Cheap Pennsylvania Auto Insurance in 2025 (Save Big With These 10 Companies!)

For cheap Pennsylvania auto insurance, USAA stands out as the top pick, with rates starting as low as $19 per month. Other notable providers offering affordable Pennsylvania auto insurance include Geico and State Farm, known for their competitive rates and excellent coverage options.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage in Pennsylvania

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage in Pennsylvania

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsThe top picks for cheap Pennsylvania auto insurance are USAA, Geico and State Farm, offering the most affordable rates starting as low as $19 per month.

Geico and State Farm offer competitive rates and solid coverage, making them strong alternatives. This guide helps you find the best deal by comparing quotes and exploring key factors in Pennsylvania auto insurance. To expand your knowledge, refer to our handbook titled “Affordable Auto Insurance.”

Our Top 10 Company Picks: Cheap Pennsylvania Auto Insurance

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $19 | A++ | Military Benefits | USAA | |

| #2 | $23 | A++ | Competitive Rates | Geico | |

| #3 | $25 | B | Excellent Service | State Farm | |

| #4 | $26 | A++ | Affordable Rates | Travelers | |

| #5 | $29 | A+ | Solid Coverage | Nationwide |

| #6 | $36 | A | Flexible Options | American Family | |

| #7 | $44 | A | Strong Service | Farmers | |

| #8 | $49 | A+ | Snapshot Program | Progressive | |

| #9 | $50 | A+ | Discount Variety | Allstate | |

| #10 | $73 | A | Discount Options | Liberty Mutual |

Geico and State Farm offer competitive rates and strong service. This table shows each company’s monthly rates, A.M. Best ratings, and key strengths to help you find the best insurance fit. Start saving on your auto insurance by entering your ZIP code above and comparing quotes.

- USAA offers the best rates and benefits, especially for military members

- Compare providers to find the best cheap Pennsylvania auto insurance

- Geico and State Farm also provide competitive rates and solid coverage

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – USAA: Top Overall Pick

Pros:

- Affordable for Military Members: USAA provides cheap Pennsylvania auto insurance tailored for military families, making it a cost-effective choice for those who serve.

- Exclusive Discounts: Military members can access unique discounts, further reducing the cost of their cheap Pennsylvania auto insurance which is covered in our review titled, “USAA Auto Insurance Review.”

- Tailored Policies: USAA offers flexible policies for military personnel, leading to cheaper Pennsylvania auto insurance.

Cons:

- Eligibility Limitations: Only military members and their families qualify, restricting access to cheap Pennsylvania auto insurance for others.

- Coverage Gaps: Specialized coverage may fall short, leading to higher costs despite cheap Pennsylvania auto insurance premiums.

#2 – Geico: Best for Competitive Rates

Pros:

- Low Starting Rates: Geico is known for offering some of the cheapest Pennsylvania auto insurance rates, appealing to budget-conscious drivers. Learn more in our resource review here “Geico Auto Insurance Review.”

- Broad Discount Options: Geico offers many discounts, making its already low rates for cheap Pennsylvania auto insurance even cheaper.

- Ease of Access: Geico’s extensive online tools and mobile app make it simple to manage and maintain cheap Pennsylvania auto insurance.

Cons:

- Rate Increases: Some drivers report that their initially cheap Pennsylvania auto insurance rates increase significantly after the first year.

- Customer Service Issues: Geico’s inconsistent customer service might affect the overall value of their cheap Pennsylvania auto insurance.

#3 – State Farm: Best for Excellent Service

Pros:

- Personalized Customer Support: State Farm offers excellent service with agents who customize policies for cheap Pennsylvania auto insurance.

- Comprehensive Coverage: State Farm offers cheap Pennsylvania auto insurance without compromising on coverage quality.

- Multi-Policy Discounts: Bundling other insurance products can further lower the cost of cheap Pennsylvania auto insurance.

Cons:

- Higher Starting Rates: State Farm’s initial premiums might be higher, deterring those seeking the absolute cheapest Pennsylvania auto insurance which you can check more in our “State Farm Auto Insurance Review.”

- Discount Complexity: Discounts can be complex, making it harder to secure truly cheap Pennsylvania auto insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#4 – Travelers: Best for Affordable Rates

Pros:

- Competitive Premiums: Travelers offers some of the most affordable cheap Pennsylvania auto insurance rates, ideal for budget-conscious drivers.

