for Safe Drivers: Nissan owners can take advantage of discounts for safe driving and other favorable behaviors, helping them to lower their insurance costs while maintaining high-quality coverage. Gain a deeper understanding through our article titled, “Nationwide Auto Insurance Review.”

- A+ Financial Rating: With an A+ rating from A.M. Best, Nissan enthusiasts can trust Nationwide’s financial stability, knowing that the company is well-equipped to handle their claims and support them through challenging times.

Cons

- Slightly Higher Rates: At $115 per month, Nationwide’s rates may be on the higher side compared to some other insurers, which might be a concern for Nissan policyholders looking to save money on their premiums.

- Limited Local Presence: Nationwide may not have as many local agents available, which could be a disadvantage for Nissan drivers who prefer face-to-face interactions and the personalized service that comes with it.

- Online Tools Could Improve: While functional, the online tools and mobile app might not be as advanced as some competitors, which could be a drawback for Nissan owners who prefer digital management of their insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#5 – American Family: Best for Customizable Plans

Pros

Pros

- Customizable Plans: American Family offers flexible coverage options that can be tailored to meet the specific needs of Nissan policyholders at a competitive rate of $120 per month, allowing them to build a policy that perfectly fits their lifestyle and driving habits. Deepen your understanding with our article called, “American Family Insurance Auto Insurance Review.”

- Strong Customer Service: Known for providing good customer service, which can be a major benefit for Nissan drivers looking for personalized support and assistance throughout their insurance journey.

- Safe Driving Discounts: Offers various discounts, including those for safe driving, which can help Nissan owners save on their premiums while encouraging responsible driving behavior.

- Solid Financial Stability: With an A rating from A.M. Best, Nissan enthusiasts can feel confident in the company’s financial backing, ensuring their claims will be handled effectively and their policies will remain secure.

Cons

- Higher Rates: At $120 per month, American Family’s rates might be higher than some competitors, which could be a concern for budget-conscious Nissan policyholders who are looking to keep their insurance costs down.

- Limited Availability: Not available in all states, which may limit access for some Nissan drivers, potentially restricting their ability to benefit from American Family’s offerings.

- Online Tools Need Improvement: The online tools and mobile app might not be as user-friendly or comprehensive as those offered by other insurers, which could be a disadvantage for tech-savvy Nissan owners who prefer managing their policies online.

#6 – Progressive: Best for Online Tools

Pros

Pros

- Advanced Online Tools: Progressive’s cutting-edge online tools and mobile app make it easy for Nissan policyholders to manage their insurance at an affordable $121 per month, providing them with convenience and control over their policies anytime, anywhere.

- Snapshot Program: Offers usage-based insurance through the Snapshot program, which can help safe Nissan drivers lower their rates by tracking and rewarding good driving behavior, potentially leading to significant savings.

- Wide Range of Discounts: Provides numerous discounts, including those for bundling policies and safe driving, which can benefit Nissan owners by reducing their overall insurance costs while maintaining comprehensive coverage.

- A+ Financial Rating: With an A+ rating from A.M. Best, Nissan enthusiasts can trust that Progressive has the financial strength to back its policies, ensuring their claims are paid promptly and their coverage remains secure.

Cons

- Rates May Vary: Progressive’s rates may fluctuate more than other insurers, which could result in higher premiums for some Nissan policyholders after the initial period, potentially making it less cost-effective in the long run.

- Customer Service Can Vary: Customer service quality might be inconsistent, which could be a concern for Nissan drivers who prioritize support and expect a high level of service throughout their policy term. Access the complete picture in our article titled, “Progressive Auto Insurance Review.”

- Complex Discount System: The discount system might be confusing or difficult to navigate for some Nissan owners, which could make it harder to maximize savings and fully benefit from Progressive’s offerings.