- Extensive Coverage Options: Travelers offers comprehensive protection even at cheap Pennsylvania auto insurance rates. – For additional details, explore our resource titled, “Travelers Auto Insurance Review.”

- Discount Opportunities: Travelers’ many discounts can make their already low premiums even cheaper for Pennsylvania auto insurance.

Cons:

- Limited Agent Availability: Fewer Travelers agents in some Pennsylvania areas may limit access to personalized advice for cheap Pennsylvania auto insurance.

- Potential Coverage Gaps: Low rates might lead to additional coverage needs, raising the overall cost beyond the initial cheap Pennsylvania auto insurance rate.

#5 – Nationwide: Best for Solid Coverage

Pros:

- Balanced Value: Nationwide offers a solid balance of comprehensive coverage and cheap Pennsylvania auto insurance for great value.

- Vanishing Deductible: This feature reduces your deductible over time, leading to cheaper Pennsylvania auto insurance.

- Multi-Policy Savings: Bundling with Nationwide can significantly lower your Pennsylvania auto insurance costs. To delve deeper, refer to report titled, “Nationwide Auto Insurance Review.”

Cons:

- Average Initial Premiums: Nationwide’s initial premiums may be higher, limiting options for the cheapest Pennsylvania auto insurance.

- Discount Limitations: Discounts may be less impactful with Nationwide, limiting the extent of cheap Pennsylvania auto insurance.

#6 – American Family: Best for Flexible Options

Pros:

- Customizable Policies: American Family provides flexible policies for cheap Pennsylvania auto insurance tailored to your needs.

- Generous Discounts: Various discounts help secure cheaper Pennsylvania auto insurance. To gain in-depth knowledge, consult our resource titled, “American Family Auto Insurance Review.”

- User-Friendly Tools: Digital tools simplify policy management for the cheapest Pennsylvania auto insurance.

Cons:

- Limited Availability: American Family’s cheap Pennsylvania auto insurance may not be available in all areas, limiting access for some drivers.

- Discount Restrictions: Some discounts have specific conditions, making it harder to consistently get cheap Pennsylvania auto insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#7 – Farmers: Best for Strong Service

Pros:

- Excellent Customer Service: Farmers offers excellent customer service, ensuring high-quality support with cheap Pennsylvania auto insurance. To enhance your understanding, explore our resource titled, “Farmers Auto Insurance Review.”

- Comprehensive Coverage Options: Farmers offers diverse coverage options at competitive rates, helping you find affordable Pennsylvania auto insurance tailored to your needs.

- Strong Claim Handling: Farmers’ efficient claims handling offers peace of mind with cheap Pennsylvania auto insurance.

Cons:

- Higher Baseline Rates: Farmers’ higher premiums may make finding the cheapest Pennsylvania auto insurance more challenging.

- Limited Online Tools: Farmers’ agent reliance can impede tech-savvy users from quickly accessing cheap Pennsylvania auto insurance deals.

#8 – Progressive: Best for Snapshot Program

Pros:

- Lower Rates with Snapshot Program: Progressive’s Snapshot Program offers significant savings on Pennsylvania auto insurance by rewarding safe driving with discounts.

- Flexible Discounts: This program tailors cheaper Pennsylvania auto insurance rates to your driving behavior, potentially lowering your monthly premium.

- Technology Integration: The Snapshot device simplifies tracking your driving, leading to cheaper Pennsylvania auto insurance. To expand your knowledge, refer to our handbook titled, “Progressive Auto Insurance Review.”

Cons:

- Privacy Concerns: The Snapshot program tracks driving, which may worry privacy-conscious individuals looking at Progressive for cheap Pennsylvania auto insurance.

- Rate Fluctuations: If driving habits don’t meet Snapshot’s standards, drivers may not get the expected cheap Pennsylvania auto insurance rates.

#9 – Allstate: Best for Discount Variety

Pros:

- Wide Range of Discounts: Helps reduce cheap Pennsylvania auto insurance costs with multi-policy and safe driving discounts.

- Young Driver Discounts: Special savings for young drivers, including Good Student and Teen Driver discounts. For additional details, explore our comprehensive resource titled, “Allstate Auto Insurance Review.”

- Easy Discount Management: Simple to apply and manage discounts for affordable cheap Pennsylvania auto insurance.

Cons:

- Higher Base Rates: Allstate’s initial rates might be higher, requiring significant discounts to achieve cheap Pennsylvania auto insurance.

- Complex Discount Qualification: Navigating discount options can be overwhelming, making it hard to find cheap Pennsylvania auto insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#10 – Liberty Manual: Best for Discount Options

Pros:

- Diverse Discount Programs: Liberty Mutual offers various discount options that make it easy to achieve cheap Pennsylvania auto insurance.

- Comprehensive Coverage at Low Rates: Liberty Mutual offers cheap Pennsylvania auto insurance with comprehensive coverage, ensuring affordability without cutting corners.

- User-Friendly Online Tools: Liberty Mutual’s digital tools help customers manage policies and find the cheapest Pennsylvania auto insurance.

Cons:

- Regional Limitations: Some discounts may not be available in all Pennsylvania areas. For detailed information, refer to our comprehensive report titled, “Liberty Mutual Auto Insurance Review.”

- Complex Eligibility: Discount qualifications can be complicated, affecting access to cheap Pennsylvania auto insurance.

Pennsylvania Auto Insurance Rates and Discounts by Provider

Explore a detailed comparison of monthly auto insurance rates and available discounts from leading providers in Pennsylvania. Review costs for both minimum and full coverage options from top insurers such as Allstate, Geico, State Farm, and USAA.

Pennsylvania Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $50 | $148 |

| American Family | $36 | $108 |

| Farmers | $44 | $131 |

| Geico | $23 | $68 |

| Liberty Mutual | $73 | $219 |

| Nationwide | $29 | $86 |

| Progressive | $49 | $148 |

| State Farm | $25 | $76 |

| Travelers | $26 | $75 |

| USAA | $19 | $57 |

Find out which companies offer the best savings opportunities through various discounts, including safe driver, multi-policy, and military benefits, to help you choose the most cost-effective auto insurance policy for your needs. Explore further details in our guide titled, “Affordable Full Coverage Auto Insurance.”

Pennsylvania requires drivers to carry various amounts of Pennsylvania auto insurance, which can be expensive. However, understanding how auto insurance works in Pennsylvania and how you can save on your Pennsylvania auto insurance coverage doesn’t have to be hard. We have what you need to know right here.

Before you buy Pennsylvania auto insurance, make sure you have compared rates. Enter your ZIP code for free Pennsylvania auto insurance quotes.

Pennsylvania Auto Insurance Requirements

Pennsylvania law requires all drivers to carry minimum liability auto insurance, which covers damages and injuries you may cause to others in an accident. This coverage is designed to protect both you and others involved in the accident by covering the costs associated with injuries, medical expenses, and property damage you may cause. The minimum required coverages are:

- Bodily Injury Liability: $15,000 per person and $30,000 per accident

- Property Damage Liability: $5,000 per accident

These requirements ensure that drivers can cover the basic costs associated with accidents, reducing the financial burden on both the at-fault driver and the injured parties. By having this insurance, you’re not only complying with Pennsylvania law but also contributing to safer roads and more responsible driving.