#7 – Travelers: Best for Broad Coverage

Pros

Pros

- Broad Coverage Options: Travelers offers a wide range of coverage options, including comprehensive and collision coverage, at a monthly rate of $125, providing Nissan drivers with extensive protection tailored to their needs.

- Discounts for Bundling: Offers discounts for bundling multiple policies, which can be advantageous for Nissan policyholders who want to save on their overall insurance costs by combining their auto and home insurance.

- Strong Customer Support: Known for providing solid customer support, ensuring that Nissan enthusiasts receive assistance when needed and have a positive experience with their insurance provider.

- A++ Financial Strength: With an A++ rating from A.M. Best, Travelers provides Nissan owners with confidence in the company’s ability to handle claims and support their insurance needs effectively.

Cons

- Higher Premiums: At $125 per month, Travelers’ rates may be higher than some competitors, which could be a drawback for budget-conscious Nissan drivers who are looking to reduce their insurance expenses.

- Complex Policies: The range of coverage options might be overwhelming for some Nissan policyholders, making it challenging to select the best policy for their needs without careful consideration. Obtain further insights from our article called, “Travelers Auto Insurance Review.“

- Limited Local Presence: May not have as extensive a network of local agents as some competitors, which could be a disadvantage for Nissan drivers who prefer face-to-face interactions and personalized service.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Various Discounts

Pros

Pros

- Variety of Discounts: Liberty Mutual offers numerous discounts, including those for safe driving, multi-policy bundling, and vehicle safety features, which can be particularly beneficial for Nissan policyholders seeking to reduce their $126 per month premium.

- Flexible Coverage Options: Provides a range of coverage options that can be customized to suit the specific needs of Nissan drivers, allowing them to tailor their policies to their individual requirements.

- Strong Financial Stability: With an A rating from A.M. Best, Liberty Mutual offers financial stability, ensuring that Nissan enthusiasts have a reliable insurer that can handle their claims and provide long-term support.

- 24/7 Customer Service: Offers round-the-clock customer service, which can be a significant advantage for Nissan policyholders needing assistance or information outside regular business hours.

Cons

- Higher Rates: At $126 per month, Liberty Mutual’s premiums might be higher than some competitors, which could be a concern for Nissan drivers looking to keep their insurance costs as low as possible.

- Complex Discount System: The variety of discounts and eligibility criteria might be confusing for some Nissan owners, making it challenging to determine which discounts they qualify for and how to apply them effectively.

- Customer Service Inconsistencies: Customer service quality can vary depending on the representative, potentially leading to inconsistent experiences for Nissan policyholders. Expand your understanding with our article called, ” Liberty Mutual Auto Insurance.”

#9 – Allstate: Best for Extensive Network

Pros

Pros

- Extensive Network of Agents: Allstate has a large network of local agents, providing Nissan drivers with personalized service and support at a monthly rate of $130, ensuring they have access to knowledgeable assistance in their area.

- Comprehensive Coverage Options: Offers a broad range of coverage options that can be tailored to meet the specific needs of Nissan policyholders, allowing them to create a policy that fits their unique driving situation.

- Numerous Discounts: Provides a variety of discounts, including those for safe driving and bundling policies, which can help Nissan owners save on their premiums while maintaining high-quality coverage.

- A+ Financial Rating: With an A+ rating from A.M. Best, Allstate provides Nissan enthusiasts with confidence in the company’s financial stability and its ability to handle claims effectively.

Cons

- Higher Premiums: At $130 per month, Allstate’s rates may be on the higher side compared to some other insurers, which could be a drawback for budget-conscious Nissan policyholders.

- Mixed Customer Service: Customer service experiences can vary, with some Nissan drivers reporting issues with responsiveness and support, potentially impacting their overall satisfaction.

- Complex Policy Options: The range of coverage options might be overwhelming for some Nissan owners, making it challenging to navigate and select the best policy for their needs. Obtain a more nuanced perspective with our article titled, “Allstate Auto Insurance Review.”