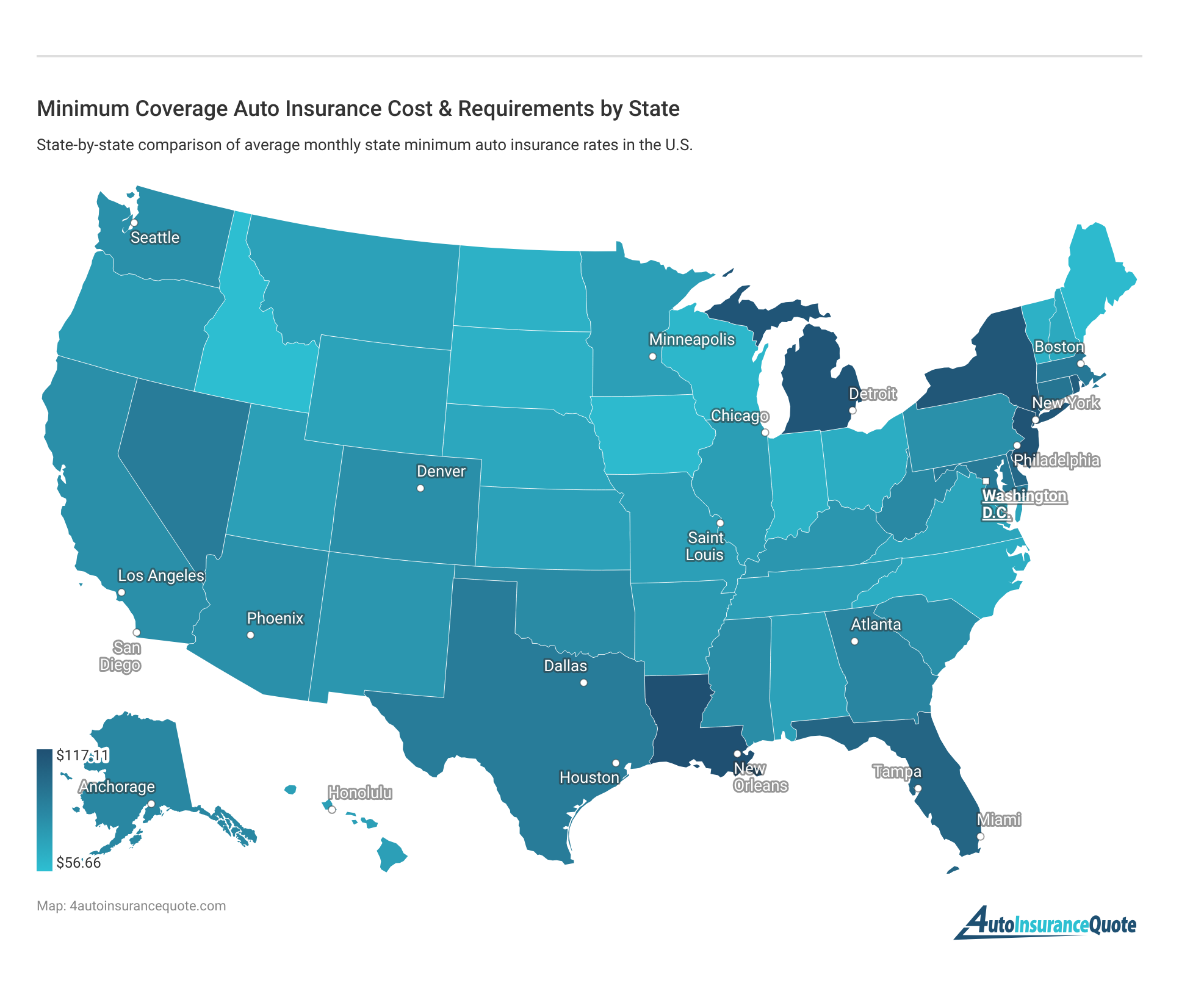

When evaluating your auto insurance coverage, it’s also essential to understand how Pennsylvania’s minimum liability rates stack up against neighboring states. Take a look at how Pennsylvania’s minimum rates compare with surrounding states.

In Pennsylvania, drivers are required to carry medical benefits coverage with a minimum of $5,000 per person. This coverage is crucial as it provides financial assistance for medical expenses related to injuries sustained in an accident, regardless of who is at fault. This ensures that you and your passengers receive necessary medical treatment without delay.

A minimum of $15,000 in bodily injury liability per person and $30,000 per accident to cover medical bills for injuries in an accident you cause. Given the high costs of medical care, it’s wise to get as much bodily injury liability coverage as you can afford with your Pennsylvania auto insurance.

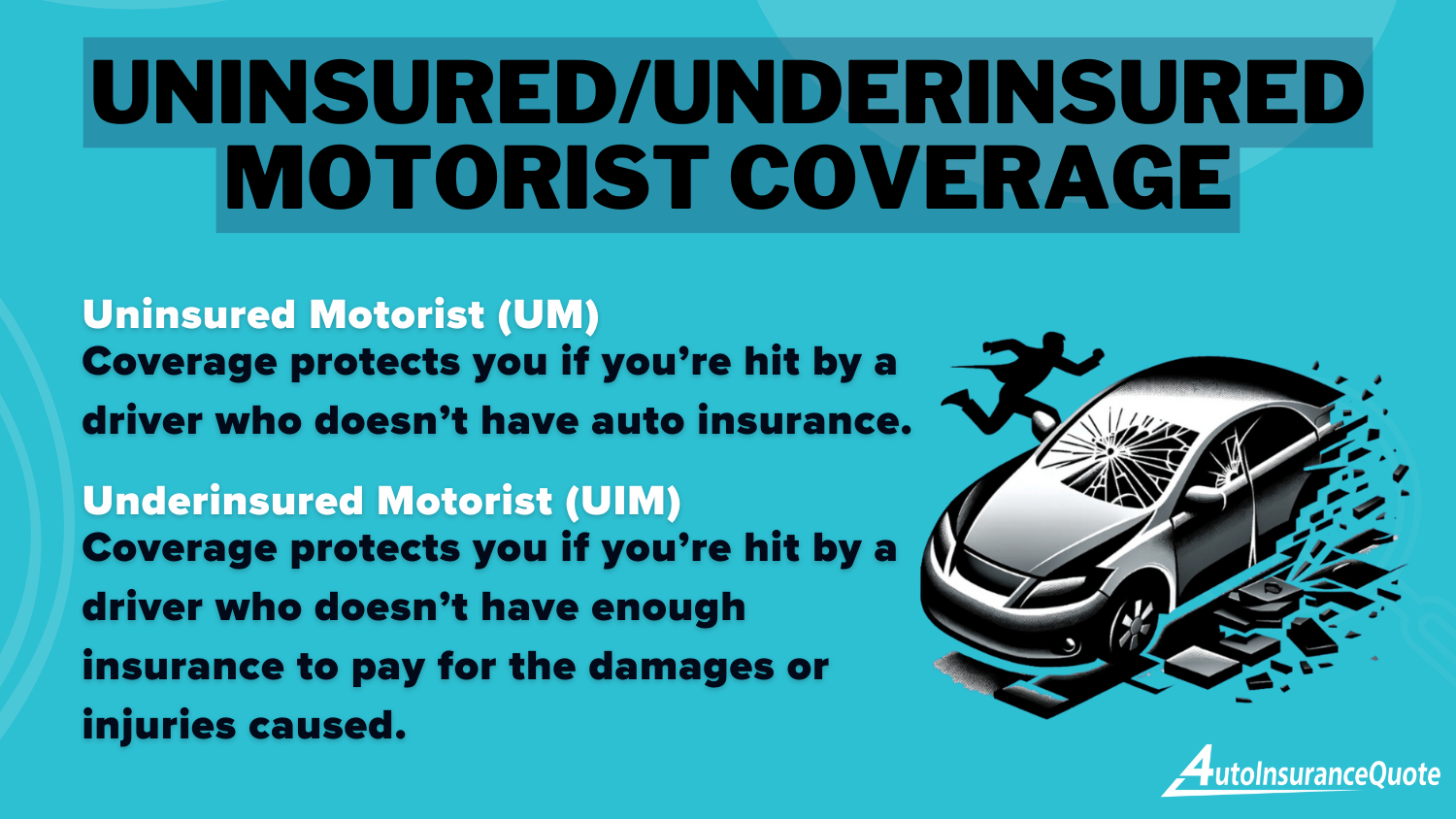

Beyond the mandatory medical coverage, Pennsylvania also offers several optional coverages that can provide additional protection:

- Collision Auto Insurance Coverage: This pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of fault.

- Comprehensive Auto Insurance Coverage: This covers damages to your vehicle caused by non-collision events such as theft, vandalism, natural disasters, or hitting an animal.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with a driver who doesn’t have any insurance, ensuring your medical and property damage expenses are covered.

- Rental Car Reimbursement Coverage: This provides coverage for rental reimbursement if your car is being repaired following an accident.

Finally, every driver must have a minimum of $5,000 in property damage liability coverage, covering any property damage you cause in an accident. $5,000 is one of the lowest minimum insurance requirements in the nation for PDL, and again, it’s recommended that you exceed this number.

Auto body repairs can be expensive, and drivers may find themselves facing substantial out-of-pocket expenses if they only carry the minimum required coverage. Therefore, opting for higher property damage liability limits is a prudent choice to ensure adequate financial protection in the event of an accident.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