#10 – Farmers: Best for Comprehensive Options

Pros

Pros

- Comprehensive Coverage: Farmers offers a wide range of comprehensive coverage options, including customizable add-ons, at a monthly rate of $135, providing Nissan drivers with extensive protection tailored to their specific needs.

- Discounts for Bundling: Provides significant discounts for bundling multiple policies, which can be advantageous for Nissan policyholders looking to save on their overall insurance costs by combining their auto and other insurance needs.

- Strong Local Agent Network: Farmers has a robust network of local agents, offering personalized service and support to Nissan drivers, ensuring they receive tailored assistance and guidance throughout their insurance journey.

- A Financial Rating: With an A rating from A.M. Best, Farmers offers financial stability, providing Nissan enthusiasts with confidence that the insurer can effectively handle claims and provide reliable coverage.

Cons

- Higher Premiums: At $135 per month, Farmers’ premiums might be higher than those of some competitors, which could be a concern for Nissan drivers seeking to keep their insurance costs lower. Discover what lies beyond with our article titled, “Farmers Auto Insurance Review.“

- Complex Policy Structure: The extensive range of coverage options and add-ons might be confusing for some Nissan policyholders, making it challenging to determine which options are necessary and how they affect the overall premium.

- Customer Service Variability: Quality of customer service may vary depending on the local agent, potentially leading to inconsistent experiences for Nissan drivers and affecting their overall satisfaction with the insurer.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Comparing Car Insurance Rates and Coverage Options for Nissans

To find the best insurance on a Nissan, start by evaluating your coverage needs—such as liability, collision, and comprehensive insurance. Gather quotes from various insurers to compare rates, ensuring each quote reflects the same level of coverage for an accurate comparison.

For specific models, like the Nissan 370Z, it’s important to consider the Nissan 370Z insurance cost, as it can vary significantly. In addition to comparing quotes, look for potential discounts that could lower your premium, such as those for safe driving, bundling policies, or having safety features installed.

Nissan Auto Insurance Monthly Rates by Coverage Level & Provider| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $130 | $200 |

| American Family | $120 | $190 |

| Farmers | $135 | $205 |

| Geico | $95 | $155 |

| Liberty Mutual | $126 | $195 |

| Nationwide | $115 | $185 |

| Progressive | $121 | $190 |

| State Farm | $110 | $180 |

| Travelers | $125 | $195 |

| USAA | $85 | $150 |

For models like the Nissan Sentra and Nissan Versa, be sure to compare Nissan Sentra insurance rates and Nissan Versa insurance rates to find the best deal. It’s also helpful to understand why Nissan Altima insurance might be higher than average, as this can affect your decision.

Always check the insurer’s reputation through independent ratings and read the fine print of each policy to ensure comprehensive coverage and the best rates. For a comprehensive understanding, consult our article titled, “What are auto insurance premiums?” Start comparing affordable insurance options by entering your ZIP code below into our free quote comparison tool today.