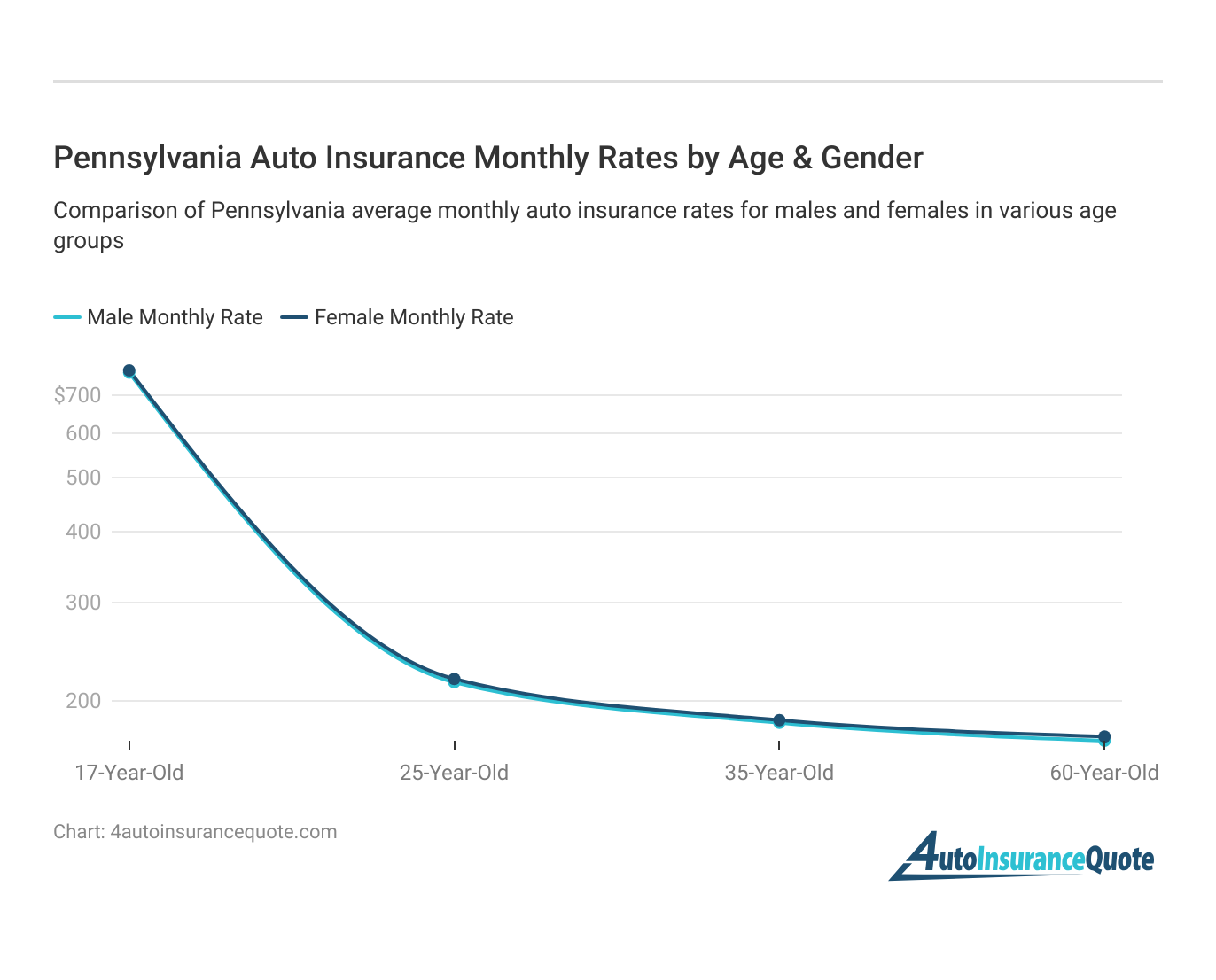

Factors Influencing Auto Insurance Rates in Pennsylvania & Average Costs by Age & Gender

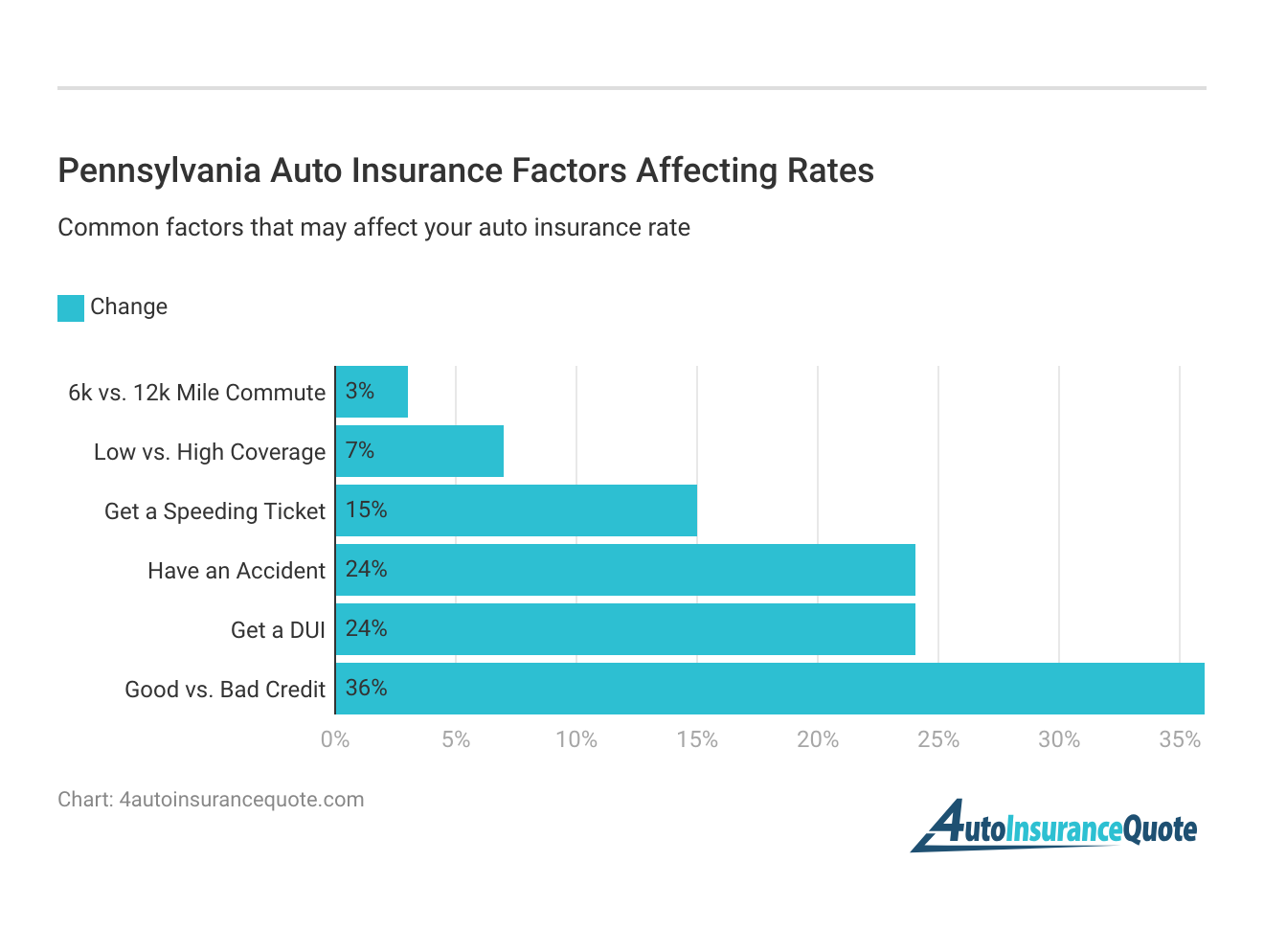

Understanding the factors that affect your auto insurance rates in Pennsylvania can help you find the best coverage at a lower cost. Key elements such as your driving record, coverage level, and commute distance can significantly impact your premium.

While many of these factors are simply based on your own driving record, two things that affect even the safest of drivers are age and gender. However, Pennsylvania differs from many of the other states in the union and has outlawed charging different rates based on gender.

That being said, younger drivers almost always pay higher rates, simply due to a lack of experience. Our article about how car insurance rates are calculated goes into more detail about the different factors affecting your auto insurance rates.

Pennsylvania Accident And Theft Statistics

In 2009, Pennsylvania recorded just over 120,000 automobile crashes on roads throughout the state. This number was a decrease from 2008 and has been trending downward for the past few years. Just 1,250 fatalities were recorded in 2009, which was the lowest fatality rate for Pennsylvania auto accidents since the early 1950s.

Pennsylvania has led nationally in reducing auto theft, with incidents dropping from 22,300 in 2008 to 17,700 in 2009, a 20% decrease. Motor vehicle thefts have decreased by 37% since 2005, highlighting the significant efforts law enforcement has made to combat auto crime in Pennsylvania. Additionally, anti-theft recovery systems have contributed to this decline in theft rates.