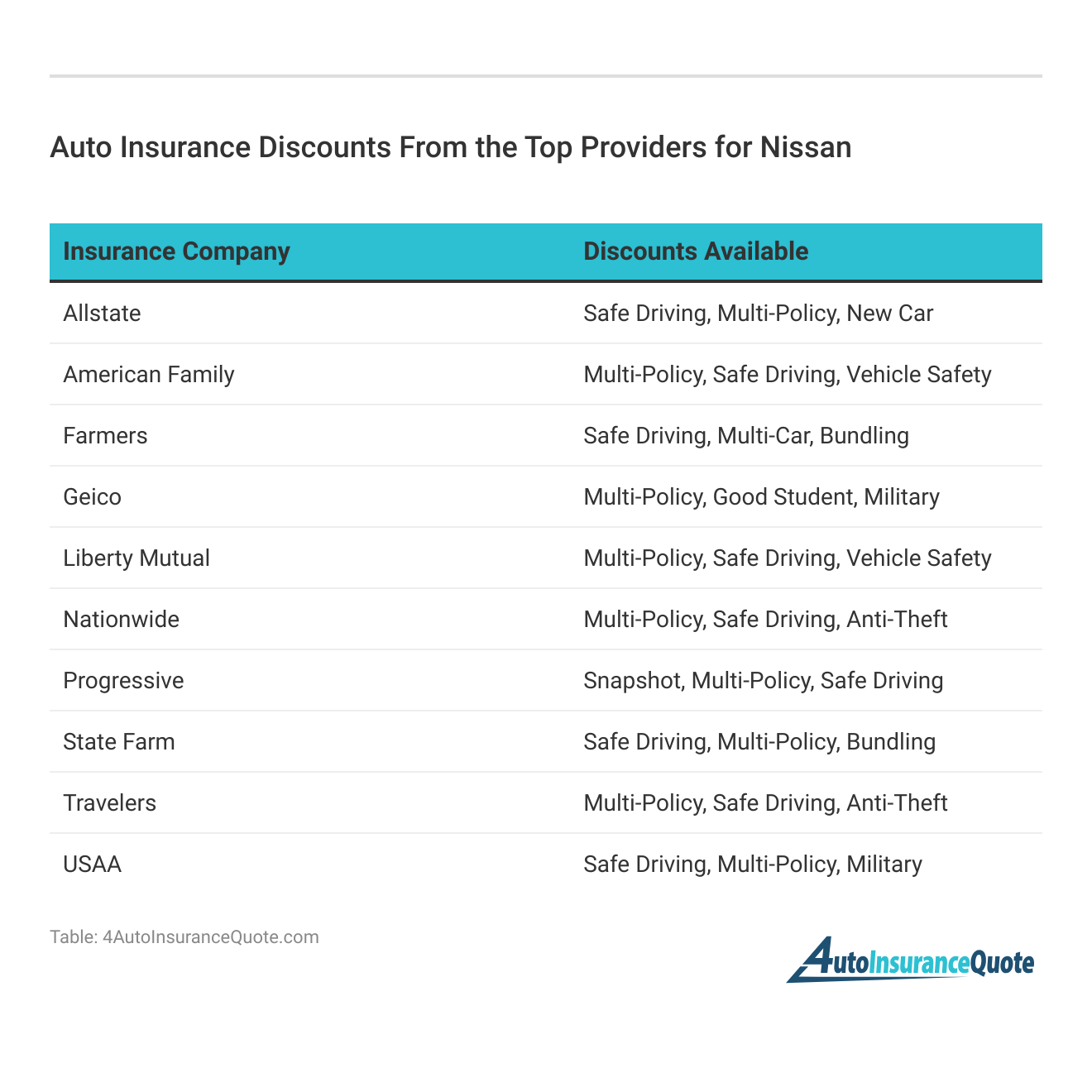

Ways to Save on Auto Insurance for Nissan Vehicles

Finding ways to save on your car insurance can significantly impact your overall expenses, and Nissan owners have several opportunities to reduce their premiums. By understanding and applying available discounts, you can keep more money in your pocket while ensuring you have the coverage you need.

This 5-step form will guide you through the process of identifying and applying for various insurance discounts tailored to your Nissan. Follow these steps to maximize your savings and make the most of your insurance policy.

- Verify Your Driving Record: Check your driving record to ensure it is clean, with no accidents or citations. This may qualify you for a safe driver discount.

- Assess Vehicle Safety Features: Review the safety features in your Nissan, such as anti-lock brakes, airbags, and automated seat belts. Make a list of these features to see if you qualify for related discounts.

- Evaluate Multi-Car and Anti-Theft Options: Determine if you own multiple vehicles and consider adding them to the same policy for a potential multi-car discount. Install or verify the installation of an anti-theft device in your Nissan to potentially qualify for an anti-theft discount.