The statistics cover automobiles, trucks, buses, and motorcycles, resulting in a theft rate of 143 motor vehicles per 100,000 residents in Pennsylvania. This rate reflects the overall frequency of vehicle thefts across the state.

Additional Pennsylvania Auto Insurance Resources

Exploring Pennsylvania auto insurance options can be streamlined with a range of valuable resources. These resources will help you navigate auto insurance requirements and will give you some idea of what auto insurance is all about in Pennsylvania.

- Insurance Department: Official Pennsylvania Department of Insurance website.

- Auto Insurance Guide: Auto insurance details from the Pennsylvania Department of Insurance.

- PennDOT: Pennsylvania Department of Transportation’s official site.

- Governors Highway Safety Association: Overview of highway safety laws in Pennsylvania.

Whether you’re a Steelers or Eagles fan or root for the Phillies or Pirates, you’ll need to deal with your Pennsylvania auto insurance before you get on the road. Use these resources to ensure you have the right coverage and stay informed about your insurance needs.

USAA offers the most affordable rates and exceptional benefits for military families, making it the top choice for Pennsylvania auto insurance.Justin Wright Licensed Insurance Agent

Before you purchase your next Pennsylvania auto insurance policy, make sure you spend some time hunting down a good price. With the many insurance companies and plans available today, you’re sure to find excellent deals, including exploring what discounts are available for auto-owners auto insurance customers, which can significantly reduce your costs.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Top Choices for Affordable Auto Insurance in Pennsylvania

Finding cost-effective auto insurance in Pennsylvania is easier with top providers like USAA, Geico, and State Farm offering competitive rates starting at just $19 per month. This guide highlights key insurance companies known for their excellent coverage options and low costs, along with essential information on Pennsylvania’s minimum insurance requirements.

It also includes insights on factors influencing insurance rates, such as driving history and age, and tips for comparing quotes to ensure you secure the best deal for your needs. This information helps you make informed decisions and secure the best auto insurance deal for your needs. Explore our detailed resource titled “Auto Insurance Requirements.”

To find affordable Pennsylvania auto insurance today, enter your ZIP code below for a free comparison of the top companies’ best Pennsylvania auto insurance rates.

Frequently Asked Questions

What is the basic car insurance in Pennsylvania?

The basic car insurance in Pennsylvania includes $15,000 of bodily injury liability per person, $30,000 per accident, and $5,000 for property damage liability. For additional insights, refer to our resource titled, “Affordable Liability Auto Insurance Coverage.”

How much are tags and title in Pennsylvania?

The cost for tags and title in Pennsylvania varies but expect to pay around $50 to $100 depending on your vehicle and any additional fees.

How much does it cost to add a 16-year-old to car insurance in Pennsylvania?

Adding a 16-year-old to your car insurance in Pennsylvania can significantly increase your premium, due to the higher risk associated with young drivers.

Do I need car insurance to buy a car in Pennsylvania?

No, car insurance is not required to purchase a car in Pennsylvania, but you will need insurance before you can register the vehicle.

Do you need a driver’s license to get car insurance in Pennsylvania?

Yes, you need a valid driver’s license to obtain car insurance in Pennsylvania. For detailed information, refer to our comprehensive report titled, “Can you get auto insurance without a license?”

Is car insurance expensive in Pennsylvania?

Car insurance in Pennsylvania is generally more affordable compared to some other states, but rates can vary based on factors like driving history and location. Uncover affordable auto insurance rates from the top providers by entering your ZIP code below.

Does Pennsylvania have a car tax?

Pennsylvania does not have a specific car tax, but you will need to pay sales tax when purchasing a vehicle.

How old does a car have to be in Pennsylvania to be considered a classic?

In Pennsylvania, a car must be at least 25 years old to be considered a classic and eligible for classic car insurance.

Is car insurance cheaper in Pennsylvania than New York?

Yes, car insurance rates in Pennsylvania are generally lower than in New York due to differences in state regulations and risk factors. Find out more in our resource review “Auto Insurance Quotes by State.”

Which type of car is cheapest to insure?

Sedans and compact cars with high safety ratings and low repair costs are usually the cheapest to insure. Brands like Toyota, Honda, and Subaru often have lower premiums compared to sports and luxury cars.

Protect your vehicle at the best prices by entering your ZIP code into our free auto insurance quote comparison tool below.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.