- Consider Payment and Bundling Options: Decide if you can pay your premium in full rather than monthly to take advantage of any payment discounts. Explore bundling your auto insurance with other policies, such as homeowner’s or renter’s insurance, to see if you can save more.

- Compare Insurance Quotes: Request quotes from multiple insurance providers, ensuring each quote reflects the same coverage amount and policy type. Compare these quotes to find the best rate and identify the discounts available to you.

By following these steps, you can ensure you’re making the most of available insurance discounts for your Nissan. Regularly reviewing your options and keeping your information up-to-date can lead to ongoing savings. Start today and enjoy the benefits of smarter insurance choices. For additional insights, refer to our article titled, “Ways that can help you save on auto insurance.“

Summary: Top Affordable Nissan Auto Insurance Picks

Finding affordable Nissan car insurance is easier with top providers like USAA, Geico, and State Farm, with rates starting at $85 per month. These companies offer competitive pricing, comprehensive coverage, and excellent customer service.

The article emphasizes comparing quotes and using discounts, such as claims-free auto insurance discount, to save money. If you’re curious about why is Nissan Altima insurance so high, understanding this can help. Use these tips to get an affordable Nissan car insurance quote. Enter your ZIP code into our free comparison tool below to start.

Frequently Asked Questions

What are the top companies for affordable Nissan auto insurance?

USAA, Geico, and State Farm are leading options for affordable Nissan auto insurance, with rates starting around $85 per month. Explore further details in our article titled, “Student Auto Insurance Discount.“

How can I find the most affordable insurance for my Nissan?

To find the most affordable insurance for your Nissan, compare quotes from various providers to pinpoint the best rate. Enter your ZIP code below to start comparing premiums from highly-rated insurers in your area.

Does the specific Nissan model impact the cost of insurance?

Yes, the insurance cost can vary depending on the Nissan model, with some models being more expensive to insure.

What should I consider to reduce my Nissan insurance premiums?

To reduce your Nissan insurance premiums, consider factors such as coverage options, available discounts, and comparing quotes. Deepen your understanding with our article called, “How much does GAP insurance cost?“

Are there any discounts available for Nissan drivers to lower insurance costs?

Yes, Nissan drivers can lower insurance costs through discounts for safe driving, vehicle safety features, and bundling multiple policies.

How does Geico’s pricing for Nissan auto insurance compare to other insurers?

Geico offers competitive pricing for Nissan auto insurance, often making it a strong choice for those seeking affordability.

Can I still find affordable Nissan auto insurance with a poor driving record?

Even with a poor driving record, you can still find affordable Nissan auto insurance by comparing quotes and seeking applicable discounts. Enhance your knowledge by reading our article titled, “Affordable Personal Injury Protection (PIP) Auto Insurance Coverage.“

What types of coverage are common for affordable Nissan auto insurance?

Common coverage options for affordable Nissan auto insurance include liability, collision, and comprehensive coverage, which can be adjusted to fit your budget.

How does State Farm’s Nissan auto insurance pricing compare?

State Farm offers competitive rates for Nissan auto insurance, along with strong service and coverage options. You can also enter your ZIP code below into our free comparison tool to start comparing rates now.

Do insurance rates differ between Nissan Versa and Altima?

Yes, insurance rates can differ between Nissan models, such as the Versa and Altima, due to factors like repair costs and theft risk. Gain deeper insights by perusing our article named, “Affordable Liability Auto Insurance Coverage.“

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Finally, comparing quotes from various providers and considering the car insurance deductible will help you find the best deal that suits your needs. For further assistance, explore resources that can help you compare affordable instant auto insurance quotes. Read more about how to compare

Finally, comparing quotes from various providers and considering the car insurance deductible will help you find the best deal that suits your needs. For further assistance, explore resources that can help you compare affordable instant auto insurance quotes. Read more about how to compare